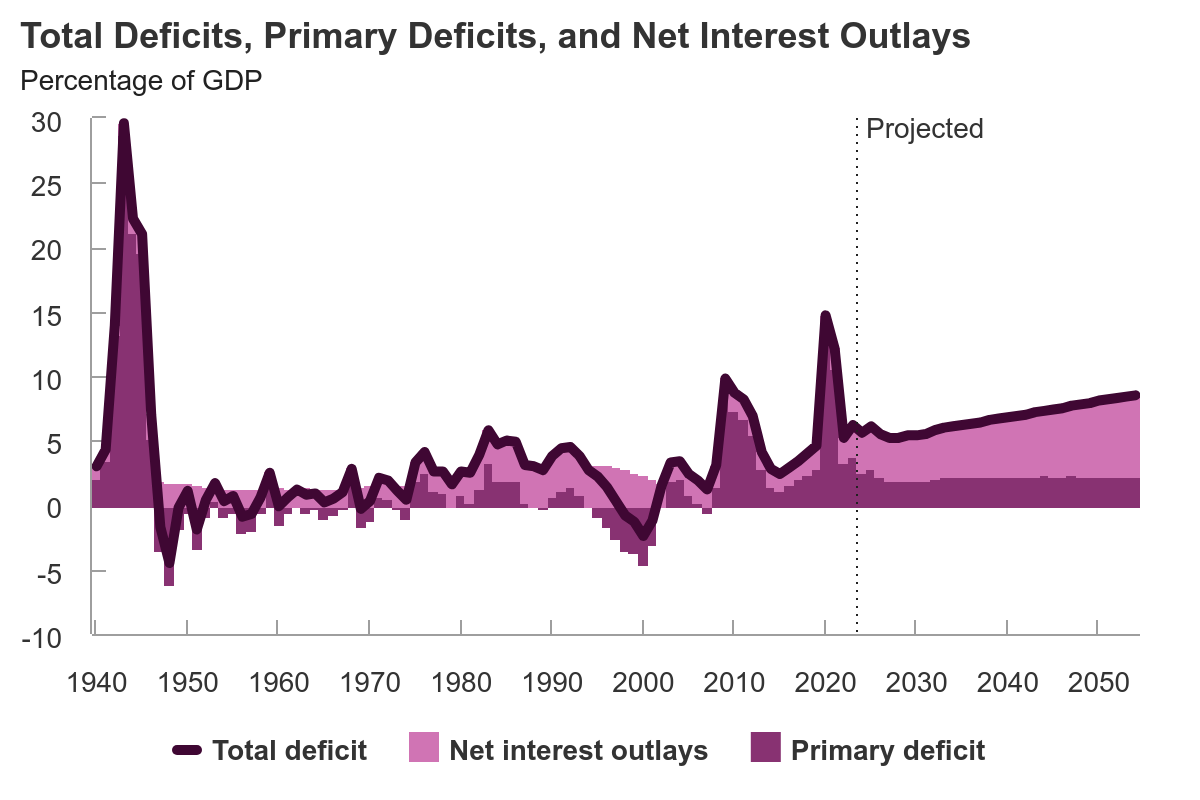

The federal budget deficit increases significantly in relation to gross domestic product over the next 30 years, in CBO’s projections, pushing federal debt held by the public far beyond any previously recorded level.

Outlook for the Budget and the Economy

- Report

In CBO’s projections, federal budget deficits total $20 trillion over the 2025–2034 period and federal debt held by the public reaches 116 percent of GDP. Economic growth slows to 1.5 percent in 2024 and then continues at a moderate pace.

- Blog Post

CBO will release "The Budget and Economic Outlook: 2024 to 2034" at 2 p.m. EST on February 7.

- Report

The U.S. faces a challenging fiscal outlook in the coming years, according to CBO's projections. Measured as a percentage of GDP, large and sustained deficits lead to high and rising federal debt that exceeds any previously recorded level.

- Report

Deficit reductions under the Fiscal Responsibility Act of 2023 reduce projected federal debt in 2033 by about 3 percent, from $46.7 trillion (or 119 percent of gross domestic product, or GDP) to $45.2 trillion (or 115 percent of GDP).

