At a Glance

In this report, the Congressional Budget Office assesses its two-year and five-year economic forecasts and compares them with forecasts of the Administration and the Blue Chip consensus, an average of about 50 private-sector forecasts.

Variables Examined. CBO examines its forecasts of output growth, the unemployment rate, inflation, interest rates, and wages and salaries.

Measures of Quality. CBO focuses on four measures of forecast quality—average error, average absolute error, root mean square error, and two-thirds spread of errors—that help the agency identify the centeredness (that is, the opposite of statistical bias), accuracy, and dispersion of its forecast errors.

The Quality of CBO’s Forecasts. Most of CBO’s forecasts of output growth, unemployment, and inflation have average errors close to zero, but CBO’s estimates of interest rates and wage growth have been too high on average. As measured by the root mean square error and the average absolute error, the two-year forecasts are not, on the whole, more accurate than the five-year ones.

Comparison With Other Forecasts. The degree of centeredness varies by forecaster and variable. For example, CBO and the Blue Chip consensus tend to produce more-centered forecasts of output growth but less-centered forecasts of interest rates than the Administration does. CBO’s forecasts tend to be more accurate than the Administration’s estimates and, for most variables, have the same or smaller two-thirds spreads. For all four quality measures, CBO’s forecasts are roughly comparable to those of the Blue Chip consensus.

Sources of Forecast Errors. All forecasters failed to anticipate certain key economic developments, resulting in significant forecast errors. The main sources of those errors are turning points in the business cycle, changes in labor productivity trends and crude oil prices, the downward trend in interest rates, the decline in labor income as a share of gross domestic product, data revisions, and the coronavirus pandemic.

Forecast Uncertainty. In this report, CBO uses past forecast errors to gauge the uncertainty of its current forecasts. For example, using the root mean square error, the agency estimates that there is an approximately two-thirds chance that economic growth will average between 0.6 percent and 3.1 percent over the next five years. CBO’s central estimate in February 2023 was 1.9 percent.

Summary

Each year, the Congressional Budget Office prepares economic forecasts that underlie its projections of the federal budget. CBO forecasts hundreds of economic variables, but some—including output growth, the unemployment rate, inflation, interest rates, and wages and salaries—play a particularly significant role in the agency’s budget projections. CBO regularly analyzes its historical forecast errors to evaluate the quality of its economic projections, estimate uncertainty ranges, and isolate the effect of such errors on budgetary projections. That analysis serves as a tool for assessing the usefulness of the agency’s projections.

In this report, CBO evaluates its two-year and five-year economic forecasts from as early as 1976 and compares them with analogous forecasts from the Administration and the Blue Chip consensus—an average of about 50 private-sector forecasts published in Blue Chip Economic Indicators.1 External comparisons help identify areas in which the agency has tended to make larger errors than other analysts. They also indicate the extent to which imperfect information may have caused all forecasters to miss patterns or turning points in the economy.

How CBO Measures Forecast Quality

CBO’s analysis focuses on four metrics of forecast quality—average error, average absolute error, root mean square error, and two-thirds spread of errors:

- The average error is CBO’s primary measure of centeredness, which indicates how close the average forecast value is to the average actual value over time. Centeredness is the opposite of statistical bias, which quantifies the degree to which a forecaster’s projections are too high or too low over a period of time.

- The average absolute error is calculated by taking the average of the absolute value of the forecast errors to show the size of the error rather than its direction.2

- The root mean square error, which is calculated by squaring the forecast errors, averaging those squares, and taking the square root of that average, is CBO’s primary measure of accuracy, or the degree to which forecast values are dispersed around actual outcomes.

- The two-thirds spread, computed as the range between the minimum and maximum errors after removing the one-sixth largest errors and the one-sixth smallest errors, illustrates a forecaster’s typical range of errors and provides information about the extent of the dispersion of those errors.

The Quality of CBO’s Forecasts

Forecasts that have an average error of zero are, on average, neither too high nor too low. CBO’s forecasts of output growth, unemployment, and inflation mostly have average errors close to zero. CBO’s estimates of interest rates and wage growth tend to exhibit small positive average errors—that is, on average, they are too high by small amounts.3

In general, it is difficult to compare quality measures across variables because the magnitudes of variables can differ substantially, and some variables are easier or harder to forecast than others. It is possible, however, to compare those measures across forecast horizons for a given variable. For example, as measured by the average absolute error or the root mean square error, five-year forecasts of interest rates and the unemployment rate are less accurate than two-year forecasts of those variables. For the other variables, CBO’s forecasts are as accurate or more accurate at the five-year horizon on the basis of those two measures of forecast quality. For most variables, the agency’s two- and five-year forecasts exhibit a similar two-thirds spread of errors.

Comparing CBO’s Forecasts With Those of the Administration and the Blue Chip Consensus

In general, forecasts produced by CBO, the Administration, and the Blue Chip consensus display similar error patterns over time. Because all forecasters faced the same challenges, periods in which CBO made large overestimates typically coincide with periods in which other forecasters made similarly large overestimates. Over time, however, even small differences in the magnitude of errors can result in appreciable differences in measures of forecast quality.

CBO and the Blue Chip consensus tend to produce more-centered forecasts of output growth but less-centered forecasts of interest rates than the Administration (see Table 1). As measured by the root mean square error, approximately two-thirds of CBO’s forecasts are more accurate than the Administration’s forecasts, and the others are equally accurate; by that measure, CBO’s forecasts are roughly comparable to the Blue Chip consensus forecasts. Finally, CBO’s forecasts exhibit two-thirds spreads that are mostly smaller than those of the Administration’s forecasts; the agency’s forecasts tend to have two-thirds spreads that are similar to those of the Blue Chip consensus forecasts.

Table 1.

Summary Measures for Two-Year and Five-Year Forecasts, by Sample Years

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Economic Analysis; Bureau of Labor Statistics; Federal Reserve. See www.cbo.gov/publication/59078#data.

Forecast errors are calculated by taking the average projected value over the two- and five-year time horizon and subtracting the average actual value.

For details on the data underlying the summary measures presented here, see the appendix.

n.a. = not available; * = between −0.05 and 0.05 percentage points.

a. The measure of output is gross national product in years before 1992 and gross domestic product in 1992 and following years.

b. The inflation differential is the difference between growth in the consumer price index (CPI) and growth in the output price index.

c. The real interest rate is the nominal interest rate deflated by projected growth in CPI inflation.

d. In the early part of the sample, the Aaa corporate bond rate was used in place of the 10-year Treasury note rate since that was the interest rate that CBO, the Administration, and the Blue Chip consensus were forecasting at the time. See the appendix for details.

Sources of Forecast Errors

Forecasters made large errors in their economic forecasts as a result of several economic developments:

- Turning points in the business cycle;

- Changes in labor productivity trends;

- Changes in crude oil prices;

- The downward trend in interest rates;

- The decline in the labor share—that is, labor income as a share of gross domestic product (GDP);

- Data revisions; and

- The coronavirus pandemic.

Some of those developments resulted in errors in forecasting specific variables. Changes in crude oil prices, for example, resulted in misestimates of inflation in the consumer price index (CPI). Other developments, such as turning points in the business cycle, affect the entirety of an economic forecast, and their effects are observable in the error patterns of several variables. The unusual circumstances associated with the pandemic—including large swings in real output (that is, output adjusted to remove the effects of inflation) and employment as well as increased inflation—also resulted in large forecast errors for several of the economic variables examined in this report.

Using Forecast Errors to Estimate Uncertainty

In this report, CBO uses the root mean square error of its historical forecasts to quantify the uncertainty of its current economic projections.4 For example, CBO’s baseline forecast for the growth of real GDP over the next five years is 1.9 percent. Using its historical root mean square error for that variable (1.2 percentage points), CBO estimates that there is an approximately two-thirds chance that the rate of real GDP growth over the next five years will be between 0.6 percent and 3.1 percent. Although the agency typically uses the historical root mean square error to estimate uncertainty, it uses the two-thirds spread of errors when the statistical bias of its historical forecasts is high relative to its root mean square error.

