In fiscal year 2013, the federal government collected $2.8 trillion in revenues. Individual income taxes were the largest source of revenues, accounting for more than 47 percent of the total. Social insurance taxes (primarily payroll taxes collected to support Social Security and Medicare) accounted for 34 percent, about 10 percent came from corporate income taxes, and other receipts—from excise taxes, estate and gift taxes, earnings of the Federal Reserve System, customs duties, and miscellaneous fees and fines—made up the remaining 9 percent.

[collapsed title="…read more" class="read-more"] Relative to the size of the economy, federal revenues increased robustly between 2012 and 2013. In 2013, revenues equaled 16.7 percent of gross domestic product (GDP), which is 1.5 percentage points above their share of GDP in 2012. That strong growth is attributable partly to the January 2013 expiration of a 2 percentage point reduction in the payroll tax, but receipts of individual income taxes also rose because of three other factors:

- Beginning in January, tax rates on personal income above certain thresholds went up;

- In anticipation of changes in tax law, some high-income taxpayers realized more income late in calendar year 2012 and therefore paid taxes on that income in fiscal year 2013; and

- Personal income rose for reasons that are unrelated to changes in tax provisions.

CBO also attributes some of the growth in revenues this year to increases in the average tax rate on domestic economic profits, which boosted receipts from corporate income taxes.

Revenues would be greater if not for the more than 200 tax expenditures in the individual and corporate income tax system, which will total more than $1 trillion in 2013, CBO estimates. Those tax expenditures—so called because they resemble federal spending to the extent that they provide financial assistance for specific activities, entities, or groups of people—are exclusions, deductions, exemptions, and credits in the individual and corporate income tax systems that cause revenues to be lower than they would be otherwise for any given schedule of tax rates.

[/collapsed]Trends in Revenues

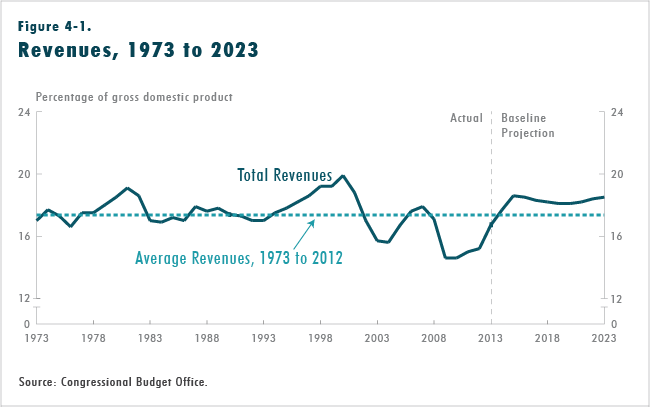

Over the past 40 years, total federal revenues have averaged 17.4 percent of GDP—ranging from a high of 19.9 percent of GDP in 2000 to a low of 14.6 percent in 2009 and 2010 (see Figure 4-1). The variation over time in total revenues as a percentage of GDP is primarily the result of fluctuations in receipts of individual income tax payments and, to a lesser extent, of fluctuations in collections of corporate income taxes. Revenues from individual income taxes have ranged from slightly more than 6 percent of GDP (in 2010) to slightly less than 10 percent of GDP (in 2000). Since the 1970s, corporate income taxes have ranged from about 1 percent to about 3 percent of GDP.

The variation in revenues generated by individual and corporate income taxes has stemmed in part from changes in economic conditions and from the way those changes interact with the tax code. For example, in the absence of legislated tax reductions, receipts from individual income taxes tend to grow relative to GDP because of a phenomenon known as real bracket creep—rising real (inflation-adjusted) income tends to push more and more income into higher tax brackets. In addition, because some parameters of the tax system are not indexed for inflation, rising prices also push a greater share of income into higher tax brackets. During economic downturns, corporate profits generally fall as a share of GDP, causing corporate tax revenues to shrink, and losses in households’ income tend to push a greater share of total income into lower tax brackets, resulting in lower revenues from individual income taxes. Thus, total tax revenues automatically rise relative to GDP when the economy is strong and decline relative to GDP when the economy is weak.

Social insurance taxes, by contrast, have been a stable source of federal revenues. Receipts from those taxes increased as a percentage of GDP during the 1970s and 1980s because of rising tax rates, increases in the number of people paying those taxes, and growth in the share of wages subject to the taxes. For most of the past two decades, legislation has not had a substantial effect on social insurance taxes, and the primary base for those taxes—wages and salaries—has varied less as a share of GDP than have other sources of income. In 2011 and 2012, however, the temporary reduction in the Social Security tax rate caused receipts from social insurance taxes to drop; with the expiration of that provision at the end of 2012, social insurance receipts as a share of GDP are expected to approach their historical level—close to 6 percent of GDP.

Revenues from other taxes and fees declined relative to the size of the economy over the period from 1971 to 2013 mainly because receipts from excise taxes—which are levied on such goods and services as gasoline, alcohol, tobacco, and air travel—have steadily dwindled as a share of GDP over time. That decline is chiefly because those taxes are usually levied on the quantity of goods sold rather than on their cost, and the rates have generally not kept up with inflation.

