CBO’s report last month about its latest budget projections (The Budget and Economic Outlook: Fiscal Years 2013-2023) summarized various changes to the agency’s projections of federal health care spending. To elaborate on that summary, an earlier blog entry discussed the reductions that CBO had made in its projections of Medicare and Medicaid spending.

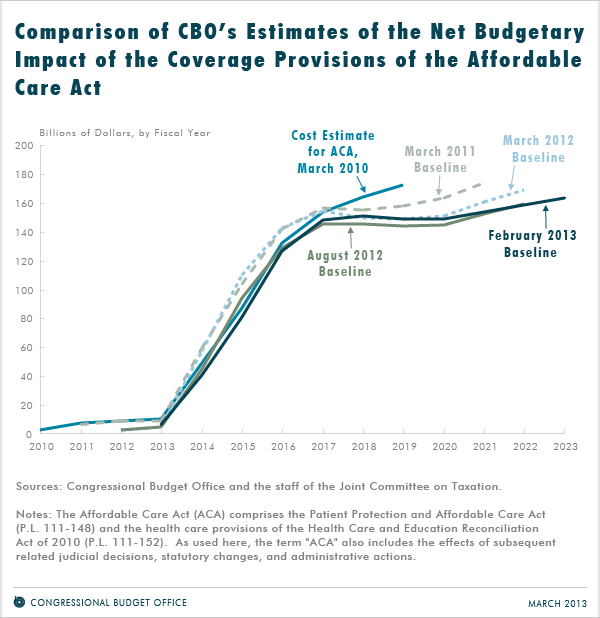

The report also presented CBO’s latest analysis of the provisions of the Affordable Care Act (ACA) related to health insurance coverage—analysis that CBO undertakes together with the staff of the Joint Committee on Taxation (JCT). CBO and JCT’s estimate of the net budgetary impact of the ACA’s insurance coverage provisions has changed little since August 2012 and, indeed, has changed little, for any given year, since the legislation was being considered in March 2010.

Changes in the Estimated Budgetary Impact of the ACA’s Coverage Provisions Since March 2010

When the ACA and other proposals that led up to that legislation were being considered by the Congress in 2009 and 2010, CBO and JCT prepared estimates of those proposals’ budgetary effects over the 2010–2019 period. In the estimate prepared in March 2010, CBO and JCT projected that the provisions of the ACA related to health insurance coverage would cost the federal government $788 billion between 2010 and 2019. The latest projections extend the original ones by four years, corresponding to the shift in the regular 10-year projection period since 2009, and the estimated cost of the ACA’s insurance coverage provisions between 2013 and 2023 is $1,329 billion. However, the projections for each given year have changed little, on net, since March 2010—as shown in the figure. (See the blog post from March 2012 for a longer discussion of the multiyear comparison.)

Those amounts do not reflect the total budgetary impact of the ACA. That legislation included many other provisions that, on net, will reduce budget deficits. On balance, CBO and JCT have estimated that the legislation as a whole will reduce deficits over a 10-year period. (We have not updated our estimates of the total budgetary impact of the ACA; for our most recent estimate of the budgetary impact of repealing the law, see the Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act.)

Changes in the Estimated Budgetary Impact of the ACA’s Coverage Provisions Since August 2012

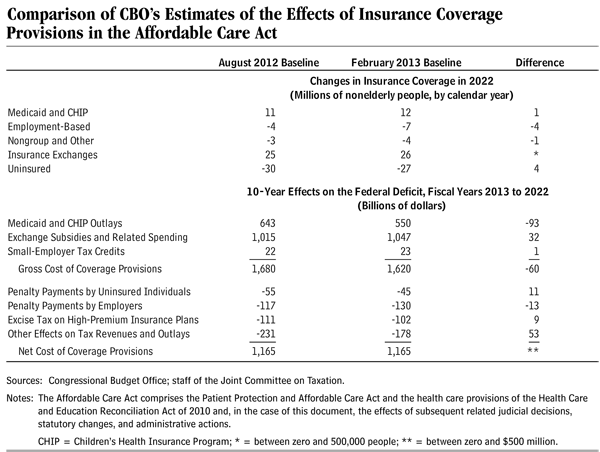

For the 2013–2022 period that was covered by our previous projections in August 2012, CBO and JCT now estimate that the net budgetary impact of the ACA’s provisions related to health insurance coverage is $1,165 billion—within $1 billion of our estimate last August. However, various components of the estimate have changed, reflecting legislative, regulatory, and administrative actions, along with economic and technical changes made since the previous estimate was published.

The most important changes to our estimates include the following (for more discussion, see pages 59 through 61 of the recent Outlook):

- Lower marginal tax rates under the American Taxpayer Relief Act reduce the tax benefit associated with employment-based health insurance and will lead to a greater reduction in such coverage and higher enrollment in insurance exchanges than previously estimated by CBO and JCT.

- The Department of Health and Human Services has indicated that, to receive full funding from the federal government for the costs of newly eligible beneficiaries through 2016, states must expand eligibility for Medicaid to the levels specified in the act. Relative to previous projections, that guidance results in a small increase in the estimate of the number of people who will be enrolled in Medicaid and a small reduction in the estimate of the number who will be covered through the exchanges.

- CBO and JCT have slightly reduced their estimates of the rates at which people will enroll in the insurance exchanges or Medicaid as the expansion of coverage is implemented—a process that had already been anticipated to occur gradually. That change reflects the agencies’ judgment about a combination of factors, including the readiness of exchanges to provide a broad array of new insurance options, the ability of state Medicaid programs to absorb new beneficiaries, and people’s responses to the availability of the new coverage. As a result, revised estimates for 2014 and 2015 reflect more people with employment-based coverage and more who will be uninsured than in the previous projections. CBO and JCT project that those factors will wane in importance over the following two years. In the current projection, the number of people gaining coverage through the exchanges rises from 7 million in 2014 to 24 million in 2016, and the number gaining coverage through Medicaid rises from 8 million in 2014 to 11 million in 2016.

- CBO has revised its analysis of the health status of newly eligible Medicaid enrollees; they now are expected to be healthier and therefore to require less costly care than CBO had previously projected.

- CBO has refined its projections of people’s income so that slightly more tax filers and their dependents are now expected to have income that will qualify them for subsidies through the exchanges and for enrollment in Medicaid, resulting in a larger reduction in employment-based coverage in response to changes made by the act than previously had been estimated.

- CBO and JCT have revised their projections of insurance coverage in the absence of the legislation. In later years, that revision shows a larger number of people with employment-based coverage and a smaller number without insurance, compared with earlier projections. That change, combined with the changes in marginal tax rates and the adjustments to projected income discussed above, leads to a larger projected net reduction in employment-based coverage under the ACA, from 4 million in the August 2012 projections to 7 million in the February 2013 projections.

Jessica Banthin is Senior Advisor in CBO's Health, Retirement, and Long-Term Analysis Division. Sarah Masi is an analyst in CBO's Budget Analysis Division.