The past few decades have seen various proposals to eliminate one or more Cabinet departments. One of the goals of those proposals has been to terminate activities thought to be better performed by state and local governments or the private sector; another has been to increase programs’ effectiveness through reorganization. This chapter focuses on a third goal: achieving budgetary savings. How much could be saved by shuttering one of the 15 current departments depends crucially on whether its programs would be terminated or transferred to a new department or agency—and, if they were transferred, on whether they would continue in altered form or without significant change. In general, achieving substantial savings would require eliminating or significantly reducing programs, perhaps in some of the ways discussed throughout this volume of budget options.

[collapsed title="…read more" class="read-more"]

Eliminating a department could result in considerable budgetary savings to the federal government if some or all of the programs operated by that department were also terminated. The amount of savings would eventually be equal to the department’s full budget for the canceled programs, minus any income that the department had received through its operation of those programs. Initially, however, the government could incur one-time costs for terminating programs or activities, such as paying the cost of accrued annual leave and unemployment benefits to federal employees whose jobs had been eliminated or paying penalties for canceling leases for office space.

In contrast, eliminating a department while transferring its programs in essentially unchanged form to other departments or agencies would probably result in little or no budgetary savings, because most of the costs incurred by departments are the costs of the programs themselves. At best, simply transferring programs to another department might reduce administrative support costs, but in most cases, such costs are much smaller than the costs of direct program activities. In particular, 66 percent of the combined budgets of the 15 departments provides individuals, state and local governments, businesses, and organizations with grants, subsidies, insurance benefits, and interest payments—which all, or nearly all, constitute program costs; excluding the Department of Defense and interest payments on the public debt, that share rises to 86 percent. That collection of payments includes, for example, payments for individuals’ health care, grants and loans for postsecondary education, grants to state governments for highway projects, and payments to farm producers for crop insurance claims. In contrast, only 12 percent of the combined budgets of the 15 departments is for personnel, an area that is likely to include more administrative costs. For some departments, such as the Department of Education, personnel costs are only a small percentage of their total budget because their primary responsibility is to administer grants or other activities that primarily provide money to state and local governments, individuals, or other entities. For other departments, such as the Department of Homeland Security (DHS), personnel costs are a much larger share of their budget because they are producing a service themselves, such as providing airport security screeners.

Transferring programs and reducing them, altering them, or combining them with other programs could yield larger savings than simply transferring them if lawmakers chose to reduce total funding for the newly combined programs. In some cases, the funding reductions might be implemented without reducing total payments or services provided to beneficiaries. That result would require that the combined programs were operated more efficiently than they were in their old organizational structure and that the funding reductions were smaller than the efficiency gains. Such efficiency gains might arise from reducing overlap or duplication of effort among programs; for example, aid might reach intended recipients at lower cost if the number of field offices could be reduced. (Consolidation might also increase a program’s effectiveness if it made participation easier for the intended beneficiaries, but that would not tend to reduce federal costs.) However, combined programs might operate less efficiently than in their old organizational structure if the cultures of different operating units were difficult to reconcile or if reduced staffing led to inadequate oversight, thereby increasing the potential for waste, fraud, and abuse.

In deciding whether to eliminate one or more of the current departments and whether to terminate, move, or reorganize its programs and activities, lawmakers would confront a variety of questions about the appropriate role of the federal government. In particular, lawmakers would face decisions about whether the activities of a department should be carried out by the public sector at all, and if so, whether the federal government was the most effective level of government to conduct them. Even if lawmakers concluded that state and local governments were best positioned to operate a program or activity, they would still have to decide whether the federal government should coordinate particular activities that crossed state borders and whether programs administered by different states should meet national standards. In addition, lawmakers would face choices about how to organize most efficiently the activities of the federal government. Those choices would involve such considerations as effective management capacity and Congressional oversight.

Although each of those choices would reflect lawmakers’ judgments about the role and operation of the federal government, each would also have consequences for the federal budget. To provide information about those consequences, this chapter provides an overview of the budgets of the Cabinet departments; information on the cost of programs operated by three of the departments most frequently proposed for elimination (Commerce, Education, and Energy); and policy and implementation issues that would arise if lawmakers were to consider eliminating a department.

[/collapsed] [collapsed]

An Overview of the Budgets of the Cabinet Departments

Since the creation of the Department of Homeland Security in 2002, the Cabinet has included 15 departments. Together, those departments account for the majority of the federal government’s budget. (The rest is allocated to independent agencies, such as the Social Security Administration and the Office of Personnel Management; to the legislative and judicial branches; and to a number of public corporations and other entities.) Individually, the departments’ budgets vary widely in size and composition.

The Size of Departmental Budgets

The size of individual departments’ budgets, as measured by their net expenditures (or outlays) in fiscal year 2012, ranged from $848 billion for the Department of Health and Human Services (HHS) to $10 billion for the Department of Commerce. The departments with the three largest budgets—HHS, Defense, and the Treasury—accounted for about three-fourths of the spending by all the departments. The next three largest departments were Agriculture, Labor, and Veterans Affairs.

Departments’ budgets can also be measured by their obligations, which are their financial commitments. Obligations in a given year typically differ from outlays in that year because some obligations are never spent, and some are spent after the year in which they were made. As discussed below, some information about obligations is useful in analyzing departments’ budget allocations.

The Composition of Departmental Budgets

Information on the composition of a particular department’s budget—in particular, its balance of program and administrative costs—helps to show what kinds of changes would have to be made to attain significant budgetary savings if that department was eliminated and some or all of its programs were transferred to new homes. To the extent that the department’s funding is for program costs, savings could be realized by making changes in how the programs operate or in how much money is provided for them. To the extent that the department’s funding is for administrative costs, savings might be realized if the receiving agency could absorb some portion of the administrative costs within its existing budget—particularly if its existing workforce assumed some responsibility for administering the transferred program. However, such savings would not necessarily happen—for example, if the transferred program overtaxed the management capacity of the receiving agency.

Unfortunately, the available data do not fully identify administrative costs. Certain costs can be identified as primarily administrative by the name of the budget account or office that incurs them, but that method does not yield comparable results across departments because they structure their accounts and offices differently.

Another way to shed light on a department’s balance of direct program costs and administrative support costs is through the “object classification” system of the Office of Management and Budget. That system classifies the budgets of federal agencies into categories and subcategories, some of which are likelier than others to be dominated either by program costs or by administrative costs. However, the federal budget does not provide detailed annual data about those object classes for agencies’ outlays. Rather, such details are provided for agencies’ obligations.