- Report

CBO provides information about how its most recent budget projections would change under different assumptions about future legislated policies.

- Report

CBO’s updated projections show a federal budget deficit of $1.5 trillion for 2023. That estimate is subject to considerable uncertainty, though, in part because of a recent shortfall in tax revenues.

- Report

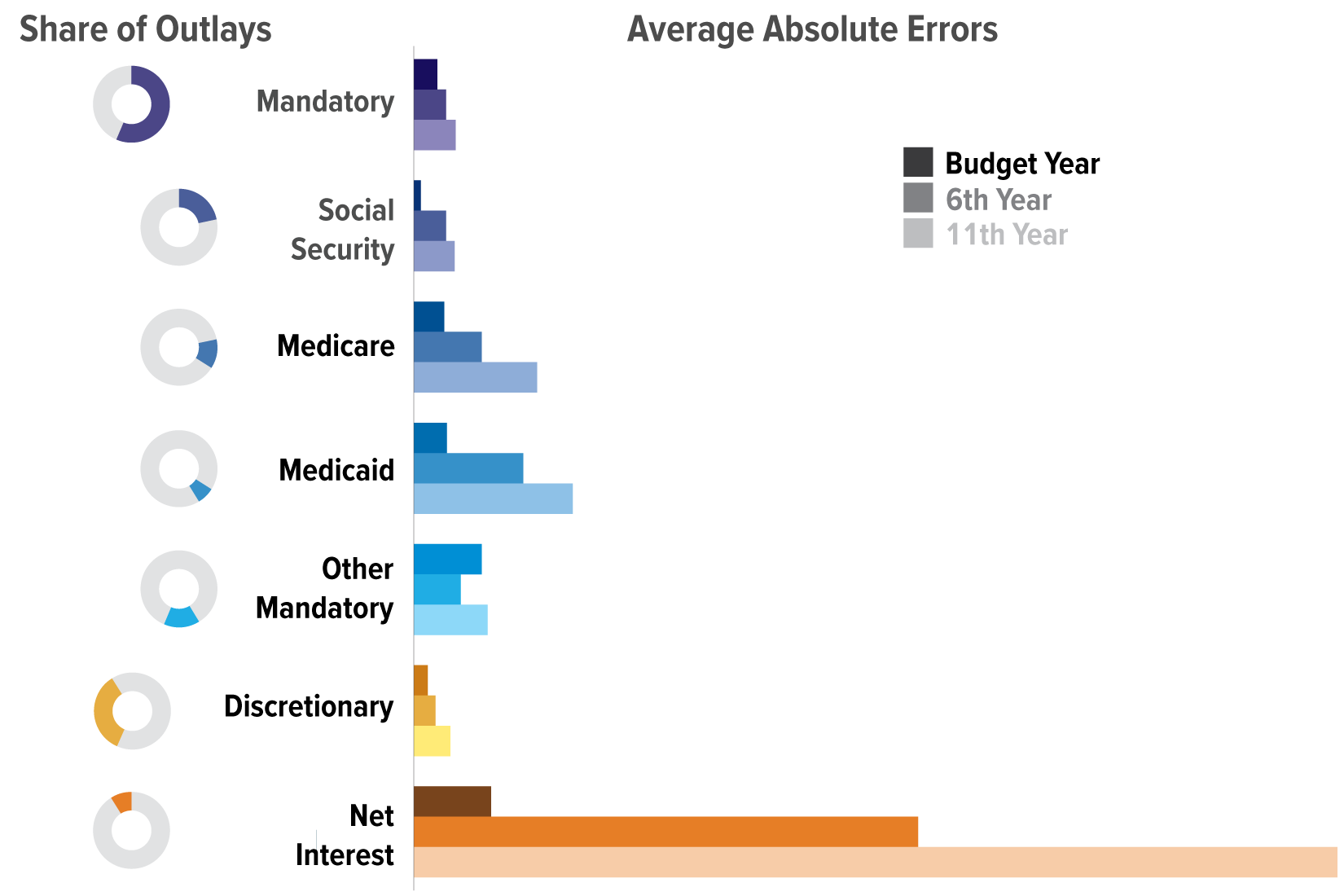

In this report, CBO uses various measures to assess the quality of its past projections of federal outlays. The analysis focuses on three fiscal years within each projection period: the budget year, the 6th year, and the 11th year.

