At a Glance

The federal government subsidizes health insurance for most Americans under age 65 through various programs and tax provisions. This report, the latest in an annual series, describes updated baseline projections by the Congressional Budget Office and the staff of the Joint Committee on Taxation (JCT) of the federal costs associated with each kind of subsidy and the number of people with different types of health insurance. Those projections reflect an assumption that laws as of March 23, 2022, governing health insurance coverage and federal subsidies for that coverage remain in place.

Federal Subsidies. In CBO and JCT’s projections, net federal subsidies (that is, the cost of all the subsidies minus the relevant taxes and penalties) in 2022 for insured people under age 65 are $997 billion, or 4.0 percent of gross domestic product (GDP). In 2032, that annual amount is projected to reach $1.6 trillion, or 4.3 percent of GDP. Over the 2022–2032 period, subsidies are projected to total $13.4 trillion.

- Medicaid and the Children’s Health Insurance Program (CHIP) account for about 42 percent of the federal subsidies annually during the period;

- Subsidies for employment-based coverage, about 37 percent;

- Payments for Medicare enrollees under age 65, about 14 percent; and

- Subsidies for coverage obtained through the marketplaces established by the Affordable Care Act or through the Basic Health Program, about 7 percent.

Health Insurance Coverage. In an average month each year during that period, between 240 million and 246 million people are projected to have health insurance, mostly from employment-based plans. Between 25 million and 29 million people are projected to be uninsured.

Effects of Temporary Policies. Legislation enacted in 2020 and 2021 in response to the coronavirus pandemic has affected CBO and JCT’s estimates of federal subsidies and health insurance coverage over the 2021–2024 period. In projections for that period, that legislation:

- Increases enrollment in and subsidies for Medicaid and CHIP,

- Increases enrollment in nongroup coverage purchased through the marketplaces and subsidies for that coverage, and

- Decreases the number of people who are uninsured.

Notes

Modeling and Results

The estimates presented in this report include the effects of legislation enacted through March 23, 2022, and are based on the Congressional Budget Office’s economic projections that reflect economic developments through March 2, 2022.

CBO and the staff of the Joint Committee on Taxation (JCT) have endeavored to develop budgetary estimates that are in the middle of the range of likely outcomes. For their current projections, the agencies assume that the public health emergency arising from the coronavirus pandemic will extend through July 2023.

Estimates of health insurance coverage reflect average monthly enrollment during a calendar year and include spouses and dependents covered under family policies. The estimates are for the civilian noninstitutionalized population under age 65, which excludes members of the armed forces on active duty and people in penal or mental institutions or in homes for the elderly or infirm. The majority of people over age 65 are covered by Medicare.

Estimates by level of income are calculated using the projected income distribution from CBO’s health insurance model, HISIM2. That distribution is based on income reported by respondents to the Current Population Survey, with adjustments to better match tax data. It is extended over the projection period in a way that is consistent with CBO’s macroeconomic forecast.

Unless this report indicates otherwise, all years referred to in describing estimates of spending and revenues are federal fiscal years, which run from October 1 to September 30 and are designated by the calendar year in which they end.

Numbers may not add up to totals because of rounding.

The data sources of all figures in this report may be cited this way: Congressional Budget Office; staff of the Joint Committee on Taxation.

Regulation About the Affordability of Employment-Based Coverage for Family Members

The projections in this report do not incorporate the effects of the proposed regulation by the Treasury Department and the Internal Revenue Service entitled “Affordability of Employer Coverage for Family Members of Employees” (87 Fed. Reg. 20354, April 7, 2022). The regulation would change the calculation used under current law to determine whether the plan being offered by an employer is affordable, for the purpose of determining eligibility for marketplace subsidies. The current calculation, based on the cost of an employee-only plan rather than a family plan, leaves some families ineligible for marketplace subsidies because the employee’s contribution for an employee-only plan does not exceed the affordability standard even though the employee’s contribution for a family plan would exceed it. The issue is often referred to as the family glitch.

CBO and JCT estimate that if finalized as proposed, the regulation would increase the number of people enrolled in nongroup coverage by an average of 900,000 in each year over the 2023–2032 period. That increase is the net result of a decrease of 600,000 in the number of people with employment-based coverage, a decrease of 400,000 in the number of people who are uninsured, and an increase in Medicaid and CHIP enrollment of 100,000. The agencies estimate that those changes in coverage would increase the deficit by $34 billion over the period. That increase is the net effect of an increase in premium tax credits for individuals newly receiving them that is slightly offset by an increase in revenues from individuals no longer receiving the tax exclusion for employment-based coverage.

