In recent years, CBO has received a growing number of questions about the effects on the federal budget of policy proposals that aim to improve the status of people’s health. CBO released a comprehensive report in 2012 about the short-term and long-term budgetary impact of one such policy—an increase in the federal tax on cigarettes. That report illustrates the range and depth of the analysis necessary to assess the full effects of such a policy proposal. Given the high degree of interest in the relationship between people’s health and the federal budget, we thought it was worth recapping some highlights from that report.

Ways in Which Health-Promotion Policies Could Affect the Federal Budget

The federal government spends roughly $1 trillion on health care programs each year, so it is easy to imagine that policies to promote a healthier population could have a significant impact on the federal budget. Such policies might include initiatives to discourage smoking or excessive alcohol consumption; promote better eating habits and physical activity to reduce obesity; encourage greater use of clinical interventions to identify health risk factors and prevent disease; or encourage compliance with medical and dietary regimens for chronic conditions, such as hypertension and diabetes.

A policy initiative aimed at improving the health of the population would affect the federal budget through the following links:

- The effects of the policy on people’s behavior;

- The impact of changes in behavior on people’s health; and

- The implications of improvements in health for people’s health care spending, life expectancy, and earnings.

Specifically, policy initiatives that caused people to change their behavior in ways that improved their health—or that prevented harmful behaviors in the future—would tend to reduce average annual health care spending per person (including spending by government programs and private insurers as well as out-of-pocket spending). Better health might also lead to lower mortality rates and greater longevity, thus increasing the size of the population and changing its age distribution, with important consequences for federal retirement programs and Medicare. Better health could also affect total earnings, because healthier people might make different decisions about working and might be more productive at work.

In the case of clinical interventions to identify risk factors for diseases—such as screenings for hypertension or breast cancer—the impact on the federal budget would also depend on two factors: how effectively the policy targets people who are at risk and who would not otherwise receive the intervention, and how many of the people who are screened because of the policy receive follow-up diagnostic tests and medical interventions based on their test results that they would not have received otherwise.

To produce comprehensive estimates of how health-promotion and disease-prevention policies would affect the federal budget, CBO must assess the size of each of those complex links. That process involves a great deal of analysis by CBO and requires extensive data on the complex interrelationships among health behaviors, health outcomes, labor market outcomes, health care spending, and participation in federal programs. In developing its modeling of those relationships, CBO depends on research by outside experts and analysts as well as on its own research.

A Case Study: Effects of Raising the Cigarette Tax

In its 2012 study, CBO analyzed a policy involving smoking—a hypothetical increase of 50 cents per pack in the federal excise tax on cigarettes and small cigars (adjusted each year to keep pace with inflation and, in the long term, with the growth of people’s income)—to demonstrate the complex links between policies that aim to improve health and the federal budget. The study focused on estimating the budgetary impact of improvements in the health of the population resulting from the policy.