Data on obligations can overstate the budgetary savings that could be realized by eliminating a department, however. For one thing, some obligations are reimbursable, meaning that they are financed by fees or other charges that are collected in payment for goods and services provided by the government. A program’s reimbursable obligations do not represent budgetary savings that would be achieved if that program was eliminated, because in that case, the fees or charges that finance the obligations would also be eliminated. For example, the Patent and Trademark Office’s obligations—which are all reimbursable, because its operations are funded entirely by fees charged to patent applicants—do not indicate savings that would be achieved if the office was eliminated, because once it was gone, the patent application fees would be gone as well. The discussion here therefore excludes reimbursable obligations and considers only the remaining obligations, which are known as “direct.”

But even direct obligations overstate potential budgetary savings. One reason is that some direct obligations are intragovernmental transfers, which budgets may count more than once because they affect multiple budget accounts. For example, the direct obligations of HHS were $1.2 trillion in 2012, a considerably larger sum than the $848 billion of outlays cited above, mainly because $230 billion of intragovernmental transfers were counted as obligations once when they were paid to Medicare’s trust funds and again when money was drawn from those funds to pay for Medicare benefits.

Another reason that direct obligations can overstate potential savings is that some of them are financed by excise taxes, which might be eliminated along with an eliminated program. For example, most of the obligations paid by the Transportation Department’s Highway Trust Fund and Airport and Airway Trust Fund are financed by specific excise taxes. In 2012, those taxes yielded $52 billion. If lawmakers terminated the department’s highway and airport grant programs, they might also eliminate the taxes—so savings in 2012 would have been $52 billion less than the amount of direct obligations suggested.

Notwithstanding their limitations as indicators of potential budgetary savings, this chapter focuses on direct obligations because the budget provides object-class data for them. Those object classes consist of four primary categories—grants and fixed charges, contractual services and supplies, personnel compensation and benefits, and acquisition of assets—each of which is divided into subcategories that provide more detail (see Figure 6-1).

Grants and Fixed Charges. This category of departmental obligations encompasses grants, subsidies, and predetermined payments for insurance claims, interest payments (largely on the federal debt), and refunds. For the 15 departments combined, the category is dominated by payments to individuals (or to third parties on their behalf)—primarily for health care (through Medicare, Medicaid, veterans’ medical care, and various smaller programs), but also for military pensions, the Supplemental Nutrition Assistance Program, tuition assistance for postsecondary education, refundable tax credits, and many other purposes. The category also includes payments to state and local governments to fund a wide variety of activities, including elementary and secondary education and the construction of highways and wastewater treatment systems. The rest of the category consists of payments to businesses and organizations, such as farmers, researchers at universities, small businesses, and hospitals. Complete data on the distribution of grants and fixed charges are not readily available, but 2012 outlay data show that, once interest payments are omitted, individuals received more than eight times as much from the 15 departments as state and local governments did.

Grants and fixed charges accounted for 66 percent of all direct obligations by the Cabinet departments in 2012, and they represented the majority of the obligations made by 8 of the 15 departments (see Table 6-1). They are largely or entirely program costs, not administrative costs; to reduce them, the government would have to reduce funding for agencies’ substantive programs and activities.

| Table 6-1. | ||||

|---|---|---|---|---|

| Direct Obligations for Grants and Fixed Charges, by Department, 2012 | ||||

| Department | Percentage of Direct Obligations Allocated to Grants and Fixed Charges | Direct Obligations for Grants and Fixed Charges (Billions of dollars) | Total Direct Obligations (Billions of dollars) | Primary Activities or Programs Funded by Grants and Fixed Charges |

| Health and Human Services | 97 | 1,153 | 1,189 | Medicare; Medicaid |

| Education | 96 | 53 | 55 | Grants to public school districts; aid to post-secondary students |

| Housing and Urban Development | 95 | 52 | 55 | Public housing; housing assistance |

| Treasury | 94 | 501 | 536 | Interest paid on the federal debt; refundable tax credits, such as the earned income tax credit |

| Labor | 93 | 143 | 153 | Unemployment Trust Fund |

| Agriculture | 87 | 133 | 153 | Food and nutrition assistance programs, such as the Supplemental Nutrition Assistance Program |

| Transportation | 74 | 59 | 80 | Grants to state and local governments for highways and transit systems |

| Veterans Affairs | 55 | 74 | 135 | Compensation, pension, and readjustment benefits for veterans |

| Interior | 38 | 7 | 19 | Mineral lease payments to states; funds and programs for Native Americans; grants for fish and wildlife restoration |

| Statea | 27 | 32 | 120 | Global health programs; Foreign Military Financing; Economic Support Fund; development assistance |

| Homeland Security | 16 | 9 | 56 | Disaster Relief Fund; grants to state and local governments for emergency management programs |

| Commerce | 15 | 1 | 8 | Grants for economic development, management of coastal and ocean resources, and research |

| Justice | 8 | 3 | 33 | Assistance to state and local law enforcement agencies; Crime Victims Fund |

| Defenseb | 7 | 56 | 824 | Pensions for military retirees |

| Energy | 7 | 2 | 27 | Grants for research and demonstration projects and for energy-efficiency projects |

Source: Congressional Budget Office based on data from the Office of Management and Budget (OMB).

Notes: Amounts shown are net of budgetary savings recorded in 2012 for new loans and loan guarantees. Those savings were $27 billion for the Department of Education (from the student loan program), $6 billion for the Department of Housing and Urban Development (from mortgage insurance programs), and less than $0.3 billion each for the Departments of Agriculture, Veterans Affairs, Commerce, and Transportation.

“Grants and fixed charges,” a category from the object classification system of OMB, includes grants, subsidies, insurance claims, interest payments, and refunds.

a. Includes direct obligations reported in the budget under the heading Department of State and Other International Programs. Half of the total obligations shown were for the Military Sales Program.

b. Includes direct obligations reported under three headings in the budget: Department of Defense—Military Programs ($682 billion); Other Defense—Civil Programs ($131 billion); and Corps of Engineers—Civil Works ($8 billion).

Contractual Services and Supplies. Some agencies of the federal government carry out substantial portions of their work through contracts with third parties for various services and supplies. Such contracts accounted for 16 percent of obligations by the Cabinet departments in 2012. Relative to its size, the Department of Energy made the greatest use of contracts, which represented more than 75 percent of its total 2012 obligations. In the combined budgets of the State Department and related international programs, contracts—mostly in the Military Sales Program—represented 62 percent of 2012 obligations. Contracts also accounted for over one-third of the budgets of the Commerce, Defense, Homeland Security, and Justice Departments.

The contractual services and supplies category includes a range of subcategories, some of which are likelier than others to include relatively large shares of administrative costs. In particular, contracts for travel and transportation and for rent, communications, and utilities are likelier to represent administrative costs than are contracts for research and development, the operation and maintenance of equipment, and the operation and maintenance of facilities.

