On Tuesday CBO published a new economic forecast in The Budget and Economic Outlook: Fiscal Years 2013-2023. The forecast—reflecting current law—takes into account the recent passage of the American Taxpayer Relief Act of 2012 (Public Law 112-240), which removed a significant amount of the fiscal tightening that had been scheduled to take effect in January 2013.

Still, some fiscal tightening has already begun or is scheduled to occur—including the expiration of a 2 percentage-point cut in the Social Security payroll tax, an increase in tax rates on income above certain thresholds, and scheduled automatic reductions in federal spending—and economic growth is expected to remain slow this year. Next year, CBO projects that underlying factors in the economy will spur a more rapid expansion, but the economy is expected to remain below its potential level until 2017. Below are some questions and answers that will help explain CBO’s economic forecast.

What Is the Economic Outlook for the Next Two Years?

CBO expects that, under current laws governing taxes and spending, economic activity will expand slowly in 2013 but will increase more rapidly in 2014. As measured by the change from the fourth quarter of the previous year, real (inflation-adjusted) gross domestic product (GDP) is projected to increase by 1.4 percent this year and by 3.4 percent next year.

With economic growth subdued until 2014, CBO forecasts that the unemployment rate will remain high—above 7½ percent through next year. If that occurs, 2014 will be the sixth consecutive year with unemployment exceeding 7½ percent of the labor force, the longest period of such high unemployment in the past 70 years. CBO projects that the high number of unemployed workers and the large amount of other unused resources in the economy will help to keep the rate of inflation (as measured by the price index for personal consumption expenditures, or PCE) below 2 percent during this year and next and that interest rates will stay quite low as well.

Why Does CBO Project Slower Growth This Year But Quickening Growth in 2014?

That pattern of slow growth in 2013 and then quickening growth in 2014 reflects a combination of a gradual improvement in underlying economic factors and the tightening of federal fiscal policy that is scheduled to occur this year. The effects of the housing and financial crisis will continue to fade, CBO expects: An upswing in housing construction (albeit from a very low level), rising real estate and stock prices, and increasing availability of credit will help to spur a virtuous cycle of faster growth in employment, income, consumer spending, and business investment over the next few years. However, the federal fiscal policy specified by current law will represent a drag on economic activity this year.

What Would Happen to Economic Growth With Less Fiscal Tightening This Year?

CBO estimates that economic growth in 2013 would be roughly 1½ percentage points faster than the agency now projects if not for the fiscal tightening. About 1¼ percentage points of that effect come from the automatic reductions in federal spending (see my blog post from yesterday for a description of those reductions), the expiration of the cut in payroll tax rates, and the increase in tax rates on income above certain thresholds; the spending changes and the combined tax changes account for about equal portions. The remaining ¼ percentage point comes from other, smaller changes in spending and taxes. If policymakers modified the tax and spending policies in current law, their actions could have significant implications for economic growth. For instance, less fiscal tightening this year would lead to stronger growth in 2013 but, if not accompanied by sufficient additional tightening in later years, would also restrain real output and income in the middle of the decade and beyond owing to higher federal debt.

When Will Output Return to Its Potential Level?

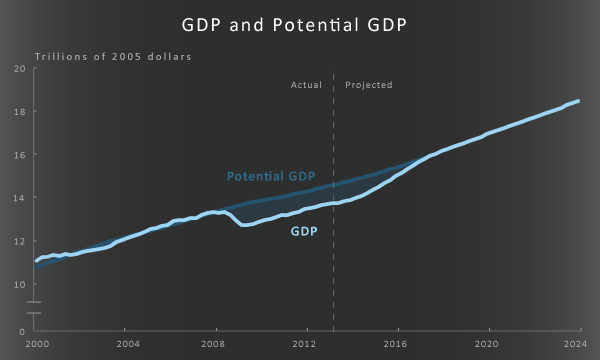

Although CBO anticipates faster economic growth after this year, output is likely to remain below its potential (or maximum sustainable) level until 2017—almost a decade after the recession started in December 2007. CBO estimates that real GDP in the fourth quarter of 2012 was below its potential level by about 5½ percent; that gap is only modestly smaller than the gap (of about 7½ percent) that existed at the end of the recession in mid-2009 because growth in output since then has been only slightly faster, on average, than growth in potential output (see figure below). With such a large gap between actual and potential output persisting for so long, the cumulative loss of output relative to the economy’s potential between 2007 and 2017 will be equivalent to nearly half of the output produced last year.

Consistent with the forecast that output will be growing rapidly enough between 2014 and 2017 to close the output gap, the unemployment rate is projected to fall from about 7½ percent at the end of 2014 to about 5½ percent at the end of 2017. The interest rate on three-month Treasury bills is forecast to remain low through 2015 and then rise considerably through 2017 as the economy strengthens; the interest rate on 10-year Treasury notes is projected to rise steadily through 2017.

What Is the Economic Outlook After 2017?

Beyond 2017, CBO’s economic forecast is based on the assumption that real GDP will grow at the same rate as potential GDP, because the agency does not attempt to predict the timing or magnitude of fluctuations in the business cycle so far into the future. Under that assumption, the average growth of real GDP in CBO’s projection is 2¼ percent a year during the 2019–2023 period; that pace is much slower than the average annual growth of 3¼ percent since 1950, primarily because of slower expected growth in the labor force from both the retirement of the baby-boom generation and an end to the long-standing increase in the labor force participation of women.

In addition, the unemployment rate in CBO’s projection falls to 5.2 percent by the end of 2023, and inflation holds steady at 2 percent between 2019 and 2023. The interest rate on three-month Treasury bills stabilizes at 4.0 percent in the 2019–2023 period, and the rate on 10-year Treasury notes stabilizes at 5.2 percent. Since the end of the recession, the path of recovery has been difficult to predict, and outcomes in future years will no doubt hold surprises as well. Many developments apart from changes in the laws regarding federal taxes and spending—such as unanticipated changes in the pace of economic growth abroad—could cause economic outcomes to differ substantially from those CBO has projected.

How Does CBO’s Forecast Differ from the Agency’s August 2012 Forecast?

CBO’s current forecast of economic growth for 2013 differs significantly from the agency’s August 2012 forecast. The American Taxpayer Relief Act removed a significant amount of the fiscal tightening that had been scheduled to take effect in January 2013. As a result, CBO no longer projects that real GDP will decline this year. However, CBO’s current projection for the growth of real GDP in 2013 is still considerably below those of the Blue Chip consensus (which is based on roughly 50 private-sector forecasts) and the Federal Reserve’s Federal Open Market Committee. Those differences probably stem in large part from differing assumptions about the federal government’s future tax and spending policies.