At a Glance

Transparency is a top priority for the Congressional Budget Office, and the agency continues to bolster its efforts to be transparent. Those efforts are intended to promote a thorough understanding of CBO’s work, help people gauge how estimates might change if policies or circumstances differed, and enhance the credibility of the agency’s analyses and processes.

In 2024, the agency will undertake a variety of activities aimed at fostering transparency, such as the following:

- Sharing more information to help people understand the federal budget process and CBO’s role in it; and

- Explaining the methods it uses for its analyses in several topic areas, including national security, climate change, and economic projections.

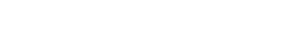

Those efforts will build on CBO’s activities in 2023, which included testifying before Congressional committees and answering Members’ questions, releasing data, evaluating the accuracy of the agency’s estimates, comparing current and previous estimates, estimating the effects of policy alternatives, characterizing the uncertainty surrounding estimates, creating data visualizations, and conducting outreach.

Summary

Transparency is a top priority for the Congressional Budget Office, and the agency continues to bolster its efforts to be transparent.

When CBO says it strives to be transparent, it has three specific goals in mind:

- To promote a thorough understanding of the agency’s analyses through accessible, clear, and detailed communication;

- To help people gauge how estimates might change if policies or circumstances differed; and

- To enhance the credibility of the agency’s analyses and processes by showing that they are grounded in data and high-quality professional research and are informed by feedback from a range of subject-matter experts.

In response to ongoing interest expressed by the Congress in CBO’s efforts to be transparent, CBO submits an annual report updating the Congress on its transparency activities.1 This edition reviews CBO’s transparency plans for 2024 and activities in 2023. A continually updated list of the agency’s most recent activities is available at www.cbo.gov/about/transparency.

Plans for 2024

This year, CBO will undertake a variety of transparency activities. They include testifying before Congressional committees and answering Members’ questions, explaining CBO’s analytic methods, releasing data and models, analyzing the accuracy of the agency’s projections, comparing current estimates with previous ones, estimating the effects of policy alternatives, characterizing the uncertainty surrounding estimates, creating data visualizations, and conducting outreach. In particular, the outreach will include continued daily interaction with the Congress to explain the agency’s estimates and get feedback as well as consultation with outside experts to seek advice. This report describes projects for which the scope has been fully developed and other projects that will be initiated.

Review of 2023

In 2023, as CBO pursued its goals for transparency, it undertook 10 types of activities:

- Testifying and publishing answers to questions. CBO testified at eight Congressional hearings and responded to requests from the Congress for public answers to specific questions. In addition to presenting written statements, making oral remarks, and answering questions at the hearings, the agency published answers to 25 questions that Members submitted after the hearings.

- Explaining its analytic methods. CBO published various reports explaining its analyses and made supporting documents and some computer code available. Also, in many cost estimates, CBO included a section describing the basis of the estimate.

- Releasing data. The Budget and Economic Outlook: 2023 to 2033, An Analysis of the Discretionary Spending Proposals in the President’s 2024 Budget, and several other reports were supplemented with comprehensive sets of data files. In total, 59 reports were accompanied by files providing the data underlying their figures.

- Analyzing the accuracy of its projections. CBO released comprehensive reports about the accuracy of its budget projections for fiscal years 2022 and 2023 as well as reports about its outlay projections and about the economy over time.

- Comparing its current estimates with its previous estimates. In several of its recurring publications released in 2023, CBO explained the differences between its current projections and those the agency had previously published. In addition, cost estimates explained the extent to which the provisions being analyzed and the resulting estimates were similar to or different from those in earlier cost estimates published during the same Congressional session.

- Comparing its estimates with those of others. CBO regularly compared its estimates with outside estimates—including the budget projections of the Administration, the economic projections of private-sector forecasters and other government agencies, and the policy analyses of various organizations. (Also, CBO often discussed comparisons with Congressional staff.)

- Estimating the effects of policy alternatives. CBO prepared reports and created interactive products to estimate the effects that alternative assumptions about future policies would have on economic and budgetary outcomes. Those products examined the effects of policies that would make broad changes in spending and revenue policies and provided in-depth examinations related to military force structure, hypersonic weapons, and Medicaid’s institutions for mental diseases (IMD) exclusion.

- Describing the uncertainty surrounding its estimates. In cost estimates and several major reports—including those on the budget and economic outlook—the agency discussed the uncertainty surrounding its estimates.

- Creating data visualizations. To make its projections and analyses easier to understand, the agency published visual reports, slide decks, infographics, and a chartbook. CBO also published visual summaries—short summaries that use figures to highlight the main points of a report—for two of its major reports.

- Conducting outreach. The most important form of outreach the agency performed in 2023 was direct communication (in person, by videoconference, by phone, and by email) between CBO and the Congress. For example, CBO’s Director met with hundreds of Members of Congress, either individually or in groups, to explain the agency’s work, respond to questions, and solicit feedback. The agency solicited input from a range of policy experts through its Panel of Economic Advisers and Panel of Health Advisers and obtained many external reviews of its work. CBO’s staff also gave presentations about the agency’s processes and recently completed work. Finally, the agency worked to make its information more accessible.

Background

CBO’s transparency efforts are built on a strong foundation that has been laid over many years. Almost all staff members contribute to the agency’s transparency efforts by spending at least some of their time on such activities.

CBO’s efforts to be transparent enhance its long-standing commitment to offering information that is objective, insightful, timely, and clearly presented and explained. Those efforts support the agency’s dedication to maintaining a level playing field regarding access to the information and analysis that it provides, thus ensuring that its work is made widely available to the Congress and the public. (Work on proposals that have not been made public remains confidential to facilitate the development of legislation.)

As CBO continues efforts to improve its transparency, it must constantly balance those efforts with its commitment to respond quickly to the Congress’s needs. Being transparent has costs, and CBO must weigh the benefits and costs of devoting resources to different activities. The agency welcomes feedback about what people find most useful and suggestions about other ways in which it can further explain its work.

CBO’s transparency efforts complement its process for publicly releasing all its cost estimates and analytic reports. Through that process, CBO delivers its work to interested Members of Congress and their staff, including the sponsor of legislation or the requester of the report; the Chairman and Ranking Member of the committees with jurisdiction over the subject at hand; and the budget committees.2 At about the same time, the agency posts the work on its website. An email service and announcements on X, formerly known as Twitter, also notify subscribers when the agency publishes its work.

CBO’s Transparency Plans for 2024

In 2024, CBO plans to continue its efforts to undertake the 10 types of transparency activities discussed above.

Testifying and Publishing Answers to Questions

CBO expects to testify about its budget and economic outlook and other topics as requested by the Congress in 2024. Testifying involves presenting written statements, making oral remarks, and answering questions at hearings, as well as publishing answers to questions that Members submit for the record after the hearings. CBO also will continue to respond to matters raised as part of the oversight by the budget committees and by the Congress more broadly. In addition, the agency expects that Members of Congress will ask other questions to which it will publish responses. CBO has already provided testimony in 2024 about the accuracy of its projections and about the budget and economic outlook.

Explaining Analytic Methods

This year, CBO has already released 11 products that include explanations of the agency’s analytic methods. The agency will continue to release products that explain models and methods that it uses to create cost estimates and support the analysis in its reports. Those products will cover health care, macroeconomic issues, taxation, national defense, and other topics.