The departments vary in their distribution of obligations among the subcategories. Particularly worth attention are the Department of Defense, because it accounts for more than half of the 15 departments’ total direct obligations for contracts, and the Department of Energy, because it relies more heavily on contracts than any other department does. Contracts for travel and transportation and for rent, communications, and utilities— the subcategories that are likely to include larger shares of administrative costs—were a negligible share (less than 1 percent) of the direct obligations for contracts in 2012 made by the Energy Department, but about 10 percent of those made by the Defense Department and by the other 13 departments taken as a group (see Table 6-2). In contrast, contracts for research and development, the operation and maintenance of equipment, and the operation and maintenance of facilities accounted for 76 percent of 2012 direct obligations for contracts by the Energy Department, 35 percent of those by the Defense Department, and just 5 percent of those by the other departments taken as a group.

| Table 6-2. | ||||||||

|---|---|---|---|---|---|---|---|---|

| Direct Obligations of Selected Departments for Contractual Services and Supplies, 2012 | ||||||||

| Direct Obligations for Contractual Services and Supplies (Billions of dollars) | Percentage of Department's Direct Obligations for Contractual Services and Supplies | |||||||

| Defensea | Energy | Other Departments | Defense | Energy | Other Departments | |||

| Supplies | 52 | 0 | 17 | 16 | 0 | 9 | ||

| Research and Development | 57 | 1 | 3 | 18 | 5 | 2 | ||

| Operation and Maintenance of Equipment | 39 | 0 | 4 | 12 | 0 | 2 | ||

| Operation and Maintenance of Facilities | 17 | 15 | 2 | 5 | 71 | 1 | ||

| Travel and Transportation | 20 | 0 | 5 | 6 | 0 | 3 | ||

| Rent, Communications, and Utilities | 10 | 0 | 12 | 3 | 0 | 6 | ||

| Other Goods and Services from Federal Sources | 70 | 0 | 82 | 22 | 0 | 42 | ||

| Other Services from Nonfederal Sources | 19 | 4 | 50 | 6 | 19 | 26 | ||

| Otherb | 41 | 1 | 20 | 13 | 5 | 10 | ||

| Total | 325 | 21 | 195 | 100 | 100 | 100 | ||

Source: Congressional Budget Office based on data from the Office of Management and Budget.

a. Includes direct obligations reported under three headings in the budget: Department of Defense—Military Programs ($682 billion); Other Defense—Civil Programs ($131 billion); and Corps of Engineers—Civil Works ($8 billion).

b. Includes advisory and assistance services, medical care, subsistence and support of persons, and printing and reproduction.

The extent to which funds in the remaining subcategories—such as supplies, other goods and services from federal sources, and other services from nonfederal sources—are used for administrative purposes cannot be determined without more detailed analysis of each department. For example, some supplies are used primarily for administrative purposes; however, the Defense and Veterans Affairs Departments account for 88 percent of obligations for supplies, and much of that spending is more directly mission-oriented.

Personnel Compensation and Benefits. Of the Cabinet departments’ 2012 obligations, 12 percent was for personnel compensation and benefits. Three departments—Defense, Veterans Affairs, and Homeland Security—accounted for 70 percent, 7 percent, and 6 percent, respectively, of the 15 departments’ 2012 direct obligations in the category. The departments that obligated the largest shares of their budgets for personnel costs were Homeland Security (45 percent), Justice (41 percent), and Commerce (37 percent). Eliminating a department and transferring its programs elsewhere could yield savings in this category if total federal employment fell as a result of the transfer.

Acquisition of Assets. The smallest of the object classification system’s four main categories, accounting for 6 percent of 2012 departmental obligations, is acquisition of assets—mostly equipment, but also land, structures, investments, and loans. The department with the largest proportion of such spending was the Department of Defense, which obligated 19 percent of its budget to acquire aircraft, ships, weapon systems, and other military equipment. The share of such obligations was also above average at the Energy Department, which obligated 10 percent of its budget for assets, primarily for land and structures used for nuclear weapons programs and environmental cleanup. Assets can be acquired for use in direct program activities, as those examples illustrate; they can also be acquired for administrative support, as in the case of software systems for payroll management.

[/collapsed] [collapsed]

Commerce, Education, and Energy: Departmental Budgets by Program

The Departments of Commerce, Education, and Energy are among those most frequently mentioned in comments about eliminating Cabinet departments. In 1982, for example, the Reagan Administration proposed eliminating the Department of Energy, which had been created just five years earlier; and in 1995, the House of Representatives passed a budget resolution that recommended doing away with all three departments. This section examines how those departments’ direct obligations were allocated in fiscal year 2012, both by office and program and by object class.

The funds of the three departments were obligated in sharply different ways. A large share of the Commerce Department’s budget was allocated to personnel costs, the Education Department’s budget was obligated almost entirely for grants, and the Energy Department’s budget was dominated by contractual services and supplies (see Table 6-3). Achieving substantial budgetary savings from eliminating one of these departments (or any other) would require reducing or eliminating the programs operated by that department. Smaller savings might be realized without cutting back on payments or services provided to beneficiaries if the programs were combined with programs at other departments, but only if the programs were managed more efficiently than they had been; the combination might also result in less efficient management.

| Table 6-3. | ||||||

|---|---|---|---|---|---|---|

| Direct Obligations of Selected Departments, by Object Class, 2012 | ||||||

| (Millions of dollars) | Grants and Fixed Charges | Contractual Services and Supplies | Personnel Compensation and Benefits | Acquisition of Assets | Totala | |

| Department of Commerceb | ||||||

| National Oceanic and Atmospheric Administration | 670 | 2,554 | 1,593 | 226 | 5,043 | |

| Bureau of the Census | 0 | 392 | 577 | 10 | 979 | |

| National Institute of Standards and Technology | 185 | 200 | 309 | 50 | 744 | |

| Other | 333 | 363 | 489 | 14 | 1,200 | |

| Total | 1,188 | 3,509 | 2,968 | 300 | 7,966 | |

| Department of Educationc | ||||||

| Office of Elementary and Secondary Education | 21,813 | 63 | 0 | 0 | 21,876 | |

| Office of Special Education and Rehabilitative Services | 15,469 | 14 | 0 | 0 | 15,483 | |

| Office of Federal Student Aid | 8,965 | 1,076 | 177 | 3 | 10,221 | |

| Office of Postsecondary Education | 2,544 | 9 | 0 | 0 | 2,553 | |

| Office of Vocational and Adult Education | 1,721 | 15 | 0 | 0 | 1,736 | |

| Office of Innovation and Improvement | 1,653 | 33 | 0 | 0 | 1,686 | |

| Office of English Language Acquisition | 722 | 4 | 0 | 0 | 726 | |

| Departmental Management | 0 | 199 | 411 | 3 | 614 | |

| Institute of Education Sciences | 256 | 342 | 2 | 0 | 601 | |

| Total | 53,143 | 1,755 | 590 | 6 | 55,496 | |

| Department of Energy | ||||||

| National Nuclear Security Administration | 58 | 9,222d | 409 | 1,154 | 10,843 | |

| Energy Programs | 1,720 | 7,056d | 477 | 686 | 9,939 | |

| Environmental and Other Defense Activities | 59 | 4,431d | 363 | 934 | 5,788 | |

| Departmental Administration | 10 | 119 | 135 | 0 | 264 | |

| Power Marketing Administrationse | 3 | 42 | 20 | 51 | 119 | |

| Total | 1,850 | 20,870 | 1,404 | 2,825 | 26,953 | |

Source: Congressional Budget Office based on data from the Office of Management and Budget.

