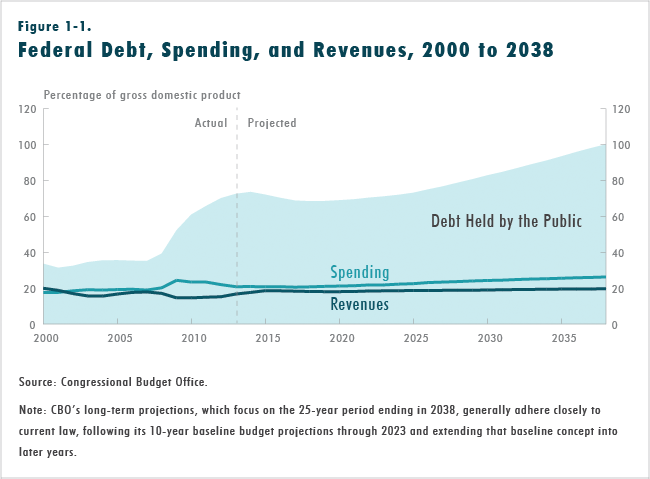

The Congress faces an array of policy choices as it confronts the dramatic increase in the federal government’s debt over the past several years and the prospect of large annual budget deficits and further increases in that debt that are projected to occur in coming decades under current law (see Figure 1-1, below). To help inform lawmakers about the budgetary implications of various approaches to changing federal policies, CBO periodically issues a compendium of policy options that would affect the federal budget as well as separate reports that include policy options in particular areas.

[collapsed title="…read more" class="read-more"]

This volume presents 103 options that would decrease federal spending or increase federal revenues over the next decade (see Summary Table of Options). Those options cover many areas—ranging from defense to energy, Social Security, and provisions of the tax code. The budgetary effects identified for most of the options span the 10 years from 2014 to 2023 (the period covered by CBO’s May 2013 baseline budget projections), although many of the options would have longer-term effects as well.

This volume presents options in the following categories:

- Mandatory spending other than that for health-related programs,

- Discretionary spending other than that for health-related programs,

- Revenues other than those related to health, and

- Health-related programs and revenue provisions.

The options begin with a description of budgetary trends for the topic area. Then, entries for the options provide background information, describe the possible policy change, and summarize arguments for and against that change. As appropriate, related options in this volume are referenced, as are related CBO publications. The options included in this volume come from a variety of sources. Some are based on proposed legislation or on the budget proposals of various Administrations; others came from Congressional offices or from entities in the federal government or in the private sector. As a collection, the options are intended to reflect a range of possibilities, not a ranking of priorities or an exhaustive list. Inclusion or exclusion of any particular option does not imply endorsement or disapproval by CBO, and the report makes no recommendations. This volume does not contain comprehensive budget plans, although it would be possible to devise such plans by combining certain options in various ways (although some overlap with others).

In addition to 11 options that are similar in scope to others in this volume, the chapter on health-related programs and revenue provisions includes 5 broad approaches for reducing spending on health care programs or revenues forgone because of tax provisions related to health care. Each would offer lawmakers a variety of possibilities for making changes in current laws.

The volume includes a chapter on the challenges and the potential budgetary effects of eliminating a Cabinet department. CBO has also presented many other options in various publications it has issued in recent years that are referenced in the volume.

[/collapsed] [collapsed]

The Current Context for Decisions About the Budget

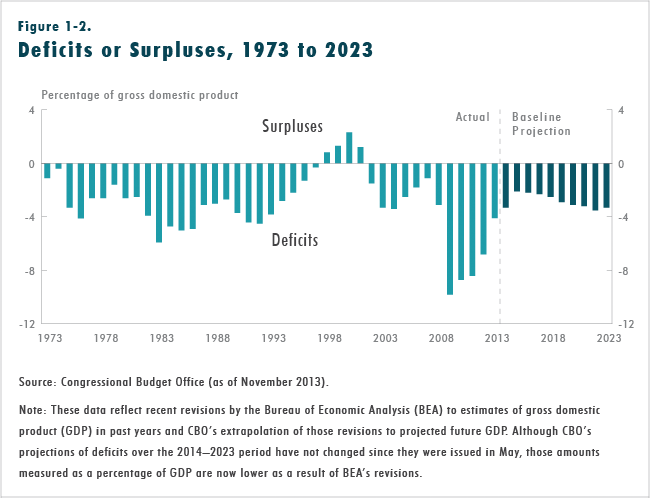

The economy’s gradual recovery from the 2007–2009 recession, the waning budgetary effects of policies enacted in response to the weak economy, and various changes to tax and spending policies—including the caps and automatic spending reductions put in place by the Budget Control Act of 2011—have resulted in the smallest budget deficit since 2008. The deficit in fiscal year 2013 was about 4 percent of gross domestic product (GDP), well below its peak of almost 10 percent in 2009 (see Figure 1-2). If current laws that govern taxes and spending remained generally unchanged—an assumption that underlies CBO’s 10-year baseline budget projections—the deficit would continue to decline over the next few years, falling to 2.1 percent of GDP by 2015, CBO estimates. As a result, by CBO’s estimates, federal debt held by the public also would decline, from 73 percent of GDP in 2013 to 68 percent in 2018.

However, budget deficits would gradually rise again under current law, CBO projects, mainly because of rising interest costs and increased spending for Social Security and the government’s major health care programs (Medicare, Medicaid, the Children’s Health Insurance Program, and subsidies to be provided through health insurance exchanges). The agency expects interest rates to rebound in coming years from their current unusually low levels, sharply increasing the government’s cost of borrowing. In addition, the pressures of caring for an aging population, rising health care costs generally, and an expansion of federal subsidies for health insurance would cause spending for some of the largest federal programs to increase relative to GDP. By 2023, CBO projects, the budget deficit would grow to 3.3 percent of GDP under current law, and federal debt held by the public would rise to 71 percent of GDP and would be on an upward trajectory.

