At a Glance

The Congressional Budget Office regularly publishes its baseline projections of what the federal budget and the economy would look like in the current year and over the next 10 years if current laws governing taxes and spending generally remained unchanged. This report provides additional detail about the agency’s latest baseline projections, which were published earlier this month.

- The Budget. CBO projects a federal budget deficit of $3.0 trillion in 2021 as the economic disruption caused by the 2020–2021 coronavirus pandemic and the legislation enacted in response continue to boost the deficit (which was large by historical standards even before the pandemic). At 13.4 percent of gross domestic product (GDP), the deficit in 2021 would be the second largest since 1945, exceeded only by the 14.9 percent shortfall recorded last year.

In CBO’s projections, deficits fall over the next few years as pandemic-related spending wanes. They increase in most years thereafter—boosted by rising interest costs and greater spending for entitlement programs—and reach 5.5 percent of GDP in 2031. (Revenues remain largely stable relative to GDP over the projection period.)

With such deficits, federal debt held by the public totals 103 percent of GDP at the end of 2021 in CBO’s projections. Debt then falls modestly through 2024 and rises thereafter, reaching 106 percent of GDP in 2031—about equal to its previous peak, recorded in 1946.

- Changes in CBO’s Budget Projections Since February 2021. Compared with the baseline projections that CBO published in February 2021, the agency’s estimate of the deficit for this year is now $0.7 trillion (or 33 percent) larger, and its current projection of the cumulative deficit for the 2022–2031 period, $12.1 trillion, is $0.2 trillion (or 1 percent) smaller. In 2021, the costs of recently enacted legislation are partly offset by the effects of a stronger economy and technical changes (changes that are neither legislative nor economic). In later years, technical changes that reduce projected deficits more than offset the effects of recently enacted legislation and revisions to the economic forecast.

- The Economy. As the pandemic eases and demand for consumer services surges, real (inflation-adjusted) GDP in CBO’s projections grows by 7.4 percent this year and surpasses its potential (maximum sustainable) level by the end of the year. Annual output growth averages 2.8 percent from 2021 to 2025, exceeding the 2.0 percent growth rate of real potential GDP. Over the 2026–2031 period, real GDP growth averages 1.6 percent annually.

Employment grows quickly in the second half of 2021 in CBO’s projections and surpasses its prepandemic level in mid-2022. Inflation rises in 2021 to its highest rate since 2008 as increases in the supply of goods and services lag behind increases in the demand for them. By 2022, supply adjusts more quickly, and inflation falls but remains above its prepandemic rate through 2025. As the economy continues to expand over the forecast period, the interest rate on 10-year Treasury notes rises, reaching 2.7 percent in 2025 and 3.5 percent in 2031—still low by historical standards.

- Changes in CBO’s Economic Projections Since February 2021. CBO now projects stronger economic growth than it projected in February 2021 because of recently enacted legislation, the diminishing effects of social distancing, and increased consumer spending. As a result, the agency’s projections of inflation and interest rates are now higher than they were in February.

Notes

Notes

The budget and economic projections in this Congressional Budget Office report include the effects of legislation enacted through May 18, 2021, and reflect economic developments as of that date. The projections do not include budgetary or economic effects of subsequent legislation, economic developments, administrative actions, or regulatory changes.

A short report describing these projections was published on July 1, 2021, to provide the Congress with information as promptly as possible (www.cbo.gov/publication/57218).

Unless this report indicates otherwise, all years referred to in describing the budget outlook are federal fiscal years, which run from October 1 to September 30 and are designated by the calendar year in which they end. Years referred to in describing the economic outlook are calendar years.

Numbers in the text, tables, and figures may not add up to totals because of rounding.

Some of the figures in this report use shaded vertical bars to indicate periods of recession. (A recession extends from the peak of a business cycle to its trough.)

Supplemental data for this analysis are available on CBO’s website (www.cbo.gov/publication/57263#data), as are a glossary of common budgetary and economic terms (www.cbo.gov/publication/42904), a description of how CBO prepares its baseline budget projections (www.cbo.gov/publication/53532), a description of how CBO prepares its economic forecast (www.cbo.gov/publication/53537), and previous editions of this report (https://go.usa.gov/xQrzS).

Visual Summary

In this report, the Congressional Budget Office describes its projections of the federal budget and the U.S. economy under current law for this year and the decade that follows. The projected deficit for 2021 is $3.0 trillion, about $0.7 trillion larger than CBO estimated in February. That increase stems mostly from the enactment of the American Rescue Plan Act (ARPA). Over the 2022–2031 period, projected deficits are much smaller, though still large by historical standards. CBO projects stronger economic growth in the near term than it did in February 2021 because of recently enacted fiscal policies and because the agency now projects the effects of social distancing to be weaker and consumer spending to be greater than it forecast at that time.

Deficits

In CBO’s projections, this year’s deficit equals 13.4 percent of gross domestic product (GDP)—smaller than the shortfall of 14.9 percent of GDP recorded in 2020 but larger than the deficit in any other year since 1945. The budget shortfall decreases to 4.7 percent of GDP in 2022 and to 2.9 percent of GDP in 2024 as the direct budgetary effects of ARPA fade and the economy improves. Thereafter, deficits begin to rise again. By 2031, the deficit reaches 5.5 percent of GDP, significantly larger than the 3.3 percent of GDP that deficits have averaged over the past 50 years.

Percentage of GDP

Primary deficits (which exclude net interest costs) hover at about 2 percent of GDP from 2023 to 2029 and increase to 3 percent in the years that follow. Despite mounting federal debt, low interest rates cause interest payments to fall in relation to GDP through 2023. Net interest costs then increase in relation to the size of the economy—from 1.3 percent of GDP in 2024 to 2.7 percent of GDP in 2031.

Trillions of Dollars

The projected deficit for 2021 has increased by a third, mostly because of recently enacted legislation. The projected cumulative deficit for the 2022–2031 period is slightly smaller than it was in CBO’s February baseline; updates to projections of revenues and mandatory outlays were largely offsetting.

Debt

Federal debt held by the public is projected to drop from 103 percent of GDP at the end of 2021 to 99 percent in 2023 and 2024 as growth in the economy outpaces rising debt. Starting in 2025, debt steadily rises in relation to the size of the economy in CBO’s projections.

Percentage of GDP

At the end of 2031, debt is projected to reach 106 percent of GDP—about equal to its previous peak, recorded in 1946.

Outlays and Revenues

Outlays in 2021 are projected to total 31 percent of GDP—the second highest that they have been in any year since 1945, behind only outlays in 2020. In CBO’s projections, outlays decline in the near term, falling below 21 percent of GDP in 2024, and then rise, reaching 23 percent of GDP in 2031; outlays remain above their 50-year average for the entire projection period. Revenues hover around 18 percent of GDP, just above their historical average.

Percentage of GDP

Boosted by increased spending for Social Security and the major health care programs and by rising interest rates on federal debt, outlays climb in relation to GDP after 2024 in CBO’s projections. The wider-than-average gap between outlays and revenues results in growing deficits and rising debt.

Economic Output and the Labor Market: 2021 to 2025

In CBO’s projections, the economy expands rapidly over the next two years. In 2021, real (inflation-adjusted) GDP grows by 7.4 percent, largely because of increased consumer spending and a rebound in business fixed investment. Thereafter, as conditions in labor and product markets remain strong, growth in real GDP moderates.

Percentage Change

The annual growth of real GDP exceeds that of real potential (maximum sustainable) GDP until 2023 in CBO’s projections. That growth slows thereafter as real GDP returns to a level slightly below potential GDP—in accordance with their historical average relationship.

Percentage Change in Real GDP per Potential Worker From Previous Business-Cycle Peak

The recession caused by the 2020–2021 coronavirus pandemic was much sharper and more severe than any recession in recent history, but the recovery has also been unusually strong. In CBO’s projections, real GDP per potential worker grows more quickly from its level at the previous business-cycle peak than it did during most economic recoveries and expansions since World War II.

Percent

The unemployment rate is projected to decline through the remainder of 2021 and the first half of 2022 before returning to a level slightly above the noncyclical rate of unemployment—consistent with their historical average relationship.