a. Includes funds obligated under the object class called “Other.”

b. Amounts shown are net of $6 million in budgetary savings recorded in 2012 for new loans made in the Fisheries Finance Program.

c. Amounts shown are net of $27.1 billion in budgetary savings recorded in 2012 for new student loans.

d. These obligations were dominated by contracts for operations and maintenance of facilities, which made up 88 percent of the total for this category for the National Nuclear Security Administration, 67 percent for energy programs, and 50 percent for environmental and other defense activities.

e. The power marketing administrations had total obligations of more than $4 billion; however, all but $119 million was reimbursable.

Department of Commerce

The Department of Commerce has the smallest budget of any Cabinet department, with direct obligations of $8 billion in fiscal year 2012. Its 11 agencies have a variety of missions, which means that the benefits and costs of various proposals to eliminate the department could differ greatly, depending on which of the agencies, if any, were retained and on the changes that were made to programs in those retained agencies.

The Commerce Department is also the department with the largest share of reimbursable obligations; in fiscal year 2012, they represented a full third of the department’s total obligations of $12 billion. Indeed, two of the department’s agencies are funded entirely by fees and other offsetting collections. The Patent and Trademark Office, with $2.4 billion in reimbursable obligations, represented more than half of those obligations in the department in 2012, and the National Technical Information Service accounted for another $66 million. Eliminating either of those offices would yield no net savings to the federal budget, because cutting the spending would also mean forgoing the income.

National Oceanic and Atmospheric Administration. Of the nine Commerce Department agencies with direct obligations in 2012, by far the largest, in budgetary terms, was the National Oceanic and Atmospheric Administration (NOAA), accounting for $5 billion in fiscal year 2012, or 63 percent of the departmental total (see Figure 6-2, as well as Table 6-4). Almost all of NOAA’s budget was obligated for five offices and for program support:

- The National Environmental Satellite, Data, and Information Service, which operates geostationary and polar orbiting satellites and manages a global environmental database;

- The National Weather Service, which provides weather forecasts and alerts;

- The National Marine Fisheries Service, which addresses issues related to fish stocks, marine mammals, and endangered species within the waters of the United States Exclusive Economic Zone;

- The National Ocean Service, which provides maps and other products and services related to navigation, supports state and territorial programs to manage coastal resources, responds to oil spills and hazardous materials releases, and manages marine sanctuaries;

- Program support, which provides maintenance and repair of NOAA’s aircraft and marine fleet through the Office of Marine and Aviation Operations, as well as more general management and administrative support; and

- The Office of Oceanic and Atmospheric Research, which conducts and funds research related to climate, weather, air chemistry, the oceans, and coastal and marine resources.

| Table 6-4. | |||

|---|---|---|---|

| Direct Obligations of the Department of Commerce, 2012 | |||

| Direct Obligations (Millions of dollars) |

|||

| National Oceanic and Atmospheric Administration | |||

| Operations, research, and facilitiesa | 3,165 | ||

| Procurement, acquisition, and constructiona | 1,786 | ||

| Pacific coastal salmon recovery | 65 | ||

| Limited Access System Administration Fund | 10 | ||

| Environmental Improvement and Restoration Fund | 10 | ||

| Fisheries Enforcement Asset Forfeiture Fund | 4 | ||

| Medicare-Eligible Retiree Health Fund contribution, NOAA | 2 | ||

| Promote and develop fishery products and research pertaining to American fisheries | 1 | ||

| Fisheries Finance Program accountb | 0 | ||

| Total | 5,043 | ||

| Bureau of the Census | |||

| Periodic censuses and programs | 695 | ||

| Salaries and expenses | 284 | ||

| Total | 979 | ||

| National Institute of Standards and Technology | |||

| Scientific and technical research and services | 575 | ||

| Industrial technology services | 135 | ||

| Construction of research facilities | 34 | ||

| Total | 744 | ||

| International Trade Administration | |||

| Operations and administration | 464 | ||

| Grants to manufacturers of worsted wool fabrics | 5 | ||

| Total | 469 | ||

| Economic Development Administration | |||

| Economic development assistance programs | 297 | ||

| Salaries and expenses | 39 | ||

| Total | 336 | ||

| Bureau of Industry and Security | 105 | ||

| Departmental Management | |||

| Salaries and expenses | 59 | ||

| Office of the Inspector General | 31 | ||

| Renovation and modernization | 5 | ||

| Gifts and bequests | 4 | ||

| Total | 99 | ||

| Economics and Statistics Administration | 97 | ||

| National Telecommunications and Information Administration | |||

| Salaries and expenses | 46 | ||

| Digital Television Transition and Public Safety Fund | 18 | ||

| Public telecommunications facilities, planning, and construction | 1 | ||

| Public Safety Trust Fund | 1 | ||

| Total | 66 | ||

| Minority Business Development Agency | 28 | ||

| Total, Department of Commerce | 7,966 | ||

Source: Congressional Budget Office based on data from the Office of Management and Budget.

Note: Two other departmental components had only reimbursable obligations: the Patent and Trademark Office and the National Technical Information Service.

a. The National Oceanic and Atmospheric Administration’s budgetary accounts for operations, research, and facilities and for procurement, acquisition, and construction fund the agency’s programs in the National Environmental Satellite, Data, and Information Service; the National Weather Service; the National Marine Fisheries Service; the National Ocean Service; and Oceanic and Atmospheric Research, as well as program support activities.

b. The Fisheries Finance Program had direct obligations of $6 million and budgetary savings of $6 million from new loans.

In terms of object classes, contractual services and supplies dominated NOAA’s 2012 obligations, representing half of the total (see Table 6-3). Roughly half of the obligations in that category were for purchases of satellites from the National Aeronautics and Space Administration, or NASA (classified as contracts for “other goods and services from federal sources”). Personnel costs accounted for about one-third of NOAA’s obligations, grants (primarily to university scientists for research and to states for purposes that included management of coastal zones and fisheries) for 13 percent, and asset acquisition for 4 percent.

