This morning I testified before the House Budget Committee on our annual Budget and Economic Outlook that was released yesterday. My testimony highlighted many of the points that were included in yesterday's blog post. One point I want to emphasize is the following: The combination of tax and spending policies that the nation has been accustomed to cannot be sustained over the long term. That is because the aging of the population and rising costs for health care will, in the absence of other changes, steadily push spending up.

The number of people age 65 or older will increase by one-third in the coming decade, substantially raising the cost of Social Security, Medicare, and Medicaid. In addition, the Affordable Care Act will significantly increase the number of nonelderly people receiving assistance through federal health care programs. Furthermore, CBO projects that the costs per enrollee for Social Security and the major health care programs will continue to rise.

Because of those forces, the set of budget policies that were in effect in the past cannot be maintained in the future. Here's one way to think about the problem using CBO's projections under the alternative fiscal scenario presented in yesterday’s report; that scenario reflects the assumption that many current tax and spending policies that have recently been in effect remain in place, though under current law, they are scheduled to change. (Yesterday's blog post described the difference in the assumptions underlying CBO's baseline projections—which are conditioned on current law—and the alternative fiscal scenario.)

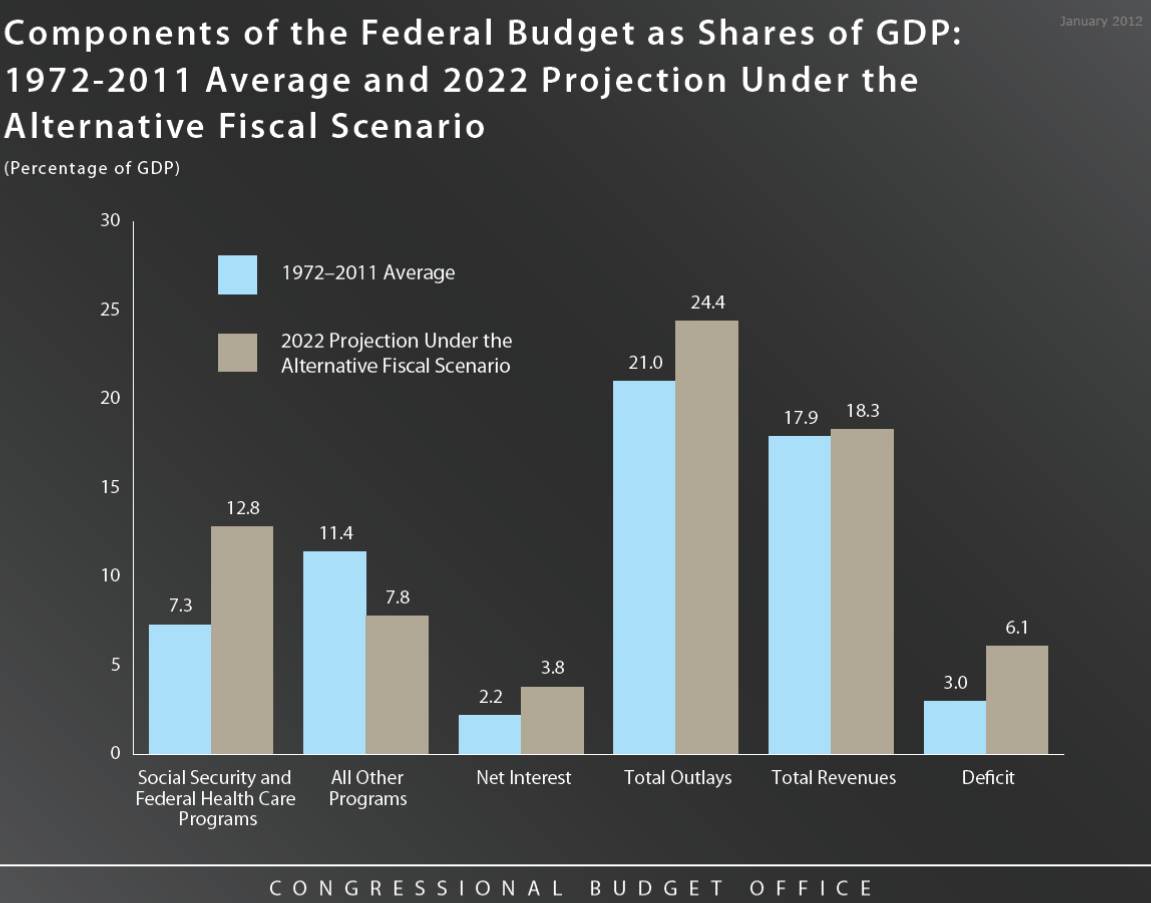

Each pair of bars in the figure below represents a component of the federal budget as a share of GDP, with the left (blue) bar of the pair showing the average during the past 40 years and the right (brown) bar our projection for 2022 under the alternative fiscal scenario.

Under this scenario, outlays for all federal programs other than Social Security and the government's major health care programs—the second set of bars—are projected to be about 8 percent of GDP in 2022, below those in any year in the past 40 years and well below the 11 percent of GDP that such outlays have averaged over that period. Even with such spending at a historically low level, the budget deficit under this scenario—shown on the far right—is projected to be 6.1 percent of GDP that year. Why? Because, under this scenario, outlays for Social Security and the health care programs—the first set of bars—would be much higher than in the past, about 5.5 percentage points of GDP more than the average over the past 40 years.

To keep debt from rising relative to GDP, the deficit would need to be about 3½ percent of GDP smaller in 2022 than we project under this alternative scenario; that's $900 billion in that year alone. Therefore, to put the federal budget on a sustainable path, policymakers will need to allow federal revenues to increase to a much higher percentage of GDP than the average over the past 40 years, or make very large changes to Social Security and federal health care programs, or pursue some combination of the two approaches.

The slides I used during my testimony can be found here.