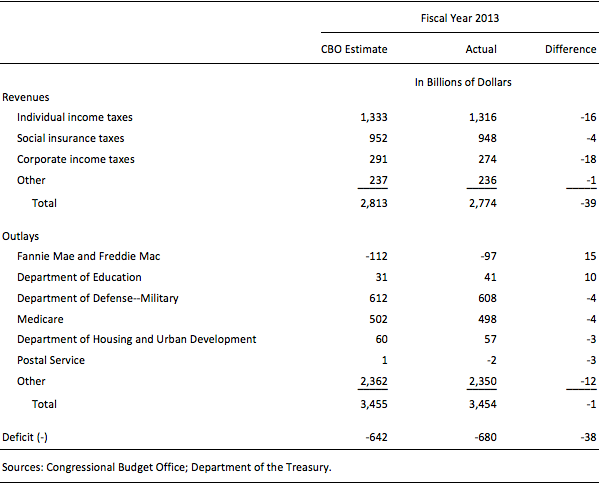

On October 30, the Treasury Department reported that the federal budget deficit for fiscal year 2013 totaled $680 billion, $38 billion more than CBO estimated in its most recent baseline in May. Nearly all of that difference occurred because revenues were less than CBO estimated (see the table below).

Revenues in fiscal year 2013 totaled $2,774 billion—$39 billion (or 1.4 percent) less than CBO projected in May:

- Receipts from corporate income taxes were $18 billion less than the amount that CBO estimated, largely reflecting an unexpected slowing in the growth of those receipts in the last several months of the fiscal year.

- Receipts from individual income taxes were $16 billion less than the baseline projection, because both quarterly estimated payments and withholding from paychecks were lower than expected.

- Social insurance receipts (which are dedicated to funding Medicare, Social Security, other retirement programs, and unemployment benefits) were $4 billion lower than the May projection—reflecting receipts from unemployment insurance taxes that were $9 billion less than anticipated, partially offset by higher receipts from other sources.

Outlays in 2013 were $3,454 billion—about $1 billion (or 0.03 percent) less than CBO estimated in May. That small difference resulted from larger discrepancies throughout the budget that nearly offset one another:

- The largest such discrepancy involves Fannie Mae and Freddie Mac, which remitted $15 billion less in payments to the Department of Treasury than CBO had estimated. Those payments are recorded in the budget as offsetting receipts, which reduce net outlays. So the smaller-than-expected payments to the Treasury increased outlays relative to CBO’s estimate.

- Spending by the Department of Education was $10 billion more than CBO projected in May, mostly as a result of the enactment of the Bipartisan Student Loan Certainty Act of 2013, which boosted outlays in 2013 by $8 billion, according to CBO’s estimate.

- In the other direction, outlays for the Department of Defense were $4 billion less than CBO expected, principally because of lower-than-anticipated spending for personnel.

- Spending was also lower than CBO projected for Medicare (by $4 billion), the Department of Housing and Urban Development (by $3 billion), and the Postal Service (by $3 billion).

- All other spending—totaling $2.3 trillion—was $12 billion (0.5 percent) below what CBO estimated in May.

CBO is currently in the process of analyzing the year-end results in more detail and will publish additional information about revenues and outlays in 2013 in its Monthly Budget Review that will be issued tomorrow and in its next Budget and Economic Outlook, which will be published early next year.

Barry Blom is an analyst in CBO’s Budget Analysis Division.