CBO’s Methods for Evaluating Forecasts

To evaluate the quality of its forecasts, CBO examines its historical forecast errors and compares them with errors made by the Administration and the Blue Chip consensus. Comparison with the Blue Chip consensus is particularly useful because that forecast incorporates a wide variety of viewpoints and methods, and some research has suggested that composite forecasts often provide better estimates than projections made by a single forecaster.5

For this analysis, CBO reviewed the economic projections that it has published each winter (usually in January) since 1976, as the basis for its baseline budget projections. Each of those economic projections spanned the current year (that is, the calendar year already underway) and either 5 or 10 subsequent years.

This report evaluates CBO’s economic forecasts over the first two years and first five years of its baseline projection period. CBO evaluates forecasts over the two-year time horizon because that interval is most relevant when the agency is preparing its baseline budget projections for the upcoming fiscal year. (That second year is often called the budget year.) CBO evaluates forecasts over the five-year time horizon to better understand the quality of its longer-term projections.6 The agency calculates errors by subtracting the average actual value over the period being analyzed from the average projected value over that period.

The span of years evaluated for this analysis varies by economic indicator and depends on two factors: the availability of historical forecast data and the availability of actual economic data. To ensure that differences in the availability of forecast data do not affect the comparisons of forecast errors, those comparisons begin in the earliest year for which forecast data were available for all three sets of forecasts. So, although CBO has two-year forecasts of real output growth dating back to 1976, its forecast errors for comparison purposes are computed starting in 1980—the first year the Blue Chip consensus data were available.7 Likewise, the final year of forecast analysis depends on the availability of actual economic data. This report incorporates data through the end of 2022, which allows CBO to analyze two-year forecasts that were made through the beginning of 2021 and five-year forecasts that were made through the beginning of 2018. (See the appendix for details.)

Selecting Forecast Variables

CBO examines 10 forecast variables on the basis of their relative importance in the economic outlook and their relevance to projections of revenues, outlays, and deficits. Those variables include the following:

- Output growth,

- The unemployment rate,

- Inflation,

- Interest rates, and

- Wages and salaries.

Projections of real and nominal output growth are fundamental to CBO’s budget projections. Faster output growth is typically accompanied by faster growth in real income and hence faster growth of revenues from individual income taxes. Similarly, periods of faster output growth are typically associated with smaller transfer payments and smaller expenditures on unemployment insurance, resulting in lower outlays.

This analysis also examines CBO’s errors in forecasting the unemployment rate, a key component of the agency’s economic forecast. CBO’s forecast of the unemployment rate affects its projections of inflation, interest rates, and other labor market variables and also informs the agency’s projections of certain outlays, including those for unemployment compensation.

CBO’s evaluation of inflation forecasts focuses on two measures: the percentage change in the CPI and the inflation differential, which is computed as the difference between growth in the CPI and growth in the output price index.8 All else being equal, higher CPI inflation implies faster growth in federal outlays (because the index is used to adjust payments to Social Security beneficiaries as well as payments made for some other programs) and slower growth in federal revenues (because elements of the individual income tax, including the tax brackets, are indexed to the CPI).9 Growth in the output price index is closely linked to growth in nominal income subject to federal taxes, which implies faster growth in revenues. Consequently, if CPI inflation was higher than anticipated and the output price index grew more slowly than anticipated, the deficit would generally be larger than expected.

The interest rates on 3-month Treasury bills and 10-year Treasury notes summarize CBO’s projections of short- and long-term interest rates, respectively. Interest rates primarily affect the budget through their effect on net interest outlays—the difference between income earned on interest-bearing assets and the cost of servicing the debt. As a result, overestimates of interest rates result in overestimates of debt and deficits. This report also analyzes the real interest rate on 3-month Treasury bills, which is computed by removing the effects of CPI inflation from forecasts of the nominal interest rate on 3-month Treasury bills. Considering errors in projecting the real interest rate on 3-month Treasury bills isolates interest rate errors from errors in inflation projections.

Finally, CBO examines growth in wage and salary disbursements and the change in those disbursements as a share of output. Wages and salaries are the largest component of national income, and their growth informs CBO’s revenue projections and its analysis of the distribution of income. Analyzing wages and salaries as a share of output offers an approximation of forecasters’ views about the labor share of national income and helps isolate errors in projecting wages and salaries from errors in projecting nominal output.

Calculating Forecast Errors

CBO computes each forecast error as the difference between the average forecast value and the average actual value. (See Box 1 for an example of how CBO calculates its forecast errors.) The actual values are reported as calendar year averages and are based on the latest available data from various agencies. A positive error indicates that the forecast value exceeded the actual value, whereas a negative error indicates that the forecast value was below the actual value.

Box 1.

How CBO Calculates Economic Forecast Errors

The Congressional Budget Office calculates forecast errors by subtracting the average actual value of an economic indicator over a two-year (or five-year) period from the average projected value of that indicator over the same period. For example, to calculate the error for the two-year forecast of the growth of real gross domestic product (that is, GDP adjusted to remove the effects of inflation) that was published in the January 2017 Budget and Economic Outlook, CBO first calculated the geometric average of the projected growth rates of real GDP for calendar years 2017 and 2018, which was 2.2 percent.1 The agency then calculated the average actual growth rate of real GDP for those two years, which was 2.6 percent. Finally, it subtracted the average actual rate of 2.6 percent from the average projected rate of 2.2 percent, resulting in an error of -0.4 percentage points. To determine the error for the five-year forecast made that same year, CBO took the averages of projected and actual output growth rates for calendar years 2017 through 2021.

Example: Calculating the Error in the Two-Year Forecast of Real GDP Growth That CBO Published in January 2017

Data sources: Congressional Budget Office; Bureau of Economic Analysis.

GDP = gross domestic product.

1. The geometric average is calculated by first multiplying the growth rates for each year and then taking the nth root of that product. It is the appropriate measure for averaging growth rates because growth is the function of a product of values. It is used to calculate the average for most of the economic indicators analyzed in this report. (See the appendix for details.)

The method used to calculate forecast errors for this report differs from the method used in CBO’s evaluations of budget projections.10 In those reports, errors are calculated for a single fiscal year. For example, the error in CBO’s two-year revenue projection for 2018 was the percentage difference between the actual amount of revenues received in fiscal year 2018 and the revenues projected for that year in January 2017.11 In this report, errors are calculated over a span of either two or five calendar years. For example, the errors in the two-year forecasts of economic variables made in January 2017 are the average of the errors for 2017 and 2018.

Measuring Forecast Quality

This evaluation focuses on four metrics of forecast quality: average error, average absolute error, root mean square error, and two-thirds spread of errors. Together, those measures help CBO identify the centeredness, accuracy, and dispersion of its forecast errors. Other measures of forecast quality, such as whether forecasters optimally incorporate all relevant information when making their projections, are harder to assess.12

Average Error. CBO primarily uses the average error—the average of forecast errors—to measure the centeredness of each variable. The agency uses centeredness to determine whether its forecasts are systematically too high or too low relative to actual economic outcomes. CBO’s goal is to provide forecasts of economic indicators that lie in the middle of the distribution of possible outcomes.

The average error does not, however, provide a complete characterization of the quality of a forecast. Because positive and negative errors are added together to calculate the average, forecast underestimates and overestimates offset one another. A small average error might indicate that all forecasts had small errors, but a small average error can also result from large overestimates and large underestimates that mostly offset one another. CBO uses the average error as its primary measure of statistical bias because it is widely used and easily interpretable.13

Average Absolute Error. CBO uses the average absolute error as another measure for calculating forecast errors. It is calculated by taking the average of the absolute value of the forecast errors, and it is useful for determining the magnitude of the error regardless of the direction.

Root Mean Square Error. CBO’s primary measure of forecast accuracy, the root mean square error, is calculated by squaring the forecast errors, averaging those squares, and taking the square root of that average.14 That calculation places greater weight on instances in which the forecast values deviate significantly from actual values. Unlike the computation of average error, forecast underestimates and overestimates do not offset one another when the root mean square error is computed.

Calculating the root mean square error of CBO’s historical forecasts is one method used to quantify the uncertainty of economic projections. When historical forecasts are well centered and have an approximately normal distribution of errors (that is, the values are distributed symmetrically around the average), about two-thirds of actual values will be within a range of plus or minus one root mean square error of the forecast values.

