Over the past year, in hearings and other contexts, I have received many questions about how the 2017 tax act (Public Law 115-97) has affected the Congressional Budget Office’s economic forecasts. In this blog post, I discuss changes to CBO’s economic forecast since January 2017 and provide an estimate of the portion of those changes that can be attributed to the enactment of the 2017 tax act.

Many factors have been responsible for the changes to CBO’s projections of gross domestic product (GDP) in its economic forecasts over the past two years. The 2017 tax act was one key factor, accounting for close to one-third of the total difference between CBO’s January 2017 and January 2019 projections of GDP for the 2017–2027 period. That increase in projected GDP, along with other macroeconomic factors, also affected CBO’s projections of budget deficits. Such macroeconomic feedback from the tax act offset about 30 percent of CBO’s estimate of the act’s increase in budget deficits through 2028—or 20 percent after debt-service costs are accounted for.

CBO has not changed its estimates of the act’s macroeconomic or budgetary effects since first publishing them in April 2018. More recent data about revenues and the economy are broadly consistent with those April estimates.

What Factors Have Affected CBO’s Projections of GDP?

CBO typically updates its economic forecast in January and in August. Because the 2017 tax act was passed in December 2017, CBO delayed the update until April 2018 so that it could incorporate analysis of that act. In that update, the agency stated its assessment that the 2017 tax act changed businesses’ and individuals’ incentives in various ways—encouraging them to save, invest, and work, and thus boosting GDP over the coming decade.

CBO also included in its April 2018 forecast the effects of other policy changes, including changes to federal spending resulting from the Bipartisan Budget Act of 2018 and the Consolidated Appropriations Act, 2018. Factors other than policy changes—in particular, revisions to the national income and product accounts (NIPAs) made by the Department of Commerce—have also affected CBO’s forecasts over the past two years. Included in those other factors are any effects on GDP during 2017 resulting from actions taken by businesses and consumers in anticipation of the changes to tax law. Although such anticipatory effects might account for a portion of CBO’s revision of projected GDP for the quarters leading up to the enactment of the 2017 tax act, they would have affected GDP during 2017 even if that legislation had not been signed into law at the end of 2017. As a result, they are a consequence of the anticipation of the enactment of the act rather than a consequence of the enactment itself.

What Portion of the Changes to Projections of GDP Was Attributable to the Enactment of the Tax Act?

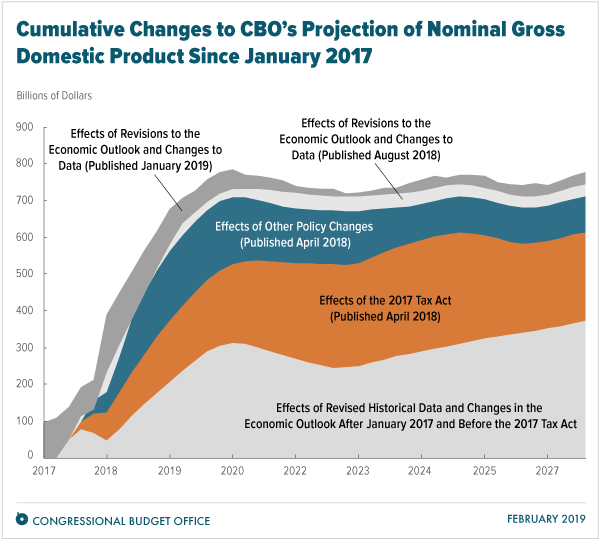

If CBO’s January 2019 forecast is compared with its January 2017 forecast, the total cumulative change in projected GDP over the 2017–2027 period (the sum of all the regions in the figure below) amounts to $7.171 trillion. (The 2017–2027 period is being used for the comparison because it was the one used for the initial January 2017 forecast.) The figure shows the changes to CBO’s projections of nominal GDP in chronological order from bottom to top, starting with changes in the January 2017 forecast.

- The first change shown consists of the effects of revised historical data and changes in the economic outlook after January 2017 and before accounting for the effects of the tax act. Those changes amount to $2.704 trillion over the 2017–2027 period, or about 38 percent of the total $7.171 trillion change.

- The second change shown is the effect of the 2017 tax act on CBO’s projection of GDP, which CBO reported in April 2018. It accounts for $2.330 trillion, or about 32 percent of the total.

- The third change is the combined effects of the other policy changes reflected in the April 2018 economic forecast, especially the changes to federal spending resulting from legislation enacted early in 2018. Those changes account for $1.290 trillion, or about 18 percent of the total.