Bureau of the Census. The agency with the second-largest budget in 2012 was the Bureau of the Census, which had direct obligations of $1 billion. Its budget from year to year is strongly influenced by the decennial census cycle; for example, direct obligations in 2010, the year the latest decennial census was conducted, were $6 billion. The bureau conducts decennial and five-year censuses, the annual American Community Survey, and other annual, quarterly, and monthly surveys that collect economic and demographic data.

National Institute of Standards and Technology. The third-largest agency in the Commerce Department in 2012 was the National Institute of Standards and Technology (NIST), which had direct obligations of $0.7 billion. The institute funds laboratories where researchers from NIST and elsewhere in government, academia, and industry investigate issues relating to measurement and standards—what measurements producers of nanoparticles can use to monitor quality, for example, or methods for testing electronic systems of health records. It also provides funding for 60 Hollings Manufacturing Extension Partnership centers around the country, which support local manufacturers by giving them access to technology, resources, and industry experts.

Other Components of the Commerce Department’s Budget. The rest of the department’s budget covers six other agencies and departmental management, with collective obligations of $1.2 billion in 2012. The largest of the six is the International Trade Administration, which promotes exports by U.S. businesses and is responsible for enforcing U.S. laws against imports deemed to be unfairly traded. The second-largest, the Economic Development Administration, differs from other agencies in the department in that most of its budget—more than 90 percent in 2012—is spent on grants, which are awarded to economically distressed communities on the basis of competitive applications. The other agencies and departmental management accounted for less than $100 million each in direct obligations.

Department of Education

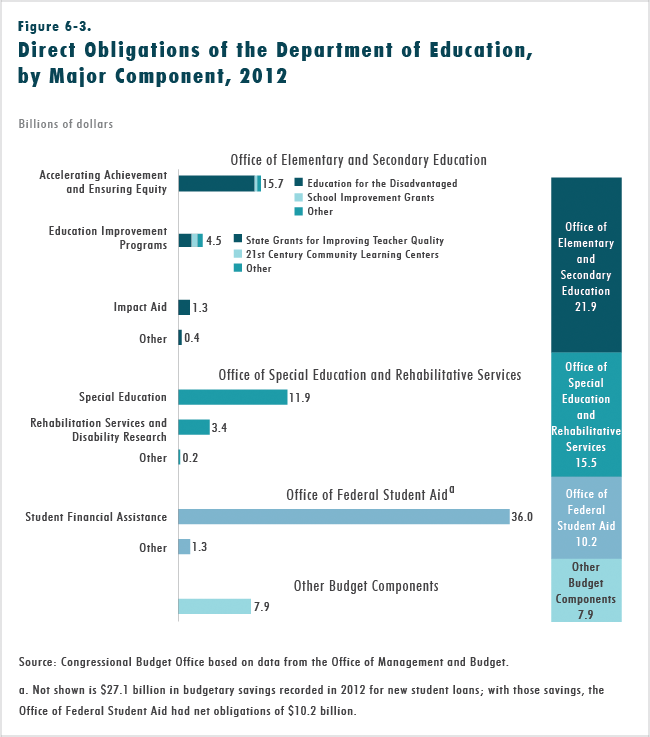

More than 95 percent of the total 2012 budget of the Department of Education, which covers seven offices, an institute, and departmental management, was obligated for grants to students pursuing postsecondary education or to state and local governments. Loans made to postsecondary students in 2012 were recorded as saving $27 billion for the federal government, because the government’s cost of borrowing is projected to be well below the interest rates charged on the loans, and because that factor outweighed the expected cost of defaults. Excluding those savings, the department had direct obligations of $83 billion in 2012; including them, the total came to $55 billion (see Figure 6-3, Table 6-3, and Table 6-5).

| Table 6-5. | |||||

|---|---|---|---|---|---|

| Direct Obligations of the Department of Education, 2012 | |||||

| Direct Obligations (Millions of dollars) | |||||

| Office of Elementary and Secondary Education | |||||

| Accelerating achievement and ensuring equity | |||||

| Education for the Disadvantaged grants to school districts | 14,490 | ||||

| School improvement grants | 534 | ||||

| State agency programs for education of migrant students and neglected and delinquent children and youth | 444 | ||||

| Other | 249 | ||||

| Subtotal | 15,717 | ||||

| Education improvement programs | |||||

| State grants for improving teacher quality | 2,450 | ||||

| 21st Century Community Learning Centers | 1,150 | ||||

| Other | 925 | ||||

| Subtotal | 4,525 | ||||

| Impact Aid | 1,275 | ||||

| Supporting student success | 228 | ||||

| Native American student education | 131 | ||||

| Total | 21,876 | ||||

| Office of Special Education and Rehabilitative Services | |||||

| Special education | 11,851 | ||||

| Rehabilitation services and disability research | 3,416 | ||||

| Gallaudet University | 126 | ||||

| National Technical Institute for the Deaf | 65 | ||||

| American Printing House for the Blind | 25 | ||||

| Total | 15,483 | ||||

| Office of Federal Student Aid | |||||

| Student financial assistance | 36,032 | ||||

| Student aid administration | 1,253 | ||||

| Teacher education assistance | 34 | ||||

| Student financial assistance debt collection | 3 | ||||

| Federal direct student loan program account | -27,101 | ||||

| Total | 10,221 | ||||

| Office of Postsecondary Education | |||||

| Higher education | 2,281 | ||||

| Howard University | 235 | ||||

| College housing and academic facilities loans program account | 33 | ||||

| College housing and academic facilities loans liquidating account | 4 | ||||

| Total | 2,553 | ||||

| Office of Vocational and Adult Education | 1,736 | ||||

| Office of Innovation and Improvement | 1,686 | ||||

| Office of English Language Acquisition | 726 | ||||

| Departmental Management | |||||

| Program administration | 447 | ||||

| Office for Civil Rights | 103 | ||||

| Office of the Inspector General | 64 | ||||

| Total | 614 | ||||

| Institute of Education Sciences | 601 | ||||

| Total, Department of Education | 55,496 | ||||

Source: Congressional Budget Office based on data from the Office of Management and Budget.

Office of Elementary and Secondary Education. The office that deals with elementary and secondary education had direct obligations of $22 billion in 2012. The funds were spent almost entirely on grant programs authorized in the Elementary and Secondary Education Act of 1965, as amended by the No Child Left Behind Act of 2001 and other acts. Most of the programs allocate grants to states on the basis of specified formulas, and the states in turn distribute the funds to school districts on the basis of formulas or, in some cases, competitions.