Inflation and Interest Rates: 2021 to 2025

In CBO’s projections, inflation increases in 2021—as various factors cause supply to grow more slowly than demand in product and labor markets—and then falls in 2022. As the economy continues to expand, interest rates on federal borrowing rise but remain low by historical standards.

Percentage Change

After spiking in 2021 and falling in 2022, inflation, as measured by the price index for personal consumption expenditures (PCE), increases in 2023 and remains slightly above the Federal Reserve’s long-run goal of 2 percent for several years.

Percent

The interest rate on 3-month Treasury bills remains near zero through early 2023 and then rises as the Federal Reserve raises the federal funds rate. The interest rate on 10-year Treasury notes increases over the next decade but at a slower pace than it rose in the first few months of 2021.

The Economy: 2026 to 2031

The economy continues to expand from 2026 to 2031 in CBO’s projections but at a slower pace than it does over the first five years of the forecast period, mostly because the agency expects monetary policy to become less accommodative. Real GDP grows at an average rate of 1.6 percent per year over the 2026–2031 period.

Average Annual Percentage Change

From 2026 to 2031, real potential GDP grows in CBO’s projections at roughly the same rate as it has since the 2007–2009 recession because of faster growth in potential labor force productivity. However, growth in the potential labor force is projected to be slower than it was in previous periods, largely because of the aging of the population.

Chapter 1The Budget Outlook

Overview

The Congressional Budget Office now estimates that if no new legislation affecting revenues or outlays is enacted after May 18, 2021, the total federal budget deficit for fiscal year 2021 will be $3.0 trillion, $0.7 trillion more than the agency estimated when it last issued its baseline projections for 2021 to 2031 in February 2021. That increase results primarily from recent legislation enacted in response to the 2020–2021 coronavirus pandemic (see Appendix A). A deficit of that amount would equal 13.4 percent of gross domestic product (GDP), about 3 percentage points higher than CBO projected in February. In CBO’s projections, deficits fall for a few years after 2021 before increasing in nearly all the remaining years in the projection period. Measured as a percentage of GDP, federal debt follows a similar pattern, rising this year, falling over the next few years, and then rising every year thereafter through 2031.

Assumptions Underlying CBO’s Baseline Budget Projections

CBO’s standard procedure is to prepare its baseline budget projections in accordance with provisions set forth in the Balanced Budget and Emergency Deficit Control Act of 1985 (Public Law 99-177, referred to here as the Deficit Control Act) and the Congressional Budget and Impoundment Control Act of 1974 (P.L. 93-344). Those laws require CBO to construct its baseline under the assumptions that current laws governing revenues and spending will generally stay the same and that discretionary budget authority provided in appropriation acts in future years will match current funding, with adjustments for inflation.1

However, after consulting with the House and Senate Budget Committees, CBO deviated from that standard procedure when constructing its current baseline for discretionary spending. Because of the unusual size and nature of the emergency funding provided in legislation enacted in response to the pandemic, the agency did not extrapolate into future years the $184 billion in discretionary budget authority that has been provided for those purposes so far in 2021.2

CBO’s baseline budget projections are meant to provide a benchmark that policymakers can use to assess the potential effects of future policy; they are not intended to provide a forecast of future budgetary outcomes. Future legislative action could lead to markedly different outcomes—but even if federal laws remained unaltered for the next decade, actual budgetary outcomes would probably differ from CBO’s baseline projections because of unanticipated economic conditions and many other factors that affect federal revenues and outlays.

Deficits

In CBO’s projections, the federal budget deficit in 2021 is $126 billion less than the deficit recorded last year but more than triple the shortfall in 2019, before the onset of the pandemic. Measured relative to the size of the economy, this year’s deficit, at 13.4 percent of GDP, is smaller than the shortfall of 14.9 percent of GDP recorded in 2020 but larger than the deficit in any other year since 1945. (Before 2020, the largest deficit since the end of World War II was 9.8 percent of GDP, recorded in 2009.) Deficits continue to decline for a few years—to 4.7 percent of GDP in 2022 and to 2.9 percent in 2024—as spending provided in response to the pandemic wanes and the economy continues to improve. After 2024, deficits rise, reaching 5.5 percent of GDP by the end of the projection period in 2031 (see Table 1-1).3

Table 1-1.

CBO’s Baseline Budget Projections, by Category

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

n.a. = not applicable.

a. The revenues and outlays of the Social Security trust funds and the net cash flow of the Postal Service are classified as off-budget.

b. Primary deficits exclude net outlays for interest.

The cumulative deficit for 2022 to 2031 is projected to total $12.1 trillion (or 4.2 percent of GDP); that shortfall is slightly smaller than the cumulative deficit for that period in the baseline projections that CBO published in February. Until recently, deficits tended to be small by historical standards when the economy was relatively strong over a period of several years. For example, between 1970 and 2019, deficits averaged 1.7 percent of GDP in years when the average unemployment rate for the year was below 6 percent. The unemployment rate is below 6 percent every year from 2022 to 2031 in CBO’s projections, yet the average deficit is about two and a half times that historical average.

Primary deficits—that is, deficits excluding net outlays for interest—fall from 11.9 percent of GDP in 2021 to 1.6 percent in 2024, remain near 2.0 percent for the next few years, and then increase again and reach 2.8 percent of GDP in 2031 in CBO’s projections (see Figure 1-1). From 2022 to 2031, primary deficits average 2.3 percent of GDP. Net outlays for interest fall from 1.5 percent of GDP this year to a low of 1.2 percent in 2023 and then increase over the remainder of the projection period as interest rates and federal debt rise. In 2031, net interest outlays total 2.7 percent of GDP, at which point they would equal their highest level since 1998.

Figure 1-1.

Total Deficits, Primary Deficits, and Net Interest

Percentage of GDP

In CBO’s projections, total deficits and primary deficits shrink as a percentage of GDP for the next few years. Over the latter part of the projection period, growing primary deficits (which reflect underlying trends related to the aging of the population and the rising costs of health care) and rising net interest costs increase total deficits.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

Primary deficits exclude net outlays for interest.

When October 1 (the first day of the fiscal year) falls on a weekend, certain payments that would have ordinarily been made on that day are instead made at the end of September and thus are shifted into the previous fiscal year. All projections presented here have been adjusted to exclude the effects of those timing shifts. Historical amounts have been adjusted as far back as the available data will allow.

GDP = gross domestic product.

Debt Held by the Public

The deficits projected in CBO’s baseline would boost federal debt held by the public, which consists mostly of securities that the Treasury issues to raise cash to fund the federal government’s activities and pay off its maturing liabilities. The net amount that the Treasury borrows by issuing those securities (calculated as the amounts that are sold minus the amounts that have matured) is determined primarily by the annual budget deficit. However, several other factors that are not directly included in budget totals also affect the government’s need to borrow from the public. Those factors—collectively referred to as “other means of financing”—include changes in the government’s cash balances and cash flows associated with federal credit programs, such as those related to student loans and loans to small businesses. (Only the subsidy costs of those programs are reflected in the budget deficit.)4

CBO estimates that the Treasury will decrease its cash balances by $1.3 trillion this year, from an all-time high of $1.8 trillion at the end of fiscal year 2020 to roughly $500 billion at the end of 2021—more in line with historical norms, though still higher than usual. The reduction would not affect the deficit but would result in a decrease in debt of an equal amount.

The deficit also excludes some cash disbursements for credit programs, which increase the amount the Treasury will add to the debt in 2021 by an estimated $277 billion. The largest such cash disbursements are for the Debt Relief Program run by the Small Business Administration (SBA). When all other means of financing that reconcile the estimated deficit with the Treasury’s borrowing needs are included, the increase in debt held by the public in 2021 will be $1.0 trillion less than the deficit, CBO projects, primarily because of the reduction in cash balances (see Table 1-2).

Table 1-2.

CBO’s Baseline Projections of Federal Debt

Billions of Dollars

Data sources: Congressional Budget Office; Department of the Treasury. See www.cbo.gov/publication/57263#data.