CBO has already produced the following in 2024:

- A report summarizing recent research findings on Medicare’s accountable care organizations and the factors that have contributed to or limited their budgetary savings (released April 16);

- A report estimating the acquisition costs of the Navy’s medium landing ship (released April 11);

- A report comparing rates of economywide inflation with rates of change in the Navy’s shipbuilding composite index, which the service uses to assess the growth of costs in the naval shipbuilding industry (released April 11);

- A report exploring the role of the Federal Home Loan Banks and describing how CBO estimates the amount of subsidies they receive from the federal government because of their status as government-sponsored enterprises (released March 7);

- A report analyzing how housing allowances for military personnel compare with the amounts that comparable civilians spend on housing, including a thorough description of the data CBO used in making that comparison (released March 6);

- A report describing CBO’s approach to estimating the effects on revenues of changes in spending by the Internal Revenue Service (released February 29);

- A visual report describing trends in greenhouse gas emissions from the manufacturing sector, with an extensive list of data sources (released February 28);

- A workbook that allows users to see how revenues and outlays that differed from those in CBO’s February 2024 baseline budget projections would affect debt service, deficits, and debt (released February 16);

- A working paper describing how CBO projects consumer price inflation (released February 9);

- A recurring visual report describing CBO’s demographic projections over the next three decades (released January 18); and

- A report describing how CBO’s work supports the Congress, how the agency produces that work, and how that work is made available to the Congress and the public (released January 17).

Computer code already has been updated for CBO’s capital tax model, which is used to estimate the effects of federal taxes on capital income from new investment, for consistency with the agency’s most recent baseline projections (on February 7).

Explanatory products on other topics scheduled to be completed this year include the following:

- A working paper describing the agency’s approach to modeling the effects of various policies in the electric power sector;

- A visual report about student loan repayment;

- A report summarizing the risks that climate change poses to the federal budget and the economy;

- A report evaluating the effects of climate change on markets for property and casualty insurance;

- A report assessing the distribution of flood insurance coverage by income, demographic, and other characteristics;

- A working paper analyzing the budgetary effects of the risk from floods to homes with federally backed mortgages;

- A report summarizing the amount of flood damage avoided by federal spending on climate adaptation;

- A working paper describing how CBO models the damage avoided from selected types of spending on flood adaptation;

- A report assessing alternative approaches to reducing prescription drug prices;

- A report examining the effects of changes in fee-for-service Medicare on Medicare Advantage and Part B premiums;

- A report describing CBO’s approach to analyzing policies that would increase Medicare’s coverage of treatments for obesity;

- A visual report describing trends in the distribution of rebates paid by pharmaceutical manufacturers in the Medicare Part D program;

- A report analyzing the cost and force structure of the Navy’s fiscal year 2025 shipbuilding plan;

- A report examining the income of Black veterans who served during the Gulf War era;

- An update to a report analyzing how inflation has affected households at different income levels since 2019;

- A visual report presenting the distribution of household income, means-tested transfers, and federal taxes in 2021, along with a companion document examining the associated trends from 1979 through 2021;

- A report comparing the cost of compensation for federal civilian employees with that of employees in the private sector;

- A report describing the distribution of family wealth;

- A report about the effects of immigration on CBO’s baseline budget projections;

- A report about the sensitivity of CBO’s February 2024 baseline budget projections to different values for economic variables;

- A report explaining how CBO’s most recent budget projections would change under different assumptions about future legislated policies;

- A report describing how CBO selects and uses discount rates in its analysis;

- A report presenting estimates of the budgetary effects of federal credit programs in 2025; and

- A report on risk sharing in federal credit programs.

Computer code and data will be updated with the most recent actual values through the end of fiscal year 2024 to allow users to replicate the evaluations CBO regularly conducts of its projections of various budget components: outlays, revenues, deficits, and debt. Code and data also will be updated to replicate CBO’s adjustments for underreporting of receipt and benefit amounts in selected means-tested transfer programs.

Releasing Data

Whenever possible, CBO publishes extensive sets of data in conjunction with its major recurring reports. Those data sets include detailed information on the agency’s 10-year budget projections; long-term budget projections; historical budget data; 10-year trust fund projections; revenue projections, by category; spending projections, by budget account; estimates of automatic stabilizers; tax parameters and effective marginal tax rates on labor and capital; 10-year projections of economic variables (including data about the economy’s maximum sustainable output); historical data and economic projections; long-term economic projections; and demographic projections.

The agency also will share details, in both spreadsheets and PDFs, about its baseline projections for these specific programs: the Federal Pell Grant Program, student loan programs, the Children’s Health Insurance Program, federal subsidies for health insurance, Medicaid, Medicare, the DoD Medicare-Eligible Retiree Health Care Fund, the military retirement program, the Pension Benefit Guaranty Corporation, the Social Security Disability Insurance program, the Social Security Old-Age and Survivors Insurance program, the trust funds for Social Security, child nutrition programs, child support enforcement and collections, foster care and adoption assistance programs, the Supplemental Nutrition Assistance Program, the Supplemental Security Income program, the Temporary Assistance for Needy Families program, the unemployment compensation program, the Airport and Airway trust fund, federal programs that guarantee mortgages, programs funded by the Highway Trust Fund, benefits for veterans and military personnel stemming from the Post-9/11 GI Bill, the Toxic Exposures Fund, the Department of Agriculture’s mandatory farm programs, and the veterans’ disability compensation and pension program.

In addition, when the agency analyzes the President’s budget request for 2024, it will post a set of files that give estimates of the budgetary effects of specific proposals. CBO has already published detailed data on expired or expiring authorizations of appropriations. Throughout the year, the agency will post the data underlying the figures in various reports. Also, CBO will continue to publish information about its estimates for appropriation bills.

Analyzing the Accuracy of CBO’s Estimates

CBO will continue its series of publications that review the accuracy of its outlay and revenue projections for the previous year. The agency also will review the accuracy of its projections of deficits and debt over time.

Comparing Current Estimates With Previous Estimates

In several of its recurring publications—about the budget and economic outlook, federal subsidies for health insurance, the costs of the Navy’s shipbuilding plan, and the distribution of household income—CBO will continue to explain the differences between the current year’s projections and those from the previous year. In its cost estimates, CBO will continue to identify related legislative provisions for which it has provided estimates during the current Congressional session and explain the extent to which the provisions and estimates at hand are similar or different.

Comparing CBO’s Estimates With Those of Other Organizations

The agency will continue to regularly publish analyses comparing its budget projections with the Administration’s and its economic projections with those of private forecasters and other government agencies. The agency also will include comparisons of estimates in various other reports. And when time does not allow publication but interest in a comparison of CBO’s estimates with others’ is high, analysts will discuss such comparisons with Congressional staff.

Estimating the Effects of Policy Alternatives

CBO will publish reports that show the potential effects of policy proposals across a range of topics. This year, CBO has already published an interactive tool that allows users to explore how various policies to increase the federal minimum wage would affect earnings, employment, family income, and poverty.

Characterizing the Uncertainty of CBO’s Estimates

CBO’s budget and economic estimates reflect the middle of a range of outcomes under a given set of policies. In its publications, CBO will discuss the sources of uncertainty in its analyses, such as those in the Budget and Economic Outlook, to help make clear the factors that might cause estimates or outcomes to differ in the future. In addition, cost estimates will continue to feature, when applicable, a section on specific areas of uncertainty in the estimate.