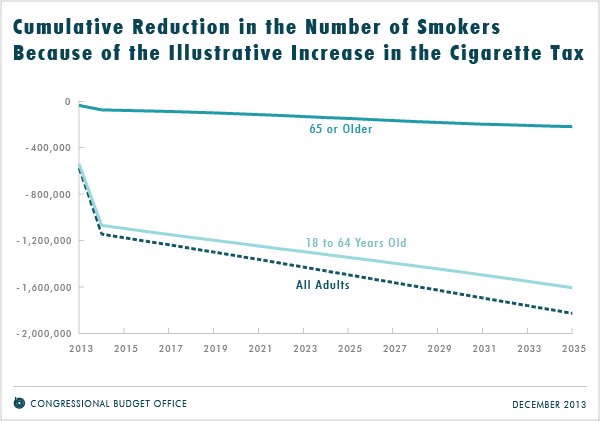

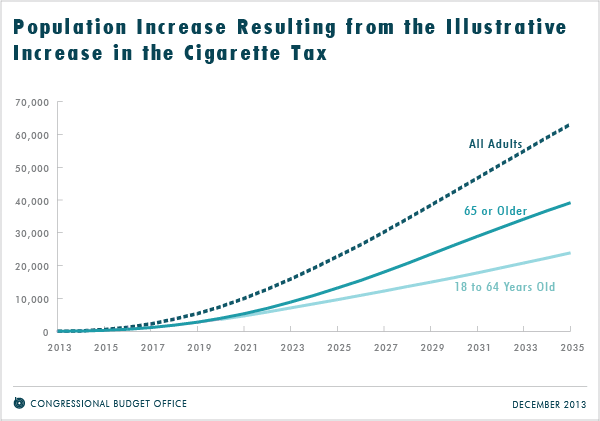

CBO concluded that by discouraging people from smoking, the higher excise tax would improve the average health status of the population. If the tax increase began in fiscal year 2013, by 2021 (the end of the 10-year period covered by CBO’s standard budget estimates when the analysis was conducted) almost 1.4 million adults would be nonsmokers rather than smokers because of the policy—including about 10,000 adults who would not otherwise have survived to that year (see the figures below). By 2085 (the final year of the analysis), over 3 million adults would be nonsmokers specifically because of the policy, including about 200,000 who would otherwise have died earlier.

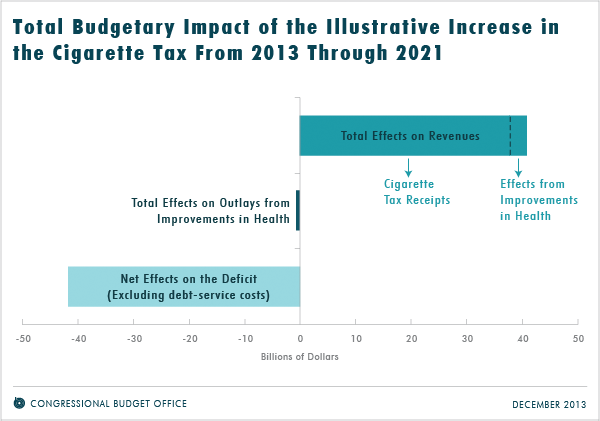

Impact on the Budget Through 2021

As a result of the increase in the excise tax and the ensuing changes in people’s behavior and health, federal revenues would rise by about $41 billion through 2021, and spending would decline by less than $1 billion (see the figure below). (Those estimates were relative to CBO’s March 2011 baseline budget projections.) Almost $38 billion of the additional revenues through 2021 would come from the higher excise tax (including partially offsetting effects on income and payroll taxes), according to estimates by the staff of the Joint Committee on Taxation. Another $3 billion in revenues would stem from improvements in health—primarily from additional earnings as better health allowed people to work more and be more productive. Spending on the government’s largest health care programs, Medicare and Medicaid, would decline slightly during that period as people’s health improved, and spending on Social Security would increase slightly as more people lived longer. Those changes would be very small relative to the size of the programs: about 0.01 percent or less of each program’s projected outlays through 2021.

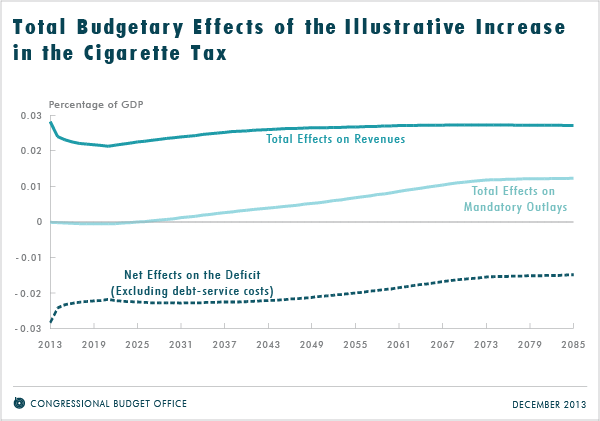

Impact on the Budget Through 2085

Over the long term, the policy’s effect on people’s longevity would play a growing role, and federal spending would rise relative to the amounts projected under current law. Those increases would continue to be small, however, compared with the size of the programs involved. The largest total increase in spending over the long term would be for Medicare, and even by 2085, its increase would represent less than 0.1 percent of the program’s total projected outlays. On net, the illustrative tax increase that CBO analyzed would reduce federal budget deficits throughout the long-term projection period—primarily because of the additional excise tax receipts—although those reductions would represent very small percentages of the nation’s gross domestic product (see the figure below).

