Budget projections are inherently uncertain. CBO’s projections in The 2014 Long-Term Budget Outlook generally reflect current law and estimates of future economic conditions and demographic trends (those projections are called CBO’s “extended baseline”). If future spending and tax policies differ from what is prescribed in current law, budgetary outcomes will differ from CBO’s extended baseline, as discussed in a blog post last week.

But even if future policies match what is specified in current law, budgetary outcomes will undoubtedly differ from CBO’s projections because of unexpected changes in the economy, demographics, and other factors. To illustrate the uncertainty of its projections, CBO estimated how variation in the following four key factors would affect budgetary outcomes:

- The rate of decline in mortality,

- Productivity growth,

- Interest rates, and

- Growth in federal health care spending.

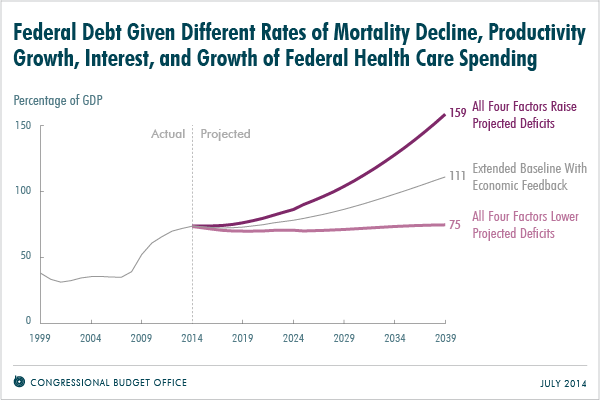

CBO’s analysis shows that the main implication of CBO’s central estimates applies under a wide range of possible values for those factors—namely, if current laws remained generally unchanged, federal debt, which is already high by historical standards, would be at least as high and probably much higher 25 years from now.

How Would Altering Four Key Factors Affect Projected Budgetary Outcomes?

Different paths for those four factors would affect the budget in various ways. For example, lower-than-projected mortality rates would mean longer life expectancy, which would increase the number of people who received benefits from such programs as Social Security, Medicare, and Medicaid; and faster growth in spending for Medicare and Medicaid would boost outlays for those two programs. Both of those changes would increase deficits and debt—which would lead to lower output and higher interest rates, economic feedback that would further worsen the budgetary outlook. By contrast, faster growth in productivity and lower interest rates on federal debt held by the public would reduce deficits and debt—the first by raising output and increasing revenues, the second by lowering government interest payments.

In CBO’s analysis, the ranges of variation for the four factors were based on the historical variation in their 25-year averages, as well as on consideration of possible future developments; together, those offer a guide (though admittedly an imperfect one) to the amount of uncertainty that surrounds projections of the factors over the next 25 years.

The budgetary effects of varying the individual factors differ widely. The simulated variations in productivity, interest rates, and Medicare and Medicaid spending have large effects on the budget within 25 years, whereas the simulated variation in mortality rates does not. In particular:

- In cases in which only one of those factors varies from the values used for the extended baseline, CBO’s projections of federal debt held by the public in 2039 range from about 90 percent of gross domestic product (GDP) to 135 percent, compared with 111 percent under the extended baseline including the economic effects of future fiscal policies.

- In a case in which all four factors varied simultaneously so as to increase projected deficits, but they vary only half as much as in the individual cases, federal debt held by the public in 2039 would reach about 160 percent of GDP (see the figure below). Conversely, in a case in which all four factors varied in a way that lowered deficits, debt in 2039 would equal 75 percent of GDP, about what it is now.

Those projected levels of debt are all high by historical standards, and a number of them exceed the peak of 106 percent of GDP that the United States reached at the end of 1946.

What Are Other Sources of Uncertainty in the Long-Term Budget Outlook and How Can Such Uncertainty Be Addressed?

Those calculations do not cover the full range of possible outcomes, and the four factors listed above are not the only ones that could differ from CBO’s expectations. Some other types of developments could sharply increase federal debt relative to CBO’s projections—an economic depression, unexpectedly large losses on federal financial obligations, a catastrophic natural disaster, or a world war, for example. Other types of developments could reduce federal debt relative to CBO’s projections; for example, a large and prolonged increase in labor force participation could lead to higher-than-expected revenues and lower-than-expected payments for various federal programs.

Policymakers could address the uncertainty associated with long-term budget projections in various ways. For instance, they might design policies that partly insulated the federal budget from some unanticipated events; however, such policies could have unwanted consequences, such as shifting risk to individuals. Or policymakers might aim for a smaller amount of federal debt, to provide a buffer against the budgetary impact of adverse surprises and give future policymakers more flexibility in responding to unexpected crises.

Jonathan Huntley is an analyst in CBO’s Macroeconomic Analysis Division.