GDP = gross domestic product.

a. Factors not included in budget totals that affect the government’s need to borrow from the public. Those factors include changes in the government’s cash balances and cash flows associated with federal credit programs, such as those related to student loans. (Only the subsidy costs of those programs are reflected in the budget deficit.)

b. The value of outstanding student loans and other credit transactions, cash balances, and various financial instruments.

c. Federal debt held by the public plus Treasury securities held by federal trust funds and other government accounts.

d. The amount of federal debt that is subject to the overall limit set in law. That measure of debt excludes debt issued by the Federal Financing Bank and reflects certain other adjustments that are excluded from gross federal debt. The debt limit was most recently set at $22.0 trillion but has been suspended through July 31, 2021. On August 1, 2021, the debt limit will be raised to its previous level plus the amount of federal borrowing that occurred while the limit was suspended. CBO’s baseline projections reflect the assumption that the limit will be raised as needed. For more details, see Congressional Budget Office, Federal Debt and the Statutory Limit, February 2019 (February 2019), www.cbo.gov/publication/54987.

After all the government’s borrowing needs are accounted for, debt held by the public rises from $21.0 trillion at the end of 2020 to $35.8 trillion at the end of 2031 in CBO’s baseline projections. As a percentage of GDP, debt at the end of 2031 stands at 106 percent, about 6 percentage points higher than it was at the end of 2020 and nearly two and a half times its average over the past 50 years (see Figure 1-2).

Figure 1-2.

Federal Debt Held by the Public, 1940 to 2031

Percentage of GDP

By 2031, federal debt held by the public is projected to exceed 106 percent of GDP—about equal to debt in 1946, when it was the highest it has ever been.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

GDP = gross domestic product.

Another measure of debt excludes the value of the government’s financial assets. That measure, debt net of financial assets, reflects the government’s overall financial condition by accounting for government spending that results in the acquisition of financial assets, such as student loans. Still another measure—which excludes Treasury securities held by the Federal Reserve in addition to those financial assets—better reflects the government’s overall effect on credit markets. In CBO’s baseline projections, that measure increases from $13.6 trillion (or 65 percent of GDP) at the end of 2020 to $28.4 trillion (or 84 percent of GDP) at the end of 2031. (Federal debt held by the Federal Reserve, which totaled $4.4 trillion at the end of 2020, increases to $5.3 trillion at the end of 2021 and to $6.4 trillion in 2023, where it remains until 2025; thereafter, such debt declines, falling to $4.8 trillion in 2031.)

Outlays and Revenues in 2021

In CBO’s projections, spending related to the pandemic causes outlays to remain elevated this year. At 30.6 percent of GDP, projected outlays for 2021 are slightly lower than those recorded in 2020 (31.2 percent of GDP) but still significantly higher than their annual average over the past 50 years (20.6 percent of GDP). By contrast, revenues are projected to increase, from 16.3 percent of GDP in 2020 to 17.2 percent in 2021, close to their historical average of 17.3 percent (see Figure 1-3).

Figure 1-3.

Total Outlays and Revenues

Percentage of Gross Domestic Product

Outlays are projected to drop from recent highs as pandemic-related spending wanes and then trend upward, as they did before the pandemic. Revenues are projected to hover around their historical average as a share of the economy.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

When October 1 (the first day of the fiscal year) falls on a weekend, certain payments that would have ordinarily been made on that day are instead made at the end of September and thus are shifted into the previous fiscal year. All projections presented here have been adjusted to exclude the effects of those timing shifts. Historical amounts have been adjusted as far back as the available data will allow.

Outlays

In CBO’s projections, federal outlays in 2021 total $6.8 trillion—about $0.3 trillion (or 4 percent) more than the amount recorded in 2020. (Because GDP is projected to grow faster than outlays this year, outlays fall in relation to the size of the economy despite the increase in nominal terms.) Nearly all of that growth is attributable to mandatory outlays. Recently enacted legislation—primarily the American Rescue Plan Act of 2021 (P.L. 117-2, enacted on March 11, 2021)—increased projected outlays for this year by $1.1 trillion and, along with legislation enacted in 2020 in response to the pandemic, contributes significantly to keeping outlays in 2021 high by historical standards. (By comparison, in 2019, outlays totaled 21.0 percent of GDP, nearly 10 percentage points less than CBO projects for 2021.)

Mandatory Spending. Mandatory, or direct, spending includes outlays for some federal benefit programs and for certain other payments to people, businesses, nonprofit institutions, and state and local governments. Such outlays are generally governed by statutory criteria and are not normally constrained by the annual appropriation process.5 Certain types of payments that federal agencies receive from the public and from other government agencies (such as premiums paid by Medicare beneficiaries and payments made by federal agencies to employees’ retirement plans) are classified as offsetting receipts and are accounted for in the budget as reductions in mandatory spending.

The Deficit Control Act requires CBO to construct baseline projections for most mandatory spending under the assumption that current laws continue unchanged.6 Therefore, CBO’s baseline projections of mandatory spending reflect the estimated effects of changes in the economy, growth in the number of beneficiaries of certain mandatory programs, and other factors related to the costs of those programs. The projections also incorporate a set of across-the-board reductions in budgetary resources (known as sequestration) that are required under current law for some mandatory programs.

In 2021, CBO estimates, total mandatory outlays (net of offsetting receipts) will amount to $4.9 trillion under current law, $284 billion (or 6 percent) more than they were in 2020 (see Table 1-3). As a share of GDP, those outlays are projected to amount to 21.7 percent—about the same share as last year, which was the highest percentage recorded since at least 1962 (the earliest year for which such data have been reported). For some programs, outlays exceed the amounts recorded in 2020; for others, outlays have declined but remain well above their prepandemic level.

Table 1-3.

CBO’s Baseline Projections of Mandatory Outlays

Billions of Dollars

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

Data on outlays for benefit programs in this table generally exclude administrative costs, which are discretionary.

MERHCF = Department of Defense Medicare-Eligible Retiree Health Care Fund (including TRICARE for Life); * = between zero and $500 million.

a. Excludes the effects of Medicare premiums and other offsetting receipts. (Net Medicare spending, which includes those offsetting receipts, is shown in the memorandum section of the table.)

b. When October 1 (the first day of the fiscal year) falls on a weekend, as it will in calendar years 2022, 2023, and 2028, certain payments that would ordinarily have been made on that day are instead made at the end of September and thus are shifted into the previous fiscal year.

c. Premium tax credits are federal subsidies for health insurance purchased through the marketplaces established under the Affordable Care Act. Related spending consists almost entirely of payments for risk adjustment and outlays for the Basic Health Program.

d. Includes outlays for recovery rebates for individuals, the American Opportunity Tax Credit, and other credits.

e. Includes outlays for Temporary Assistance for Needy Families, Child Support Enforcement, Child Care Entitlement to States, the Child Care and Development Block Grant, and other programs that benefit children.

f. Includes benefits for retirement programs in the civil service, foreign service, and Coast Guard; benefits for smaller retirement programs; and annuitants’ health care benefits.

g. Includes veterans’ compensation, pensions, and life insurance programs. (Outlays for veterans’ health care are classified as discretionary.)

h. Cash payments from Fannie Mae and Freddie Mac to the Treasury are recorded as offsetting receipts in 2020 and 2021. Beginning in 2022, CBO’s estimates reflect the net lifetime costs—that is, the subsidy costs adjusted for market risk—of the guarantees that those entities will issue and of the loans that they will hold. CBO counts those costs as federal outlays in the year of issuance.

i. Includes premium payments, recoveries of overpayments made to providers, and amounts paid by states from savings on Medicaid’s prescription drug costs.

The following programs have the largest projected increases in 2021:

- Refundable tax credits. Outlays for refundable tax credits total $706 billion in 2021 in CBO’s projections, $327 billion more than the amount recorded in 2020. Most of that increase—$287 billion—stems from the recovery rebates for individuals that were provided in response to the pandemic.7 In addition, a temporary expansion of the child tax credit for 2021 boosts mandatory outlays by $45 billion.

- Coronavirus State and Local Fiscal Recovery Funds. In 2020 and 2021, lawmakers provided direct assistance to state, local, tribal, and territorial governments in response to the pandemic. Outlays for such assistance will total $284 billion this year, CBO estimates, significantly more than the $149 billion recorded in 2020.

- Medicaid. Outlays for the program will total $519 billion this year, CBO estimates, an increase of $61 billion (or 13 percent) from last year. That spending is boosted by two provisions enacted in response to the public health emergency caused by the pandemic. The first raised the portion of Medicaid costs that the federal government must cover. The second required that states maintain coverage for almost all Medicaid enrollees regardless of any changes in their income or circumstances that would otherwise cause them to become ineligible for the program. Both provisions are set to remain in place for the duration of the public health emergency, which CBO anticipates will continue through July 2022.