Under current law, revenues are projected to increase further, to 17.7 percent of GDP in 2014 and 18.6 percent in 2015, and then to remain above 18 percent of GDP from 2016 through 2023. About half of the expected increase in the next two years would stem from changes in tax rules, such as the scheduled expiration at the end of December 2013 of enhanced depreciation deductions allowed for certain business investments. Accounting for the other half are factors related mainly to the strengthening economy, including increases relative to GDP in some components of taxable income (such as wages and salaries, capital gains realizations, proprietors’ income, and domestic economic profits) and the continued rise to more normal levels in the average tax rate on domestic economic profits. CBO projects that revenues will grow at close to the same rate as GDP over the 2015–2023 period. Individual income tax receipts are projected to rise relative to GDP as increases in taxpayers’ real income push more income into higher tax brackets; in contrast, corporate income tax receipts and remittances to the U.S. Treasury from the Federal Reserve are projected to fall relative to GDP.

Trends in Tax Expenditures

Unlike discretionary spending programs (and some mandatory programs), most tax expenditures are not subject to periodic reauthorization or annual appropriations. And, as is the case for entitlement programs, any person or entity that meets program requirements can receive benefits. Because of the way tax expenditures are treated in the budget, however, they are much less transparent than is spending on entitlement programs.

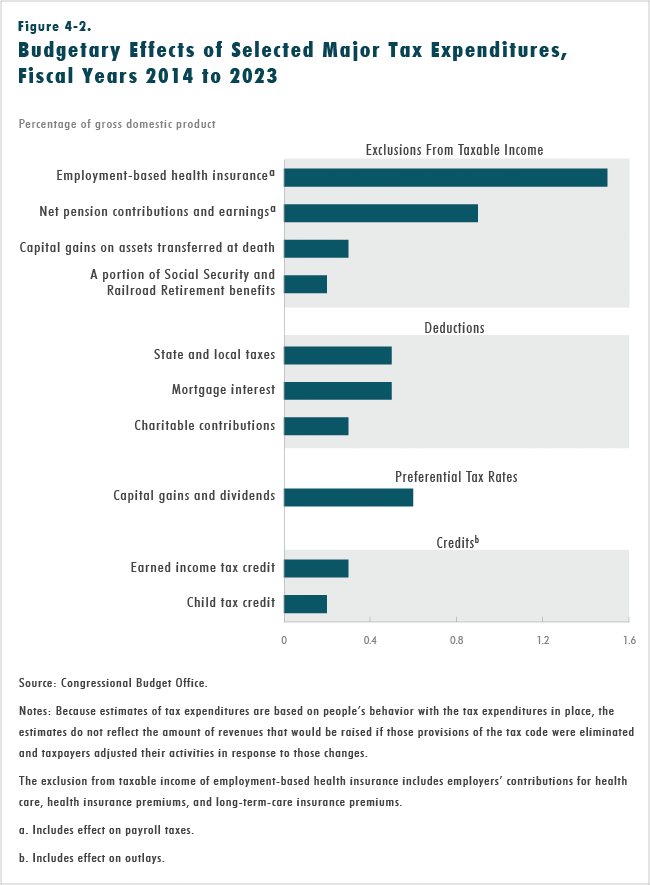

Ten of the largest tax expenditures will account for approximately two-thirds of the total budgetary effect of all tax expenditures in 2013, CBO estimates. They fall in four major categories, as follows:

- Exclusions from taxable income of employment-based health insurance, net pension contributions and earnings, capital gains on assets transferred at death, and a portion of Social Security and Railroad Retirement benefits;

- Itemized deductions for certain taxes paid to state and local governments, mortgage interest payments, and charitable contributions;

- Preferential tax rates applied to capital gains and dividends; and

- Tax credits, specifically the earned income tax credit and the child tax credit.

CBO estimates that in 2013, those 10 tax expenditures will total more than $900 billion in income and payroll taxes, or 5.6 percent of GDP, and they are projected to amount to nearly $12 trillion, or 5.3 percent of GDP, between 2014 and 2023 (see Figure 4-2). In 2013, the combined costs of the 10 tax expenditures will equal about one-third of federal revenues, CBO estimates, and they will exceed spending on Social Security, defense, or Medicare.

Beginning in 2014, the tax credits that some people will receive to help pay health insurance premiums under the Affordable Care Act will represent a new tax expenditure. CBO and the staff of the Joint Committee on Taxation (JCT) estimate that those tax credits will equal 0.2 percent of GDP in 2015 and 0.5 percent of GDP by 2023.

Corporate tax expenditures reduce revenues by much less than individual tax expenditures do. The largest corporate tax expenditure—estimated by JCT to total about $42 billion in fiscal year 2013 and $266 billion from 2013 through 2017—is for the deferral of taxes on the income of controlled foreign corporations (that is, income earned by foreign subsidiaries of U.S. multinational corporations) from their business activities abroad. Although the federal government taxes the worldwide income of U.S. businesses, the income that foreign subsidiaries of U.S. multinational corporations earn is not subject to U.S. taxation until it is paid to a U.S. parent company—that is, the tax is deferred until the income is repatriated.