Individual Coverage Health Reimbursement Accounts

The “Health Reimbursement Arrangements and Other Account-Based Group Health Plans” (26 C.F.R. parts 1 and 54, 29 C.F.R. parts 2510 and 2590, and 45 C.F.R. parts 144, 146, 147, and 155) regulation expanded the use of health reimbursement accounts (HRAs) beginning in January 2020. Specifically, the regulation permitted employers to provide funds through an individual coverage health reimbursement account (ICHRA) to employees to purchase health insurance through the nongroup market rather than providing them with group health insurance. Those funds are excluded from income and payroll taxes. Before the regulation went into effect, employers could offer employees funds through an HRA only if the HRA was paired with an offer of group health insurance. By 2032, CBO and JCT estimate, roughly 2 million people will enroll in an ICHRA through the nongroup market outside of the health insurance marketplaces established by the Affordable Care Act instead of enrolling in group health insurance. The federal cost of that coverage is reflected in CBO and JCT’s estimates of the tax exclusion for employment-based coverage.

Basic Health Program

Under the Affordable Care Act, states have the option to establish a Basic Health Program, which is primarily for people whose income is between 138 percent and 200 percent of the federal poverty level. To subsidize that coverage, the federal government provides states with funding equal to 95 percent of the subsidies for which those people would have been eligible through a marketplace. States can use those funds, in addition to funds from other sources, to offer health insurance that covers a broader set of benefits or requires smaller out-of-pocket payments than coverage in the marketplaces does. Minnesota and New York are the only states with individuals enrolled in such a program.

Federal Poverty Level

In most states, the federal poverty level in 2022 is $13,590 of income for a single person. For each additional person in a household, $4,720 is added. Income levels reflect modified adjusted gross income (MAGI) for the calendar year. MAGI equals gross income plus untaxed Social Security benefits, foreign earned income that is excluded from adjusted gross income, tax-exempt interest, and the income of dependent filers.

Related Publications

For details about the methods underlying the projections, see Lucas Goodman and others, Data and Methods for Constructing Synthetic Firms in CBO’s Health Insurance Simulation Model, HISIM2, Working Paper 2021-15 (Congressional Budget Office, December 2021), www.cbo.gov/publication/57431; Congressional Budget Office, “HISIM2: The Health Insurance Simulation Model Used in Preparing CBO’s July 2021 Baseline Budget Projections” (July 2021), www.cbo.gov/publication/57205; and Jessica Banthin and others, Sources and Preparation of Data Used in HISIM2—CBO’s Health Insurance Simulation Model, Working Paper 2019-04 (Congressional Budget Office, April 2019), www.cbo.gov/publication/55087.

For a discussion of how CBO and JCT project premiums, see Congressional Budget Office, Private Health Insurance Premiums and Federal Policy (February 2016), pp. 9–11, www.cbo.gov/publication/51130.

For a discussion of how CBO and JCT define health insurance coverage and the uninsured population, see Congressional Budget Office, Health Insurance Coverage for People Under Age 65: Definitions and Estimates for 2015 to 2018 (April 2019), www.cbo.gov/publication/55094.

For details about the uninsured population in 2019, see Congressional Budget Office, Who Went Without Health Insurance in 2019, and Why? (September 2020), www.cbo.gov/publication/56504.

For CBO’s estimates of federal spending on Medicare, the primary health insurance coverage for people age 65 or older, see Congressional Budget Office, “Medicare—May 2022 Baseline” (May 2022), https://tinyurl.com/2p8bxfdy.

For CBO’s estimates of federal spending on Medicaid, see Congressional Budget Office, “Medicaid—May 2022 Baseline” (May 2022), https://tinyurl.com/2khhpaer.

In this report, the latest in an annual series, the Congressional Budget Office and the staff of the Joint Committee on Taxation (JCT) provide projections of health insurance coverage for people under age 65 and the federal costs of that coverage. Net federal subsidies for that coverage are projected to total $997 billion in 2022 and $1.6 trillion in 2032. Measured as a share of gross domestic product (GDP), the subsidies are an estimated 4.0 percent and 4.3 percent, respectively.

Projected Subsidies for Health Insurance Coverage

For people under 65, the federal government subsidizes health insurance in several ways: by giving tax benefits for employment-based coverage, by providing a majority of funding (states provide the remainder) for Medicaid and the Children’s Health Insurance Program (CHIP) and by offering tax credits to eligible people who purchase coverage through the health insurance marketplaces established by the Affordable Care Act (ACA). The federal government also provides coverage through the Medicare program to people under 65 who receive benefits from the Social Security Disability Insurance program or who have been diagnosed with end-stage renal disease.

Average federal subsidies for health insurance per recipient differ for the various types of health insurance because the people who are eligible for and enrolled in each type differ by age, health status, income, and disability status; because the federal government subsidizes the coverage to different extents; and because the prices paid to providers differ for different types of coverage.

