Taxing Businesses Through the Individual Income Tax

Since the individual income tax was instituted in 1913, the profits of most businesses have been allocated, or “passed through,” to their owners and subjected to that tax—rather than to the corporate income tax. However, most business activity (specifically, the total revenue that businesses receive as receipts from sales of goods and services) has occurred at firms subject to the corporate income tax (C corporations) because those firms tend to be larger than pass-through entities.

Summary

Since the individual income tax was instituted in 1913, the profits of most businesses have been allocated, or “passed through,” to their owners and subjected to that tax—rather than to the corporate income tax. However, most business activity (specifically, the total revenue that businesses receive as receipts from sales of goods and services) has occurred at firms subject to the corporate income tax (C corporations) because those firms tend to be larger than pass-through entities.

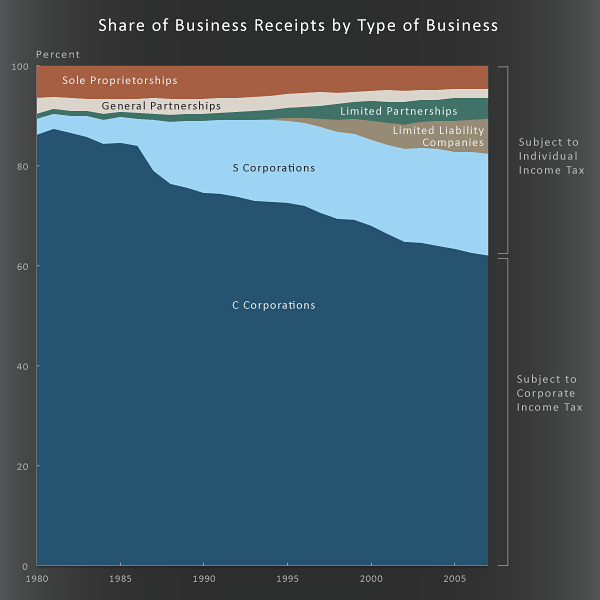

Over the past few decades, the proportion of firms organized as pass-through entities and their share of business receipts have increased substantially: In 1980, 83 percent of firms were organized as pass-through entities, and they accounted for 14 percent of business receipts; by 2007, those shares had increased to 94 percent and 38 percent, respectively.

This report examines those shifts in organizational structure, the effect they have had on federal revenues, and the potential effects on revenues and investment of various alternative approaches to taxing businesses’ profits.

Changes in Businesses’ Organizational Structure Stem from Changes in the Tax Code and a Shift Away from a U.S. Economy Based on Manufacturing

The trends in the way businesses are organized and the resulting income taxes to which they are subject are linked to the growing popularity of entities such as S corporations (those organized under the rules of subchapter S of the Internal Revenue Code) and limited liability companies (LLCs) that have arisen mainly in the past 30 years. Those newer organizational forms provide owners with the same protection from liability for the debts of the firm that the owners of C corporations receive but in addition offer more favorable tax treatment. Spurring those shifts in organizational form have been, in particular:

- Changes in the tax code—particularly the enactment of the Tax Reform Act of 1986, which lowered the top marginal rate in the individual income tax (that is, the rate that applies to an additional dollar of income) to below the top marginal rate in the corporate income tax; and

- The trend in the United States away from an economy based primarily on manufacturing and toward one based for the most part on providing services—an activity that derives fewer benefits from the C-corporation structure.

Growth of New Types of Businesses Not Subject to the Corporate Income Tax Has Reduced Federal Revenues

One effect of the growth of newer types of businesses is that total federal revenues have been reduced relative to a world in which C corporations still earned over 85 percent of all business receipts. CBO estimates that if the C-corporation tax rules had applied to S corporations and LLCs in 2007 and if there had been no behavioral responses to that difference in tax treatment, federal revenues in that year would have been about $76 billion higher. Behavioral responses—for example, owners of S corporations might have reduced those corporations’ taxable income by reporting larger amounts for their compensation (which would have raised payroll taxes and lowered corporate income taxes relative to CBO’s estimate)—would have changed the amount of additional tax revenue that would have been collected. Furthermore, the estimate does not account for interactions with other tax provisions, such as the alternative minimum tax. Despite those complications, however, it is clear that the growth of newer types of businesses not subject to the corporate income tax has significantly reduced federal revenues relative to what would otherwise have occurred.

Growth of Pass-Through Entities Has Had Some Positive Aspects

The increased share of business activity attributable to pass-through firms not only reduces federal revenues but also increases the extent to which businesses similar in size and in the same industry are being taxed differently. Nevertheless, the trend toward pass-through entities’ accounting for a larger share of business activity has some positive aspects. For example, it has probably reduced the overall effective tax rate on businesses’ investments, thus encouraging firms to invest. The shift in activity toward pass-through firms has also reduced at least two biases associated with the current corporate income tax that influence what businesses do with their earnings and how they pay for their investments:

- The bias in favor of retaining earnings rather than distributing them, which results from taxing dividends immediately but deferring the taxation of capital gains; and

- The bias in favor of debt financing, which results from allowing businesses, when they calculate their taxes, to deduct from their income the interest they pay to creditors but not the dividends they pay to shareholders.

CBO Examined Three Potential Approaches to the Taxation of Businesses’ Profits

Reducing the distortions caused by the current rules for taxing businesses’ income would increase businesses' incentives to allocate their investments more efficiently—that is, in a way that maximizes the production of goods and services given the available resources. CBO examined three potential approaches to the taxation of businesses' profits:

- Limiting the use of pass-through taxation. Policies following that approach would increase federal revenues but probably also raise effective tax rates on businesses’ investments and exacerbate the inefficiencies associated with the two biases described above.

- Integrating the individual and corporate income taxes. That approach, which includes alternatives that achieve only partial integration, would increase the use of pass-through taxation and have the opposite effects of the first approach. That is, it would probably lower federal revenues, reduce effective tax rates, and lessen the biases described earlier.

- Unifying taxes on businesses in a new entity-level tax. That approach is designed to reduce or even eliminate the two biases—particularly the bias in favor of debt financing. Such a change could either raise or lower revenues and effective tax rates, depending on its details.