- Supplemental Nutrition Assistance Program (SNAP). Outlays for SNAP are projected to total $145 billion this year, an increase of $59 billion (or 69 percent) from last year. Much of that increase stems from recently enacted legislation that increased SNAP benefits for 2021 and expanded the program that allows states to provide benefits to replace meals that children would otherwise have received at school. A projected increase in SNAP enrollment and an ongoing program that allows states to provide households with additional benefits during the public health emergency will also boost outlays this year. (By comparison, outlays for SNAP totaled $63 billion in 2019.)

CBO anticipates that outlays for a number of other programs will be lower in 2021 than they were in 2020 but remain well above their prepandemic amounts. Those programs include the following:

- Unemployment compensation. Outlays for unemployment compensation, which soared to $472 billion in 2020, are projected to fall to $380 billion in 2021. Despite that drop, they remain well above the $28 billion recorded for such benefits in 2019, mostly because legislation extended pandemic-related unemployment benefits through September 2021. In addition, the unemployment rate and the number of people claiming benefits are expected to remain elevated in 2021 (but lower than they were in 2020).

- Small Business Administration loans. Mandatory outlays for the SBA will total $323 billion in 2021, CBO estimates, down from $552 billion in 2020 but still very high by historical standards. (Such outlays totaled −$1 billion in 2019, reflecting a downward revision to the subsidy costs of loans made in previous years.) The Paycheck Protection Program accounts for most of that change; outlays for the program are projected to fall from $526 billion in 2020 to $290 billion this year.

- Higher education. CBO estimates that outlays for higher education will fall from $124 billion in 2020 to $108 billion in 2021. (Those outlays will still be well above the $33 billion they totaled in 2019.) That drop in outlays occurs primarily because the $95 billion upward revision to the subsidy costs of student loans disbursed in previous years that the Administration plans to record in 2021 is smaller than the revision recorded in 2020 (though it is still much larger than the 2019 revision).8 The 2020 and 2021 revisions were made primarily to account for updated projections of income of borrowers with income-driven repayment plans, which would result in lower repayments of principal and payments of interest by those borrowers.

Taken together, outlays for all other mandatory programs are estimated to rise, on net, by $40 billion (or 2 percent) in 2021. The largest of those changes are for the following programs:

- Medicare. Outlays for Medicare (net of offsetting receipts) will fall by $86 billion (or 11 percent) in 2021, to $683 billion, CBO projects. That decrease is largely the result of two factors. First, whereas Medicare made payments totaling roughly $100 billion to providers through accelerated and advance payment programs in 2020, it is not making such payments in 2021. Second, CBO expects recoupment of those 2020 payments to decrease outlays by $35 billion in 2021.

- Social Security. Outlays for Social Security are estimated to increase by $39 billion (or 4 percent) in 2021, to $1.1 trillion, as a result of growth in the average benefit payment and the number of beneficiaries.

- Emergency rental assistance. Support to state, local, tribal, and territorial governments to assist households in making rent and utility payments will increase outlays in 2021 by $34 billion.

- Agriculture. Outlays for major agriculture programs will increase by $17 billion in 2021, to a total of $48 billion, CBO estimates. That increase is largely the result of continued spending on the Coronavirus Food Assistance Program, which provides assistance to farmers, ranchers, and consumers affected by the pandemic. Recently enacted legislation related to the pandemic will also increase outlays for agriculture programs in 2021, CBO estimates.

Changes in mandatory spending for a variety of other programs and activities—including subsides for health insurance, veterans’ programs, and federal retirement programs—account for the rest of the increase.

Discretionary Spending. Discretionary spending encompasses an array of federal activities that are funded through or controlled by appropriations. That category includes most defense spending; spending for many nondefense activities, such as elementary and secondary education, housing assistance, international affairs, and the administration of justice; and outlays for highway programs.9 In any year, some discretionary outlays arise from budget authority provided in the same year, and some arise from appropriations made in previous years.

Discretionary funding for 2021 is governed by limits, or caps, that were previously set in law.10 (No statutory caps are in place for years after 2021.) Some elements of discretionary funding are not constrained by the caps. For most of those exceptions, the caps are adjusted to accommodate the funding provided. In particular, adjustments to the caps are made for all appropriations designated for emergency requirements and overseas contingency operations (OCO) in accordance with section 251 of the Deficit Control Act.11 Subject to certain limits, additional adjustments are made for funding designated for disaster relief activities, some efforts to reduce overpayments in benefit programs, and wildfire suppression.

Two types of spending neither count toward the caps nor result in an adjustment to the caps: a portion of funding—up to amounts specified in law—for certain activities authorized by the 21st Century Cures Act (P.L. 114-255) and a small portion of funding provided for 2021 in division N of the Consolidated Appropriations Act, 2021 (P.L. 116-260).12

By CBO’s estimate, discretionary budget authority for 2021 totals $1.6 trillion, $284 billion (or 15 percent) less than the amount provided in 2020. That total for 2021 includes $295 billion for emergency requirements, OCO, and other activities not constrained by the caps (see Table 1-4).13 The drop in budget authority in 2021 mostly stems from a significant reduction in funding for activities that have been designated as emergency requirements in accordance with the Deficit Control Act. Funding for such activities totaled $487 billion in 2020; so far in 2021, $192 billion has been provided for such activities. Almost all of the emergency funding for 2020 and 2021 was provided in legislation enacted in response to the ongoing pandemic.

Table 1-4.

CBO’s Baseline Projections of Discretionary Spending

Billions of Dollars

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

Nondefense discretionary outlays are usually greater than budget authority because of spending from the Highway Trust Fund and the Airport and Airway Trust Fund that is subject to obligation limitations set in appropriation acts. The budget authority for such programs is provided in authorizing legislation and is considered mandatory.

n.a. = not applicable.

a. The amount of nondefense budget authority for 2020 and 2021 does not match the sum of the caps on funding and the adjustments to the caps. That occurs mostly because net reductions in mandatory budget authority stemming from provisions in appropriation acts for those years were credited as offsets to new discretionary budget authority when the acts’ compliance with the caps was determined. In CBO’s baseline projections, those changes to mandatory budget authority appear in their normal mandatory accounts.

b. Some discretionary funding related to certain types of activities is not constrained by the caps; for most of those activities, the caps are adjusted to accommodate such funding, up to certain limits. Specifically, appropriations designated for overseas contingency operations and for activities designated as emergency requirements are assumed to grow with inflation after 2021, and the caps are adjusted accordingly. (After consulting with the House and Senate Budget Committees, CBO did not extrapolate into future years the discretionary funding designated as an emergency requirement that was provided in legislation enacted specifically in response to the 2020–2021 coronavirus pandemic because of the unusual size and nature of that funding.) For three other activities—disaster relief, wildfire suppression, and certain efforts to reduce overpayments in benefit programs—the extent to which the caps can be adjusted is subject to annual constraints, as specified in law. There are two additional exceptions: A portion of funding for certain activities authorized by the 21st Century Cures Act (P.L. 114-255) and a small portion of funding provided by division N of the Consolidated Appropriations Act, 2021 (P.L. 116-260), that was originally classified as mandatory spending do not count toward the caps but do not result in an adjustment to the cap limits. (After consulting with the budget committees, CBO did not extrapolate the latter amount into future years.)

CBO anticipates that if no further appropriations are provided this year, discretionary outlays will total $1.7 trillion in 2021—$25 billion (or 2 percent) more than they were last year. Outlays rise in 2021 even as the budget authority provided falls, primarily because of the large increase in budget authority provided in 2020.

In CBO’s projections, discretionary funding for defense totals $741 billion in 2021, including $69 billion for OCO. Defense outlays, which amounted to $714 billion in 2020, increase by $25 billion (or 4 percent), to $739 billion. Outlays for military personnel increase by $7 billion, as do outlays for operation and maintenance. Outlays for procurement and outlays for research and development each increase by $4 billion.