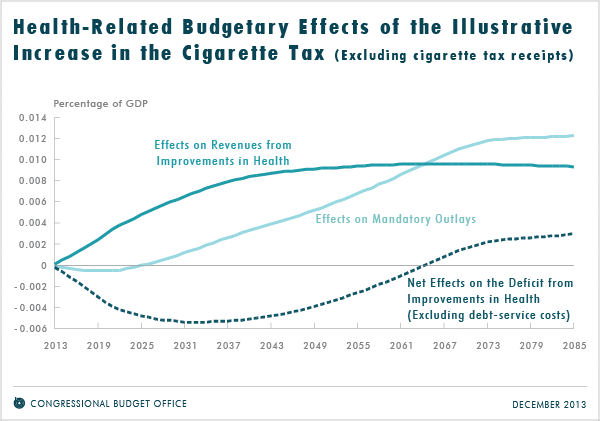

By themselves, the effects of improved health (including greater longevity) on revenues and outlays would have the net result of reducing deficits for roughly the next 50 years. After that, however, the increase in spending spurred by greater longevity would exceed the increase in revenues stemming from improved labor market outcomes (such as greater productivity and labor force participation). Whether positive or negative, those health effects on the deficit would always be very small—less than 0.01 percent of gross domestic product, as shown in the figure below—and they would always be outweighed by the increase in revenues from the higher excise tax.

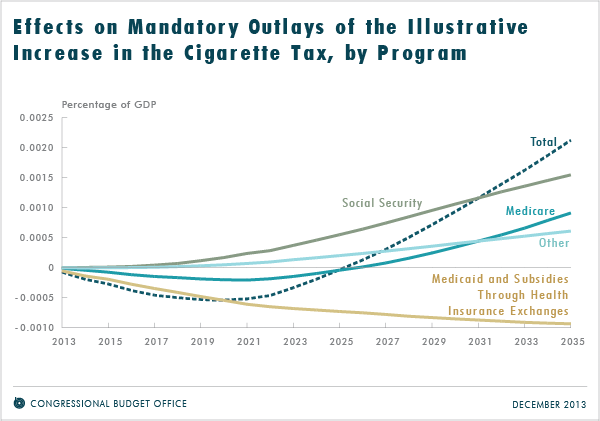

That policy would affect spending for federal programs in different ways, increasing outlays for some programs and decreasing outlays for others. Medicaid would see savings through the entire period of CBO’s analysis, whereas Medicare would experience net savings for the first decade that the policy was in place but then net costs starting sometime in the policy’s second decade (see the figure below). The reason that net savings for Medicare would give way to net costs involves the age range of the program’s beneficiaries—the effects on longevity from a reduction in smoking would be largest among the elderly population, and the additional spending for Medicare beneficiaries who would otherwise have died would eventually outweigh the decline in health spending per person at a given age from reduced smoking. Costs for Social Security’s Old-Age and Survivors Insurance program would increase throughout the long-term projection period because greater longevity would mean more people receiving benefits for a longer time.

Other Considerations About Health-Promotion Policies

If lawmakers were to consider raising the federal excise tax on cigarettes, their decisions would most likely depend on various issues besides the effects on the federal budget. Those other considerations would probably include the impact of the policy on people’s health and mortality rates, views about the appropriate role of the government in influencing behavior, the burdens that the policy might impose on people in different circumstances, and the policy’s effects on the budgets of state and local governments. Those other concerns were beyond the scope of CBO’s analysis, which addressed only the impact on the federal budget (with related analysis of the effects on health and longevity). Similarly, if lawmakers considered other policies to promote a healthier population, their decisions would be influenced by a number of considerations in addition to the budgetary impact. Moreover, the effects of other health-improving policies on the federal budget might differ substantially from the effects of the tax increase that CBO analyzed.

CBO was able to conduct that analysis because of the data that were available: information about smoking behavior collected by national surveys of households’ health and employment, as well as many research studies about the effects of changes in the price of cigarettes on smoking behavior and the effects of smoking on health. Despite that relative abundance of information, CBO’s estimates of the effects of raising the excise tax on cigarettes are uncertain. Analyzing the effects of other types of health-promotion and disease-prevention policies would probably prove more challenging—and the results would be even more uncertain—because of a lack of critical data and a less extensive body of research on key questions.

Linda Bilheimer is Assistant Director and James Baumgardner is Deputy Assistant Director for Health, Retirement, and Long-Term Analysis at CBO. Noelia Duchovny is an analyst in CBO’s Health, Retirement, and Long-Term Analysis Division. Ellen Werble is an analyst in CBO’s Budget Analysis Division.