Do you receive a tax deduction for the interest paid on your mortgage or for the taxes you pay to your state and local governments? Would you think about those deductions in the same way if instead of seeing a reduction in taxes for those items the federal government instead simply sent you a check for the same amount?

The individual and corporate income tax systems contain many exclusions, deductions, exemptions, and credits. Some of those tax provisions are called "tax expenditures" by many tax analysts because they resemble government spending in that they provide financial assistance to specific activities, entities, or groups of people. Tax expenditures are more like entitlement programs (for example, Medicare) than like discretionary spending programs (which are generally funded one year at a time in fixed dollar amounts). In contrast, tax expenditures are not subject to annual appropriations, and any person or entity that meets the requirements for them can receive the benefits.

Tax expenditures have a significant impact on the budget because, in aggregate, they reduce revenues by a sizable amount. But because they are not readily identifiable in the budget and are generally not subject to annual reauthorization, tax expenditures are much less transparent than spending on entitlement programs.

CBO discusses major tax expenditures in its report on the budget and economic outlook issued earlier this week (see pages 93–96). On the basis of estimates prepared by the Joint Committee on Taxation and extrapolated by CBO through the 10-year budget window, CBO estimates that:

- Certain major tax expenditures total more than $800 billion in 2012—or 5.3 percent of GDP, equal to about one-third of the federal revenues projected for 2012 and greater than projected spending on Social Security, on defense, or on Medicare.

- That set of tax expenditures will total nearly $12 trillion over the 2013–2022 period—or 5.8 percent of GDP—including the effects on both payroll and income taxes.

It is important to note that those estimates of tax expenditures are based on people’s behavior with the tax expenditures in place, and that, in many cases, people would behave differently if the tax rules were changed. Thus, the estimates do not reflect the amount of revenues that would be raised if those provisions of the tax code were eliminated and taxpayers adjusted their activities in response to the changes.

What Are the Major Tax Expenditures?

