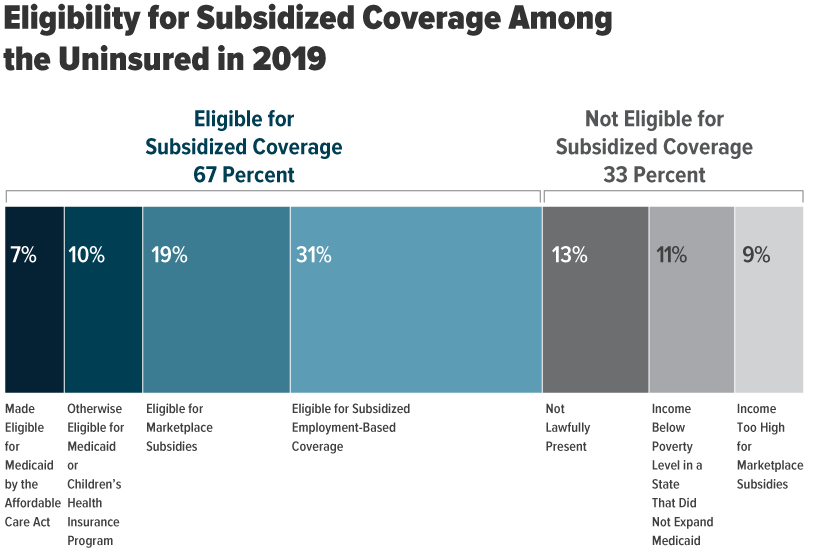

In 2019, about 12 percent of people under 65 were not enrolled in a health insurance plan or a government program that provides financial protection from major medical risks. In this report, CBO describes that uninsured population.

September 2020

CBO and JCT project that federal subsidies, taxes, and penalties associated with health insurance coverage for people under age 65 will result in a net subsidy from the federal government of $920 billion in 2021 and $1.4 trillion in 2030.

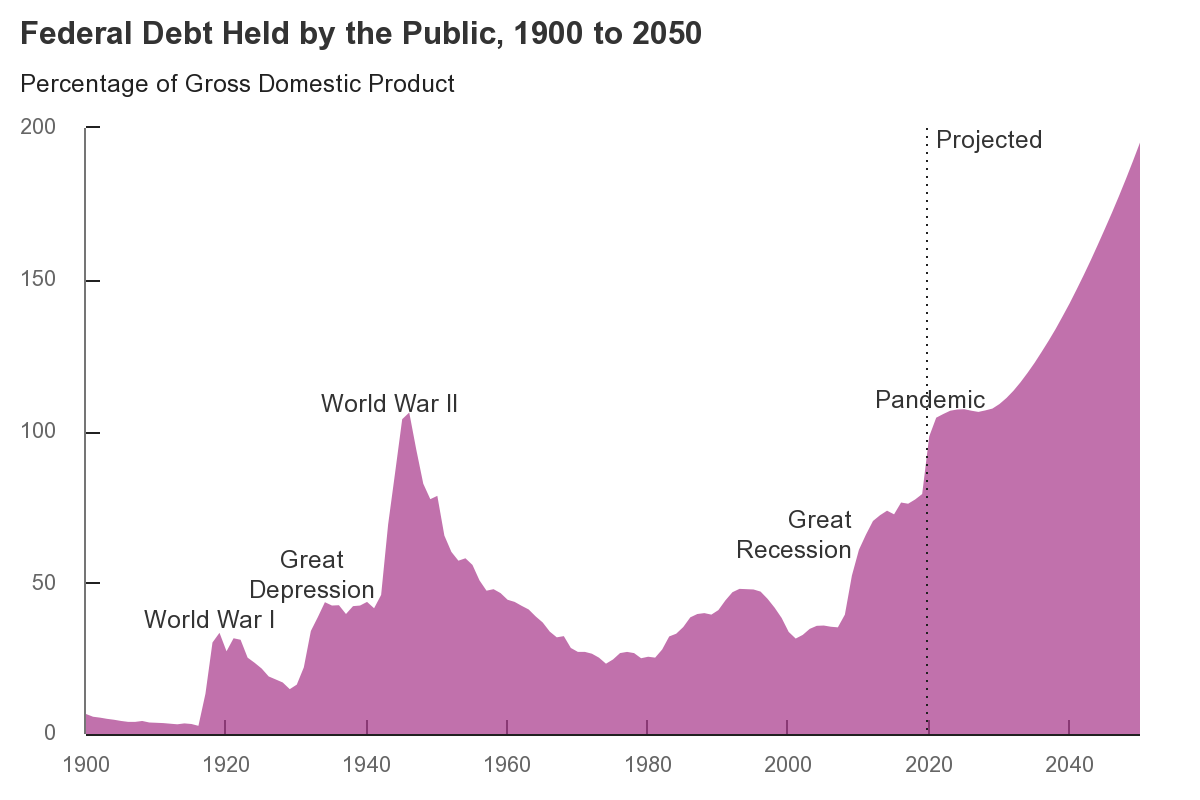

CBO Director Phill Swagel focuses on the long-term fiscal challenges facing the nation in his statement on CBO’s report The 2020 Long-Term Budget Outlook.

CBO presents its projections of what federal deficits, debt, spending, and revenues would be for the next 30 years if current laws governing taxes and spending generally did not change.

By providing financial support to households, businesses, and state and local governments, federal laws enacted in response to the 2020 coronavirus pandemic will offset part of the deterioration in economic conditions brought about by the pandemic.

In a talk before the U.S. Chamber of Commerce’s Chief Economists Committee, CBO Director Phillip Swagel spoke about CBO’s latest 10-year budget projections.

CBO analyzes DoD’s plans for 2021 through 2025 as presented in the 2021 Future Years Defense Program and projects how those plans would affect defense costs through 2035.

CBO projects a federal budget deficit of $3.3 trillion in 2020, more than triple the shortfall recorded in 2019, mostly because of the economic disruption caused by the 2020 coronavirus pandemic and the enactment of legislation in response.

CBO projects that the balances held by federal trust funds will fall by $43 billion in fiscal year 2020. Spending from the trust funds is projected to exceed income by $18 billion in 2021, a deficit that grows to $502 billion by 2030.