Obligations in 2012 were largest for the following programs:

- Education for the Disadvantaged grants to school districts, which are based on the number of students from low-income families;

- Grants to improve the quality of teachers, which cover the recruitment, retention, and professional development of teachers and principals;

- Impact Aid, which compensates school districts for the cost of educating “federally connected children,” such as those who live on military bases;

- 21st Century Community Learning Center grants, which support learning opportunities for school-age children outside school hours; and

- School Improvement Grants, which states allocate to help schools that have not demonstrated “adequate yearly progress” (as defined by the No Child Left Behind Act) for two consecutive years.

Office of Special Education and Rehabilitative Services. The Office of Special Education and Rehabilitative Services had direct obligations of $15 billion in 2012. The largest amounts were obligated for special education (almost entirely for grants to states for special education and related services for children with disabilities) and rehabilitation services and disability research (almost entirely for grants to states to fund vocational rehabilitation services).

Office of Federal Student Aid. The office that is responsible for federal student aid had direct obligations of $34 billion for Pell grants, $2 billion for campus-based activities (supplemental educational opportunity grants and federal work-study assistance), and $1 billion for administration of student aid, mostly for the cost of contractual services. The office also had the estimated budgetary savings of $27 billion from new student loans that were noted above.

Other Components of the Education Department’s Budget. The rest of the department consists of the Office of Postsecondary Education, the Office of Vocational and Adult Education, the Office of Innovation and Improvement, the Office of English Language Acquisition, and the Institute of Education Sciences. Those entities, along with the department’s management, accounted for $8 billion in direct obligations in 2012.

Department of Energy

The operations of the Energy Department are different from those of the Commerce and Education Departments in two important ways. First, much of the department’s spending is for programs related to national defense, so policymakers weighing the costs and benefits of eliminating the department would have to take national security considerations into account. Second, a uniquely large share of the Energy Department’s budget is allocated to contractual goods and services— particularly contracts for the operation and maintenance (O&M) of facilities. That subcategory alone represented 56 percent of the department’s 2012 obligations; in contrast, it accounted for only 2 percent of the Defense Department’s obligations that year and less than 0.1 percent of the combined budgets of the other 13 Cabinet departments. Sixteen of the Energy Department’s 17 national laboratories, plus five other sites controlled by the National Nuclear Security Administration (NNSA), are operated entirely by contractors.

The Energy Department’s budget is presented in four broad categories plus management (see Figure 6-4, as well as Table 6-6). The three largest of the four— the NNSA, energy programs, and environmental and other defense activities—accounted for more than 98 percent of the department’s direct obligations in 2012.

| Table 6-6. | |||

|---|---|---|---|

| Direct Obligations of the Department of Energy, 2012 | |||

| Direct Obligations (Millions of dollars) |

|||

| National Nuclear Security Administration | |||

| Weapons activities | 7,063 | ||

| Defense nuclear nonproliferation | 2,302 | ||

| Naval reactors | 1,070 | ||

| Office of the Administrator | 408 | ||

| Total | 10,843 | ||

| Energy Programsa | |||

| Science | 4,937 | ||

| Energy efficiency and renewable energy | 1,619 | ||

| Nuclear energy | 682 | ||

| Fossil energy research and development | 527 | ||

| Title 17 Innovative Technology Loan Guarantee Programb | 496 | ||

| Uranium Enrichment Decontamination and Decommissioning Fund | 472 | ||

| Advanced Research Projects Agency—Energy | 297 | ||

| Nondefense environmental cleanup | 227 | ||

| Strategic Petroleum Reserve | 194 | ||

| Northeast Home Heating Oil Reserve | 156 | ||

| Electricity delivery and energy reliability | 143 | ||

| Energy Information Administration | 106 | ||

| Ultra-deepwater and Unconventional Natural Gas and Other Petroleum Research Fund | 50 | ||

| Naval petroleum and oil shale reserves | 16 | ||

| Advanced Technology Vehicles Manufacturing Loan Program accountb | 8 | ||

| Nuclear waste disposal | 6 | ||

| Payments to states under Federal Power Act | 3 | ||

| Total | 9,939 | ||

| Environmental and Other Defense Activities | |||

| Defense environmental cleanup | 4,946 | ||

| Other defense activities | 841 | ||

| Defense nuclear waste disposal | 1 | ||

| Total | 5,788 | ||

| Departmental Administration | |||

| Departmental administration | 218 | ||

| Office of the Inspector General | 46 | ||

| Total | 264 | ||

| Power Marketing Administrationsa | |||

| Construction, rehabilitation, operation, and maintenance, Western Area Power Administration | 103 | ||

| Operation and maintenance, Southwestern Power Administration | 12 | ||

| Operation and maintenance, Southeastern Power Administration | 3 | ||

| Western Area Power Administration, borrowing authority, Recovery Act | 1 | ||

| Total | 119 | ||

| Total, Department of Energy | 26,953 | ||

Source: Congressional Budget Office based on data from the Office of Management and Budget.

a. Two other budget accounts in energy programs—the Federal Energy Regulatory Commission and the Isotope Production and Distribution Program Fund—had only reimbursable obligations, as did the Bonneville Power Administration Fund. The power marketing administrations as a group had more than $4 billion in reimbursable obligations.

b. Obligations shown are for the expected subsidy costs of loans or loan guarantees, as defined under the Federal Credit Reform Act.

National Nuclear Security Administration. The largest component of the Energy Department’s budget is the NNSA, which had direct obligations of $11 billion in 2012, 40 percent of the departmental total. Of that sum, $7 billion was obligated for weapons activities, including management of the stockpile of nuclear weapons; scientific and technical studies to maintain the safety and reliability of those weapons; stewardship of the sites where the weapons and other nuclear materials were housed; processing and management of spent nuclear materials; and efforts to provide security for NNSA personnel and facilities, as well as for the transportation of nuclear weapons and materials. Another $2 billion was obligated for defense nuclear nonproliferation; it funded efforts to create a plutonium reprocessing facility, keep nuclear weapons materials at vulnerable sites secure, and monitor the proliferation of nuclear weapons and materials. For the NNSA as a whole, facilities O&M contracts accounted for 75 percent of the $11 billion total; acquisition of land and structures accounted for another 9 percent (see Table 6-3).

Energy Programs. The second-largest component of the department’s budget, energy programs, had direct obligations of $10 billion in 2012. Half of its budget was obligated for the Science account, which primarily supported research at the national laboratories in a wide portfolio of areas: basic energy sciences, high-energy physics, nuclear physics, biological and environmental research, advanced scientific computing, fusion energy, and others. Also relatively large was the budget account for Energy Efficiency and Renewable Energy, which funded a variety of programs, including those focusing on vehicle and building technologies, solar energy, alternative fuels, and weatherization.