CBO also has published an interactive tool about how changes in spending and revenues could affect debt (released February 16), a tool about how outlays could differ depending on the types and amounts of budget authority (released February 29), and a tool about how different economic conditions could affect the budget (released April 9).

Creating Data Visualizations

CBO already has published executive summaries of The Budget and Economic Outlook and The Long-Term Budget Outlook in a new format featuring data visualization. Also, the agency has issued a visual report this year on the demographic outlook from 2024 to 2054 (released January 18) and infographics about the deficit, spending, and revenues in fiscal year 2023 (released March 5). Later this year, CBO will publish visual reports on student loans and on the distribution of household income.

Conducting Outreach

CBO will continue to communicate daily with people outside the agency to explain its findings and methods, respond to questions, and get feedback. The agency’s Director will meet regularly with Members of Congress to do the same. In 2024, CBO’s Director has already briefed many Members of Congress about the budget and the economy. After CBO’s baseline was published in February, the agency’s staff discussed the new projections with Congressional staff and answered their questions. Similar briefings and discussions will occur after the release of CBO’s spring baseline.

In addition, CBO has already published letters answering specific questions from Members:

- A letter about CBO’s timeline for providing a preliminary analysis of H.R. 1770, the Equitable Community Access to Pharmacist Services Act (released March 22);

- A letter, and an update, describing implementation of the caps on most discretionary funding for fiscal year 2024 (released January 4 and March 13);

- A letter responding to a request for estimates of what the effects on federal deficits would be if the economy was stagnant over two years (released January 30); and

- A letter about CBO’s engagement with the AbilityOne program and the agency’s procurement of AbilityOne products and services (released January 19).

CBO also will continue to seek and respond to input from its Panel of Economic Advisers and Panel of Health Advisers. The agency will continue to turn to other experts as well. Many reports will benefit from comments made by outside experts on early drafts. For some recurring reports produced on compressed timetables, the agency will solicit comments on previous editions and on selected technical issues and then use that feedback to improve future editions.

CBO staff will continue to give presentations on Capitol Hill on its budget and economic projections and on other topics. Those presentations allow CBO to explain its work and answer questions. The agency also will give presentations about its findings and about work in progress in a variety of other venues to offer explanations and gather feedback. In addition, CBO will publish HTML versions of all reports to make them more accessible.

A Review of CBO’s Transparency Efforts in 2023

In 2023, CBO’s publications—including reports, working papers, presentations, interactive tools, data sets, and computer code—contributed to transparency activities that can be grouped into 10 categories.

Testifying and Publishing Answers to Questions

In 2023, representatives of CBO appeared as witnesses at eight Congressional hearings. In addition to presenting written statements, making oral remarks, and answering questions at the hearings, the agency published answers to questions that Members submitted after the hearings. These are the venues and topics:

- Before the United States Joint Economic Committee about CBO’s demographic projections;

- Before the House Transportation and Infrastructure Committee’s Highway and Transit Subcommittee about the status of the highway trust fund (followed by answers to four questions for the record about charging fees for electric vehicles, assessing the efficacy and fairness of a vehicle-miles traveled charge, charging more to the trucking industry, and how the highway trust fund supports the expansion and upgrading of highways);

- Before the Senate Budget Committee about alternative payment models and the slowdown in federal health care spending (followed by answers to two questions for the record about CBO’s projections of federal health care spending);

- Before the Senate Armed Services Committee’s Subcommittee on Personnel about approaches to reducing the Department of Defense’s compensation costs (followed by answers to three questions for the record about whether CBO supports section 902 of the National Defense Authorization Act for fiscal year 2024, how the Department of Defense could make its military compensation plan more understandable to potential recruits, and how the Department of Defense could make its military compensation plan more attractive);

- Before the Senate Budget Committee about CBO’s projections of Social Security’s finances (followed by answers to 10 questions for the record about the economic effects of a new tax on higher-income people and increases in Social Security benefits for retirees, the effects of Social Security on the federal budget and debt, differences between the shortfalls projected by CBO and the Social Security trustees, the fundamentals of trust fund accounting, and immigration reform and trust fund solvency);

- Before the House Ways and Means Committee’s Subcommittee on Social Security about CBO’s projections of Social Security’s finances (followed by answers to two questions for the record about changes in labor force participation and the effect of Social Security’s retirement earnings test on program finances and workers’ decisions to draw benefits or continue working);

- Before the Senate Appropriations Committee’s Subcommittee on the Legislative Branch about CBO’s budget request for fiscal year 2024 (followed by answers to four questions for the record about the agency’s cybersecurity and transparency efforts); and

- Before the House Appropriations Committee’s Subcommittee on the Legislative Branch about CBO’s appropriation request for fiscal year 2024.

Explaining Analytic Methods

CBO’s estimates are produced by teams who use information from experts, data, and research to determine which analytic methods to use. The agency aims to explain its methods, sometimes for a general audience and sometimes by sharing technical information.

General Information. In 2023, CBO published the following material giving details about methods underlying particular analyses and offering more detail on issues:

- A report analyzing the earnings, personal income, and household income of working-age veterans receiving disability compensation;

- A report examining the status, federal support, and future potential of carbon capture and storage;

- A visual report estimating the Navy’s costs to eliminate its deferred maintenance backlog and to renovate and modernize its buildings;

- A visual report estimating the flood damage that homes with federally backed mortgages are expected to face in a changing climate;

- A report analyzing the Navy’s fiscal year 2024 shipbuilding plan;

- A report analyzing the Department of Defense’s plans for 2024 through 2028 as presented in the Future Years Defense Program;

- A slide deck describing how CBO projects corporate income tax revenues;

- A report describing the federal budgetary effects of the activities of the Center for Medicare & Medicaid Innovation;

- A visual report examining the variation in current and future flood risk across communities with different economic and demographic characteristics;

- A report presenting estimates of the budgetary effects of federal credit programs in 2024;

- A visual report analyzing funding for special and incentive pay for active-duty service members and how those types of pay have been used to address personnel shortfalls;

- A report analyzing alternative scenarios for the economy and the budget that differ from those underlying CBO’s long-term baseline budget projections;

- A report estimating the economic and budgetary effects of discretionary funding caps as specified in the Limit, Save, Grow Act of 2023;

- A visual report detailing CBO’s long-term projections for Social Security;

- A report describing the budgetary effects of the Fiscal Responsibility Act of 2023;

- A report projecting the budgetary effects of automatic stabilizers;

- A report explaining the statutory foundations of CBO’s baseline;

- A report describing the principles that CBO follows to identify mandates in legislation;

- A visual report giving an overview of issues surrounding the use of large constellations of low-altitude satellites for defense communications and observation;

- A report explaining how CBO’s most recent budget projections would change under different assumptions about future legislated policies;

- A report examining trends in corporate economic profits and tax payments;

- A report describing features of the Medicare and Medicaid improvement funds and how the funds are accounted for in CBO’s baseline and cost estimates;

- A report explaining how CBO develops the budget baseline;

- A report describing CBO’s cost-estimating process;

- A visual report describing the financial commitments the federal government has made through its credit and insurance programs;

- A slide deck explaining how CBO projects realized capital gains;

- A visual report examining the availability and use of the Department of Defense’s F-35 fighter aircraft and findings on availability rates, flying hours, and the effects of aging;

- A report on issues and budgetary choices involved in procuring hypersonic weapons and alternatives; and

- A report analyzing the Department of Defense’s plans for 2023 through 2027 as presented in the Future Years Defense Program.

