In fiscal year 2011, federal expenditures for the Supplemental Nutrition Assistance Program (SNAP, formerly known as Food Stamps)—$78 billion—and participation in the program were the highest they have ever been. In an average month that year, about one in seven U.S. residents received SNAP benefits.

In a report issued today, CBO describes the program, its beneficiaries, recent trends in participation and spending, and some possible approaches to changing how it operates. To provide a handy summary of some of the most pertinent information about SNAP, CBO also published an infographic on SNAP.

What Are Some Characteristics of SNAP Beneficiaries?

In 2010, about three out of four SNAP households included a child, a person age 60 or older, or a disabled person. Most people who received SNAP benefits lived in households with very low income, about $8,800 per year on average in that year. The average monthly SNAP benefit per household was $287, or $4.30 per person per day. On average, SNAP benefits boosted gross monthly income by 39 percent for all participating households and by 45 percent for households with children.

How Did SNAP Participation and Spending Change Over the Past Several Years?

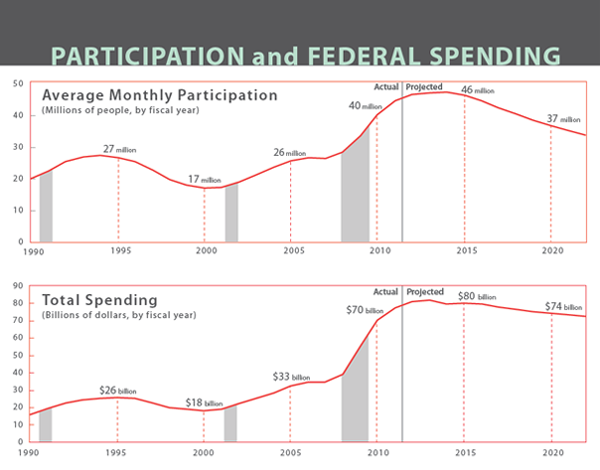

On average, 45 million people received SNAP benefits each month in fiscal year 2011, which represents a 70 percent increase over the roughly 26 million people (or one of every 11) who received benefits in 2007. Outlays for SNAP benefits (not including administrative costs) more than doubled during that period, from about $30 billion to $72 billion.

Why Have SNAP Participation and Spending Increased So Much?

Almost two-thirds of the growth in spending on SNAP benefits between 2007 and 2011 stemmed from the increase in the number of participants. Labor market conditions deteriorated dramatically between 2007 and 2009 and have been slow to recover; since 2007, both the number of people eligible for the program and the share of those who are eligible and who participate in the program have risen.

About one-fifth of the growth in spending can be attributed to temporarily higher benefit amounts enacted in the American Recovery and Reinvestment Act of 2009. The remainder stems from other factors, such as higher food prices and lower income among beneficiaries, both of which have boosted benefits.

What Are CBO’s Projections for SNAP Participation and Spending over the 2012–2022 Period?

According to CBO’s March 2012 projections, the number of people who receive SNAP benefits will continue to rise slightly from fiscal year 2012 through fiscal year 2014 and then decline in the following years, reflecting an improved economic situation and a declining unemployment rate. Nevertheless, the number of people receiving SNAP benefits will remain high by historical standards, CBO estimates.

By fiscal year 2022, CBO projects, 34 million people (or about one in 10 U.S. residents) will receive SNAP benefits each month (roughly the same number as in 2009), and SNAP expenditures, at about $73 billion, will be among the highest of all non-health-related federal support programs for low-income households.

What Are Some Approaches to Changing SNAP Policy That Are Being Considered by Policymakers and Researchers?

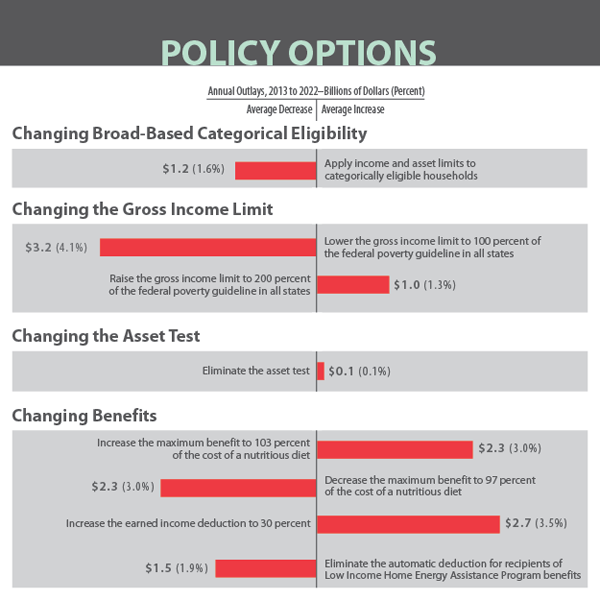

Some policymakers might want to consider scaling the program back as part of a larger effort to reduce federal spending. Others might want to expand it to provide more assistance or to boost the economy in the short term. CBO has examined four broad sets of options.

The first two sets of approaches—changing eligibility rules or changing benefit amounts—are summarized in the figure below. For example, changing broad-based categorical eligibility would decrease average annual outlays by $1.2 billion over the 2013–2022 period and reduce the number of participants by 1.8 million per year, on average. (Categorical eligibility refers to those households that automatically qualify for benefits on the basis of participation in other federal or state programs.)

The third set of approaches—changing the administrative costs of the program—would be another way to modify SNAP spending. For example, a policy that required states to pay a penalty to the federal government for all erroneous payments to SNAP participants—and not just a portion of erroneous payments above some threshold, as under current policy—would have generated nearly $2.5 billion in fiscal year 2010, CBO estimates.

The fourth set—changing the way the program is funded—would fundamentally change the way the program is operated. Replacing the annual appropriation with a block grant, for example, could transfer much of the decisionmaking power from the federal government to the states. SNAP participants might receive higher or lower benefits than they would receive under current law, depending on how the rules were set at the federal and state levels.

This report was prepared by Kathleen FitzGerald and Emily Holcombe of CBO’s Budget Analysis Division and Molly Dahl and Jonathan Schwabish of CBO’s Health and Human Resources Division.