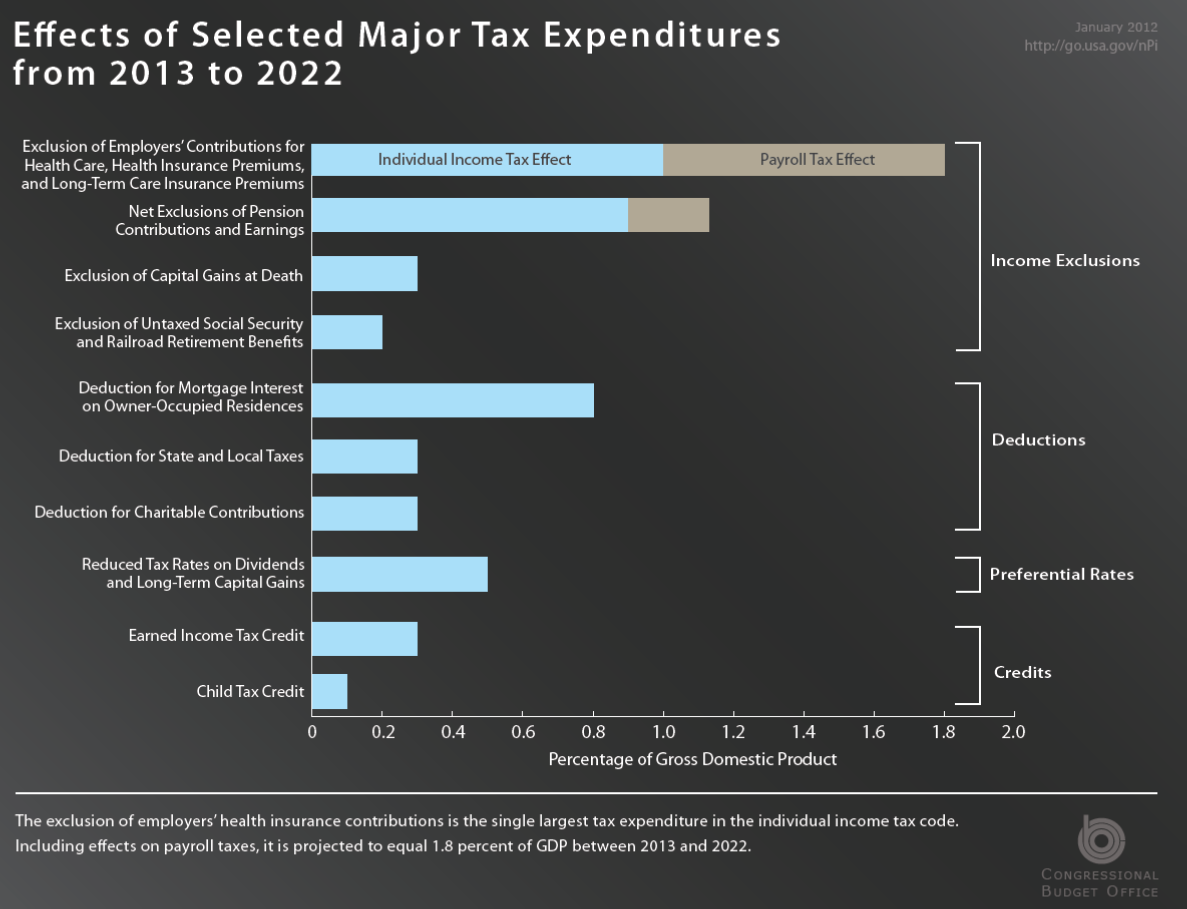

The major tax expenditures discussed in CBO’s report fall into four categories (shown in the figure and discussed below). The tax expenditures that have the largest impact on revenues involve the exclusion from workers’ taxable income of employers’ health insurance contributions; the exclusion of contributions to and earnings of pension funds; and the deduction for interest paid on mortgages for owner-occupied residences.

Income Exclusions

Four of the major tax expenditures are exclusions of certain types of income from individual income taxes.

- The exclusion of employers’ contributions for health care, health insurance premiums, and long-term care insurance premiums is the single largest tax expenditure in the individual income tax code; including effects on payroll taxes, that tax expenditure is projected to equal 1.8 percent of GDP over the 2013–2022 period.

- The exclusion of pension contributions and earnings has the next largest impact, generating net tax expenditures (including effects on payroll taxes) estimated to total 1.1 percent of GDP over that period.

- The exclusion of unrealized capital gains from assets that are transferred at the owner’s death is projected to generate tax expenditures equal to 0.3 percent of GDP over those 10 years, and

- Tax expenditures for the exclusion of untaxed Social Security and Railroad Retirement benefits are projected to equal 0.2 percent of GDP.

Deductions

Three other major tax expenditures allow taxpayers who itemize deductions to deduct their spending for certain items from their taxable income.

- The deduction for interest paid on mortgages for owner-occupied residences is the biggest of the three; tax expenditures for that deduction are projected to equal 0.8 percent of GDP between 2013 and 2022.

- By comparison, the tax expenditures for deductions for state and local taxes and for charitable contributions are each projected to equal 0.3 percent of GDP over that period.

Preferential Rates

Some forms of income are subject to preferential tax rates under the income tax. Both long-term capital gains and dividends are taxed at lower rates in 2012 than other forms of income. Although the preferential rate on dividends is scheduled to expire at the end of December 2012, a slightly higher preferential rate on long-term capital gains will continue after that. Tax expenditures for those preferential rates on dividends and long-term capital gains are projected to total 0.5 percent of GDP between 2013 and 2022.

Credits

The other major tax expenditures projected by CBO are two refundable tax credits, both targeted toward households with children:

- Tax expenditures for the earned income tax credit (which is also available to some low-income workers without children) are projected to be 0.3 percent of GDP between 2013 and 2022, and

- Tax expenditures for the child tax credit are projected to be 0.1 percent of GDP over that period. Both credits were expanded in 2001 and again in later years, but the expansions are scheduled to expire at the end of December 2012. Thus, the projected impact of those two credits is larger in 2012—0.4 percent of GDP each—than in the 2013–2022 period.

Tax expenditures may help to achieve certain societal goals, such as a healthier population, adequate financial resources for retirement, and stable communities of homeowners. At the same time, however, tax expenditures—especially if not limited in size—may encourage overconsumption of goods that receive preferential treatment or subsidize activity that would have taken place without the tax incentives. For example, the tax expenditures for health insurance costs, pension contributions, and mortgage interest may also prompt people to consume more health services than are necessary, reallocate existing savings from accounts that are not tax-preferred to retirement accounts, and purchase more-expensive homes than they need.