Technical Information. CBO also published details intended to help analysts outside the agency understand its work.

On macroeconomic issues, CBO published the following:

- A working paper describing how CBO uses a Bayesian vector autoregression model to generate alternative economic projections to the agency’s baseline;

- A working paper analyzing the effects of supply disruptions and economic slack on inflation; and

- A working paper examining the role and economic effects of the U.S. dollar’s status as an international currency.

Publications on other topics included the following:

- A visual report estimating the federal subsidies for health insurance;

- A report assessing the cost of federal loans and loan guarantees, including lifetime administrative costs;

- A visual report analyzing the distribution of household income, means-tested transfers, and federal taxes in 2020;

- A working paper exploring the economic and budgetary effects of Medicaid spending on children;

- A working paper modeling the demand for electric vehicles and the supply of charging stations in the United States;

- A visual report comparing rates of aircraft availability from two Navy databases of F/A-18E/F Super Hornet aircraft;

- A report explaining how CBO estimates savings from rescissions of budgetary authority;

- A working paper examining how Alabama’s recent expansion of its work requirement for the Temporary Assistance for Needy Families program affects employment and income;

- A working paper describing the role of defined benefit and defined contribution retirement plans in the distribution of family wealth;

- A slide deck outlining the models CBO uses to assess the budgetary effects of alternative economic scenarios such as those presented in CBO’s Current View of the Economy in 2023 and 2024 and the Budgetary Implications;

- A slide deck describing how CBO used a Markov-switching model to assess the uncertainty of the economic forecast presented in CBO’s Current View of the Economy in 2023 and 2024 and the Budgetary Implications;

- A slide deck describing how CBO used a Bayesian vector autoregression model to assess the uncertainty of the economic forecast presented in CBO’s Current View of the Economy in 2023 and 2024 and the Budgetary Implications; and

- A working paper analyzing how the amount that physicians are paid for services affects access to care for people dually enrolled in Medicare and Medicaid in comparison with people enrolled only in Medicare.

Computer code and data were updated with the most recent actual values through the end of fiscal year 2023 to allow users to replicate evaluations of projections of outlays, revenues, deficits, and debt. Code also was updated for CBO’s capital tax model. Code and data also were updated to replicate CBO’s adjustments for underreporting of receipt and benefit amounts from selected means-tested transfer programs.

Releasing Data

In 2023, CBO continued publishing weekly tables that include estimates for legislation expected to be considered in the House of Representatives under the suspension of the rules (the process by which the House can pass a bill in an expedited manner). Those tables give the bill number and name, a summary of the effects on mandatory spending and revenues, and links to the bill text and a published estimate, if available.

In 2023, CBO also made available many files of data underlying the analyses for its major reports and several other studies. The agency maintains a page on its website with links to current and past releases of the budget and economic data underlying its key projections.

New files on the following topics were posted on the website at least once, and sometimes twice, related to updates the agency made to its budget and economic baseline in May 2023:

- 10-year budget projections, including projections of federal spending, revenues, deficits, and debt held by the public;

- Long-term budget projections, showing estimates of CBO’s key projections in a 30-year budget window;

- Historical budget data, showing revenues, outlays, and the deficit or surplus since 1965;

- 10-year trust fund projections, showing the balances and the deficits or surpluses for Social Security, Medicare, military retirement, civilian retirement, and other trust funds;

- Revenue projections, by category, with more details about adjusted gross income, taxable income, and income tax liability;

- Spending projections, by budget account, which show budget authority and outlays organized by Treasury identification number;

- The tax parameters and effective marginal tax rates on labor and capital used in CBO’s microsimulation tax model and economic forecast, respectively;

- 10-year economic projections, showing estimates of output, prices, labor market measures, interest rates, income, and other economic factors;

- Historical economic data, including estimates of output, prices, labor market measures, interest rates, income, and other economic factors;

- Long-term economic projections, showing extensions of the agency’s 10-year economic projections; and

- Demographic projections, showing projections of population size, immigration, emigration, mortality, and fertility.

CBO also maintains a page on its website with details about many of its past and current 10-year baseline projections for selected programs. In all, the agency publishes 26 files with information on different programs.

Some of those files include information on education and health programs:

- Data on the Federal Pell Grant Program include projections of the program’s three funding sources—discretionary budget authority, the largest portion, supporting a maximum award set in an annual appropriation act; mandatory budget authority, specified in the Higher Education Act of 1965; and a formula-based automatic “mandatory add-on” to each award’s discretionary portion.

- Data on student loan programs show the agency’s projections of the cost for each associated budget account (estimated using the procedures established in the Federal Credit Reform Act), projections of loan volume and subsidy rates for the direct student loans made using those procedures, estimates of administrative costs, projections of interest rates for borrowers, and projections of the cost of the programs made using fair-value estimating procedures.

- Data on the Children’s Health Insurance Program include projections of federal funding, average monthly enrollment in the program by age, average annual federal spending per enrollee, and details on the total funding available based on budget authority and other factors.

- Data on federal subsidies for health insurance (including the effects of the Affordable Care Act) show details about the agency’s projections of health insurance coverage and its projections of net federal subsidies associated with each type of insurance coverage.

- Medicaid data present details about the agency’s projections of federal payments by type of Medicaid benefit, including acute care, the fee-for-service program, managed care, Medicaid’s payments of Medicare premiums, long-term care, and vaccines for children. The files also include details on enrollment, total payments, and payments per enrollee by Medicaid eligibility category (aged, blind or disabled, children, and adults).

- Medicare data include detailed projections of mandatory outlays, benefit payments, annual growth rates, payment updates and changes in price indexes, enrollment, the status of the Hospital Insurance Trust Fund, and offsetting receipts.

Other program-specific files relate to pensions and Social Security:

- Data on the Department of Defense Medicare-Eligible Retiree Health Fund include projections of outlays, the number of beneficiaries, and the annual cost per beneficiary.

- Data about the military retirement program include projections of the number of beneficiaries and average annual benefits for retirees and for surviving spouses and dependents of deceased service members.

- Data about the Pension Benefit Guaranty Corporation describe CBO’s projections of premiums, interest receipts, and outlays for the single-employer program, the multiemployer program, and administrative costs.

- Data on the Railroad Retirement program include projections of the number of beneficiaries and annual outlays.

- Data on the Social Security Disability Insurance program include projections of the number of beneficiaries, the average monthly benefit, the average wage for indexing, the maximum amount of taxable earnings, the cost-of-living adjustment, and other factors.

- Data about the Social Security Old-Age and Survivors Insurance program include projections of the number of beneficiaries and the average monthly benefit for retired workers and families and for surviving spouses and dependents. Also included are projections of the average wage for indexing, the maximum amount of earnings that can be taxed, the cost-of-living adjustment, and other factors.

- Data on the Social Security trust funds show details about CBO’s projections of outflows for benefits and other costs and of income from payroll taxes, interest, and other sources.

The program-specific files also cover other income security programs:

- Data on child nutrition programs report details about CBO’s projections of the consumer price index for food away from home and of budget authority for the National School Lunch Program, the School Breakfast Program, the Child and Adult Care Food Program, the procurement of commodities, the Summer Food Service Program, state administrative expenses, and other spending.