Two-Thirds Spread. CBO uses the two-thirds spread of errors—defined as the difference between the minimum and maximum error after removing the one-sixth largest and one-sixth smallest errors—to measure the dispersion of its forecast errors. Larger two-thirds spreads imply greater variability in forecast errors, whereas smaller two-thirds spreads imply a narrower range of forecast misestimates.

In certain cases, CBO uses the two-thirds spread instead of the root mean square error to quantify the uncertainty of its current economic projections. The agency relies on the two-thirds spread when the ratio of the average error to the root mean square error is greater than or equal to 0.3. Above that threshold, the root mean square error reflects a substantial amount of bias in the estimates in addition to their variance. CBO estimates that, when that criterion is met, about two-thirds of actual values will be within a range of plus or minus one-half of the two-thirds spread of the forecast values.

Limitations of the Forecast Evaluations

CBO’s interpretation of forecast errors is somewhat limited for two reasons. First, forecast methodology continues to evolve. Over time, CBO and other forecasters have adjusted the procedures they use to develop economic forecasts in response to changes in the economy and advances in forecasting methods. Even when such adjustments improve the quality of forecasts, they make it difficult to draw inferences about the size and direction of future errors.

The second challenge is understanding the effects of different assumptions about future fiscal policy. CBO is required by statute to assume that future fiscal policy will generally reflect the provisions in current law, an approach that derives from the agency’s responsibility to provide a benchmark for lawmakers as they consider proposed legislative changes.15 When the Administration prepares its forecasts, however, it assumes that the fiscal policy in the President’s proposed budget will be adopted. The private forecasters included in the Blue Chip survey all make their own assumptions about fiscal policy, but the survey does not report them.

Forecast errors may be affected by those different fiscal policy assumptions, especially when forecasts are made while policymakers are considering major legislative changes. In early 2009, for example, contributors to the Blue Chip consensus reported that they expected additional fiscal stimulus, which implied stronger output growth than would be expected under current law. By contrast, CBO’s growth projections were tempered by the requirement that its forecasts reflect current law. In February 2009, shortly after CBO’s forecast was published, lawmakers enacted the American Recovery and Reinvestment Act (Public Law 111-5). Similarly, in early 2017, the Blue Chip consensus forecast for 2017 and 2018 probably incorporated some anticipation of a tax cut, as well as other changes in fiscal policy that would boost output in those years. Those anticipated changes probably led the Blue Chip consensus economic forecast to be stronger than CBO’s in early 2017.16 Finally, at the beginning of 2021, many Blue Chip forecasters probably assumed that further legislative action would occur to address the pandemic and its economic effects, which CBO’s current-law forecast did not take into account. The American Rescue Plan Act of 2021 (P.L. 117-2) became law in March, soon after CBO’s forecast was published.

The Quality of CBO’s Forecasts

On the whole, it is difficult to compare quality measures, like average error and root mean square error, across variables because the magnitudes of variables can differ substantially, and some variables are easier or harder to forecast than others. It is possible, however, to compare those measures across forecast horizons for a given variable. For example, all but one of CBO’s two-year forecasts exhibit smaller average errors than its five-year forecasts. In particular, CBO’s two-year forecasts of growth in nominal output, interest rates, and growth in wages and salaries display much smaller average errors than its five-year forecasts.

In contrast, as measured by the root mean square error and the average absolute error, CBO’s two-year forecasts are not, on the whole, more accurate than its five-year forecasts. For example, the agency’s two-year forecasts of inflation as measured by the CPI are less accurate than its five-year forecasts of that variable because anticipating short-term fluctuations is often more difficult than identifying long-term trends. That pattern does not hold for all variables, however. For example, CBO’s two-year forecasts of interest rates (both for 3-month Treasury bills and for 10-year Treasury notes) are more accurate than its five-year forecasts of interest rates; similarly, the agency’s two-year forecast of the unemployment rate is slightly more accurate than its five-year forecast.

CBO’s forecasts also tend to exhibit similar two-thirds spreads for most variables across the two- and five-year forecast horizons, but exceptions do occur. For example, CBO’s five-year forecast of the unemployment rate has a larger error spread than its comparable two-year forecast. Conversely, the agency’s forecasts of CPI inflation and growth of wages and salaries have smaller two-thirds spreads over the five-year horizon than over the two-year horizon.

A Comparison of Forecast Quality

CBO compares its economic forecasts with analogous forecasts produced by the Administration and the Blue Chip consensus. (For a comparison of CBO’s two-year forecasts with forecasts made by the Federal Reserve, see Box 2.) Each set of forecasts displays similar error patterns over time, but small differences in the magnitude of those errors lead to some appreciable differences in measures of forecast quality.

Box 2.

Comparing CBO’s and the Federal Reserve’s Two-Year Forecasts

Like the Administration and the Blue Chip consensus, the Federal Reserve regularly produces economic forecasts that serve as useful comparisons when evaluating the quality of forecasts by the Congressional Budget Office. The scope of the Federal Reserve’s forecasts is limited: It does not publish forecasts of interest rates for Treasury securities or growth in wages and salaries, nor does it publish any five-year forecasts. As a result, CBO did not include the Federal Reserve’s forecasts in the principal analysis for this report. However, the Federal Reserve does publish comparable forecasts of real output growth (that is, output growth adjusted to remove the effects of inflation) and consumer price inflation for a two-year time horizon.

CBO’s forecasts of real output growth are generally similar to the Federal Reserve’s forecasts (see the figure). Both forecasters tended to underpredict real output growth in the 1980s and 1990s and have overpredicted real output growth since 2000. Overall, CBO and the Federal Reserve produce forecasts of real output growth that display a similar degree of accuracy; however, CBO’s forecasts have a smaller two-thirds spread of errors.

CBO’s and the Federal Reserve’s forecasts of consumer price inflation are also similar. Each set of forecasts has a similar degree of centeredness and accuracy. However, the Federal Reserve’s forecasts tend to display a smaller two-thirds spread.

The Federal Reserve’s forecasts differ from CBO’s forecasts in two ways. First, the Federal Reserve’s forecasts include the effects of anticipated changes in fiscal policy, whereas CBO’s forecasts reflect the assumption that current laws governing fiscal policy will remain generally unchanged. Second, the Federal Reserve’s recent forecasts are modal—that is, they represent the single most likely outcome for the economy. By contrast, CBO’s forecasts represent the middle of the range of possible outcomes. In periods when the range of possible outcomes is highly skewed, the Federal Reserve’s forecasts will differ from CBO’s.

Comparison of Two-Year Forecast Errors by CBO and the Federal Reserve

Percentage Points

Data sources: Congressional Budget Office; Federal Reserve; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

The measure of output is gross national product in years before 1992 and gross domestic product in 1992 and following years. For years before 2020, the dots shown on the horizontal axis indicate that the forecast period overlapped a recession by six months or more; for 2020 and afterward, the dots indicate that the forecast period overlapped a recession by three months because of the unusually short recession in 2020.

Most inflation errors are errors in forecasting the consumer price index for all urban consumers, but some are errors in forecasting the consumer price index for urban wage earners and clerical workers, and some are errors in forecasting the price index for personal consumption expenditures. For details on the underlying data, see the appendix.

CPI = consumer price index.

For average errors, CBO’s two- and five-year economic forecasts are broadly similar to forecasts produced by the Administration and the Blue Chip consensus. However, CBO and the Blue Chip consensus have smaller average errors when forecasting output growth, whereas the Administration produces the most-centered forecasts of interest rates. In terms of root mean square errors, CBO’s forecasts are similar to the Blue Chip consensus forecasts and are equal to or slightly more accurate than the Administration’s forecasts. Finally, CBO’s forecasts tend to display two-thirds spreads that are smaller than those of the Administration’s forecasts and similar to those of the Blue Chip consensus forecasts.17 There are exceptions, however, for some variables and forecast horizons (see Table 1).