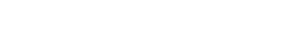

Federal Health Insurance Subsidies for People Under Age 65

In 2022, the federal government is projected to spend $316 billion on support for employment-based coverage for people under age 65 and $462 billion for Medicaid and CHIP. By the end of the decade, the costs for those two largest categories of subsidies are projected to rise to $612 billion and $627 billion, respectively.

As a percentage of GDP, federal subsidies for employment-based coverage and for Medicare are projected to grow over the coming decade, whereas those for Medicaid and CHIP and for nongroup coverage and the Basic Health Program are projected to decrease.

Average Federal Subsidies per Enrollee Under Age 65, by Type of Health Insurance

Dollars

Over the 2022–2032 period, average subsidies are projected to grow—those for employment-based coverage at the highest rate, 6.8 percent per year, and those for nongroup coverage and the Basic Health Program at the lowest, 4.6 percent. Differences in growth rates reflect federal policies that are scheduled to expire and the fact that prices paid to providers generally grow faster in commercial plans than in public programs like Medicare and Medicaid, in which prices are administratively determined.

Effects of Temporary Policies on Medicaid and Coverage in the Marketplaces

The Families First Coronavirus Response Act (FFCRA) increased the federal medical assistance percentage, or FMAP (the formula that determines the federal matching rate for Medicaid), by 6.2 percentage points for most enrollees for the duration of the COVID-19 public health emergency. To receive the enhanced federal funding, states must provide continuous eligibility, which allows people to remain enrolled in Medicaid and CHIP during that period regardless of changes in their eligibility.

The American Rescue Plan Act of 2021 (ARPA) extended eligibility for premium tax credits to people with income over 400 percent of the federal poverty guidelines (commonly known as the federal poverty level, or FPL) and increased subsidies for 2021 and 2022 for those previously eligible. Administrative actions established a special enrollment period in 2021 for people regardless of income and gave people with income below 150 percent of the FPL the ability to enroll at any time if their required contribution for the benchmark plan is zero percent of their income.

Medicaid Enrollment Due to Continuous Eligibility Provisions, by Eligibility Category, 2022

Millions of People

According to CBO’s estimates, of the 73.6 million people enrolled in Medicaid in 2022, 12.9 million of them are enrolled because of the continuous eligibility provisions.

After the assumed end of the COVID-19 public health emergency in July 2023, enrollment is projected to decline and the boost attributable to the continuous eligibility provisions is projected to dissipate by mid-2024.

Marketplace Coverage Due to Enhanced Subsidies, 2021 to 2023

Millions of People

Because enhanced marketplace subsidies enacted in ARPA took effect midway through 2021, they are projected to affect enrollment more in 2022 than in 2021. Although the provision will expire in 2023, CBO expects some of its effects from 2022 to persist into 2023. Then, in the agency’s projections, the effects dissipate by 2024.

Projected Private Health Insurance Premiums

Total federal subsidies for employment-based insurance and nongroup coverage depend on the total amount of premiums in those markets. In the case of employment-based coverage, employers and employees each typically pay a portion of the premiums. The employer’s portion is exempt from federal income and payroll taxes. In most cases, the employee’s portion is also excluded from those taxes. In general, people with higher income and, therefore, higher marginal tax rates receive a higher federal subsidy. In the case of nongroup coverage, someone eligible to receive a subsidy in the marketplace can use the premium tax credit to lower the out-of-pocket cost of his or her monthly premiums. The amount of the credit is calculated as the difference between the benchmark premium (that is, the premium for the second-lowest-cost silver plan available in the marketplace in the area of residence) and a specified maximum contribution expressed as a percentage of income.

CBO and JCT project private health insurers’ spending on health care and administration on the basis of trends in premium growth and of projected growth in personal income, which affects people’s ability to buy health insurance. Between 2022 and 2032, spending per private health insurance enrollee, which is the basis for employment-based and nongroup premiums, is projected to grow by an average of 5 percent per year.

Annual Percentage Change in Gross Premiums for Benchmark Plans and Private Health Insurance Spending

Percent

Marketplace premiums declined again for 2022, diverging from per capita private health insurance spending. The continued decline is due to increased competition from more insurers entering the marketplaces and healthier- than-average people enrolling because of the temporary enhanced subsidies. Premiums are expected to increase at a faster-than-average rate in 2024, when those healthier enrollees have fully exited the market. Subsequently, the growth of marketplace premiums is projected to roughly follow the path of spending.