- Data on child support enforcement and collections include projections of administrative costs, incentive payments, and other payments, as well as projections of collection amounts.

- Data about foster care and adoption assistance programs include projections of outlays for maintenance, administration, training, and other costs, as well as projections of average monthly caseloads.

- Data on the Supplemental Nutrition Assistance Program include projections of total benefit amounts, administrative costs, average monthly participation, average monthly benefits, changes in the cost of the Thrifty Food Plan, and the unemployment rate.

- Data on the Supplemental Security Income program include projections of the number of beneficiaries who are aged, blind, or disabled adults and of the number who are blind or disabled children. Also included are projections of the number of awards and average monthly benefits for each group.

- Data on the Temporary Assistance for Needy Families program include projections of budget authority for state family assistance grants, grants related to marriage and fatherhood, and other types of assistance.

- Data about the unemployment compensation program include projections of regular benefits, extended benefits, and trade adjustment assistance. Projections also include average weekly benefits, the average duration of benefits, the number of people receiving first payments, the number of people in the labor force, and the unemployment rate.

Data files for some other programs are published as well:

- Data on the Airport and Airway Trust Fund include details about CBO’s projections of inflows from excise taxes and interest earnings and outflows for spending on programs administered by the Federal Aviation Administration.

- Data about federal programs that guarantee mortgages include projections of the budgetary effects of the activities of Fannie Mae and Freddie Mac, the Federal Housing Administration’s Mutual Mortgage Insurance Fund, the home loan program for veterans, and Ginnie Mae’s mortgage-backed securities program. Also available are estimates of the value of annual loans and subsidy rates.

- Data on programs funded by the Highway Trust Fund include projections of the start-of-year balances, revenues and interest, outlays, and cumulative shortfalls of the fund’s highway and transit accounts.

- Data on Post-9/11 GI Bill benefits include projections of the number of veterans and military personnel who will receive benefits and of average annual payments.

- Data on the Department of Agriculture’s mandatory farm programs include projections of outlays for crop insurance, conservation programs, disaster assistance, and assistance from the Commodity Credit Corporation account and related accounts. Also available are projections of the supply of the following crops and related outlays: corn, soybeans, wheat, upland cotton, rice, peanuts, sorghum, barley, oats, sunflower seed, canola, flaxseed, safflower, mustard seed, inedible rapeseed, extra-long-staple cotton, dry field peas, lentils, dairy, and large and small chickpeas.

- Data on the veterans’ disability compensation and pension program include projections of the number of beneficiaries and the average annual benefits for veterans and for surviving spouses and dependents.

Two files were posted with last year’s report on the long-term budget outlook:

- Data on the long-term budget projections include data about economic factors, information about trust funds, and other details.

- Data on the long-term economic projections include extensions of 10-year economic projections for additional decades.

In 2023, supplemental data accompanied several other analyses:

- Data underlying CBO’s analysis of the distribution of household income, means-tested transfers, and federal taxes in 2020;

- Data that translate CBO’s revenue and outlay projections for 2023 to 2033 to the receipts and expenditures used in the national income and product accounts framework;

- Supplemental data describing CBO’s estimates of the costs of federal credit programs in 2024;

- Data underlying CBO’s projections of the costs of U.S. nuclear forces for 2023 to 2032;

- Data that describe CBO’s estimates of the effects of automatic stabilizers on the federal budget from 2023 to 2033;

- Data underlying CBO’s analysis of the discretionary spending proposals in the President’s 2024 budget;

- Data detailing expired and expiring authorizations of appropriations for fiscal year 2023; and

- Data underlying the agency’s analysis of the Department of Defense’s plans for the 2023 Future Years Defense Program.

CBO collects all publications with data files in one location on its website.

Analyzing the Accuracy of CBO’s Estimates

In 2023, in two updates to a recurring report, CBO assessed the accuracy of its budget projections for fiscal years 2022 and 2023. In January 2023, CBO focused on its July 2021 baseline projections. That analysis indicated that CBO overestimated the federal deficit in 2022—the result of underestimating revenues by 10 percent and outlays by 5 percent. In December 2023, CBO focused on its May 2022 baseline projections. That analysis indicated that CBO underestimated the federal deficit in 2023—the result of overestimating revenues by 11 percent and underestimating outlays by 9 percent. The largest factors affecting the accuracy of the projections of outlays and revenues for 2023 were actions by the Administration that occurred after the projections were made.

In addition, CBO issued a report assessing the accuracy of its economic forecasts, which have been more accurate than the Administration’s.

Comparing Current Estimates With Previous Estimates

In several of its recurring publications in 2023, CBO explained the differences between the current year’s projections and those of the previous year. The explanations offer insight into the agency’s methods by indicating why it changed its projections.

In The Budget and Economic Outlook: 2023 to 2033 (Appendix A), CBO explained the differences between CBO’s projections from February 2023 and those that it published in May 2022. Those revisions were separated into three categories:

- Legislative changes, which result from laws enacted since the agency published its previous baseline projections and which generally reflect the budgetary effects reported in CBO’s cost estimates when the new laws were enacted;

- Economic changes, which arise from changes the agency has made to its economic forecast (including those made to incorporate the macroeconomic effects of recently enacted legislation); and

- Technical changes, which are revisions to projections that are neither legislative nor economic.

CBO also explained the differences between CBO’s February 2023 economic projections and those that it published in 2022.

In The 2023 Long-Term Budget Outlook (Appendix B), CBO explained the differences between the agency’s current projections and those it published in 2022. In particular, the agency reviewed the reasons for changes in its projections of GDP, labor force participation rates, inflation, and interest rates.

In its annual report on the Troubled Asset Relief Program, CBO updated its estimate of the program’s costs. CBO’s 2023 estimate—a net cost of about $31 billion—was similar to its May 2022 projection and the Administration’s estimate.

Comparing CBO’s Estimates With Those of Other Organizations

CBO’s estimates can differ from others’ for a variety of reasons, including differences in the policies considered, the data used, the interpretation of research findings, and analytic approaches. CBO regularly compares its budget projections with those of the Administration, but opportunities to compare budgetary projections and costs estimates for legislation with those of other organizations are rare, mainly because not many other organizations focus on federal costs. By contrast, the agency has the opportunity to compare its economic projections with those of private forecasters and other government agencies, and sometimes it can make comparisons with other organizations’ policy analyses. (Some of those comparisons are communicated in discussions with Congressional staff.)

In 2023, CBO compared its budget projections with those of the Administration, private-sector forecasters, and other federal agencies. In The Budget and Economic Outlook: 2023 to 2033 (pp. 60–65), CBO compared its forecast with the range of forecasts from more than 40 private-sector forecasters surveyed for the Blue Chip Economic Indicators, roughly 40 private-sector forecasters participating in the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters, and the Federal Open Market Committee of the Federal Reserve. For several reasons, CBO’s projections suggested a slightly weaker outlook for 2023 but a stronger outlook than those of other forecasters for later years. Differences in the economic data available when the forecasts were completed may have led to some of the differences in forecasts. Differences may also exist in the economic and statistical models used to prepare the forecasts, and other forecasters may assume changes in federal policies, whereas CBO’s projections reflect the assumption that current laws generally remain unchanged.

