Different generations will pay different amounts of Medicare and Social Security payroll taxes and receive different amounts of Medicare and Social Security benefits during their lifetime—as discussed in The 2013 Long-Term Budget Outlook released this week. Medicare benefits are expected to be higher for later generations primarily because of the growth of health care spending per person but also because increases in life expectancy will cause later generations to receive benefits for longer periods, on average. Social Security benefits are expected to be higher for later cohorts because of increased life expectancy and because real earnings generally grow over time. Payroll taxes will be higher for later cohorts because of that growth in real earnings.

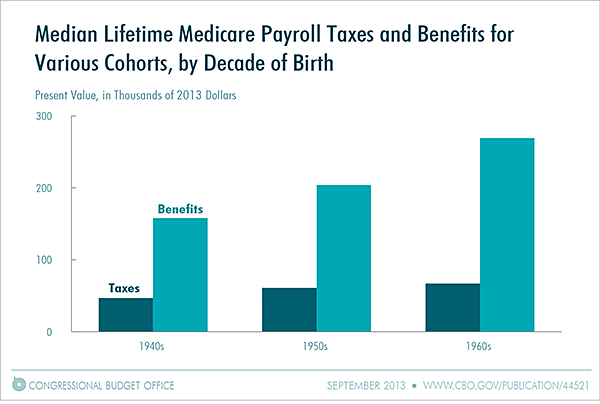

Medicare Benefits and Taxes

For Medicare, CBO estimated real (inflation-adjusted) lifetime benefits and payroll taxes for various birth cohorts as the present value, discounted to the year in which a beneficiary turns 65, of all benefits that an individual receives from Medicare (net of premiums paid for those benefits) and all payroll taxes paid to the program. (The payroll taxes are 2.9 percent of all taxable earnings, plus, beginning in 2013, an additional 0.9 percent tax on earnings over

$200,000 for single taxpayers and $250,000 for married couples.)

According to CBO’s projections, under the assumption that all scheduled benefits are paid, real median lifetime Medicare benefits (net of premiums paid) and real median lifetime payroll taxes would be greater, in general, for each successive cohort (see the figure below). Over their lifetime, beneficiaries born in the 1940s would, on average, receive about $160,000 in benefits (net of premiums paid) and pay about $45,000 in payroll taxes (both figures are expressed in 2013 dollars). Those born in the 1950s would receive, on average, about $205,000 in benefits and pay about $60,000 in payroll taxes, CBO estimates. And those born in the 1960s would receive, on average, about $270,000 in benefits and pay about $65,000 in payroll taxes.

In each cohort, Medicare beneficiaries would also pay other taxes to the federal government over their lifetime, and a portion of those other taxes would be used to finance Medicare benefits—but those amounts cannot be readily traced to taxes paid by taxpayers in different cohorts.

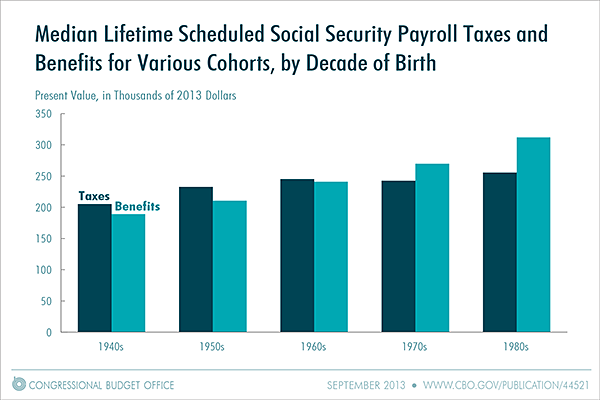

Social Security Benefits and Taxes

For Social Security, CBO estimated real lifetime benefits and payroll taxes for various birth cohorts as the present value, discounted to the year in which a beneficiary turns 62, of all benefits that an individual receives from Social Security (net of income taxes paid on benefits and credited to the Social Security trust funds) and all payroll taxes paid to the program. (Those payroll taxes are generally 12.4 percent of earnings. Only earnings up to a maximum annual amount—$113,700 in 2013—are subject to the payroll tax.)

According to CBO’s projections, under the assumption that all scheduled benefits are paid, real median lifetime Social Security benefits and real median lifetime payroll taxes would be greater, in general, for each successive cohort (see the figure below). Over their lifetime, beneficiaries born in the 1940s would, on average, receive about $190,000 in benefits and pay about $205,000 in payroll taxes. Those born in the 1960s would, on average, receive $240,000 in benefits and pay $245,000 in payroll taxes; and those born in the 1980s would, on average, receive $310,000 in benefits and pay $260,000 in payroll taxes. For workers born from the 1940s through the 1980s, taken all together, lifetime payroll taxes would be roughly equal to lifetime benefits. But benefits for earlier generations were considerably larger than their payroll taxes, and that historical imbalance contributes to the system’s ongoing financial shortfall. (Because Social Security benefits are more predictable than Medicare benefits, CBO has extended its projections for Social Security further into the future.)

The calculations of lifetime benefits and payroll taxes are based on a real discount rate of 3.0 percent, the average long-term interest rate projected by CBO for securities held in the trust funds for Medicare and Social Security.

Julie Topoleski and Noah Meyerson are analysts in CBO’s Health, Retirement, and Long-Term Analysis Division.