Real and Nominal Output Growth

CBO’s forecasts of real and nominal output growth are more centered and display greater accuracy than the Administration’s forecasts. CBO also has two-thirds spreads that are smaller than those of the Administration, except for nominal output growth at the five-year time horizon. The agency’s forecasts are roughly comparable to the Blue Chip consensus forecasts for the various quality measures. Although CBO’s forecasts of nominal output are slightly more centered than the Blue Chip consensus forecasts, its forecasts of real output are the same as or slightly less centered than those of the Blue Chip consensus. The Blue Chip consensus produces five-year forecasts of nominal output growth that have smaller two-thirds spreads than the corresponding CBO forecasts.

The Unemployment Rate

CBO, the Administration, and the Blue Chip consensus tend to produce similar forecasts of the unemployment rate, which results in similar measures of forecast quality. Over both the two- and the five-year time horizons, all three sets of forecasts show little variation in their average errors and root mean square errors. Although the Administration has slightly underestimated the unemployment rate over the two-year time horizon, all three sets of forecasts underestimated it over the five-year horizon. The forecasts also show no variation in the two-thirds spread over the two-year horizon but slight differences over the five-year horizon, whereas the Administration’s spread is larger than those of CBO and the Blue Chip consensus.

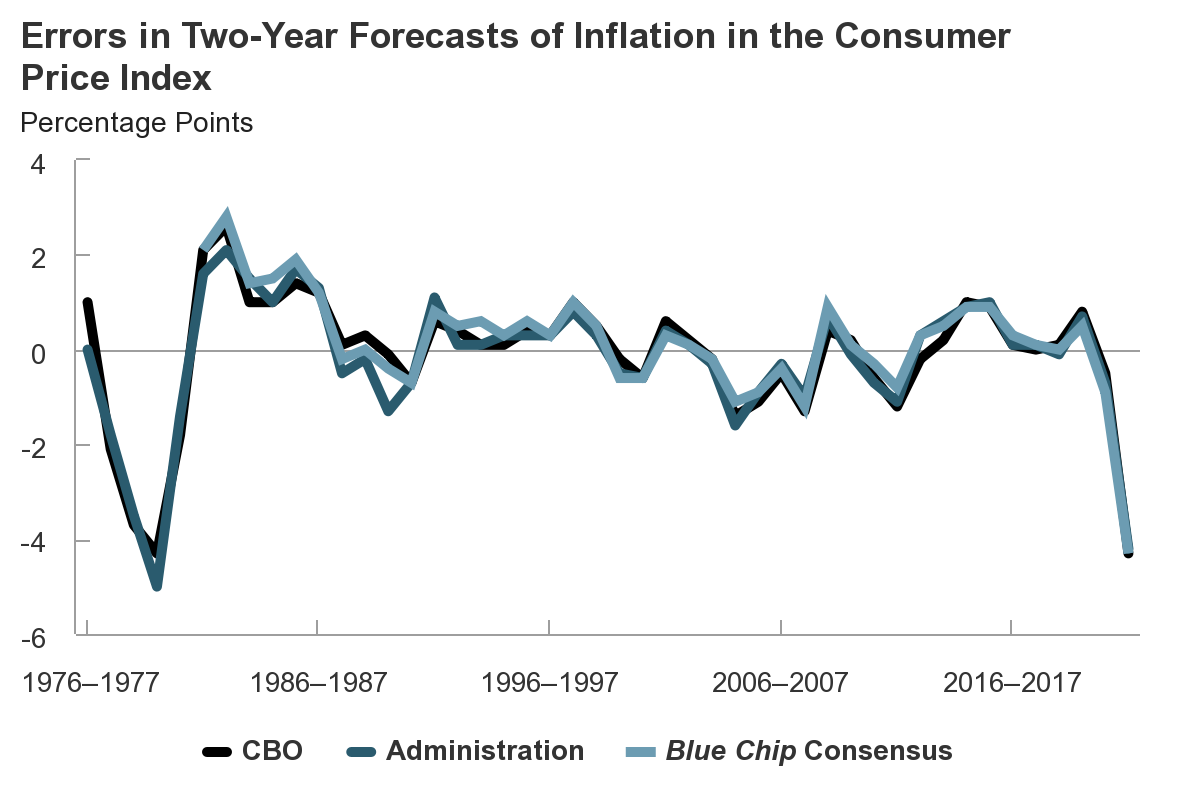

Inflation

CBO’s forecasts of CPI inflation are similar to those of the Administration and the Blue Chip consensus over the two-year time horizon. At the five-year time horizon, CBO’s inflation forecasts are slightly more accurate and display a smaller two-thirds spread than the forecasts of the Administration and the Blue Chip consensus, although the Administration’s inflation forecasts are more centered. All three sets of forecasts underestimated the rise in inflation in 2021 and 2022, which led to large forecast errors for those years.

CBO’s forecasts of the inflation differential are comparable to those of the Administration and the Blue Chip consensus. For each measure of forecast quality, CBO, the Administration, and the Blue Chip consensus produce similar errors over both forecast periods. Over the five-year time horizon, each set of forecasts has underestimated the inflation differential.

Interest Rates

All forecasters have struggled to produce high-quality forecasts of real and nominal interest rates. At the two-year horizon, CBO, the Administration, and the Blue Chip consensus produce interest rate forecasts that tend to overpredict the actual value. The Administration’s interest rate forecasts display more centeredness but also slightly less accuracy than those of CBO and the Blue Chip consensus because its forecasts tend to include large and partially offsetting overpredictions and underpredictions. The two-thirds spreads do not follow a clear pattern. The forecasts of real and nominal interest rates on 3-month Treasury bills produced by the Blue Chip consensus have a smaller two-thirds spread than those of the other forecasters, but the Administration’s forecast of interest rates on 10-year Treasury notes has a larger two-thirds spread than the forecasts of CBO and the Blue Chip consensus.

Over the five-year time horizon, a similar pattern holds. CBO produces interest rate forecasts that are considerably less centered than, but roughly as accurate as, the Administration’s forecasts. CBO’s forecasts are comparable to the Blue Chip consensus forecasts. Results over the five-year horizon differ from those over the two-year horizon in one respect: All of the Administration’s interest rate forecasts have a much larger two-thirds spread than the forecasts of both CBO and the Blue Chip consensus.

Wages and Salaries

Over both the two- and five-year horizons, CBO’s forecasts of the growth in wages and salaries are slightly more centered and slightly more accurate than the Administration’s forecasts. (The Blue Chip consensus does not provide forecasts of the growth in wages and salaries.) CBO’s forecasts have a larger two-thirds spread over the two-year horizon and a smaller spread over the five-year horizon. Over both time horizons, CBO’s and the Administration’s forecasts exhibit significant upward bias.18 The quality of CBO’s forecasts of wages and salaries as a share of output is nearly indistinguishable from that of the Administration’s forecasts.

Some Sources of Forecast Errors

Forecast errors often result from difficulties in anticipating significant economic developments. Such developments include turning points in the business cycle, changes in labor productivity trends, changes in crude oil prices, the downward trend in interest rates, the declining labor share, data revisions, and the pandemic. Some of those developments are closely tied to errors in forecasting specific variables—for example, the changes in crude oil prices that resulted in misestimates of CPI inflation. Other developments, such as turning points in the business cycle, have wide-ranging effects on economic forecasts and affect the projections of many variables.

Turning Points in the Business Cycle

Business cycle peaks and troughs mark the beginning and end of recessions, or periods of significant economic contraction. This analysis covers five complete recessions—those in 1980, 1981 to 1982, 1990 to 1991, 2001, and 2007 to 2009—as well as the most recent recession brought on by the pandemic in 2020. Although the depth and duration of the recessions differed, all contributed to forecast misestimates that were substantially larger than those made in nonrecession years. The root mean square errors for most economic variables considered in this analysis and for all three forecasters are larger in periods that overlap with recessions (see Figure 1). The frequency of large errors (defined as the top three largest errors in absolute value) is greater during periods of recessions.

Figure 1.

Root Mean Square Errors of Two-Year Forecasts Made Near Business Cycle Peaks

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Economic Analysis; Bureau of Labor Statistics; Federal Reserve. See www.cbo.gov/publication/59078#data.