In An Analysis of the Navy’s Fiscal Year 2024 Shipbuilding Plan (pp. 15–20), the agency compared its estimates with those of the Navy. CBO’s estimates were higher largely because CBO’s projections accounted for the rising costs of labor and material used in building naval ships.

Estimating the Effects of Policy Alternatives

CBO’s baseline budget projections, constructed in accordance with provisions of law, are intended to show what would happen to federal spending, revenues, and deficits if current laws generally remained unchanged. Estimating the effects of policy alternatives promotes understanding of why and how estimates can differ and how large the effects of the alternatives might be; CBO therefore also published many products about specific policies and programs that present projected economic and budgetary outcomes under multiple policy scenarios:

- In CBO’s Interactive Force Structure Tool, the agency illustrated the relationship between the size of the defense budget and the kinds of forces fielded by the U.S. military.

- In The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget, CBO analyzed eight scenarios that would affect the agency’s budget projections.

- In The Economic and Budgetary Effects of Discretionary Funding Caps as Specified in the Limit, Save, Grow Act of 2023, the agency performed a dynamic analysis that took into account the ways reductions in discretionary spending would affect the total output of the economy and how the resulting macroeconomic changes would in turn affect federal revenues and spending.

- In Budgetary Outcomes Under Alternative Assumptions About Spending and Revenues, CBO analyzed the budgetary implications of alternative assumptions about the future funding for discretionary programs and the continuation of certain tax provisions currently scheduled to change.

- In Budgetary Effects of Policies to Modify or Eliminate Medicaid’s Institutions for Mental Diseases Exclusion, the agency examined two options available to policymakers to expand federal Medicaid payments. The first would permanently extend the option for states to receive federal matching funds for Medicaid enrollees with at least one substance use disorder, and the second would eliminate the policy known as the institutions for mental diseases (IMD) exclusion.

- In U.S. Hypersonic Weapons and Alternatives, CBO analyzed the hypersonic missiles being developed by the U.S. military and compared them with less expensive existing or potential weapons that might fill similar roles.

Characterizing the Uncertainty of CBO’s Estimates

CBO’s budget and economic projections reflect the middle of a range of outcomes under a given set of policies. CBO’s analysts often test the sensitivity of their projections to identify the range of possible outcomes for those projections and to observe how projections change as factors vary. Likewise, in its cost estimates, CBO aims to produce estimates that generally reflect the middle of the likely range of budgetary outcomes that would result if the legislation was enacted. The agency included discussions of uncertainty in many of its cost estimates.

Several times in 2023, CBO explained sources of uncertainty in its reports to help policymakers understand the factors that might cause outcomes or future estimates to differ from the agency’s current estimates:

- In The Navy’s Costs to Eliminate Its Deferred Maintenance Backlog and to Renovate and Modernize Its Buildings (p. 21), the agency discussed uncertainty about the future costs of goods and services (including materials) and deterioration in the buildings after the assessment date.

- In Flood Damage and Federally Backed Mortgages in a Changing Climate (p. 14), the agency described three main sources of uncertainty—projections of flood risk and flood damage, how the climate will change over the next 30 years, and modeling of the 2020 distribution of mortgages.

- In Federal Budgetary Effects of the Activities of the Center for Medicare & Medicaid Innovation (p. 4), CBO described the sources of uncertainty that could lead to higher or lower estimates of federal spending as well as sources with unknown directional effects.

- In Communities at Risk of Flooding (p. 22), CBO discussed uncertainty surrounding how people’s economic and demographic characteristics, terrain elevation, and stream flows would affect future flood risk.

- In An Update to the Economic Outlook: 2023 to 2025 (p. 8), the agency discussed how its projections are subject to uncertainty arising from unexpected changes in many factors, such as faster- or slower-than-projected GDP growth, higher or lower interest rates, and more or less demand for goods and services.

- In The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget, the agency analyzed how changes in economic conditions or current law might affect budgetary and economic outcomes.

- In CBO’s Economic Forecasting Record: 2023 Update (p. 22), the agency discussed how it used previous forecast errors to quantify the uncertainty of its economic projections.

- In The 2023 Long-Term Budget Outlook (p. 10), the agency discussed the uncertainty in its long-term forecast, focusing on the possibilities of severe economic downturns, unexpectedly strong and sustained economic growth, discovery or development of natural resources, and effects of climate change that are more significant than expected.

- In An Update to the Budget Outlook: 2023 to 2033 (p. 3), the agency discussed two significant factors affecting revenues and outlays—a shortfall in tax receipts and a Supreme Court case involving student loans—that could result in a much larger or smaller deficit than CBO projected.

- In How Changes in Economic Conditions Might Affect the Federal Budget: 2023 to 2033 and an accompanying interactive workbook, CBO illustrated how economic scenarios that differed from those in its February 2023 baseline budget projections would affect the federal budget.

- In An Evaluation of CBO’s Projections of Outlays from 1984 to 2021 (p. 24), the agency discussed the uncertainty in its baseline projections of outlays.

- In CBO Describes Its Cost-Estimating Process (p. 10), the agency discussed how its cost estimates are subject to many sources of uncertainty—such as changes to current law, the amount of program funding, and extreme weather events—and why it still develops point estimates.

- In Budgetary Effects of Policies to Modify or Eliminate Medicaid’s Institutions for Mental Diseases Exclusion (p. 10), CBO discussed uncertainty in projecting which of the exceptions to IMD exclusions states may adopt and whether existing and new IMDs can accommodate all Medicaid enrollees needing that type of care.

- In a letter to the Honorable Virginia Foxx and Honorable William Cassidy (p. 8), CBO discussed how its estimates are highly uncertain because it is difficult to anticipate the ways students and postsecondary institutions would respond to the availability of the plan.

- In The Economic Outlook for 2023 to 2033 in 16 Charts (p. 7), the agency discussed the high degree of uncertainty in its projections in both the short and long term.

- In “How Changes in Revenues and Outlays Would Affect Debt Service, Deficits, and Debt” (an interactive workbook), users can explore how revenues and outlays that differed from those in CBO’s February 2023 baseline budget projections would increase or decrease net interest costs and thus affect deficits and debt.

- In The Budget and Economic Outlook: 2023 to 2033, CBO discussed uncertainty in both the budgetary forecast (p. 29) and economic forecast (p. 52).

CBO also produced interactive tools that allow users to assess the sensitivity of budget projections:

- CBO’s waterfall model simulates the agency’s process for projecting outlays for different types and amounts of discretionary budget authority; and

- An interactive workbook shows how changing revenues and outlays would increase or decrease net interest costs.

Creating Data Visualizations

To make CBO’s projections and reports easier to understand, the agency publishes data visualizations that highlight the key findings of its analyses.

The agency published 15 visual reports in 2023:

- In The Navy’s Costs to Eliminate Its Deferred Maintenance Backlog and to Renovate and Modernize Its Buildings, CBO analyzed the condition of the buildings that the active Navy uses and maintains.

- In The Distribution of Household Income in 2020, the agency presented the distributions of household income, means-tested transfers, and federal taxes between 1979 and 2020.

- In Flood Damage and Federally Backed Mortgages in a Changing Climate, CBO estimated the flood damage that homes with federally backed mortgages are expected to face in multiyear periods centered on 2020 and 2050, reflecting the effects of climate change.