Environmental and Other Defense Activities. This component of the Energy Department’s budget accounted for $6 billion of direct obligations in 2012. Most of the obligations were for cleanup efforts at sites contaminated by the production of nuclear weapons, particularly the Hanford Site in the state of Washington and the Savannah River Site in South Carolina. Of the $6 billion in obligations, 38 percent were for facilities O&M contracts, 34 percent for contracts for other nonfederal services, and 16 percent for acquisition of land and structures.

Other Components of the Energy Department’s Budget. The other two components of the Energy Department’s budget are departmental administration and the power marketing administrations (PMAs). Together, they accounted for direct obligations of $383 million in 2012. That figure excludes more than $4 billion in reimbursable obligations by the PMAs, which are offset by sales of electricity from hydropower facilities.

[/collapsed] [collapsed]

Policy and Implementation Issues

The advantages and disadvantages of various possible changes to federal programs are presented in the preceding chapters of this report. But in considering whether to close a Cabinet department—and if so, which of its programs to terminate, move unchanged to a new department or agency, or move in a reduced, altered, or combined form—lawmakers would face a number of questions beyond those directly relating to the programs’ merits. This section discusses three. First, if a program was moved, what would be the transition costs and the long-term costs or benefits? Second, if a program was terminated, to what extent would it be replaced by efforts by the private sector or by state or local governments? And third, what steps would be legally required to terminate a program, and what types of termination costs would be incurred?

Costs and Benefits of Moving a Program

Programs may be moved from one administrative home to another for reasons other than the pursuit of budgetary savings. Indeed, the four Cabinet departments created since the 1970s—Energy in 1977, Education in 1980, Veterans Affairs in 1989, and Homeland Security in 2002—were formed primarily to facilitate coordination and communication within the government or to provide greater prominence to certain activities or policy areas.

Whatever policymakers’ motivations for moving a program, doing so would probably entail significant transition costs in the short run and might increase or decrease costs in the long run. The transition costs would include physical moving expenses, rental payments on offices at two locations until the lease on the original space expired, and costs to integrate administrative systems for acquisitions, asset management, human resources, budgeting and planning, and financial management. Costs that are less visible in budgets could be incurred as well; moving could disrupt an agency’s operations, for instance, or lead to conflicts and coordination problems because of differences in organizational culture. The creation of the Department of Homeland Security serves as an example of the challenges that arise from integrating many existing governmental units. Ten years after the department’s creation, a former commandant of the Coast Guard (which had been transferred from the Transportation Department to DHS) noted that budget presentations by various departmental agencies reflected the different appropriation structures that they had used before the department existed, making it “difficult to clearly differentiate, for example, between personnel costs, operations and maintenance costs, information technology costs, and capital investment.”

In the long run, spending on a transferred program would be determined by the amount of appropriations it receives (for a discretionary program) or eligibility rules and formulas (for a mandatory program)—but the cost of achieving a given level of program outputs could go up or down as a result of a transfer. Costs for administrative support activities could decrease if a transferred program was administered more efficiently—with fewer people or less office space, for example—in its new home. In addition, costs for direct program activities, such as interactions with beneficiaries, could decrease if the transfer allowed a reduction in efforts that were redundant or at cross-purposes with those of other programs. The Government Accountability Office has issued a series of reports on “fragmentation, overlap, and duplication” in federal programs, noting, for example, that the Small Business Administration and the Departments of Commerce, Housing and Urban Development, and Agriculture collectively administer 80 economic development programs, including 21 that focus on supporting efforts of entrepreneurs. However, overlap among programs is not necessarily inefficient, and simply reducing spending on overlapping programs may reduce the total output of the programs—for example, total benefits to recipients, in the case of grant programs. Lawmakers might or might not view that result as desirable. Further, administrative and program costs of a transferred program per unit of output could be higher if the administrative structure in the new location was more unwieldy, if the cultures of different operating units were difficult to combine, or if waste, fraud, or abuse increased because management capacity was overtaxed.

The benefits and costs of shifting a program might depend on the agency or department selected as its new home. Two relevant factors are the compatibility of organizational cultures and the availability of suitable infrastructure, such as field offices and data systems. The choice of a new administrative home may not be clear-cut. For example, the Defense Department would seem to be an appropriate new home for the defense-related activities currently conducted by the Energy Department, but the separation of responsibility for nuclear weapons themselves and for the systems and personnel that would deliver those weapons has been a feature of federal policy since 1946. As another example, making the Internal Revenue Service (IRS) the new home for the Education Department’s student financial aid programs would also present both advantages and disadvantages. On the one hand, the IRS already collects financial data from households (much of the same data that the Free Application for Federal Student Aid requires, in fact) and both collects and disburses funds. On the other hand, a significant fraction of students and families who want financial aid might be unwilling to submit additional financial information to the IRS. The advantages and disadvantages would need to be weighed and compared with those of moving the financial aid programs elsewhere—for instance, to the Department of Health and Human Services, which was originally the Department of Health, Education, and Welfare.

Responses by the Private Sector and State and Local Governments

If the federal government eliminated or significantly reduced one or more federal programs, the private sector and state and local governments might increase their own activities in the affected areas. However, the extent and nature of those responses would differ substantially across programs. In many cases, the responses of the private sector and of state and local governments would replace only a small share of the eliminated federal benefits or services, primarily because of differences in priorities and constraints on resources.

The Private Sector. The nature of the goods or services previously provided by a terminated federal program would greatly affect the extent to which the private sector would step in to replace that program. In cases in which a program’s goods and services were primarily commercial, in the sense that others would voluntarily pay enough to cover the cost of producing them, the private sector might fully replace the federal role. One example is electricity generation. Generating facilities owned by the Tennessee Valley Authority or by the various power marketing administrations in the Energy Department could be transferred or sold to private firms or to the states. However, selling assets that generate income would not necessarily improve the government’s long-term financial position, although it would generally improve the budget deficit in the years when sales occurred.

Conversely, in cases in which users (or some users) would not voluntarily pay enough to cover the cost of producing a program’s goods and services, the private sector would be unlikely to fill the federal role if the program was eliminated. Some such cases involve goods or services that are produced most efficiently by a single provider and then can be shared by many consumers at little incremental cost—the collection and dissemination of data of broad public interest, for example. A private firm might not find it worthwhile to conduct the surveys underlying the consumer price index if it could not restrict the results to those who paid for access. Also, such information would be most efficiently collected by a single entity, rather than competing ones, so if that entity was private, policy issues regarding regulation of monopolists would arise.