The root mean square errors for recessions are based on forecasts made near business cycle peaks—those published in 1981, 1990, 2001, 2008, and 2020. The root mean square errors for other years are based on all two-year forecasts made through 2021, except for the five made near business cycle peaks.

Real output is nominal output that has been adjusted to remove the effects of inflation. The measure of output is gross national product in years before 1992 and gross domestic product in 1992 and following years.

a. Real interest rates are nominal interest rates deflated by the projected rate of growth in the consumer price index.

Forecasters struggle to produce accurate forecasts around business cycle downturns for three main reasons. Because business cycle downturns are hard to predict, the first challenge is anticipating when one will occur. During periods of growth, it is often difficult to identify which economic imbalances will ultimately result in a recession. Recessions are often precipitated by unforeseeable exogenous shocks, such as the Iraqi invasion of Kuwait (1990) or the pandemic (2020). Moreover, it is often difficult to know whether the economy is in a recession until well after it has begun. Thus, forecasts made just before a recession tend to be overly optimistic about economic outcomes.

The second challenge is identifying the length and severity of a recession. Recessions often coincide with periods of great uncertainty, both in economic outcomes and in fiscal and monetary policy. Under those conditions, a wide range of outcomes can appear equally probable, making it difficult to produce a forecast that is in the middle of the distribution of possible outcomes.

The final challenge is predicting the speed with which the economy will recover from a recession. Until the early 1990s, the U.S. economy typically grew rapidly for several quarters after a recession ended. Since then, however, recoveries have been much slower.19 Failing to predict slower economic recoveries has caused forecasters to overestimate economic growth in the aftermath of business cycle downturns.20

Changes in Labor Productivity Trends

Growth of labor productivity in the nonfarm business sector—the ratio of real output to labor hours worked—is a key input into CBO’s forecast of real output growth. Although growth in labor productivity fluctuates widely from quarter to quarter, its average growth rate tends to remain stable over long periods. The stability of that average typically helps forecasters estimate real output growth over longer time horizons. However, three shifts in labor productivity trends have contributed to errors in projecting real output growth (see Figure 2).

Figure 2.

Trends in Average Annual Growth in Labor Productivity

Percent

Data source: Congressional Budget Office, using data from the Bureau of Labor Statistics. See www.cbo.gov/publication/59078#data.

Data show the average annual growth of labor productivity in the nonfarm business sector. Labor productivity equals real output (that is, output adjusted to remove the effects of inflation) divided by the total number of hours worked.

The first shift occurred in 1974, stemming in part from the 1973 recession. Whereas productivity had grown at an average rate of 2.8 percent per year over the previous 25 years, it grew by an average of only about 1.5 percent per year through the mid-1990s. Partly because most forecasters in the 1970s expected that the productivity trend of the previous decades would prevail, their forecasts of real output growth in the latter half of the 1970s turned out to be too optimistic (see Figure 3).

Figure 3.

Errors in Forecasts of Real Output Growth

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

The measure of real output is gross national product in years before 1992 and gross domestic product in 1992 and later years. Positive errors represent overestimates. For years before 2020, the dots shown on the horizontal axis indicate that the forecast period overlapped a recession by six months or more; for 2020 and afterward, the dots indicate that the forecast period overlapped a recession by three months because of the unusually short recession in 2020. The years indicate the time span covered by each of the forecast errors shown in the figure.

The second shift occurred in 1997, when growth in labor productivity in the nonfarm business sector accelerated, averaging more than 3 percent per year for nearly a decade. For the first several years of that period, forecasters underestimated the trend of productivity growth, which partly explains why their projections of the economy’s growth rate were too low and their projections of inflation in the output price index were too high.21 The acceleration in labor productivity stemmed from a pickup in technological progress (especially in information technology) and an increase in the amount of capital per worker as firms invested heavily in new technology.

The third shift occurred in 2006, when the average growth of labor productivity slowed to 1.4 percent per year through 2022 for reasons that are not fully understood. The slowdown partly reflects cyclical factors related to the severe recession that occurred from 2007 to 2009 and the ensuing weak recovery. In addition, the growth of the labor force decelerated, which in turn slowed the growth of investment and of capital services. That slowdown in investment may have also reduced the rate at which businesses could introduce new technologies into the production process. Some research suggests that other long-term structural problems might be impeding the rate at which new technologies diffuse through industries.22

In general, shifts in labor productivity are difficult to forecast. Such shifts are typically the result of changes in capital accumulation, changes in educational attainment, and technological innovation—factors that are difficult to forecast and that are only easily identified several years after the fact. Consequently, if CBO and other forecasters make incorrect inferences about the percentage of the labor force receiving higher education degrees, for example, that error affects their projections of productivity growth and, by extension, real output growth.

Changes in Crude Oil Prices

Crude oil is an important energy source in the United States, and petroleum accounts for more than one-third of total energy consumption.23 As a result, crude oil prices are a major component of CPI inflation. Crude oil prices are more volatile than overall prices, and they fluctuate widely in response to economic and geopolitical developments (see Figure 4).

Figure 4.

The Effect of Oil Prices on CPI-U Inflation

Data sources: Congressional Budget Office; Bureau of Labor Statistics; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

CPI-U = consumer price index for all urban consumers.

a. The real cost of crude oil is the refiners’ cost of acquiring crude oil divided by the price index for personal consumption expenditures, excluding prices for food and energy.

b. The major components of energy prices in the CPI-U are motor fuel (which is primarily composed of petroleum products), electricity, and natural gas purchased from utilities.

Some of the largest errors in forecasting CPI inflation can be attributed to forecasters’ inability to predict major changes in crude oil prices. For example, rising oil prices in the late 1970s and early 1980s probably contributed to the sizable underprediction of inflation by CBO and the Administration when they completed their forecasts at the end of the 1970s.24 More recently, oil prices increased rapidly in 2022, which contributed to elevated inflation. For that and several other reasons, the two-year forecasts that CBO, the Administration, and the Blue Chip consensus made at the beginning of 2021 all substantially underestimated CPI inflation (see Figure 5).

Figure 5.

Errors in Forecasts of CPI Inflation

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Labor Statistics. See www.cbo.gov/publication/59078#data.

Most forecast errors are errors in forecasting the consumer price index for all urban consumers, but some are errors in forecasting the consumer price index for urban wage earners and clerical workers. For details on the underlying data, see the appendix.

Positive errors represent overestimates. For years before 2020, the dots shown on the horizontal axis indicate that the forecast period overlapped a recession by six months or more; for 2020 and afterward, the dots indicate that the forecast period overlapped a recession by three months because of the unusually short recession in 2020. The years indicate the time span covered by each of the forecast errors shown in the figure.

CPI = consumer price index.

Large changes in crude oil prices reflect producers’ and consumers’ limited capacity to quickly adjust supply and demand in response to changing market conditions.25 Fluctuations in oil prices are often difficult to forecast because markets for petroleum products can be sensitive to developments that forecasters cannot reasonably be expected to predict. For example, during the 1973–1981 period, oil prices spiked in response to the oil embargo imposed by the Organization of Arab Petroleum Exporting Countries (1973 to 1974), the Iranian Revolution (1979), and the start of the Iran–Iraq War (1980). Those developments affected forecasters’ ability to correctly forecast CPI inflation.

Until recently, political factors appeared to have waned as a source of uncertainty. Oil prices rose steeply in the lead-up to the 2007–2009 recession and fell sharply in 2015 and 2016 because of shifts in global supply and demand as well as technological changes, such as horizontal drilling and hydraulic fracturing. But the war in Ukraine has shown that political factors remain a source of uncertainty. Russia’s invasion of Ukraine contributed to sharp increases in oil prices in 2022. Sanctions levied against Russia, the world’s third-largest exporter of petroleum, drastically reduced the supply of crude oil and drove up energy prices following its initial invasion in 2022. The crude oil supply has recovered as of early 2023; however, the duration and severity of the war in Ukraine and further sanctions imposed on or enforced against Russia continue to add uncertainty to CBO’s inflation outlook.

The Downward Trend in Interest Rates

Interest rates have trended downward since the early 1980s (see Figure 6). Before the onset of the pandemic, that decline was partly attributable to a lower average rate of inflation. Recent research has identified several additional factors that may have contributed to the decline in real interest rates: the aging of the population, increased income inequality, a trend toward slower output growth, and increased saving among emerging market economies.26

Figure 6.