- In Federal Subsidies for Health Insurance: 2023 to 2033, the agency described updated baseline projections prepared by CBO and the Joint Committee on Taxation of the federal costs associated with each kind of subsidy and the number of people with different types of health insurance.

- In Communities at Risk of Flooding, CBO examined the variation in current and future flood risk across communities with different economic and demographic characteristics.

- In Purposes and Uses of Special and Incentive Pay for Military Personnel, CBO analyzed funding for special and incentive pay for active-duty service members in the Army, Navy, Air Force, and Marine Corps and explored how those types of pay have been used to address personnel shortfalls.

- In DECKPLATE and AMSRR: Comparing Two Ways to Measure the Availability of F/A-18E/F Super Hornet Aircraft, CBO compared rates of aircraft availability from two Navy databases of F/A-18E/F Super Hornet aircraft.

- In CBO’s 2023 Long-Term Projections for Social Security, the agency described its two sets of long-term projections for Social Security; each set has different underlying assumptions about whether the program’s trust funds maintain balances sufficient to cover the Social Security program’s outlays.

- In Large Constellations of Low-Altitude Satellites: A Primer, CBO introduced the basics of satellites and constellations, described the reasons for and consequences of the projected growth in large constellations, and discussed the costs of fielding those constellations.

- In An Evaluation of CBO’s Projections of Outlays from 1984 to 2021, CBO used various measures to assess the quality of its past projections of federal outlays.

- In The Foreign-Born Population, the U.S. Economy, and the Federal Budget, CBO described immigration’s effects on total economic output, the federal budget, and government programs.

- In The Economic Outlook for 2023 to 2033 in 16 Charts, CBO summarized information about the agency’s economic forecast published in February 2023.

- In Availability and Use of F-35 Fighter Aircraft: An Update, the agency examined the availability and use of the Department of Defense’s F-35 fighter aircraft and findings about availability rates, flying hours, and the effects of aging.

- In Availability and Use of the F/A-18E/F Super Hornet Fighter Aircraft, CBO compared rates of aircraft availability of F/A-18E/F Super Hornet.

- In The Demographic Outlook: 2023 to 2053, the agency described its population projections that underlie the baseline budget projections and economic forecast that CBO published in May 2022 and the long-term budget projections that the agency published in July 2022.

CBO also published two visual summaries of its projections of the federal budget and U.S. economy: The 2023 Long-Term Budget Outlook and The Budget and Economic Outlook: 2023 to 2033. In addition, the agency published a chartbook (a report that features one exhibit per page) on the financial exposures of the federal government’s credit and insurance portfolios: Financial Commitments of Federal Credit and Insurance Programs, 2012 to 2021.

The agency also produced slide decks that describe the methods and models used in its estimates:

- A slide deck presenting the distributions of household income, means-tested transfers, and federal taxes between 1979 and 2020;

- A slide deck examining new ways to budget for and price fuel within the Department of Defense;

- A slide deck explaining how CBO estimated the budgetary impact of prescription drug provisions in the 2022 reconciliation act; and

- A slide deck further explaining CBO’s February 2023 baseline projections of remittances to the Treasury from the Federal Reserve.

CBO also published five infographics:

- “Atlas of Military Compensation” gives an overview of military compensation—defense and nondefense spending, trends in compensation in the Department of Defense’s budget, components of service members’ compensation, and a comparison of military and civilian compensation.

- “Discretionary Spending in Fiscal Year 2022: An Infographic” shows changes in defense and nondefense discretionary spending since 2002 and describes spending within those categories.

- “Mandatory Spending in Fiscal Year 2022: An Infographic” shows changes in several categories—including spending for the major health care programs, Social Security, and income security programs—since 2002 and describes spending within those categories.

- “Revenues in Fiscal Year 2022: An Infographic” illustrates trends in sources of federal revenues—individual income taxes, payroll taxes, corporate income taxes, and other taxes—over the past 20 years and describes those sources in 2022.

- “The Federal Budget in Fiscal Year 2022: An Infographic” shows the major categories of federal outlays and revenues and illustrates trends in federal deficits and debt held by the public over the past 50 years.

Conducting Outreach

In addition to conducting the daily gathering of information that supports the agency’s work, CBO staff members communicated regularly with people outside the organization to explain the agency’s findings and methods and to get feedback to help it maintain and improve the quality of its work. As part of its outreach, CBO consulted with experts outside the organization to seek feedback to complement its rigorous internal review process (which involves multiple people at different levels in the organization). The agency also explained its work and got feedback by encouraging its staff to give presentations to various audiences. Finally, CBO continually worked to make its information more accessible.

Direct Communication With Members and Staff. The most important form of outreach CBO conducted in 2023 was the direct communication between the agency and the Congress that occurred in person, by phone, and by email. In 2023, CBO’s Director met with hundreds of Members of Congress, either individually or in groups, to explain the agency’s work, respond to questions, and solicit feedback. For example, in October the Director met with the members of the House Budget Committee’s Health Care Task Force to discuss the agency’s analysis of prescription drug legislation.

During the development of legislation, communication between CBO’s staff and Congressional staff was frequent. After major cost estimates were released, CBO’s staff contacted staff of key committees to explain the results and answer questions.

In addition, CBO’s staff attended the Congressional Data Task Force’s internal and public meetings in 2023. At the December meeting, CBO presented highlights of some of its recent transparency efforts, such as code and data releases, and participated in a panel discussion about artificial intelligence. (The task force consists of representatives from legislative branch agencies who coordinate on ways to support openness and transparency in the legislative process.)

Consultation With Outside Experts. As part of its regular processes of developing cost estimates and undertaking other analyses, CBO consults with many outside experts who represent a variety of perspectives. In 2023, CBO continued doing so.

The experts include professors, analysts at think tanks and consulting firms, representatives of industry groups, other experts in the private sector, and people working for federal agencies and for state and local governments. CBO gets suggestions about whom to consult and independently seeks other experts so that the agency can gather information and insights from people with varied backgrounds, training, experience, and views. (The agency always works with Congressional staff to ensure that information about a legislative proposal that they wish to keep confidential remains so during its development.) When time allows, CBO seeks external review of its methods and of drafts of reports. Such external review allows the agency’s analyses to reflect both the consensus and the diversity of views of experts from around the country.

CBO’s full Panel of Economic Advisers met twice in 2023, and smaller groups of panelists met throughout the year. As part of the agendas for those meetings, CBO requested and received feedback on its economic forecasts, interest rate modeling, and projections of the effects of immigration and of the expiration of provisions of the 2017 tax act. Panelists and invited experts also discussed broad issues underlying various analyses by CBO, including labor force participation, the outlook for inflation, and monetary policy and fiscal sustainability.

The meeting of the Panel of Health Advisers included presentations and discussions about health care workforce policies and their effect on the federal budget, reimbursement models for innovative technology, and the role of ownership in health care.

When it receives feedback about an analysis, CBO acknowledges that assistance in a section called About This Document at the end of a publication. CBO got feedback on drafts of 23 reports and working papers in 2023.

Presentations. At various venues, CBO staff members gave eight presentations about the agency’s processes for conducting analyses:

- A presentation on CBO’s estimates of the noncyclical rate of employment (at the 67th Economic Conference of the Federal Reserve Bank of Boston) discussed the agency’s current approach for making those estimates and an alternative approach that the agency is exploring.