Projected Health Insurance Coverage

To estimate the net effects that subsidies have on the federal budget, CBO and JCT project the number of people with different types of health insurance coverage. To better align estimates with underlying data sources on coverage, the agencies do not assign people to a primary source of coverage. That choice results in the sum of individual coverage types being greater than the total population.

By those estimates, of the 271 million people under age 65 in 2022, 156 million will have coverage through an employer, and 25 million will be uninsured. In 2032, when the population is estimated to be about the same size, 158 million are projected to have coverage through an employer, and 28 million, to be uninsured. The types of coverage that people enroll in vary substantially depending on their income. (In the underlying data, some Medicaid and CHIP enrollees appear to have income higher than the programs’ upper limits—which can be the case when, for example, income is low during Medicaid enrollment that ends partway through the year and is much higher thereafter.)

Health Insurance Coverage for People Under Age 65, by Type and Income, 2022

Millions of People

In 2022, of the 82 million people under age 65 with income below 150 percent of the FPL, 57 million are estimated to be enrolled in Medicaid or CHIP.

Of the 88 million people with income between 150 percent and 400 percent of the FPL, 21 million are estimated to be enrolled in Medicaid or CHIP and 9 million in nongroup coverage or the Basic Health Program.

The vast majority of people who have an income above 400 percent of the FPL are enrolled in employment-based coverage.

Trends in the Uninsured Population and Its Composition

CBO and JCT consider people uninsured if they are not covered by an insurance plan or enrolled in a government program that provides financial protection from major medical risks.

Uninsured people receive some types of health care and are often not required to pay the full cost of that care, but they have substantially less access to care and financial protection than do insured people. Uninsured people who are eligible for Medicaid have more financial protection than others because they can enroll at any time—in some cases, as they are seeking care in hospitals or other settings—and may receive coverage retroactively.

Some people may be eligible for multiple sources of coverage. To characterize the uninsured population, CBO and JCT classified people who lack insurance in mutually exclusive groups on the basis of the most heavily subsidized option available to them or the primary reason they were ineligible for subsidized coverage. People can be eligible for subsidies through employment-based coverage, Medicaid, or premium tax credits through the marketplaces.

Number and Percentage of People Under Age 65 Without Health Insurance, 2017 to 2032

CBO and JCT estimate that about 10 percent of the population was without insurance in 2021 and 9 percent will be without insurance in 2022, when the temporary policies inducing enrollment have been in effect for the full year. After the effects of those policies have dissipated, the share of the population that is uninsured is projected to rise to an average of 11 percent in each year over the 2025–2032 period. That figure is slightly lower than the rate in the years before the policies were enacted.

Composition of the Uninsured Population Under Age 65, 2022 and 2032

Millions of People

In CBO and JCT’s projections, among the 25.1 million people uninsured in 2022, 15.3 million are eligible for subsidized coverage. In 2032, of the 28.2 million uninsured people, 16.8 million are projected to be eligible for subsidized coverage. Projected changes in Medicaid eligibility over time contribute to that increase.

In 2022, CBO and JCT estimate, 9.8 million uninsured people are not eligible for subsidized coverage. In 2032, 11.4 million are projected to not be eligible for subsidized coverage. The ending of ARPA’s enhanced subsidy provisions for 2021 and 2022 increases the number of uninsured people with income too high for marketplace subsidies.

Enrollment in and Spending for Medicaid and CHIP

Medicaid is jointly financed by state governments and the federal government; the federal government pays for roughly 65 percent of the cost of services, on average. Like Medicaid, CHIP is also jointly financed by state governments and the federal government; in that program, the federal government pays for roughly 70 percent of the cost of services. As discussed in “Effects of Temporary Policies on Medicaid and Coverage in the Marketplaces,” FFCRA temporarily increased the share of federal spending for Medicaid and CHIP.

Enrollment in and Spending for Medicaid and CHIP, by Eligibility Category, 2022

Percentage of Total

People in different eligibility categories for Medicaid and CHIP account for very different shares of enrollment and spending. For example, people with disabilities, for whom health care spending is higher, on average, are estimated to account for 9 percent of enrollment and 37 percent of spending in 2022, whereas children, for whom health care spending is lower, on average, are estimated to constitute 42 percent of Medicaid enrollment but only 14 percent of spending. People made eligible for Medicaid by the ACA, for whom the federal government pays a higher share of total health care spending, are estimated to constitute 20 percent of enrollment and 25 percent of spending.

Comparison of 2021 Projections With Actual Enrollment

CBO and JCT analyze how their current projections differ from the prior year’s and how their previous projections compare with actual enrollment when figures (from the Administration, state governments, and surveys) are available. Such evaluations help guide the agencies’ efforts to improve the quality of their projections and help ensure that the current projections accurately reflect any significant changes in economic trends, enrollment and spending patterns, and policy that occurred over the previous year.