The second-largest corporate tax expenditure is the deduction for domestic production activities: U.S. businesses engaged in manufacturing and certain other types of domestic production may deduct from their taxable income a percentage of what they earn from those activities. That expenditure will total $14 billion in fiscal year 2013 and $78 billion from 2013 through 2017, JCT estimates.

Methodology Underlying the Revenue Estimates

Nearly all of the revenue estimates in this chapter were prepared by JCT. The budgetary savings were estimated relative to CBO’s baseline projections for receipts, under the general assumption that current laws remain in effect and specifically that scheduled changes in provisions of the tax code take effect and no additional changes are enacted to those provisions. If combined, the options might interact with one another in ways that could alter their revenue effects and their impact on households and the economy.

CBO’s and JCT’s budget estimates generally reflect changes in the behavior of people and firms, except for those that would affect total output in the economy— such as any changes in labor supply or private investment resulting from changes in fiscal policy. The convention of not incorporating macroeconomic effects in cost estimates has been followed in the Congressional budget process since it was established in 1974. CBO and JCT separately produce estimates of the effects of some major proposals on overall output and, in turn, the effects of those changes in output on the federal budget.

However, cost estimates incorporate other changes in people’s behavior that would have budgetary effects. An impending increase in the tax rate applicable to capital gains, for example, would spur some investors to sell assets before the rate increase took effect. Or, when faced with paying higher Social Security taxes for their employees, employers would pay less in salaries and benefits to offset the higher payroll taxes. Revenue estimates for those options would incorporate such behavioral responses: The acceleration of capital gains realizations in the first example would cause a temporary hike in taxable realizations in the year before implementation of the increase, and the change in compensation in the second example would cause individual income tax receipts to fall at the same time that payroll tax revenues rise.

Some revenue options would affect outlays as well as receipts. For example, options that would change eligibility for, or the amount of, refundable tax credits would generally cause a change in outlays because the amount of such credits that exceeds someone’s income tax liability (before the tax credit) is usually paid to the person and is recorded in the budget as an outlay. In addition, changes in other tax provisions could affect the allocation of refundable credits between outlays and receipts. For instance, when tax rates are increased (with no changes in the amounts of refundable tax credits or eligibility for them), the portion of the refundable credits that offsets tax liabilities increases (because the tax liabilities that can be offset are greater) and the outlay portion of the credits falls correspondingly; the total cost of the credit remains the same. For simplicity in presentation, the revenue estimates for options that affect refundable tax credits represent the net effects on revenues and outlays combined.

Options that would expand the base for Social Security taxes would affect outlays as well. When options would require some or all workers to contribute more to the Social Security system, those workers would receive larger benefits when they retired or became disabled. For nearly all such options in this report, CBO anticipates that a change in Social Security benefit payments would be small over the period from 2014 through 2023, and thus the estimates for those options do not include those outlay effects. One exception, however, is Option 18, which would increase the amount of earnings subject to Social Security tax. In that case, the effects on Social Security outlays over the 10-year projection period would be more sizable; they are shown separately in the table for that option.

Options in This Chapter

This chapter presents 36 options grouped into several categories according to the part of the tax system they would target: individual income tax rates, the individual income tax base, individual income tax credits, payroll taxes, taxation of income from businesses and other entities, taxation of income from worldwide business activity, excise taxes, and other taxes and fees.

Several comprehensive approaches to changing tax policy—each with the potential to increase revenues substantially—that have received much attention lately are not included in this report. One would eliminate or reduce the value of all or most tax expenditures. Another would fundamentally change the tax treatment of multinational corporations. Yet another would impose a tax on most goods and activities, possibly through a value-added tax.

Each would have significant consequences for the economy and for the federal budget:

- Limiting or eliminating a broad array of tax expenditures would influence many taxpayers’ decisions to engage in certain activities or to purchase favored goods.

- Changing the tax treatment of multinationals would, to some extent, affect businesses’ choices about how and where to invest. Those changes also would affect incentives for engaging in various strategies that allow a business to avoid paying U.S. taxes on some income.

- Creating a value-added tax would favor saving more than consumption because it would tax businesses’ receipts from the sales of their goods and services instead of taxing people’s income.

Although this chapter includes options that contain elements of those approaches, none of the options is as comprehensive as those approaches. One reason that the report does not contain options that entail comprehensive changes to the tax code is that such proposals often are combined with those that would reduce individual and corporate income tax rates or—in the case of a valueadded tax—replace an existing tax, and therefore their effects may be best assessed in the context of such broader packages. Moreover, the estimates would vary greatly depending on the particular proposals’ specifications. Hence, the amount—and even the direction—of the budgetary impact of broad approaches to changing tax policy is uncertain.