As I mentioned in an earlier blog post, we think that some of our answers to follow-up questions from Congressional hearings may be of general interest, so we’re posting them.

Following a recent hearing, we were asked by a Member of Congress: “How would higher-than-expected interest rates affect federal budget deficits over the next decade? In particular, what would be the effects of these scenarios:

- Interest rates rise to their average levels over the 1991-2000 period;

- Interest rates rise to their average levels over the 1981-1990 period; and

- Interest rates follow a path that is consistent with the average of the 10 highest projections shown in the October 2012 and February 2013 releases of Blue Chip Economic Indicators.”

Here was our answer:

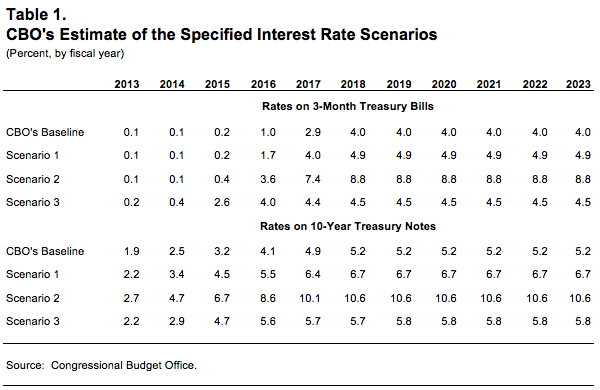

For scenarios 1 and 2, we have assumed that by 2017, interest rates would rise to and then remain at the levels that Treasury interest rates averaged during the 1990s (scenario 1) or 1980s (scenario 2). Thus, over the 2018–2023 period, rates for 3-month Treasury bills would be 4.9 percent under scenario 1 and 8.8 percent under scenario 2, compared with 4.0 percent in CBO’s baseline projections (see Table 1 below). Similarly, rates on 10-year Treasury notes would average 6.7 percent between 2018 and 2023 under scenario 1 and 10.6 percent under scenario 2, compared with 5.2 percent in the baseline projections.

For scenario 3, we have based the assumed path of rates on the average of the 10 highest forecasts from the Blue Chip Economic Indicators: Rates for 2013 and 2014 come from the February 2013 Blue Chip report, and rates for 2015 through 2023 come from the October 2012 Blue Chip report (the most recent report with longer-term projections). Following the procedure used in our 2011 analysis, we have adjusted the Blue Chip forecast upward by 30 basis points to account for significant interest rate movements since that report was released. Under that scenario, interest rates for 3-month Treasury bills would be much higher from 2015 through 2017 than in CBO’s baseline projections and would be 4.5 percent from 2018 through 2023, compared with 4.0 percent in the baseline projections.

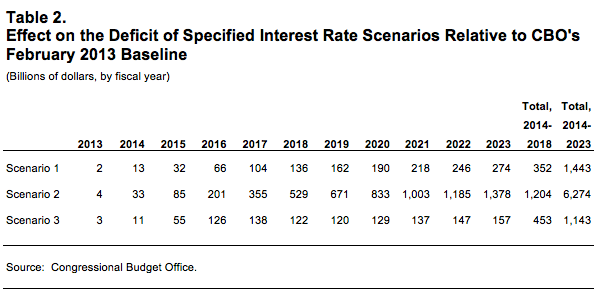

The budgetary effects of those alternative interest rate paths would be minimal in 2013 but substantial over the coming decade. Relative to CBO’s baseline projections, interest payments between 2014 and 2023 would be $1.4 trillion higher under scenario 1, $6.3 trillion higher under scenario 2, and $1.1 trillion higher under scenario 3 (see Table 2 below). Cumulative deficits and debt held by the public at the end of the 2014–2023 period would be higher by similar amounts.

CBO strives to create baseline budget and economic projections that are in the middle of the distribution of possible outcomes. As a consequence, CBO sees an equal risk of interest rates’ being higher or lower than in its baseline projection. Lower interest rates would imply lower federal interest payments, and the budgetary effects of differences in interest rates relative to CBO’s baseline would be roughly symmetric.

It is important to note that the estimates in Table 2 do not account for the effects on the federal budget of other differences in economic conditions that would probably accompany higher interest rates. For example, interest rates could be higher than in CBO’s baseline because inflation could be higher than CBO anticipates. Indeed, inflation was higher during the 1990s, and much higher during the 1980s, than CBO projects for the next decade: Inflation as measured by the consumer price index averaged 5.1 percent annually during the 1980s and is projected by CBO to average 2.2 percent over the coming decade. If CBO assumed that inflation over the next decade matched the average seen during the 1980s, to parallel the assumption about interest rates, projected tax revenues would be much higher than in CBO’s baseline projections, and federal spending would be moderately higher. On balance, those two effects would reduce deficits.

Not only was inflation higher in the 1980s and 1990s than is currently projected for the next decade, real interest rates (nominal rates adjusted for inflation) were also higher during those periods than in CBO’s baseline projections for the coming decade. If real interest rates over the next decade ended up matching those historical values, it might be because the economy (and thus demand for credit) was stronger than in CBO’s projections. In that case, revenues would be greater than the amounts projected in the baseline, offsetting some of the increase in interest costs.

The causes of higher interest rates would also affect the conduct of monetary policy by the Federal Reserve. Changes in both interest rates and the magnitude of the Federal Reserve’s purchases and sales of securities would affect remittances by the Federal Reserve to the Treasury (which are counted in the budget as revenues). Without knowing what overall economic conditions would be under those three scenarios, and thus what actions the Federal Reserve would take, it is not possible to estimate how the Federal Reserve’s remittances to the Treasury might differ from the amounts in CBO’s baseline projections.