(The sum of figures for actual enrollment in 2021 in each coverage category and for the number of people who were uninsured is greater than the estimate of the total population under 65. That overcount results because in analyzing data on actual enrollment and projecting insurance coverage, CBO and JCT do not assign people reporting multiple sources of coverage to a primary source. That approach better aligns the projections with administrative and survey data.)

Comparison of July 2021 Estimates With Actual Amounts

Millions of People

Compared with July 2021 estimates, actual enrollment in employment-based coverage was lower than anticipated because people drew on ARPA’s subsidies (available from April through September 2021) for employment-based coverage after the involuntary loss of a job less than the agencies expected. In the other direction, enrollment in Medicaid and subsidized nongroup coverage was higher than anticipated because the temporary policies encouraging enrollment had a bigger effect than expected. Those revisions resulted in a greater number of people with multiple sources of coverage and a smaller number of people without health insurance.

Changes Since July 2021 in Projections of Subsidies and Sources of Coverage

Since CBO and JCT’s previous projections, in July 2021, the agencies have increased their estimate, for the 2022–2031 period, of the net federal subsidies for health insurance coverage for people under age 65 from $11.6 trillion to $11.8 trillion. The agencies have revised their estimates of enrollment over the period to reflect enacted legislation, economic assumptions, new data on marketplace enrollment and premiums, and an updated assumption about the duration of the public health emergency.

Comparison of Current and Previous Estimates of Employment-Based Coverage

CBO and JCT now estimate higher enrollment in employment-based coverage than what the agencies estimated in July 2021. That increase is the result of higher projected employment and lower estimates of enrollment in individual coverage health reimbursement arrangements.

Like the estimates of enrollment, estimates of subsidies for employment-based coverage are higher than before. In addition to higher enrollment, higher projected incomes also contribute to the increase in subsidies.

Comparison of Current and Previous Estimates for Medicaid and CHIP

Medicaid and CHIP enrollment is projected to be higher in the near term than previously estimated because of higher-than-projected enrollment resulting from the continuous eligibility provisions. That higher enrollment is projected to persist through the assumed end of the public health emergency in July 2023, at which point it will gradually decline over the following year.

Federal spending on Medicaid and CHIP is projected to be higher in the near term than previously estimated because of increases in federal matching rates and enrollment attributable to FFCRA. After the public health emergency ends, subsidies are projected to be lower than previously estimated because of lower enrollment by a smaller estimated population.

Comparison of Current and Previous Estimates for Subsidized Nongroup Coverage and the Basic Health Program

Since July 2021, the agencies increased their near-term projections of nongroup coverage because of higher-than-expected enrollment in the marketplaces in 2021 and 2022. Higher enrollment in later years reflects an increase in the number of people eligible for subsidies and higher projected take-up of coverage.

In total, over the 2022–2031 period, CBO and JCT have increased their projections of subsidies for premium tax credits for nongroup coverage and the Basic Health Program. That increase is the net result of increased enrollment and, in later years, higher premiums.

Changes Since July 2021 in Projections of the Number of Uninsured People and People With Multiple Sources of Coverage

Compared with the amounts estimated in July 2021, CBO and JCT’s current estimates of the number of uninsured people are about 2 million smaller, on average, over the 2022–2024 period. The current estimates reflect increases in nearly all sources of coverage.

For 2022, the current estimate of the uninsured population is nearly 3 million smaller. That revision is the net result of changes in estimates of nearly all sources of coverage: 400,000 more people than previously estimated are enrolled in employment-based insurance; 9.6 million more, in Medicaid and CHIP; 400,000 more, in nongroup coverage or the Basic Health Program; and 500,000 fewer, in Medicare. In addition, 7 million more people have multiple sources of coverage over the course of the year.

The increase in the number of people with multiple sources of coverage does not correspond to an equal change in the total number of people estimated to have coverage. For example, some people enrolled in Medicaid at the beginning of the year continue to be covered by that program but also obtain employment-based coverage later in the year. The increase also explains how higher enrollment across coverage sources can exceed the decline in the uninsured population.

Comparison of Current and Previous Estimates of the Number of People Without Insurance

Millions of People

CBO and JCT now estimate fewer uninsured people in 2022 and 2023 than they previously estimated. That decline reflects the higher-than-anticipated response to the temporary policies boosting enrollment in other coverage categories.

Comparison of Current and Previous Estimates of the Number of People With Multiple Sources of Insurance

Millions of People

CBO and JCT currently estimate that more people will have multiple sources of coverage than the agencies estimated in July 2021. Most of the increase is attributable to people enrolled in Medicaid and another source of coverage in 2021. That increase is projected to persist through the end of the public health emergency.