For 2021, nondefense discretionary funding totals $874 billion in CBO’s baseline projections. That total includes $225 billion that is not limited by the caps on discretionary funding. Of that amount, $222 billion resulted in cap adjustments—$192 billion for activities designated as emergency requirements, $17 billion for disaster relief, $8 billion for OCO, $2 billion for efforts to reduce overpayments in benefit programs, and $2 billion for wildfire suppression. The remaining amounts—$3 billion in appropriations stemming from division N of the Consolidated Appropriations Act, 2021, and $0.5 billion for 21st Century Cures Act programs—are not subject to the caps and did not result in cap adjustments.

Under current law, CBO expects that nondefense discretionary outlays will total $914 billion in 2021, about the same as they totaled in 2020; that estimate is the result of some large, but mostly offsetting, changes in 2021. Outlays from the Public Health and Social Services Emergency Fund will fall by $36 billion in 2021, and spending on disaster loans will fall by $22 billion, CBO estimates. Those reductions are projected to mostly be offset by a $16 billion increase in outlays from the Education Stabilization Fund, a $10 billion increase in transit infrastructure grants, and a number of smaller increases in spending for a variety of programs.

Net Interest. In the budget, net interest outlays primarily consist of the government’s interest payments on federal debt, offset by interest income that the government receives. Net outlays for interest are dominated by the interest paid to holders of the debt that the Treasury issues to the public. The Treasury also pays interest on debt issued to trust funds and other government accounts, but such payments are intragovernmental transactions that have no effect on the budget deficit.

Although debt held by the public is set to increase by 9 percent from 2020 to 2021, net outlays for interest are projected to fall by $15 billion this year, to $331 billion (or 1.5 percent of GDP). That drop occurs primarily because the average interest rate paid by the Treasury has been lower in 2021 than it was in 2020. Partially offsetting that reduction, inflation has been higher in 2021, resulting in larger increases in the principal of inflation-protected securities. Because those increases are recorded as interest outlays, higher inflation raises net outlays for interest.

Revenues

Despite the economic disruptions that resulted from the pandemic and the actions taken in response, federal revenues declined by only 1 percent in 2020, totaling $3.4 trillion (or 16.3 percent of GDP). Those receipts reflect income generated and economic activity that occurred before and after the disruptions began and the federal government responded by enacting legislation and implementing other policy changes.

On the basis of receipts recorded through May 2021, CBO anticipates that revenues will rise by 12 percent this year to reach $3.8 trillion (or 17.2 percent of GDP). That growth is projected to occur even though CBO expects the effects of social distancing measures put in place to curb the spread of COVID-19 (the disease caused by the coronavirus) and of legislation enacted since March 2020 (including the American Rescue Plan Act) to continue to weigh on receipts this year.

The projected growth in receipts largely reflects increases in collections of individual and corporate income taxes, which are expected to grow this year by 21 percent and 13 percent, respectively. Recent collections from both of those sources, which include taxes withheld from workers’ paychecks as well as final payments of taxes for the 2020 tax year and estimated payments of taxes for both 2020 and 2021, have been greater than CBO anticipated when it made its projections earlier this year. Those collections were more robust than the amounts implied by currently available data on the economy given the past relationship between the level of economic activity and revenues. The specific reasons for those greater-than-anticipated collections will become clearer as detailed information about taxable income from individual and corporate income tax returns becomes available over the next two years.

Outlays and Revenues From 2022 to 2031

In nominal terms, federal outlays are projected to fall by nearly $1.5 trillion (or 21 percent) over the next two years before growing at an average annual rate of nearly 5 percent over the remainder of the projection period. Revenues increase by about $0.5 trillion (or 14 percent) in 2022 in CBO’s projections and then grow by about 3 percent per year, on average, through 2031.

Outlays

In CBO’s baseline projections, federal outlays fall from $6.8 trillion this year to $5.5 trillion in 2022 and to $5.4 trillion in 2023 and 2024. Thereafter, outlays rise, reaching $7.8 trillion in 2031.

Measured relative to the size of the economy, federal outlays fall in CBO’s projections from 31 percent of GDP in 2021 to just under 21 percent in 2024, roughly the same as the share recorded in 2019 (see Figure 1-4). Both mandatory and discretionary outlays decline in relation to GDP through 2024 as spending related to the pandemic falls. Net outlays for interest fall in 2022 and 2023, primarily because interest rates remain low by historical standards. Federal outlays generally increase after 2024, reaching 23 percent of GDP in 2031. That growth stems from rising interest rates and underlying trends related to the aging of the population and the rising costs of health care.

Figure 1-4.

Outlays, by Category

Percentage of Gross Domestic Product

Every category of spending drops in the near term. In later years, rising spending for Social Security and the major health care programs boosts mandatory outlays, and net interest costs increase as interest rates and federal debt rise.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

When October 1 (the first day of the fiscal year) falls on a weekend, certain payments that would have ordinarily been made on that day are instead made at the end of September and thus are shifted into the previous fiscal year. All projections presented here have been adjusted to exclude the effects of those timing shifts. Historical amounts have been adjusted as far back as the available data will allow.

Mandatory Spending. In CBO’s baseline projections, outlays for mandatory programs (net of offsetting receipts) fall from nearly 22 percent of GDP in 2021 to about 13 percent in 2024 and then rise in most years thereafter, reaching 15 percent of GDP by 2031. (Such outlays averaged just over 10 percent of GDP each year from 1971 to 2020.) That pattern occurs mostly because spending related to the pandemic falls over the next few years and two underlying factors—the aging of the population and rapid growth in federal health care costs—put upward pressure on mandatory outlays. The aging of the population causes the number of participants in Social Security and Medicare to grow faster than the overall population, and federal health care costs per beneficiary continue to rise faster than GDP per capita. As a result of those two trends, outlays for Social Security and Medicare increase in relation to GDP between 2021 and 2031 (see Table 1-5). The effects of those trends on federal spending will persist beyond the projection period.

Table 1-5.

Key Projections in CBO’s Baseline

Percentage of Gross Domestic Product

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

This table satisfies a requirement specified in section 3111 of S. Con. Res. 11, the Concurrent Resolution on the Budget for Fiscal Year 2016.

a. Consists of outlays for Medicare (net of premiums and other offsetting receipts), Medicaid, and the Children’s Health Insurance Program, as well as subsidies for health insurance purchased through the marketplaces established under the Affordable Care Act and related spending.

b. Includes payroll taxes other than those paid by the federal government on behalf of its employees; those payments are intragovernmental transactions. Also includes income taxes paid on Social Security benefits, which are credited to the trust funds.

c. Does not include outlays related to the administration of the program, which are discretionary. For Social Security, outlays do not include intragovernmental offsetting receipts stemming from the employer’s share of payroll taxes paid to the Social Security trust funds by federal agencies on behalf of their employees.

d. The net increase in the deficit shown in this table differs from the change in the trust fund balance for the associated program. It does not include intragovernmental transactions, interest earned on balances, or outlays related to the administration of the program.

Social Security and the Major Health Care Programs. Outlays for Social Security and the major health care programs, net of offsetting receipts, are projected to dip to 10.6 percent of GDP in 2022 and to increase in most years thereafter, reaching 12.8 percent in 2031.14 (Spending for the major health care programs consists of outlays for Medicare, Medicaid, and the Children’s Health Insurance Program, as well as subsidies for health insurance purchased through the marketplaces established under the Affordable Care Act and related spending.)

CBO’s current baseline includes the following projections of outlays for specific programs:

- Outlays for Social Security fall slightly in 2022 to 4.9 percent of GDP in 2022 and then rise steadily thereafter, reaching 6.0 percent of GDP in 2031.

- Outlays for Medicare equal 3.0 percent of GDP in 2022 and rise to 4.3 percent of GDP in 2031.

- Federal outlays for Medicaid are relatively stable as a percentage of GDP over the coming decade, averaging about 2 percent each year.

- Outlays for subsidies for health insurance purchased through the marketplaces and related spending average 0.2 percent of GDP per year through 2031.

Other Mandatory Programs. Aside from spending on Social Security and the major health care programs, all other mandatory spending is projected to drop by 6.8 percentage points in 2022, to 4.1 percent of GDP, as the effects of pandemic-related spending dissipate. (Such spending was 2.7 percent of GDP in 2019.) The category “other mandatory spending” includes spending on income support programs (such as unemployment compensation and the Supplemental Nutrition Assistance Program), military and civilian retirement programs, most veterans’ benefits, and major agriculture programs.