- Report

In CBO’s projections, the federal deficit totals $1.4 trillion in 2023 and averages $2.0 trillion per year from 2024 to 2033. Real GDP growth comes to a halt in 2023 and then rebounds, averaging 2.4 percent from 2024 to 2027.

- Report

CBO describes its current view of the economy over the next two years, compares that view with projections of other forecasters and with those that CBO made previously, and explains the implications for the federal budget.

- Report

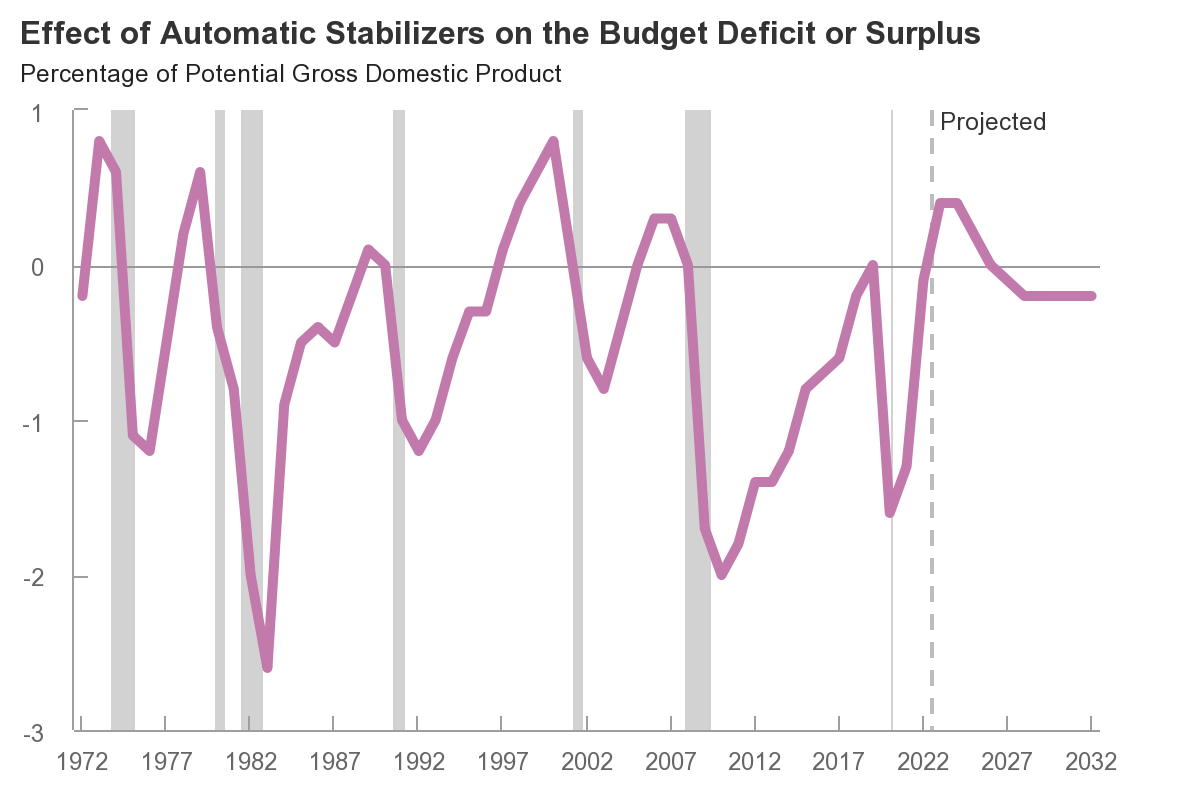

CBO projects the budgetary effects of automatic stabilizers—as well as the size of deficits without them—from 2022 to 2032 and provides historical estimates of the stabilizers’ effects since 1972.