The Persistent Decline in Interest Rates

Percent

Data source: Congressional Budget Office, using data from the Federal Reserve. See www.cbo.gov/publication/59078#data.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

Over the past two decades, forecasters have underestimated the effect of those factors on interest rates, and they did not anticipate the extent or persistence of the eventual decline. Thus, all forecasters have tended to make sizable overpredictions of both short- and long-term interest rates since the early 2000s.

The Decline in the Labor Share

“Labor share” refers to the total compensation paid to workers as a percentage of GDP. The labor share consists of several components, the largest of which is total wages and salaries paid to employees; that component accounts for about 80 percent of all labor income. Therefore, misestimates of the labor share typically arise from misestimates of wages and salaries.

In the early 2000s, the labor share experienced a structural decline because the growth of labor compensation did not keep pace with GDP. That decline has partly reversed over the past decade, and the reasons for it are only partially understood (see Figure 7). One theory is that globalization may have increased incentives for businesses to move their production of labor-intensive goods abroad.27 Another is that technological innovation may have increased the returns on capital more than it has increased the returns on labor. Either way, forecasters at the start of the millennium projected that the growth in wages and salaries would continue at its historical average, causing the labor share to stabilize or return to its historical average. That expectation resulted in projections of wage and salary growth that tended to be too high (see Figure 8).

Figure 7.

Labor’s Share of Gross Domestic Product

Percent

Data sources: Congressional Budget Office; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

Labor income is the sum of employees’ compensation and CBO’s estimate of proprietors’ income that is attributable to labor.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

Figure 8.

Errors in Forecasts of Growth in Wages and Salaries

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

Positive errors represent overestimates. For years before 2020, the dots shown on the horizontal axis indicate that the forecast period overlapped a recession by six months or more; for 2020 and afterward, the dots indicate that the forecast period overlapped a recession by three months because of the unusually short recession in 2020. The years indicate the time span covered by each of the forecast errors shown in the figure.

Recessions have contributed significantly to forecast misestimates of the growth in wages and salaries. Other transient factors can also cause movements in the labor share and lead to greater forecast errors. One such factor is the downward shift in the number of employees enrolling in employment-based health insurance plans that occurred in the late 1980s and early 1990s.28 The decline in enrollment was largely the result of rising employee premiums and stagnant employer contributions, which reflected the rising cost of medical care during that period. Employees who declined employment-based health insurance implicitly reduced their total compensation, because employers’ payments toward health insurance premiums are counted in total employee compensation. That development led forecasters to overestimate the growth of labor compensation and therefore labor’s share of income between 1989 and 1994.

Data Revisions

Many of the data series analyzed in this report are periodically revised in response to new data, methods, and definitions. For example, the Bureau of Economic Analysis (BEA) periodically issues comprehensive revisions of its national income and product accounts, which contain historical data on real output growth and growth of wages and salaries. Those data revisions affect the computation of forecast errors and, by extension, measures of forecast quality.

One way that data revisions affect the computation of forecast errors is by creating a wedge between the currently available data and the data that were available when the forecast was completed. For example, the root mean square error of CBO’s two-year forecasts of real output growth is 1.3 percentage points if calculated from the most recently available data (see Table 1) but is 1.2 percentage points if calculated from the real-time data available immediately after the conclusion of the two-year horizon. Although some research suggests that real-time data may be more appropriate for that kind of analysis, CBO uses the most recently available data.29 That decision simplifies the analysis and helps account for definitional changes that affect the interpretation of certain data series over time.30

In addition to affecting the analysis of forecast errors after the fact, data revisions can affect a forecaster’s projections in real time. For example, BEA made several downward revisions to estimates of real GDP growth during the 2007–2009 recession. When CBO prepared its baseline forecast in January 2009, real GDP had reportedly fallen at an annualized rate of 0.5 percent during the third quarter of 2008; however, revised data now show a 2.1 percent drop during that quarter (see Figure 9). Similarly, the latest revisions show that the average annual growth of real GDP was nearly one-quarter of a percentage point lower during the recession than BEA initially reported in January 2010. Had CBO and other forecasters known the true state of the economy at the time of their forecasts, their projections probably would have been different.

Figure 9.

The Effect of Revisions in Estimates of the Real Growth of Gross Domestic Product

Percent

Data sources: Congressional Budget Office; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

The Coronavirus Pandemic

The pandemic dramatically affected the economy and therefore many of the economic variables that CBO forecasts. Economic growth and the unemployment rate underwent large swings in 2020 as the economy shut down and reopened. Those swings were unexpected in January 2020, when CBO and others completed forecasts just before the onset of the pandemic. As a result, forecast errors for many of the economic variables that CBO and others project were unusually large in recent years.

The pandemic also contributed to a rise in inflation. In early 2021, when the most recent two-year forecasts analyzed in this report were completed, forecasters were expecting inflation to rise from 1.3 percent in 2020 to roughly 2 percent in 2022 (see Figure 10). Actual CPI inflation rose to 4.7 percent in 2021 and 8.0 percent in 2022—a 40-year high. The unexpected increase in inflation was partly due to factors that were directly related to the pandemic, such as supply-chain disruptions and changes in consumer spending patterns. Policy responses to the pandemic, including increased federal spending and the easing of monetary policy, contributed as well by boosting overall demand in the economy. Factors unrelated to the pandemic, such as the war in Ukraine and rising food and oil prices, also contributed to rising inflation. As a result, errors in the 2021 forecast for two-year CPI inflation were the largest made by CBO, the Administration, and the Blue Chip consensus over the 1981–2021 sample period that is common to all three sets of forecasts.31

Figure 10.

Actual CPI-U Inflation and 2021 Forecasts of CPI-U Inflation

Percent

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Labor Statistics. See www.cbo.gov/publication/59078#data.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

CPI-U = consumer price index for all urban consumers.

The forecast errors for the five-year inflation forecasts completed in 2017 and 2018 were also affected by the rise in inflation in 2021 and 2022. Forecasters expected CPI inflation to average between 2.2 percent and 2.4 percent for the 2017–2021 and 2018–2022 five-year periods (see Table 2). Actual CPI inflation averaged 2.5 percent over the 2017–2021 period and 3.6 percent over the 2018–2022 period. The five-year forecasts completed in 2019, 2020, and 2021 will also be affected by the rise in inflation in 2020 and 2021. Those errors will be analyzed in future reports.

Table 2.

Recent Five-Year CPI-U Inflation Forecasts, Actual CPI-U Inflation, and Forecast Errors

Percentage Points

Data sources: Congressional Budget Office; Office of Management and Budget; Wolters Kluwer, Blue Chip Economic Indicators; Bureau of Labor Statistics. See www.cbo.gov/publication/59078#data.

CPI-U = consumer price index for all urban consumers.

The unexpectedly high inflation in 2021 and 2022 affected the forecast errors for several other economic variables that are analyzed in this report. For example, in response to higher inflation, the Federal Reserve raised interest rates more than forecasters had expected in early 2021. Wages and salaries were also higher than anticipated because nominal wages and salaries increased at a faster pace as a result of unexpectedly tight labor market conditions in 2021 and 2022.

Using Previous Forecast Errors to Quantify Uncertainty

CBO relies on the root mean square error of its historical forecasts to quantify the uncertainty of its economic projections. For each variable, CBO computes root mean square errors for the next one- to five-year time horizons.32 Those root mean square errors can be applied symmetrically to the agency’s baseline projections to produce the range of the middle two-thirds of outcomes.

The middle two-thirds range helps illustrate the breadth of possible outcomes and the degree of uncertainty underlying CBO’s economic projections. For example, there is an approximately two-thirds chance that the average annual growth rate of real GDP will be between 0.6 percent and 3.1 percent over the next five years (see Figure 11). CBO’s central estimate in February 2023 was 1.9 percent, and the root mean square error for CBO’s five-year forecasts of real GDP growth is 1.2 percentage points.

Figure 11.