In CBO’s baseline projections, other mandatory spending declines more gradually as a share of GDP after 2022, falling to 2.1 percent in 2031. The projected decline occurs in part because benefit amounts for many of those programs are adjusted for inflation each year, and in CBO’s economic forecast, inflation is less than the rate of growth of nominal GDP (see Chapter 2).

Discretionary Spending. In accordance with section 257 of the Deficit Control Act, CBO bases its projections of discretionary spending for individual accounts on the most recent funding and applies the appropriate inflation rate to project funding for future years.15 Because the caps on discretionary appropriations expire after 2021, most budget authority after that year is assumed to grow with inflation for the duration of the baseline projection period.

The $10 billion of funding projected for emergency requirements in 2022 is a sharp reduction from the $192 billion of such funding provided for 2021. Nearly all of that amount—$184 billion—was provided in response to the coronavirus pandemic. Because of the unusual size and nature of that pandemic-related funding, CBO, after consulting with the House and Senate Budget Committees, deviated from the standard procedures that it uses to construct its baseline and did not extrapolate into future years that $184 billion when projecting discretionary budget authority.

In CBO’s projections, total discretionary budget authority falls in 2022, from $1.6 trillion to $1.5 trillion. After 2022, funding rises by an average of 2.6 percent each year through the end of the projection period. Total discretionary outlays, however, remain near $1.6 trillion from 2022 to 2025 as spending of the pandemic-related funding provided in 2020 and 2021 declines. After 2025, outlays begin to rise again, reaching $1.9 trillion in 2031. Measured as a share of GDP, discretionary outlays decrease steadily, from 6.8 percent in 2022 to 5.6 percent in 2030 and 2031—which would be the smallest share on record. By comparison, discretionary outlays averaged 8.2 percent of GDP over the past 50 years, although they were as low as 6.0 percent of GDP in 1999.

Defense. In CBO’s projections, budget authority for defense programs—including funding for OCO—is $763 billion in 2022, an increase of $22 billion (or 2.9 percent) from the total amount provided in 2021. After 2022, defense funding is projected to grow by an average of 2.5 percent each year and to reach $954 billion in 2031. Projected outlays for defense programs total $751 billion in 2022 and then grow at a rate similar to that of budget authority, rising to $923 billion in 2031. Despite that growth in nominal terms, discretionary defense outlays measured as a percentage of GDP are projected to fall from 3.1 percent in 2022 to 2.7 percent in 2031—lower than they have ever been since they were first reported in1962.

Nondefense. Total budget authority for nondefense discretionary programs is projected to drop significantly in 2022, from $874 billion to $714 billion, primarily because CBO did not extrapolate into future years the $184 billion in nondefense emergency funding that was provided in response to the pandemic in 2021 in its baseline.16 After 2022, funding is projected to grow by 2.6 percent a year, on average, and to reach $899 billion in 2031.

As outlays associated with the government’s response to the pandemic decline, discretionary outlays for nondefense programs are projected to decrease, from $899 billion in 2022 to $818 billion in 2024. (CBO estimates that about one-third of the $184 billion in nondefense discretionary funding provided in 2021 in response to the pandemic will be spent in this fiscal year and that about 95 percent will be spent by 2024.) After 2024, nondefense outlays begin to rise again in CBO’s projections; in 2031, they reach $954 billion. Relative to the size of the economy, outlays for nondefense discretionary programs fall from 3.7 percent of GDP in 2022 to 2.8 percent of GDP in 2031—lower than any previously reported level.

Net Interest. The two main factors that affect the federal government’s net interest costs are the amount of debt held by the public and the interest rates on Treasury securities.17 In CBO’s projections, debt held by the public (in nominal terms) increases by roughly 55 percent from 2021 to 2031. Although interest rates rise throughout the period, they remain low by historical standards for the next few years. As debt matures and is refinanced at prevailing lower interest rates, the average interest rate on federal debt dips.18 In 2021, the average interest rate on debt held by the public is estimated to be 1.7 percent; that rate falls to 1.4 percent in 2022 and 2023 in CBO’s projections and rises thereafter, reaching 2.7 percent in 2031.

Initially, the effects of those lower interest rates more than offset the effects of the projected increase in federal debt. As a result, net outlays for interest in CBO’s projections decline from 1.5 percent of GDP in 2021 to 1.2 percent in 2023. Thereafter, rising rates and the projected increases in federal debt cause net outlays for interest measured as a share of the economy to more than double after 2023 in CBO’s projections. In 2031, such outlays reach 2.7 percent of GDP—0.7 percentage points higher than their 50-year average.

Revenues

After this year, as income continues to rise and the effects of the economic disruptions caused by the pandemic and of the legislation enacted in response dissipate, revenues are projected to grow to 18.1 percent of GDP in 2022 and to fluctuate between 17.5 percent and 18.1 percent of GDP through 2031 (see Figure 1-5). That variation in overall receipts reflects different patterns among the major revenue sources.

Figure 1-5.

Revenues, by Category

Percentage of Gross Domestic Product

Receipts of individual and corporate income taxes are expected to rise in 2022 as the economy recovers and temporary provisions enacted in response to the pandemic expire. Individual income taxes are projected to rise again following scheduled increases in taxes after 2025.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

Individual Income Taxes. If current laws generally remained unchanged, receipts from individual income taxes would rise from 8.7 percent of GDP in 2021 to 9.6 percent in 2022, CBO projects, largely because of the expiration of temporary provisions enacted in response to the pandemic and because employers who deferred payment of their portion of certain payroll taxes in 2020 and 2021 would begin making those payments in 2022.19 Individual income tax receipts are projected to decline to 8.8 percent of GDP in 2025, in part because payments of deferred taxes are due in 2022 and 2023 but not in subsequent years.

In addition, individual income tax collections in 2020 and 2021 were greater than the amounts implied by currently available data on economic activity and the past relationship between tax revenues and the state of the economy. Those larger-than-anticipated receipts might reflect higher wage or nonwage income or larger realizations of capital gains in those years, or perhaps the temporary tax provisions enacted in response to the pandemic were not as widely used as anticipated. Depending on which factors explain those larger receipts from individual income taxes, their effects on receipts might be expected to persist permanently, end abruptly, or even reverse. In CBO’s projections, the unexplained strength gradually dissipates over the next few years. Between 2025 and 2031, individual income tax receipts are projected to rise to 9.5 percent of GDP as the result of scheduled increases in taxes after 2025, real bracket creep, and other factors.20

Corporate Income Taxes. In CBO’s baseline projections, corporate income tax receipts rise from 1.1 percent of GDP in 2021 to 1.5 percent of GDP in 2023, remain at that level through 2025, and then gradually decline, reaching 1.2 percent of GDP in 2031. Those receipts will be boosted over the next several years by the expiration of temporary provisions enacted in response to the pandemic and scheduled changes to tax rules enacted in the 2017 tax act (P.L. 115-97). After 2025, corporate income taxes measured as a share of GDP are projected to decline because of the end of the scheduled payments of a onetime tax on previously untaxed foreign profits and because profits are projected to grow more slowly than GDP.

Payroll Taxes. Receipts from payroll taxes, which fund social insurance programs—primarily Social Security and Medicare—typically remain stable as a share of wages because workers’ earnings constitute most of the payroll tax base. In CBO’s projections, payroll taxes as a percentage of GDP decrease by a total of 0.2 percentage points from 2021 to 2031, mostly because collections of unemployment insurance taxes decline. States’ unemployment insurance trust funds were depleted as a result of unusually high unemployment during the past year. Some states have begun to replenish the balances of those funds by collecting more in unemployment taxes from employers, but those collections are expected to return to typical prepandemic levels by 2031. (States collect the unemployment taxes that they use to replenish their trust funds, but those taxes count as federal revenues, reflecting the nature of the unemployment insurance system, which is a federal program administered by the states.)

Remittances From the Federal Reserve. Remittances from the central bank, which began to rise in 2020, are expected to continue rising, from 0.4 percent of GDP this year to 0.6 percent by 2023, as the Federal Reserve significantly increases its asset holdings, which boost its earnings. In CBO’s projections, short-term interest rates remain low through 2023, holding down the amounts the Federal Reserve must pay to depository institutions on their reserves. Interest rates begin to rise in 2024, and the Federal Reserve’s asset holdings begin to shrink slowly in relation to economic output, reducing remittances. By 2029, remittances stabilize around 0.3 percent of GDP.