AppendixDetails of the Projections of Health Insurance Coverage and Federal Subsidies

The tables in this appendix show the Congressional Budget Office and the staff of the Joint Committee on Taxation’s current projections of health insurance coverage and federal subsidies for health insurance for each year from 2021 to 2032. For the current projections of health insurance coverage, from May 2022, see Table A-1; for the current projections of net federal subsidies for health insurance, see Table A-2. For the projections of health insurance coverage from July 2021, see Table A-3; for the July 2021 projections of net federal subsidies for health insurance, see Table A-4. For a comparison of the current and prior estimates, see Table A-5.

Table A-1.

CBO’s May 2022 Projections for Health Insurance Coverage for People Under Age 65

Millions of People, by Calendar Year

Data sources: Congressional Budget Office; staff of the Joint Committee on Taxation. See www.cbo.gov/publication/57962#data.

The table shows coverage for the civilian noninstitutionalized population under age 65. The components do not sum to the total population because some people report multiple sources of coverage. Estimates reflect average monthly enrollment over the course of a year and include spouses and dependents covered under family policies.

ACA = Affordable Care Act; CHIP = Children’s Health Insurance Program; JCT = staff of the Joint Committee on Taxation.

a. Actual amounts are estimated on the basis of preliminary data and are subject to revision. For more information on the individual data sources and how CBO develops its integrated estimates of enrollment, see Congressional Budget Office, Health Insurance Coverage for People Under Age 65: Definitions and Estimates for 2015 to 2018 (April 2019), www.cbo.gov/publication/55094.

b. Includes noninstitutionalized enrollees under age 65 with full Medicaid benefits. Estimates are adjusted to account for people enrolled in more than one state.

c. Many people can purchase subsidized health insurance coverage through marketplaces established under the ACA, which are operated by the federal government, state governments, or partnerships between the federal and state governments.

d. The Basic Health Program, created under the ACA, allows states to establish a coverage program primarily for people with income between 138 percent and 200 percent of the federal poverty guidelines. To subsidize that coverage, the federal government provides states with funding equal to 95 percent of the subsidies for which those people would otherwise have been eligible through a marketplace.

e. Includes noninstitutionalized Medicare enrollees under age 65. Most Medicare-eligible people under age 65 qualify for Medicare because they participate in the Social Security Disability Insurance program.

f. Includes people with other kinds of insurance, such as student health plans, coverage provided by the Indian Health Service, or coverage from foreign sources.

g. CBO and JCT consider people uninsured if they are not covered by an insurance plan or enrolled in a government program that provides financial protection from major medical risks. See Congressional Budget Office, Health Insurance Coverage for People Under Age 65: Definitions and Estimates for 2015 to 2018 (April 2019), www.cbo.gov/publication/55094.

Table A-2.

CBO’s May 2022 Projections for Net Federal Subsidies for Health Insurance Coverage for People Under Age 65

Billions of Dollars, by Fiscal Year

Data sources: Congressional Budget Office; staff of the Joint Committee on Taxation. See www.cbo.gov/publication/57962#data.

The table shows subsidies for the civilian noninstitutionalized population under age 65. The table excludes outlays made by the federal government in its capacity as an employer.

Positive numbers indicate an increase in the deficit, and negative numbers indicate a decrease in the deficit.

ACA = Affordable Care Act; CHIP = Children’s Health Insurance Program; GDP = gross domestic product; JCT = staff of the Joint Committee on Taxation; n.a. = not available; * = between -$500 million and $500 million.

a. Actual amounts are estimated on the basis of preliminary data and are subject to revision.

b. The estimates shown, which JCT produced, reflect the tax value of the exclusion from federal income and payroll taxes for employer-based health insurance for people under age 65, as well as the penalty payments by employers. The tax value represents the change in tax revenues if the exclusion from federal income and payroll taxes was repealed and the total compensation paid by the employer (including the employer’s payroll taxes) remained constant by increasing wages. The estimates differ from those of the tax expenditure for the exclusion. The tax expenditure represents the change in tax revenues if the amount of excluded compensation was taxed and was larger than the tax value. Neither measure reflects employees’ behavioral responses to the change.

c. Includes increases in outlays and reductions in revenues.

d. The estimates shown, which JCT produced, do not include effects stemming from the deduction for people over age 65.

e. For Medicaid, spending reflects medical services for noninstitutionalized enrollees under age 65 who have full Medicaid benefits.

f. Under section 1332 of the ACA, states may apply for waivers from some of the rules governing insurance markets or programs offering health insurance established by the ACA. Waivers are required to be budget neutral and to provide comparable levels of insurance coverage.

g. Estimated Medicare spending for benefits net of offsetting receipts for noninstitutionalized Medicare beneficiaries under age 65. Estimates include Part D spending by the federal government for Medicare beneficiaries under 65.

h. Excludes the associated effects on revenues of changes in taxable compensation, which are included in the estimates of the tax exclusion for employment-based insurance. If those effects were included, net revenues from penalty payments by employers would total $6 billion over the 2023–2032 period.