- A presentation on CBO’s call for research (at Dartmouth College) gave an overview of the questions that new research could help answer to inform the agency’s estimates.

- A presentation on the agency’s role in the budget process (at AcademyHealth’s 2023 Health Policy Orientation, “Information Sources for Policymaking”) described how CBO helps the Congress make effective budget and economic policy. (A similar presentation was made to the Leadership Fellowship Program at the National Hispanic Medical Association.)

- A presentation on CBO’s long-term economic projections (at the National Bureau of Economic Research’s Summer Institute 2023: Economics of Social Security) gave an overview of the method that CBO uses to project labor force participation rates.

- A presentation on CBO’s support of the U.S. Congress (at an annual seminar of the European Centre for Parliamentary Research and Documentation) described how the agency gets data from federal agencies, evaluates its estimates and forecasts, and makes its work transparent and accessible.

- A presentation on research (at the Stanford Institute for Economic Policy Research) described the forms of research CBO collects and how the agency uses research in its products.

- A presentation on CBO’s estimate of the effects of climate change on economic output (to the Australian Treasury’s Macroeconomic Group) gave an overview of the agency’s work on the effects of climate change and climate change policy on the economy and the federal budget.

- A presentation on CBO’s role in assessing climate change (at the National Academies of Sciences, Engineering, and Medicine Roundtable on Macroeconomic and Climate-Related Risks and Opportunities) presented an overview of CBO’s work on the effects of climate change and climate change policy on the economy and the federal budget.

CBO also presented 17 products that offered an overview of recent analyses and estimates:

- A presentation on Medicaid (to the Children’s Health Group, American Academy of Pediatrics) described CBO’s analysis of the short-term and long-term effects of Medicaid spending on children.

- A presentation on CBO’s long-term budget projections (at the National Conference of State Legislatures’ Budget Working Group) described those projections. (Similar presentations were made at the University of Michigan’s 71st Annual Economic Outlook Conference and at the American Enterprise Institute’s panel discussion “Methodologies in Fiscal, Economic, and Health Spending Projections.”)

- A presentation on electric vehicles (at ICEX España Exportación e Inversiones) described CBO’s projections of the demand for electric vehicles and the supply of charging stations. (A similar presentation was made at the 2023 Conference of the Western Economic Association International.)

- A presentation on health care (to the MITRE Health Advisory Council) discussed the long-term outlook for federal spending on health care and the recent slowdown in the growth of such spending.

- A presentation on the contingent financial liabilities of the federal government (at the MIT Golub Center for Finance and Policy’s 10th Annual Conference) described the size and nature of those liabilities and their effects on measures of federal debt.

- A presentation on CBO’s economic projections (at the NABE Foundation’s 20th Annual Economic Measurement Seminar) explained those projections and the importance of total factor productivity.

- A presentation on the maintenance costs of Army bases (at the 2023 Conference of the Western Economic Association International) described the costs to eliminate the deferred maintenance backlog and renovate and modernize buildings.

- A presentation on federal health care spending (at a Trustee Briefing of the Committee for Economic Development of the Conference Board) gave updates on trends in the federal government’s spending on health care.

- A presentation on options for reducing the deficit (at the National Tax Association’s 53rd Annual Spring Symposium) described the changes in fiscal policy that would be needed to address the rising costs of interest and mitigate other adverse consequences of high and rising debt.

- A presentation on health care costs (at the 15th Annual Meeting of the Organisation for Economic Co-operation and Development’s Working Party of Parliamentary Budget Officials and Independent Fiscal Institutions) highlighted CBO’s long-term projections of health care spending and the implications for the federal budget.

- A presentation on costs of student loans (at the American Enterprise Institute) described CBO’s projections of a proposed rule on income-driven repayment plans.

- A presentation on CBO’s projections of the macroeconomic and fiscal outlook (at the Annual Economic Policy Conference of the National Association for Business Economics) explained those projections.

- A presentation on CBO’s budget and economic projections (to the Prosperity Caucus) described those projections.

- A presentation on the Department of Defense’s and the Department of Veterans Affairs’ budgets for military compensation (at the Military Manpower Roundtable) described the composition of military compensation and examined some of the trends in their funding.

- A presentation on U.S. hypersonic weapons and alternatives (as part of the Global Security Technical Webinar Series at the Massachusetts Institute of Technology) reviewed CBO’s findings in a report on the topic.

- A presentation on the Navy’s shipbuilding plans (at the National Defense Industrial Association’s 25th Annual Expeditionary Warfare Conference) examined those plans’ implications for the size and composition of the fleet, emphasizing the Navy’s surface ships. (Similar presentations were made at the Surface Navy Association’s 35th National Symposium and at the Bank of America 2023 Defense Outlook and Commercial Aerospace Forum.)

- A presentation on CBO’s budget and economic projections (at the Committee for Economic Development of the Conference Board) described those projections.

CBO also responded to 11 letters from Members of Congress requesting information:

- A letter responded to questions about CBO’s estimates of the effects of price negotiation for drugs and the agency’s simulation model of drug development.

- A letter responded to questions about CBO’s current view of the economy and the implications for the federal budget and for workers.

- A letter presented the agency’s projections of gross federal debt through 2053.

- A letter described the agency’s efforts to respond to a request for a cost estimate for the Primary Care and Health Workforce Expansion Act.

- A letter described CBO’s efforts to provide budgetary analysis related to the reauthorization of the farm bill.

- A letter responded to questions about the agency’s ongoing work—specifically, its macroeconomic analysis of legislation, health care modeling, and support for the legislative process.

- A letter responded to questions about the agency’s work assessing the risks associated with climate change and examining how reforms to health care delivery systems affect costs and health outcomes.

- A letter further described CBO’s estimate of the budgetary effects of work requirements for the Medicaid program, as provided in the Limit, Save, Grow Act of 2023.

- A letter shared more information about how CBO’s 2010 projections of federal health care spending compared with actual spending over the 2010–2020 period and with the agency’s current baseline.

- A letter assessed the amounts of spending reductions that would be necessary to balance the federal budget in 2033.

- A letter provided an estimate of the cost of the Administration’s proposed rule for a new income-driven repayment plan for federal student loans.

Communications Infrastructure. In 2023, CBO upgraded its website’s open-source content management system to the latest version. That upgrade establishes a stronger foundation for future innovations. The agency also added a feature on the Cost Estimates page that shows a weekly listing of the 10 most-viewed cost estimates and created subtopics pages on CBO’s analytical methods to make that work easier to find. In addition, the agency upgraded and redesigned its intranet site, SharePoint, to take advantage of new functionality and features.

1. For CBO’s 2023 transparency update, see Congressional Budget Office, Transparency at CBO: Future Plans and a Review of 2022 (March 2023), www.cbo.gov/publication/58930.

2. For more about CBO and its work, see Congressional Budget Office, An Introduction to the Congressional Budget Office (January 2024), www.cbo.gov/publication/59687.

About This Document

The Congressional Budget Office prepared this report to describe its transparency plans. It was written by Wendy Kiska.

Jeffrey Kling and Robert Sunshine reviewed the report. Gabe Waggoner edited it, and Casey Labrack prepared the text for publication. It is available at www.cbo.gov/publication/59975.

The agency seeks feedback to make its work as useful as possible. Please send comments to communications@cbo.gov.

Phillip L. Swagel

Director

April 2024