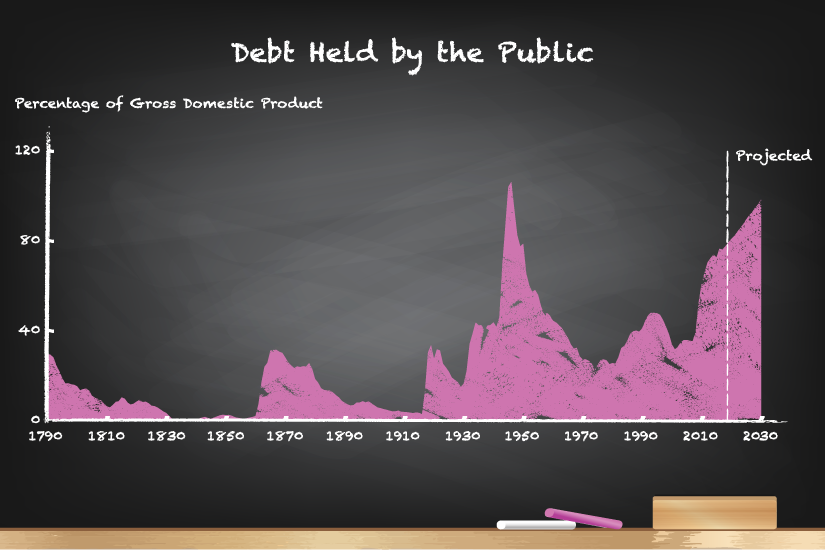

On February 10, the Administration transmitted its annual set of budgetary proposals to the Congress. CBO estimates that in the coming decade deficits under those proposals would be smaller and debt held by the public would be lower than amounts in CBO’s baseline projections—but larger than the Administration projected. CBO’s estimates do not account for changes to the nation’s economic or fiscal outlook arising from the recent public health emergency.

March 2020

Congress created the Troubled Asset Relief Program (TARP) in 2008 to stabilize financial markets. CBO estimates that the TARP’s net cost will be $31 billion—about what it reported last April and slightly less than OMB’s latest estimate.

CBO provides cost estimates, reports, analyses, and other information to policymakers throughout the legislative process and often provides technical assistance to lawmakers as legislation is being crafted.

As usual, CBO has produced spring baseline budget projections to reflect recent legislation and technical changes. Those projections are based on the agency’s January economic forecast and do not account for changes arising from the current public health emergency.

CBO’s transparency efforts aim to promote a thorough understanding of its work, help people gauge how estimates might change if policies or circumstances differed, and enhance the credibility of its analyses and processes.

From the end of 2008 to 2019, the amount of federal debt held by the public nearly tripled. This report describes federal debt, various ways to measure it, CBO’s projections for the coming decade, and the consequences of its growth.

The federal budget deficit was $625 billion for the first five months of fiscal year 2020, CBO estimates, $80 billion more than the deficit recorded during the same period last year.