Other cases in which the private sector would probably not fill the role of a terminated federal activity involve goods or services whose value depends on the government’s sovereign power. For example, no one would pay for a license from one private provider to use a portion of the electromagnetic spectrum if a second private provider could issue the same license to someone else.

Still other cases in which it could be hard for the private sector to fully replace federal programs involve activities that serve noncommercial purposes along with commercial purposes. Consider federal insurance products, such as the flood insurance offered by the Department of Homeland Security and the crop insurance sold by the Agriculture Department. The flood insurance program includes a substantial effort to map flood risks, which would be costly for private insurers to continue; indeed, they might be less willing to offer flood insurance in the absence of that effort. Federal crop insurance is heavily subsidized, serving not only to reduce the variability in farm producers’ incomes but also to raise those incomes, on average. How large a market would exist for private crop insurance in the absence of the federal coverage is unclear—and because such insurance would not be subsidized, it would not raise average incomes.

In some cases in which federal programs mix commercial and noncommercial purposes, the private sector would probably replace part of a federal program if it was terminated. Student loans are an example. The federal government’s sovereign powers allow it to enforce loan contracts in ways that private lenders cannot; for instance, it can garnish the income tax refunds of a borrower who defaults. Private lenders therefore concentrate on students whose risk of default is thought to be lower, such as those attending law or medical schools. If the federal loan programs were eliminated, the private lenders would expand the scope of their lending, but they probably would not serve all students who would have borrowed from federal loan programs.

State and Local Governments. Eliminating a department while restructuring, scaling back, or abolishing its programs might prompt stronger responses from state and local governments than from the private sector, because the bulk of federal spending is associated with programs that seek to achieve noncommercial purposes rather than commercial purposes. In particular, some state and local governments might want to provide benefits or services within their jurisdictions that were formerly provided by federal programs. Several factors would probably determine the extent to which state and local governments replaced the federal role.

First, the greater the local, as opposed to national, benefits of federally funded activities, the more that state and local governments would tend to replace lost federal funding. In contrast, state and local governments would do less to replace reduced or terminated programs that had primarily provided benefits beyond their boundaries. For instance, programs that fund basic research, such as the research conducted at the Energy Department’s national laboratories, provide benefits that fall outside any particular state.

Second, state and local governments would probably do more to replace lost federal funding in program areas that already had substantial involvement by those governments than in areas that did not. Examples of areas where state and local governments currently play large roles include primary and secondary education and transportation infrastructure.

Third, state and local governments would step into roles being vacated by federal programs more vigorously when their own fiscal situations were stronger than when they were weaker. State and local governments would face their own trade-offs in deciding whether to offset forgone federal benefits or services, and if so, how to reduce spending elsewhere or raise additional taxes or other revenues. (Similar choices among policy priorities arise when state and local governments receive federal block grants with few restrictions on the use of the funds.) Those trade-offs could be particularly difficult for state and local governments that had previously received federal grants that significantly redistributed income to their jurisdictions from elsewhere in the country. Another challenge is that most states have balanced-budget requirements, which would make it particularly hard for them to replace federal programs whose spending increases during economic downturns, because such downturns reduce state revenues.

Fourth, state and local governments whose policy preferences regarding certain benefits and services were more closely aligned with the preferences of the federal government would tend to replace a larger share of any step-down in federal support. Having the preferences of state and local governments play a larger role in determining policies would allow those governments to design programs differently, which could be more efficient when the benefits and costs of a program were confined to individual states or when experimentation and variation from state to state yielded valuable information for the nation as a whole. Conversely, it could be less efficient when the decisions made in one jurisdiction had significant consequences elsewhere. Moreover, greater flexibility in designing programs at the state level could undermine a federal objective of uniform standards for all states.

Legality of Program Termination

Eliminating a federal program would involve a complex set of policy choices but generally would not pose insuperable legal obstacles. The Congress could terminate some programs simply by not appropriating funds for them. To end other programs, the Congress would have to modify related laws. In either case, costs would continue for existing contracts and other legal requirements, and certain new costs would be incurred, such as the cost of paying for accrued annual leave and unemployment benefits to federal employees whose work had ended.

Constitutional Requirements. Only a few programs fulfill one of the federal government’s constitutional requirements, but terminating such a program could violate the Constitution, unless the Constitution was amended or the requirement was assigned to another entity. For instance, the Constitution requires that the government conduct a decennial census; eliminating the Department of Commerce would require the federal government to make alternative plans to meet that requirement.

A second kind of constitutional obstacle involves the effect that eliminating certain federal programs could have on the protection of constitutional rights. For example, the Sixth Amendment guarantees the accused in a criminal prosecution the right “to have the Assistance of Counsel for his defence,” which courts have subsequently interpreted to require the provision of counsel to the indigent. Eliminating the public defender program could therefore lead to violations of the Sixth Amendment.

Requirements of International Treaties and Agreements. Some federal programs are responsible for implementing obligations under treaties or agreements that the United States has entered into with other countries. International treaties typically have weak legal enforcement mechanisms or none at all; however, eliminating programs that fulfill treaty obligations could have consequences for U.S. citizens. For example, a determination by the World Trade Organization that the United States had failed to comply with its treaty obligations could result in the imposition of tariffs by other governments against U.S. exports.

Statutory Requirements. Most spending programs could be eliminated by modifying one or more laws, such as those that directly established and financed the programs. Terminating some federal activities, however, would require changes to other programs with which they interact. To eliminate the Bureau of Labor Statistics, for instance, lawmakers would need either to reassign the responsibility for calculating certain statistics, such as the consumer price index, or to amend the tax code and federal programs that are currently indexed to those statistics.

Contractual Requirements. The Congress could eliminate programs involving contracts that imposed requirements on the federal government, but doing so would probably entail costs for canceling or renegotiating the contracts or for litigating or settling lawsuits for breach of contract. In some cases, the federal government might be able to achieve savings by terminating a contract or otherwise renegotiating with the other parties to the contract, though it would probably avoid only a fraction of the remaining costs owed under the contract. In other cases, including legal settlements that the government had already made, the costs would probably be unavoidable. In the 1980s, for example, the Department of Energy entered into contracts with utilities to dispose of their nuclear waste, but it missed the 1998 deadline for accepting such waste. The federal government has entered into settlement agreements requiring that it reimburse dozens of those utilities; the reimbursements would have to be made even if the Department of Energy was closed.

Tort Liability. Some federal programs have generated legal obligations that the government cannot easily dismiss without incurring tort liability. For example, eliminating the Department of Energy’s cleanup efforts at sites contaminated by the production of nuclear weapons could lead to liability for environmental damage. Some of the liability (and litigation) costs might be avoided if lawmakers changed the relevant environmental laws and immunized the federal government from lawsuits.

[/collapsed]