Quantifying the Uncertainty in CBO’s Economic Projections

Trillions of 2012 Dollars

Data sources: Congressional Budget Office; Bureau of Economic Analysis. See www.cbo.gov/publication/59078#data.

Vertical bars indicate the duration of recessions. A recession extends from the peak of a business cycle to its trough.

Real GDP is gross domestic product adjusted to remove the effects of inflation. The shaded area around CBO’s baseline projection of growth in real GDP, which encompasses two-thirds of possible outcomes, is based on the errors in CBO’s one-, two-, three-, four-, and five-year projections of real GDP from its forecasts for 1976 through 2021.

GDP = gross domestic product.

Sometimes CBO uses the two-thirds spread instead of the root mean square error to quantify the uncertainty of its current economic projections. When the ratio of the average error to the root mean square error is greater than or equal to 0.3, CBO estimates that about two-thirds of actual values will fall within a range of plus or minus one-half of the two-thirds spread of forecast values. For example, CBO’s two-year forecasts of interest rates on 10-year Treasury notes have an average error of 0.4 percentage points and a root mean square error of 0.8 percentage points (see Table 1). Because the ratio of those numbers is greater than 0.3, CBO uses the two-thirds spread (1.2 percentage points) to estimate that there is a two-thirds chance that the average interest rate on 10-year Treasury notes will fall within a range of roughly 0.6 percentage points above or below the agency’s central estimate of 3.9 percent.

Forecast errors for economic variables have implications for the budget. For example, according to CBO’s rules of thumb, if interest rates were 0.1 percentage point higher than projected for five consecutive years (and all else remained constant), the budget deficit over that period would be $107 billion higher than the baseline budget projection. Similarly, if inflation and interest rates were 0.1 percentage point higher than projected for five consecutive years (and all else remained constant), the budget deficit would be an estimated $98 billion higher than the baseline budget projection.33

1. For the purposes of this report, CBO examined the following economic variables: real gross domestic product (that is, GDP adjusted to remove the effects of inflation) and nominal GDP (GDP valued at prices in the current year), the unemployment rate, inflation as measured by the consumer price index (CPI), the inflation differential (the difference between growth in the CPI and growth in the output price index), interest rates on 3-month Treasury bills, real interest rates on 3-month Treasury bills (nominal interest rates on 3-month Treasury bills adjusted to remove the effects of CPI inflation), interest rates on 10-year Treasury notes, wages and salaries, and wages and salaries as a share of output.

2. The absolute value is the magnitude of a number without regard to its sign.

3. Forecast errors throughout this report were calculated as projected values minus actual values; thus, a positive error is an overestimate.

4. CBO uses a different method to quantify uncertainty in its reports on the federal budget and the economy; see The Budget and Economic Outlook: 2023 to 2033 (February 2023), www.cbo.gov/publication/58848.

5. Mark F. J. Steel, “Model Averaging and Its Use in Economics,” Journal of Economic Literature, vol. 58, no. 3 (2020), pp. 644–719, https://doi.org/10.1257/JEL.20191385; Allan Timmermann, “Forecast Combinations,” in Graham Elliott, Clive W. J. Granger, and Allan Timmermann, eds., Handbook of Economic Forecasting, vol. 1 (North Holland, 2006), pp. 135–196, https://doi.org/10.1016/S1574-0706(05)01004-9; Andy Bauer and others, “Forecast Evaluation With Cross-Sectional Data: The Blue Chip Surveys,” Economic Review, vol. 88, no. 2 (Federal Reserve Bank of Atlanta, 2003), pp. 17–31, https://tinyurl.com/y3qmyjzg (PDF); Henry Townsend, “A Comparison of Several Consensus Forecasts,” Business Economics, vol. 31, no. 1 (January 1996), pp. 53–55, www.jstor.org/stable/23487509; and Robert T. Clemen, “Combining Forecasts: A Review and Annotated Bibliography,” International Journal of Forecasting, vol. 5, no. 4 (1989), pp. 559–583, https://doi.org/10.1016/0169-2070(89)90012-5.

6. CBO cannot compare forecasts over longer time horizons because some data are not available. Although the agency has produced 11-year economic forecasts since 1992, it produced only 6-year economic forecasts before then. In addition, the Blue Chip consensus currently produces long-run economic forecasts spanning just 7 years.

8. For most years examined here, the inflation forecasts were for the CPI-U, which measures inflation in the prices of goods and services consumed by all urban consumers. Some forecasts, however, were for the CPI-W, which measures inflation in the prices of goods and services consumed by urban wage earners and clerical workers. CBO forecast the CPI-W from 1976 to 1978 and again from 1986 to 1989; the Administration forecast the CPI-W through 1991. For the purpose of this evaluation, the distinction between the two measures was most consequential in 1984, when inflation in the CPI-U and CPI-W diverged by 0.9 percentage points. For the output price index, CBO used the gross national product price index for forecasts made before 1992 and the GDP price index for forecasts made between 1992 and 2021.

9. Starting in 2018, tax brackets were indexed to increase with inflation (as measured by the chained CPI).

10. Congressional Budget Office, An Evaluation of CBO’s Projections of Outlays From 1984 to 2021 (April 2023), www.cbo.gov/publication/58613, The Accuracy of CBO’s Budget Projections for Fiscal Year 2022 (January 2023), www.cbo.gov/publication/58603, An Evaluation of CBO’s Past Revenue Projections (August 2020), www.cbo.gov/publication/56499, and An Evaluation of CBO’s Past Deficit and Debt Projections (September 2019), www.cbo.gov/publication/55234.

11. In evaluating its revenue projections, CBO calculated errors as the percentage difference (rather than the simple difference used in this report) between the projected and actual values because revenues are expressed as dollar amounts. If the errors in revenue projections were measured as simple differences in dollar amounts, they would be difficult to compare over time. (A $5 billion error in 1992, for example, would be significantly larger than a $5 billion error in 2014.) The simple difference is more appropriate in this report because it evaluates errors in forecasts of economic indicators that are expressed as rates or percentages—growth rates, interest rates, and changes in wages and salaries as a percentage of output. Forecast errors in this report are thus percentage-point differences between forecast and actual values.

12. Several studies have examined how well CBO’s economic forecasts incorporate relevant information—a characteristic referred to as forecast efficiency. See, for example, Leland Farmer, Emi Nakamura, and Jon Steinsson, Learning About the Long Run, Working Paper 29495 (National Bureau of Economic Research, revised February 2023), https://tinyurl.com/2p8r7tjz (PDF); and Robert Krol, “Forecast Bias of Government Agencies,” Cato Journal, vol. 34, no. 1 (Winter 2014), pp. 99–112, https://tinyurl.com/y7cmapw3 (PDF).

13. Several analysts outside of CBO have used more elaborate techniques to test for bias in the agency’s forecasts. One such alternative approach to testing a forecast for bias is based on linear regression analysis of actual values compared with forecast values. For details of that method, see Jacob A. Mincer and Victor Zarnowitz, “The Evaluation of Economic Forecasts,” in Jacob A. Mincer, ed., Economic Forecasts and Expectations: Analysis of Forecasting Behavior and Performance (National Bureau of Economic Research, 1969), pp. 3–46, www.nber.org/chapters/c1214. Studies that use more elaborate techniques to evaluate CBO’s and the Administration’s short-term forecasts have not found statistically significant evidence of bias over short forecast horizons. See, for example, Robert Krol, “Forecast Bias of Government Agencies,” Cato Journal, vol. 34, no. 1 (Winter 2014), pp. 99–112, https://tinyurl.com/y7cmapw3 (PDF); Graham Elliott and Allan Timmermann, “Economic Forecasting,” Journal of Economic Literature, vol. 46, no. 1 (March 2008), pp. 3–56, https://doi.org/10.1257/jel.46.1.3; and George A. Krause and James W. Douglas, “Institutional Design Versus Reputational Effects on Bureaucratic Performance: Evidence From U.S. Government Macroeconomic and Fiscal Projections,” Journal of Public Administration Research and Theory, vol. 15, no. 2 (April 2005), pp. 281–306, https://doi.org/10.1093/jopart/mui038.

14. The root mean square forecast error is equal to the square of the bias in the errors plus the variance of the errors. The variance measures the average squared difference between the errors and the average error.