- The remaining changes shown are more recent ones, from August 2018 and January 2019, that resulted from revisions to the economic outlook and changes to data. (The January 2019 changes include the comprehensive update to the NIPAs that was made in July 2018.) Combined, those changes account for $0.846 trillion, or about 12 percent of the total.

All of those changes are changes in nominal GDP. The reason is that federal outlays and receipts are nominal measures, so it can be helpful to report nominal GDP when the issue at hand is the effects of the economy on the budget. (That is the case even though income tax brackets are adjusted for inflation.)

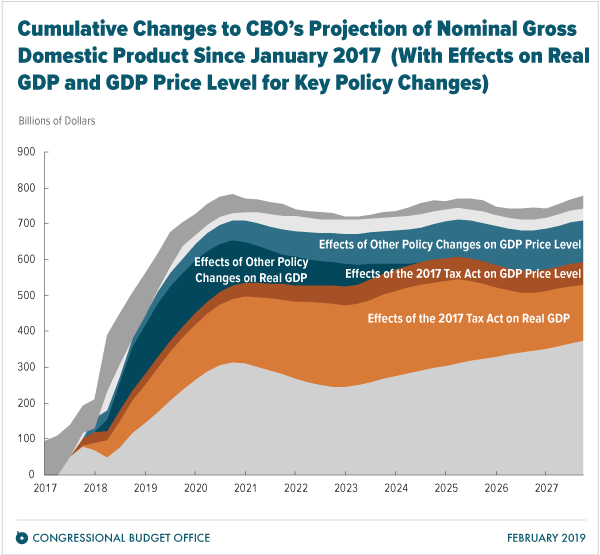

The changes to nominal GDP have two components: changes to real GDP and changes to the GDP price level. The figure below reproduces the earlier figure but shows those two components for the two major policy changes—the 2017 tax act and the 2018 spending legislation. For the 2017 tax act, about three-quarters of the change to nominal GDP results from an increase in real GDP, and the rest results from the effect on the price level. For the 2018 spending legislation, the increase in real GDP accounts for a smaller share (about 40 percent) of the change in nominal GDP and is more front-loaded, whereas the increase in the price level is a larger share (about 60 percent) and more sustained.

How Did the Economic Changes Resulting From the Tax Act Affect the Budget?

In the same April 2018 publication that contained its updated economic forecast after the enactment of the tax act, The Budget and Economic Outlook: 2018–2028, CBO estimated that the tax act would increase the primary deficit (that is, the deficit excluding the costs of servicing debt) by $1.843 trillion over the 2018–2028 period. (When this blog post mentions budget numbers, the periods described are in fiscal years.) When debt-service costs were added, the increase in the total deficit came to $2.314 trillion. (A reason for offering both estimates was that CBO does not include debt-service costs in its cost estimates for specific pieces of legislation.) Those projections do not account for macroeconomic feedback.

In the same report, CBO also estimated the macroeconomic feedback resulting from the tax act. CBO estimated that the economic changes resulting from the act—not including its effects on debt service—would reduce primary deficits by $0.571 trillion over the 2018–2028 period. The main reason was that the act would boost taxable income and thus federal revenues. (Through 2028, the 2017 tax act was estimated to boost GDP by a cumulative $2.562 trillion.) But the act would also lead to larger deficits and higher interest rates, raising debt-service costs. Once that effect was included as well, CBO estimated, macroeconomic feedback from the act would reduce budget deficits by $0.461 trillion over the 2018–2028 period, bringing the net deficit increase down to $1.854 trillion. Macroeconomic feedback over the period thus offsets about 30 percent of the projected impact on the primary deficit and 20 percent of the projected impact on the total deficit.

How Did CBO’s April 2018 Estimate of the Tax Act’s Budgetary Effects Differ From Its December 2017 Estimate?

CBO’s current estimates of the tax act’s budgetary effects, which are the same estimates published in the April 2018 report, differ from what the agency reported before the tax act was enacted. In December 2017, CBO and the staff of the Joint Committee on Taxation estimated that the legislation would increase the deficit by $1.455 trillion over the 2018–2027 period. There are several reasons for the difference between that estimate and the current one. The December 2017 estimate did not incorporate any macroeconomic feedback from the act; it did not incorporate changes to CBO’s economic forecast since January 2017; and the period that it projected ran through 2027, not 2028.

Keith Hall is CBO’s Director.