Receipts From Other Sources. Receipts from all other sources are expected to vary by less than 0.1 percent of GDP over the next decade.

- Revenues from estate and gift taxes are projected to rise by less than 0.1 percent of GDP in 2027 after a provision of the 2017 tax act that doubled the amount of the estate and gift tax exemption expires at the end of calendar year 2025.21

- Customs duties, which are assessed on certain imports, are projected to decline through 2031 by a total of less than 0.1 percent of GDP. That decline is partly because imports other than oil are projected to grow more slowly than GDP over the next decade.

- Excise taxes are projected to rise slightly in 2022 as the economy recovers but then to gradually decline, along with the tax bases on which many excise taxes are levied, every year thereafter, ultimately by a total of less than 0.1 percent of GDP.

The federal government also collects revenues in the form of miscellaneous fees and fines. CBO projects that, under current law, revenues from those sources would grow at about the same pace as GDP through 2031.

Uncertainty in the Budget Outlook

CBO’s baseline budget projections are intended to show what would happen to federal spending, revenues, deficits, and debt if current laws governing spending and taxes generally remained the same. Changes to laws—particularly those affecting fiscal policies—that caused them to differ from the laws underlying CBO’s baseline projections could lead to budgetary outcomes that diverged considerably from those in the baseline. For example, CBO’s estimate of the deficit for 2021 has increased by more than $0.7 trillion since February, largely as a result of laws that have been enacted since those projections were published.

Even if federal laws remained the same for the next decade, actual budgetary outcomes would differ from CBO’s baseline projections because of unanticipated changes in economic conditions and in other factors that affect federal spending and revenues. Because of the ongoing coronavirus pandemic, the current projections are subject to an unusually high degree of uncertainty. That uncertainty stems from many sources, including incomplete knowledge about how the pandemic will unfold, how effective monetary and fiscal policy will be, and how global financial markets will respond to the substantial increases in federal deficits and debt. CBO aims for its projections to be in the middle of the distribution of possible outcomes, given the baseline assumptions about federal tax and spending policies, and recognizes that actual outcomes will typically differ from such projections.

CBO’s projections of outlays and revenues—and therefore of deficits and debt—depend in part on the agency’s economic projections for the coming decade, which include forecasts for such variables as interest rates, inflation, and growth in productivity. Discrepancies between those forecasts and actual economic outcomes can cause significant differences between baseline budget projections and budgetary outcomes.

Although the agency’s current economic and budget projections are subject to an unusually high degree of uncertainty, particularly in the near term, a comparison of CBO’s past projections with actual outcomes gives some indication of the magnitude of the uncertainty of budget projections.22 On the basis of an analysis of its past projections, CBO estimates that there is approximately a two-thirds chance that, under current law, the deficit in 2022 would be between 3.8 percent and 5.7 percent of GDP. (The baseline projection of the deficit that year is 4.7 percent of GDP.) The range in 2026 would be larger: CBO estimates that, under current law, there is approximately a two-thirds chance that the deficit that year would be between 1.4 percent and 6.1 percent of GDP. (The baseline projection is 3.7 percent of GDP.)

1. Budget authority is the funding provided by federal law to incur financial obligations that will result in immediate or future outlays of federal government funds.

2. CBO also did not extrapolate into future years $3 billion in funding provided for 2021 in division N of the Consolidated Appropriations Act, 2021 (P.L. 116-260). The agency classified that amount, which was also provided in response to the pandemic, as mandatory funding in its cost estimate but reclassified it as discretionary funding in its July 2021 baseline. About $8 billion in emergency funding provided for other purposes is projected to continue in the future, with increases to account for inflation each year after 2021.

3. Because October 1 will fall on a weekend in calendar years 2022, 2023, and 2028, certain payments that are due on those days will be made at the end of September instead, thus shifting them into the previous fiscal year. In CBO’s projections, those shifts noticeably boost outlays and deficits in fiscal years 2022 and 2028 but reduce them in fiscal years 2024 and 2029. If not for those shifts, deficits would decline in each year between 2021 and 2023 and increase as a percentage of GDP in all but one year between 2024 and 2031.

4. For more details on other means of financing and on federal debt more broadly, see Congressional Budget Office, Federal Debt: A Primer (March 2020), www.cbo.gov/publication/56165.

5. Each year, some mandatory programs are modified by provisions in annual appropriation acts. Such changes may increase or decrease spending for the affected programs for one or more years. In addition, some mandatory programs, such as Medicaid, the Supplemental Nutrition Assistance Program, and benefits for Coast Guard retirees and annuitants, are considered mandatory but require benefits to be paid from amounts provided in appropriation acts.

6. Section 257 of the Deficit Control Act also requires CBO to project spending for certain mandatory programs beyond their scheduled expiration and to project spending for entitlement programs, including Social Security and Medicare, under the assumption that they will be fully funded, and thus able to make all scheduled payments, even if the trust funds associated with those programs do not have sufficient resources to make full payments. Other rules that govern the construction of CBO’s baseline projections have been developed by the agency in consultation with the House and Senate Budget Committees. For further details, see Congressional Budget Office, How CBO Prepares Baseline Budget Projections (February 2018), www.cbo.gov/publication/53532.

7. The Treasury has classified all of the recovery rebates paid in advance of tax return filings as outlays rather than as reductions in revenues.

8. CBO does not estimate those revisions to subsidy costs; rather, that total reflects the amount that the Office of Management and Budget has indicated that it will record in fiscal year 2021.

9. The budget authority for highway programs is provided in authorizing legislation and is considered mandatory.

10. Most discretionary funding is limited by caps that were originally specified in the Budget Control Act of 2011 (P.L. 112-25) and modified by subsequent legislation. See Congressional Budget Office, cost estimate for the Bipartisan Budget Act of 2019 (July 23, 2019), www.cbo.gov/publication/55478. Under current law, separate caps exist for defense and nondefense funding through 2021. If the total amount of discretionary funding provided in appropriation acts for a given year exceeds the cap for either category, the President must sequester—or cancel—a sufficient amount of budgetary resources (following procedures specified in the Budget Control Act) to eliminate the breach.

11. Overseas contingency operations are certain military and diplomatic activities in Afghanistan and elsewhere, although some funding designated for OCO has not been directly related to those activities.

12. In its cost estimate for division N of P.L. 116-260, CBO classified the funding provided as mandatory in keeping with section 1401 of division O of that legislation. See Congressional Budget Office, cost estimate for division N, Additional Coronavirus Response and Relief, of H.R. 133, Consolidated Appropriations Act, 2021, enacted as P.L. 116-260 on December 27, 2020 (January 14, 2021), www.cbo.gov/publication/56961. After consulting with the Office of Management and Budget, CBO reclassified nearly $3.4 billion of that funding as discretionary in its July baseline projections because that funding was provided for activities that have historically received discretionary funding.

13. The amount that is constrained by the caps—$1,320 billion—is $22 billion more than the overall limit on discretionary funding for this year; that excess occurs primarily because appropriation acts for 2021 included provisions that were estimated to reduce budget authority for mandatory programs on net. When an appropriation act includes changes that affect mandatory funding, the estimated changes are included in estimates of discretionary funding that it provides when assessing whether the act complies with the limits on budget authority. Once the legislation is enacted, however, any such changes are incorporated into CBO’s baseline projections for mandatory spending. The opposite occurs when authorizing legislation provides funding for activities that traditionally receive discretionary appropriations.

14. Offsetting receipts include mostly payments of premiums, recoveries of overpayments made to providers, and amounts paid by states from savings on Medicaid’s prescription drug costs.

15. The Deficit Control Act specifies which measures of inflation CBO should use to construct its projections: The employment cost index for wages and salaries of workers in private industry is used to adjust discretionary funding related to federal personnel, and the gross domestic product price index is used to adjust other discretionary funding.

16. Similarly, CBO did not extrapolate into future years the $3 billion in funding provided for 2021 in division N of the Consolidated Appropriations Act, 2021 (P.L. 116-260), that the agency had originally classified as mandatory but reclassified as discretionary in its July 2021 baseline. That funding—which was also provided in response to the pandemic—supports programs and activities that historically receive discretionary appropriations.