Looking beyond the 10-year period covered by its baseline projections, CBO has produced an extended baseline that extrapolates those projections through 2038. Those extended projections show a substantial imbalance in the federal budget over the long run, with annual revenues consistently falling short of annual outlays. Budget deficits would rise steadily and, by 2038, would push federal debt held by the public to 100 percent of GDP—close to the peak percentage, which was seen just after World War II—even without factoring in the harm that growing debt would cause to the economy.

In fact, such high and rising amounts of federal debt would have significant negative consequences for both the economy and the federal budget. Those consequences include reducing the total amounts of national saving and income relative to what they would otherwise be; increasing the government’s interest payments, thereby putting more pressure on the rest of the budget; limiting lawmakers’ flexibility to respond to unexpected events; and increasing the likelihood of a fiscal crisis. With effects on the economy included, debt under the extended baseline would rise to 108 percent of GDP in 2038, CBO estimates.

The increase in federal debt would be even greater if certain policies that are now in place but that are scheduled to change under current law were instead continued and if some provisions of current law that might be difficult to sustain for a long period were modified. With such changes to current law, federal debt held by the public would reach 190 percent of GDP by 2038, CBO projects, after accounting for the harmful effects on the economy of the rapidly growing deficits.

[/collapsed] [collapsed]

Choices for the Future

Current federal tax and spending policies present lawmakers and the public with difficult challenges because the United States is on track to have a federal budget that will look very different from budgets of the past. Under current law, spending for all federal activities other than the major health care programs and Social Security is projected to account for its smallest share of GDP in more than 70 years. At the same time revenues would represent a larger percentage of GDP in the future—averaging 18.3 percent of GDP over the 2014–2023 period—than they generally have in the past few decades. Despite those trends, revenues would not keep pace with outlays under current law because the government’s major health care programs and Social Security would absorb a much larger share of the economy’s output in the future than they have in the past.

To put the federal budget on a sustainable long-term path, lawmakers would need to make significant policy changes—allowing revenues to rise more than would occur under current law, reducing spending for large benefit programs to amounts below those currently projected, or adopting some combination of those approaches.

Lawmakers and the public may weigh several factors in considering new policies that would reduce budget deficits: How much deficit reduction is necessary? What is the proper size of the federal government and what would be the best way to allocate federal resources? What types of policy changes would most enhance prospects for nearterm and long-term economic growth? What would be the distributional implications of proposed changes—that is, who would bear the burden of particular cuts in spending or increases in taxes and who would realize long-term economic benefits?

Moreover, lawmakers face difficult trade-offs in deciding how quickly to carry out policy changes that will make the path of federal debt more sustainable. On the one hand, waiting to cut federal spending or to raise taxes would lead to a greater accumulation of debt and would increase the magnitude of the policy adjustments needed. On the other hand, implementing spending cuts or tax increases quickly would weaken the economy’s current expansion and would give people little time to plan for and adjust to the policy changes. The negative short-term effects of deficit reduction on output and employment would be especially large now because output is so far below its potential level that the Federal Reserve has been holding short-term interest rates close to zero. The Federal Reserve thus has no room to reduce those rates any further to offset the effects of any changes in spending or tax policies.

[/collapsed] [collapsed]

Caveats About This Report

The ways in which specific federal programs, the budget as a whole, or the U.S. economy will evolve under current law are uncertain, as are the possible effects of proposed changes to federal spending and revenue policies. Because a broad range of results for any change in policy is plausible, CBO’s estimates are designed to fall at the middle of the distribution of possible outcomes.

The estimates presented in this volume could differ from cost estimates for similar proposals that CBO might produce at a later date or from revenue estimates developed later by the staff of the Joint Committee on Taxation. One reason is that the proposals on which those estimates were based might not precisely match the options presented here. Another is that the baseline budget projections against which such proposals would ultimately be measured might have changed and thus would differ from the projections used for this report.

Many of the options in this report could be combined to provide building blocks for broader changes. In some cases, however, combining various spending or revenue options would produce budgetary effects that would differ from the sums of those estimates as presented because some options would overlap or interact with one another in ways that would change their budgetary impact. Also, some options would be mutually exclusive.

To reduce deficits through changes in discretionary spending, lawmakers would need to reduce the statutory funding caps below the levels already established under current law or enact appropriations below those caps. The discretionary options in this report could be used to accomplish either of those objectives. Alternatively, some of the options could be implemented to comply with the existing caps on discretionary funding, which are $1.5 trillion lower over the 2014–2023 period than the amounts that would be required to continue the funding provided for 2013 in later years with increases for inflation.

The estimated budgetary effects of options do not reflect the extent to which those policy changes would reduce interest payments on federal debt. Those savings may be included as part of a comprehensive budget plan (such as the Congressional budget resolution), but CBO does not make such calculations for individual pieces of legislation or for individual options of the type discussed here.

Some of the estimates in this volume depend on projections of states’ responses to federal policy changes, which can be difficult to predict and can vary over time because of states’ changing fiscal conditions and other factors. CBO’s analyses do not attempt to quantify the impact of options on states’ spending or revenues.

Some options might impose federal mandates on other levels of government or on private entities. The Unfunded Mandates Reform Act of 1995 requires CBO to estimate the costs of any mandates that would be imposed by new legislation that the Congress considers. (The law defines mandates as enforceable duties imposed on state, local, or tribal governments or the private sector, as well as certain types of provisions affecting large mandatory programs that provide funds to states.) In this volume, CBO does not address the costs of any mandates that might be associated with the various options.

[/collapsed]