Table A-3.

CBO’s July 2021 Projections for Health Insurance Coverage for People Under Age 65

Millions of People, by Calendar Year

Data sources: Congressional Budget Office; staff of the Joint Committee on Taxation. See www.cbo.gov/publication/57962#data.

The table shows coverage for the civilian noninstitutionalized population under age 65. The components do not sum to the total population because some people report multiple sources of coverage. Estimates reflect average monthly enrollment over the course of a year and include spouses and dependents covered under family policies.

ACA = Affordable Care Act; CHIP = Children’s Health Insurance Program; JCT = staff of the Joint Committee on Taxation.

a. Includes noninstitutionalized enrollees with full Medicaid benefits. Estimates are adjusted to account for people enrolled in more than one state.

b. Many people can purchase subsidized health insurance coverage through marketplaces established under the ACA, which are operated by the federal government, state governments, or partnerships between the federal and state governments.

c. The Basic Health Program, created under the ACA, allows states to establish a coverage program primarily for people with income between 138 percent and 200 percent of the federal poverty guidelines. To subsidize that coverage, the federal government provides states with funding equal to 95 percent of the subsidies for which those people would otherwise have been eligible through a marketplace.

d. Includes noninstitutionalized Medicare enrollees under age 65. Most Medicare-eligible people under age 65 qualify for Medicare because they participate in the Social Security Disability Insurance program.

e. Includes people with other kinds of insurance, such as student health plans, coverage provided by the Indian Health Service, or coverage from foreign sources.

f. CBO and JCT consider people uninsured if they are not covered by an insurance plan or enrolled in a government program that provides financial protection from major medical risks. See Congressional Budget Office, Health Insurance Coverage for People Under Age 65: Definitions and Estimates for 2015 to 2018 (April 2019), www.cbo.gov/publication/55094.

Table A-4.

CBO’s July 2021 Projections for Net Federal Subsidies for Health Insurance Coverage for People Under Age 65

Billions of Dollars, by Fiscal Year

Data sources: Congressional Budget Office; staff of the Joint Committee on Taxation. See www.cbo.gov/publication/57962#data.

The table shows subsidies for the civilian noninstitutionalized population under age 65. The table excludes outlays made by the federal government in its capacity as an employer.

Positive numbers indicate an increase in the deficit, and negative numbers indicate a decrease in the deficit.

ACA = Affordable Care Act; CHIP = Children’s Health Insurance Program; GDP = gross domestic product; JCT = staff of the Joint Committee on Taxation; * = between zero and $500 million.

a. The estimates shown, which JCT produced, reflect the tax value of the exclusion from federal income and payroll taxes for employer-based health insurance for people under age 65, as well as penalty payments by employers. The tax value represents the change in tax revenues if the exclusion from federal income and payroll taxes was repealed and the total compensation paid by the employer (including employer’s payroll taxes) remained constant by increasing wages. The estimates differ from those of the tax expenditure for the exclusion. The tax expenditure represents the change in tax revenues if the amount of excluded compensation was taxed and was larger than the tax value. Neither measure reflects employees’ behavioral responses to the change.

b. Includes increases in outlays and reductions in revenues.

c. The estimates shown, which JCT produced, do not include effects stemming from the deduction for people over age 65.

d. For Medicaid, spending reflects medical services for noninstitutionalized enrollees under age 65 who have full Medicaid benefits.

e. Under section 1332 of the ACA, states may apply for waivers from some of the rules governing insurance markets or programs offering health insurance established by the ACA. Waivers are required to be budget neutral and to provide comparable levels of insurance coverage.

f. Estimated Medicare spending for benefits net of offsetting receipts for noninstitutionalized Medicare beneficiaries under age 65. Estimates include Part D spending by the federal government for Medicare beneficiaries under 65.

g. Excludes the associated effects on revenues of changes in taxable compensation, which are included in the estimate of the tax exclusion for employment-based insurance. If those effects were included, net revenues from penalty payments by employers would total $12 billion over the 2022–2031 period.

Table A-5.

Comparison of Previous Projections With Actual Amounts and Current Projections

Data sources: Congressional Budget Office; staff of the Joint Committee on Taxation. See www.cbo.gov/publication/57962#data.

The table applies to the civilian noninstitutionalized population under age 65. Estimates of insurance coverage apply to calendar years, and estimates of the effect on the federal deficit apply to fiscal years.