15. For details about some exceptions to that rule, see Congressional Budget Office, What Is a Current-Law Economic Baseline? (June 2005), www.cbo.gov/publication/16558.

16. Different assumptions about monetary policy can also make it difficult to compare CBO’s forecasts with other forecasts. CBO’s forecasts incorporate the assumption that monetary policy will reflect the economic conditions that the agency expects to prevail under the fiscal policy specified in current law.

17. This description of relative forecast quality is strictly qualitative. CBO also conducted a series of statistical tests to assess the differences in root mean square errors among forecasters. Compared with the Administration’s forecasts, CBO’s forecasts had statistically smaller root mean square errors for 4 of 20 variables and horizons examined in this report. The Administration’s forecasts were never more accurate than CBO’s forecasts by statistically significant amounts. Compared with the Blue Chip consensus forecasts, CBO’s forecasts had statistically smaller root mean square errors for 1 of 16 variables and horizons examined in this report. The Blue Chip consensus forecasts were more accurate than CBO’s forecasts for one of those variables by a statistically significant amount.

18. CBO also examined its forecasts of real growth in wages and salaries, which inform its analysis of the distribution of taxable income. Examining errors in real wage and salary growth helps isolate errors in forecasting nominal wage and salary growth from errors in forecasting growth in CPI inflation. Although those forecasts exhibited slightly greater statistical bias than their nominal counterparts, the accuracy of the forecasts was similar. For that reason, CBO did not include those results in its primary summary tables.

19. For information about what caused more recent recoveries to be slow, see Congressional Budget Office, The Slow Recovery of the Labor Market (February 2014), www.cbo.gov/publication/45011.

20. Another change that caught most forecasters by surprise was the reduction in the volatility of GDP growth beginning in the mid-1980s. In particular, from the mid-1980s until the 2007–2009 recession, quarterly movements in real GDP growth were more muted than in previous decades. See, for example, Jordi Galí and Luca Gambetti, “On the Sources of the Great Moderation,” American Economic Journal: Macroeconomics, vol. 1, no. 1 (January 2009), pp. 26–57, https://tinyurl.com/y65mv7fj.

21. Spencer Krane, “An Evaluation of Real GDP Forecasts: 1996–2001,” Economic Perspectives, vol. 27, no. 1 (Federal Reserve Bank of Chicago, January 2003), pp. 2–21, https://tinyurl.com/y8wadllm; and Scott Schuh, “An Evaluation of Recent Macroeconomic Forecast Errors,” New England Economic Review (Federal Reserve Bank of Boston, January/February 2001), pp. 35–56, https://tinyurl.com/ych7zk8d.

22. Ryan A. Decker and others, Declining Business Dynamism: Implications for Productivity? Hutchins Center Working Paper 23 (Brookings Institution, September 2016), https://tinyurl.com/lv9cs9h; and Dan Andrews, Chiara Criscuolo, and Peter N. Gal, The Global Productivity Slowdown, Technology Divergence, and Public Policy: A Firm Level Perspective, Hutchins Center Working Paper 24 (Brookings Institution, September 2016), https://tinyurl.com/km6942w.

23. Energy Information Administration, Monthly Energy Review (June 2023), Table 1.3, https://tinyurl.com/y8hha93c (PDF).

24. The Blue Chip consensus forecast of CPI inflation was not available until 1981.

25. In the near term, consumers are constrained by the existing energy efficiency of their homes, places of work, and modes of transportation; producers are constrained by their equipment, technology, and the availability and accessibility of natural resources. For further discussion, see Congressional Budget Office, Energy Security in the United States (May 2012), www.cbo.gov/publication/43012.

26. Edward N. Gamber, The Historical Decline in Real Interest Rates and Its Implications for CBO’s Projections, Working Paper 2020-09 (Congressional Budget Office, December 2020), www.cbo.gov/publication/56891; Lukasz Rachel and Thomas D. Smith, “Are Low Real Interest Rates Here to Stay?” International Journal of Central Banking (September 2017), pp. 1–42, www.ijcb.org/journal/ijcb17q3a1.htm; and Council of Economic Advisers, Long-Term Interest Rates: A Survey (July 2015), https://tinyurl.com/5cmx99br (PDF).

27. See, for example, Michael W. L. Elsby, Bart Hobijn, and Aysegul Sahin, “The Decline of the U.S. Labor Share,” Brookings Papers on Economic Activity, vol. 44, no. 2 (Fall 2013), pp. 1–63, https://brook.gs/2VCVbyx.

28. For information about changes in employers’ contributions to health insurance during the late 1990s, see David M. Cutler, Employee Costs and the Decline in Health Insurance Coverage, Working Paper 9036 (National Bureau of Economic Research, July 2002), www.nber.org/papers/w9036.

29. See, for example, Tom Stark and Dean Croushore, “Forecasting With a Real-Time Data Set for Macroeconomists,” Journal of Macroeconomics, vol. 24, no. 4 (December 2002), pp. 507–531, https://doi.org/10.1016/S0164-0704(02)00062-9.

30. For example, business and government spending on computer software was once treated as spending for an intermediate good—that is, an input into the production process—and thus did not count as a component of GDP, which measures only final spending. But in 1999, BEA reclassified such spending as investment, which is a category of final spending. That same year, BEA adopted new methods for calculating the price indexes for various categories of consumption. Largely as a result of those changes, BEA increased its estimates of growth in real GDP for the 1980s and 1990s. In particular, BEA’s estimates of average annual growth in real GDP from 1992 to 1998 rose by 0.4 percentage points, and inflation in the GDP price index for those years was revised downward by 0.1 percentage point per year.

31. CBO and the Administration both had larger CPI inflation forecast errors in 1979, but the Blue Chip consensus did not produce forecasts of CPI inflation before 1981.

32. The root mean square errors for CBO’s forecasts of growth in real output at the one- to five-year horizons are 1.3, 1.2, 1.2, 1.2, and 1.2 percentage points, respectively. The root mean square errors for the two- and five-year horizons differ from those in Table 1 because the sample periods are different. Table 1 has a shorter sample period, chosen to coincide with the availability of data from the Blue Chip consensus and the Administration. The root mean square errors given here are based on CBO’s forecasts dating back to 1976.

33. Congressional Budget Office, “Workbook for How Changes in Economic Conditions Might Affect the Federal Budget: 2023 to 2033” (March 2023), www.cbo.gov/publication/59027.

AppendixThe Data CBO Uses to Evaluate Its Economic Forecasting Record

This appendix provides an overview of the forecast and historical data that the Congressional Budget Office uses to evaluate its forecasting record. In the report, CBO analyzes its errors in forecasting output growth, the unemployment rate, inflation, interest rates, and changes in wages and salaries. Forecast values are primarily compiled from CBO’s annual report, The Budget and Economic Outlook, which is typically published in the first quarter of each calendar year; the Administration’s annual budget documents; and Blue Chip Economic Indicators reports from the first quarter of each calendar year. Actual values for each variable are based on the latest available data from various agencies, including the Bureau of Economic Analysis (BEA) and the Bureau of Labor Statistics (BLS).

Most forecasts analyzed in this report were published in the first quarter of the year, but some were published in December of the previous year. Forecasts that are published later have an informational advantage over those published earlier, which affects comparisons of relative accuracy.

Forecasts Included in This Evaluation

This report evaluates forecasts published between 1976—the first year that CBO made economic projections—and 2021. From 1976 to 1984, however, those reports did not regularly include CBO’s forecasts of wages and salaries, so this analysis incorporates some unpublished forecasts of those amounts.

For comparison, this report also evaluates the Administration’s forecasts made between 1976 and 2021, all but two of which were taken from the Office of Management and Budget’s annual budget documents. In Presidential transition years, forecasts are taken from the budget documents of incoming Presidential administrations, with two exceptions: First, the Reagan Administration’s 1981 economic projections were based on revisions of the Carter Administration’s final budget and were released separately. Second, the Clinton Administration chose not to make its own economic projections before releasing its 1993 budget, adopting instead CBO’s economic projections as the basis of its budget. As a result, errors in the 1993 forecast are the same for both forecasters.