17. Inflation rates also affect net outlays for interest, mostly for Treasury inflation-protected securities, which differ from other securities in that their principal amounts are adjusted to account for inflation.

18. For more details on the government’s net interest costs, see Congressional Budget Office, Federal Net Interest Costs: A Primer (December 2020), www.cbo.gov/publication/56780.

19. Although some of those provisions affect payroll taxes, they will not change the amounts credited to the Social Security and Railroad Retirement trust funds, and the effects are being recorded in the budget—at least for now—as reductions in individual income tax collections.

20. Real bracket creep is the process in which, as income rises faster than inflation (as generally happens when the economy is expanding), a larger portion of income is pushed into higher tax brackets and thus becomes subject to higher tax rates. It occurs because the income tax brackets are indexed to inflation. Other parameters of the tax system, such as the amount of the child tax credit, are fixed in nominal dollars and are not adjusted for inflation. In CBO’s projections, real bracket creep causes receipts from individual income taxes to grow throughout the entire projection period. For further information, see Congressional Budget Office, “How Income Growth Affects Tax Revenues in CBO’s Long-Term Budget Projections” (June 2019), www.cbo.gov/publication/55368.

21. For more on CBO’s projections of estate and gift taxes, see Congressional Budget Office, Understanding Federal Estate and Gift Taxes (June 2021), www.cbo.gov/publication/57129.

22. See Congressional Budget Office, An Evaluation of CBO’s Past Deficit and Debt Projections (September 2019), www.cbo.gov/publication/55234.

Chapter 2The Economic Outlook

Overview

This chapter provides details about the Congressional Budget Office’s July 2021 economic projections, which the agency used as the basis for updating its budget projections. Both sets of projections were published earlier this month.1

The forecast for 2021 to 2031 is rooted in current economic conditions: In the second quarter of 2021, CBO estimates that real economic output (that is, output adjusted to remove the effects of inflation) grew at an annual rate of 8.4 percent as the 2020–2021 coronavirus pandemic eased and demand for consumer services surged. The increase followed a 6.4 percent increase in the first quarter of 2021. The strong economic growth in the first half of 2021 was accompanied by a marked increase in inflation.

The Economic Outlook for 2021 to 2025

In CBO’s projections—which incorporate the assumptions that current laws (as of May 18) governing federal taxes and spending generally remain in place and that no significant additional funding or aid is provided—output exceeds its potential (maximum sustainable) level from 2021 to 2025, and demand for labor remains strong.

- Real gross domestic product (GDP) grows rapidly this year. Output increases by 7.4 percent and surpasses its potential level by the end of 2021 (see Figure 2-1). The annual growth of real GDP averages 2.8 percent during the five-year period from 2021 to 2025, exceeding the 2.0 percent growth rate of real potential GDP.

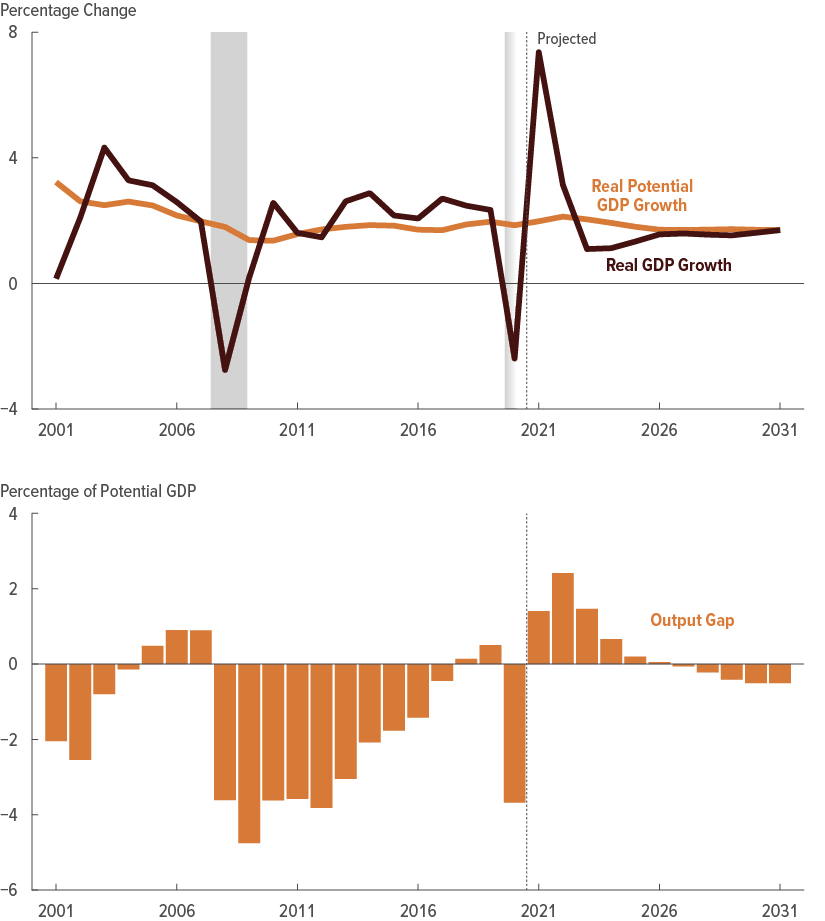

Figure 2-1.

The Relationship Between GDP and Potential GDP

In CBO’s projections, the annual growth of real (inflation-adjusted) GDP exceeds that of real potential GDP until 2023.

The gap between real GDP and real potential GDP (that is, the output gap) rises above 2 percent by 2022 before moving back toward its historical average.

Data source: Congressional Budget Office. See www.cbo.gov/publication/57263#data.

Real values are nominal values that have been adjusted to remove the effects of changes in prices. Potential GDP is CBO’s estimate of the maximum sustainable output of the economy. Growth of real GDP and of real potential GDP is measured from the fourth quarter of one calendar year to the fourth quarter of the next.

The output gap is the difference between GDP and potential GDP, expressed as a percentage of potential GDP. A positive value indicates that GDP exceeds potential GDP; a negative value indicates that GDP falls short of potential GDP. Values for the output gap are for the fourth quarter of each year.

GDP = gross domestic product.

- Labor market conditions continue to improve. Employment grows quickly in the second half of 2021, reflecting increased demand for goods and services and the waning of factors dampening the supply of labor, including health concerns and enhanced unemployment insurance benefits. Employment surpasses its prepandemic level in mid-2022. The unemployment rate declines through 2022 and then remains below or near 4 percent for several years (see Table 2-1). The labor force participation rate rises through 2022 and then remains above or near 62 percent for several years.2

Table 2-1.

CBO’s Economic Projections for Calendar Years 2021 to 2031

Data sources: Congressional Budget Office; Bureau of Economic Analysis; Bureau of Labor Statistics; Federal Reserve. See www.cbo.gov/publication/57263#data.

Economic projections for each year from 2021 to 2031 appear in Appendix C.

GDP = gross domestic product; PCE = personal consumption expenditures; * = between zero and 0.05 percentage points.

a. Real values are nominal values that have been adjusted to remove the effects of changes in prices.

b. Excludes prices for food and energy.

c. The consumer price index for all urban consumers.

d. The employment cost index for wages and salaries of workers in private industries.

e. Value for the fourth quarter of 2025.

f. Value for the fourth quarter of 2031.

g. The average monthly change, calculated by dividing by 12 the change in payroll employment from the fourth quarter of one calendar year to the fourth quarter of the next.

h. Data for 2020 are based on data released after CBO completed its economic forecast. Projections are based on data available on May 18, 2021.

i. Adjusted to remove distortions in depreciation allowances caused by tax rules and to exclude the effect of inflation on the value of inventories.

j. Net measure of transactions between the United States and the rest of the world in goods, services, income, and unilateral transfers.

- Inflation is higher than it has been since 2008 and then moderates. The growth rate of the price index for personal consumption expenditures (PCE) increases to 2.8 percent in 2021, as increases in the supply of goods and services lag behind increases in the demand for them, adding to inflationary pressures. By 2022, supply adjusts more quickly, and PCE price inflation falls to 2.0 percent during the year. After 2022, PCE price inflation remains at 2.1 percent through 2025, above its rate before the pandemic.