CBO recently published Options for Reducing the Deficit: 2014 to 2023. That report is now available in a fully digital version, so users can search the options according to major budget category, budget function, and major program category. The report included 36 options for raising revenues (apart from options primarily involving health); they are listed at the bottom of this post with estimates of their budgetary savings.

Trends in Revenues

In fiscal year 2013, the federal government collected $2.8 trillion in revenues. Individual income taxes were the largest source of revenues, accounting for 47 percent of the total. Social insurance taxes (primarily payroll taxes collected to support Social Security and Medicare) accounted for 34 percent, about 10 percent came from corporate income taxes, and other receipts—from excise taxes, estate and gift taxes, earnings of the Federal Reserve System, customs duties, and miscellaneous fees and fines—made up the remaining 9 percent.

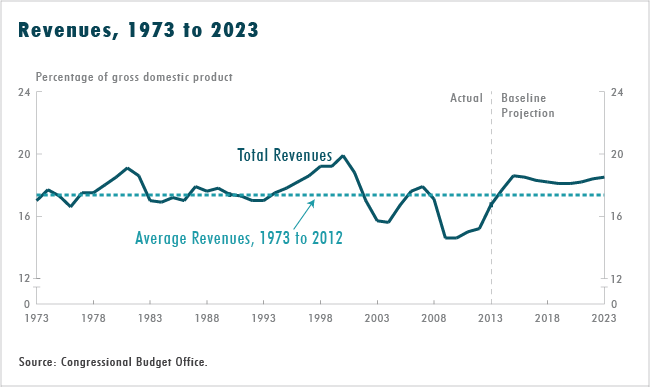

In 2013, revenues equaled 16.7 percent of gross domestic product (GDP). Over the past 40 years, total federal revenues have averaged 17.4 percent of GDP—ranging from a high of 19.9 percent of GDP in 2000 to a low of 14.6 percent in 2009 and 2010 (see the figure below). The variation over time in total revenues as a percentage of GDP is primarily the result of fluctuations in receipts of individual income tax payments and, to a lesser extent, of fluctuations in collections of corporate income taxes.

Under current law, revenues as a share of the economy are projected to reach levels above the historical average—rising to 17.7 percent of GDP in 2014 and 18.6 percent in 2015, and then remaining above 18 percent of GDP from 2016 through 2023. About half of the expected increase in the next two years would stem from changes in tax rules. Accounting for the other half are factors related mainly to the strengthening economy. CBO projects that revenues will grow at close to the same rate as GDP over the 2015–2023 period. Individual income tax receipts are projected to rise relative to GDP as increases in taxpayers’ real income push more income into higher tax brackets; in contrast, corporate income tax receipts and remittances to the U.S. Treasury from the Federal Reserve are projected to fall relative to GDP.

Revenues would be greater if not for the more than 200 tax expenditures in the individual and corporate income tax system, which totaled more than $1 trillion in 2013, CBO estimates. Those tax expenditures—so called because they resemble federal spending to the extent that they provide financial assistance for specific activities, entities, or groups of people—include certain exclusions, deductions, exemptions, and credits in the individual and corporate income tax systems that cause revenues to be lower than they would be otherwise for any given schedule of tax rates.

Options

The 36 revenue options are grouped into several categories according to the part of the tax system they would target: individual income tax rates, the individual income tax base, individual income tax credits, payroll taxes, taxation of income from businesses and other entities, taxation of income from worldwide business activity, excise taxes, and other taxes and fees.

* For options primarily affecting mandatory spending or revenues, savings sometimes would derive from changes in both. When that is the case, the savings shown include effects on both mandatory spending and revenues.

Janet Holtzblatt is Chief of the Tax Policy Studies Unit in CBO's Tax Analysis Division. The options related to revenues are the result of work by various analysts at CBO, whose names can be found on the About the Document page. The staff of the Joint Committee on Taxation prepared the revenue estimates of nearly all of the options.