ACA = Affordable Care Act; CHIP = Children’s Health Insurance Program; JCT = staff of the Joint Committee on Taxation; n.a. = not available; * = between −500,000 and 500,000; ** = between −$500 million and $500 million.

a. For insurance coverage, amounts over the period are averages; for effects on the federal deficit, they are totals.

b. Actual amounts are estimated on the basis of preliminary data and are subject to revision.

c. The components do not sum to the total population because some people report multiple sources of coverage. Estimates reflect average monthly enrollment over the course of a year and include spouses and dependents covered under family policies.

d. Includes noninstitutionalized enrollees with full Medicaid benefits. Estimates are adjusted to account for people enrolled in more than one state.

e. Many people can purchase subsidized health insurance coverage through marketplaces established under the ACA, which are operated by the federal government, state governments, or partnerships between the federal and state governments.

f. The Basic Health Program, created under the ACA, allows states to establish a coverage program primarily for people with income between 138 percent and 200 percent of the federal poverty guidelines. To subsidize that coverage, the federal government provides states with funding equal to 95 percent of the subsidies for which those people would otherwise have been eligible through a marketplace.

g. Includes noninstitutionalized Medicare enrollees under age 65. Most Medicare-eligible people under age 65 qualify for Medicare because they participate in the Social Security Disability Insurance program.

h. Includes people with other kinds of insurance, such as student health plans, coverage provided by the Indian Health Service, or coverage from foreign sources.

i. CBO and JCT consider people uninsured if they are not covered by an insurance plan or enrolled in a government program that provides financial protection from major medical risks. See Congressional Budget Office, Health Insurance Coverage for People Under Age 65: Definitions and Estimates for 2015 to 2018 (April 2019), www.cbo.gov/publication/55094.

j. Positive numbers indicate an increase in the deficit, and negative numbers indicate a decrease in the deficit.

k. The estimates shown, which JCT produced, reflect the tax value of the exclusion from federal income and payroll taxes for employer-based health insurance for people under age 65, as well as the penalty payments by employers. The tax value represents the change in tax revenues if the exclusion from federal income and payroll taxes was repealed and the total compensation paid by the employer (including the employer’s payroll taxes) remained constant by increasing wages. The estimates differ from those of the tax expenditure for the exclusion. The tax expenditure represents the change in tax revenues if the amount of excluded compensation was taxed and was larger than the tax value. Neither measure reflects employees’ behavioral responses to the change.

l. The estimates shown, which JCT produced, do not include effects stemming from the deduction for people over age 65.

m. For Medicaid, spending reflects medical services for noninstitutionalized enrollees under age 65 who have full Medicaid benefits.

n. Under section 1332 of the ACA, states may apply for waivers from some of the rules governing insurance markets or programs offering health insurance established by the ACA. Waivers are required to be budget neutral and to provide comparable levels of insurance coverage.

o. Estimated Medicare spending for benefits net of offsetting receipts for noninstitutionalized Medicare beneficiaries under age 65. Estimates include Part D spending by the federal government for Medicare beneficiaries under 65.

p. Excludes the associated effects on revenues of changes in taxable compensation, which are included in the estimate of the tax exclusion for employment-based insurance.

About This Document

Each year, the Congressional Budget Office issues a series of publications describing its projections of the federal budget. This report provides background information that helps explain some of the projections in the most recent of those publications and also provides updated estimates. In keeping with CBO’s mandate to provide objective, impartial analysis, the report makes no recommendations.

Carolyn Ugolino and Emily Vreeland prepared the report. Katherine Feinerman, Stuart Hammond, Caroline Hanson, Christian Henry, Nianyi Hong, Ben Hopkins, Sean Lyons, Eamon Molloy, Romain Parsad, Allison Percy, Lisa Ramirez-Branum, Sarah Sajewski, Robert Stewart, Chris Zogby, and the staff of the Joint Committee on Taxation contributed to the analysis. Chad Chirico, Carrie H. Colla, Berna Demiralp, Theresa Gullo, Tamara Hayford, Leo Lex, Sarah Masi, Alexandra Minicozzi, and Chapin White provided guidance and comments. Jared Hirschfield fact-checked the report.

Bill Kramer of the Purchaser Business Group on Health commented on an earlier draft. The assistance of an external reviewer implies no responsibility for the final product; that responsibility rests solely with CBO.

Mark Hadley and Jeffrey Kling reviewed the report. John Skeen edited it, and Casey Labrack created the graphics and prepared the text for publication. The report is available on CBO’s website at www.cbo.gov/publication/57962.

CBO seeks feedback to make its work as useful as possible. Please send any comments to communications@cbo.gov.

Phillip L. Swagel

Director

June 2022