I was honored to speak today to the Economic Club of Minnesota. My presentation was titled Making Choices About Federal Spending and Taxes.

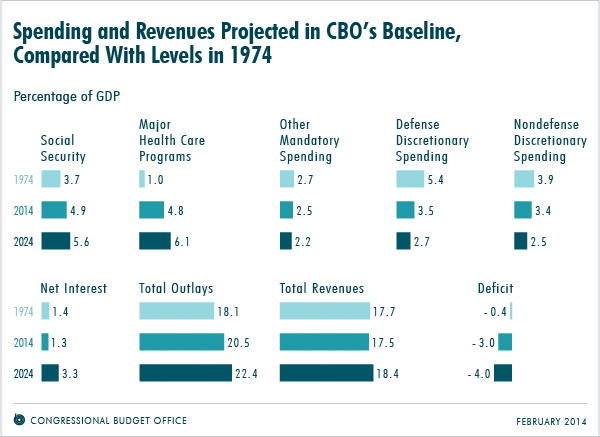

I began by noting that the federal budget deficit has fallen sharply from its peak in 2009 of $1.4 trillion and nearly 10 percent of GDP—to about $500 billion and 3 percent of GDP estimated for 2014. But I emphasized that the nation has not made the fundamental choices it needs to make: Federal debt remains on an unsustainable path, and the composition of federal spending is changing dramatically from what it has been in the past (see the figure below).

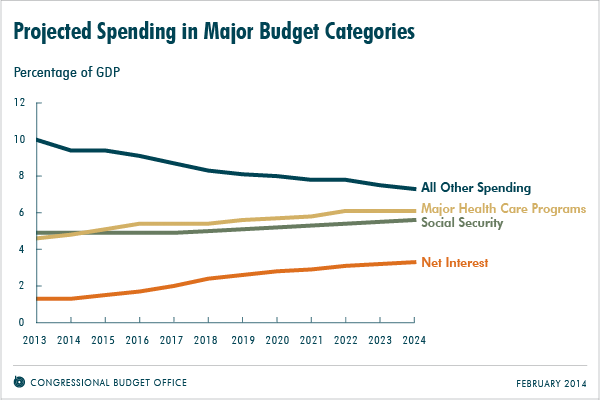

The shift in the composition of federal spending is being driven by a combination of the aging of the population, the expansion of federal subsidies for health insurance, rising health care costs per person, a projected return of interest rates to more typical levels, and caps on most discretionary funding. As a result, spending for Social Security, major health care programs, and net interest is rising relative to the size of the economy—while all other spending is falling sharply relative to the size of the economy (see the figure below).

I also discussed four criteria for evaluating changes in federal budget policies that we examined in our December report Choices for Deficit Reduction: An Update:

1) What Role Would the Federal Government Play in Society?

In considering policies aimed at reducing deficits, policymakers and the public would need to make judgments about the proper size and scope of the federal government, including the types of activities they consider appropriate for the government to carry out or subsidize and the weight they give to various types of spending and to various benefits conveyed through so-called tax expenditures (provisions of the tax code that resemble government spending by providing financial assistance for specific activities, entities, or groups of people).

2) How Much Would Deficits Be Reduced?

Many approaches are possible. For example, the ratio of debt to GDP in 25 years could be brought down close to its 40-year average if deficits in this decade were reduced by $4 trillion relative to what would happen under current law (excluding interest savings and assuming that the reduction as a percentage of GDP at the end of the decade was maintained later). With deficit reductions totaling $2 trillion during this decade, the ratio of debt to GDP would be close to what it is today.

3) What Would the Economic Impact Be?

In the short term, reductions in federal spending or increases in taxes would generally reduce demand for goods and services, thereby lowering output and employment—especially under current economic conditions. In the long term, reductions in federal deficits would generally increase national saving and investment, thereby raising output and income.

4) Who Would Bear the Burden of Proposed Changes in Tax and Spending Policies?

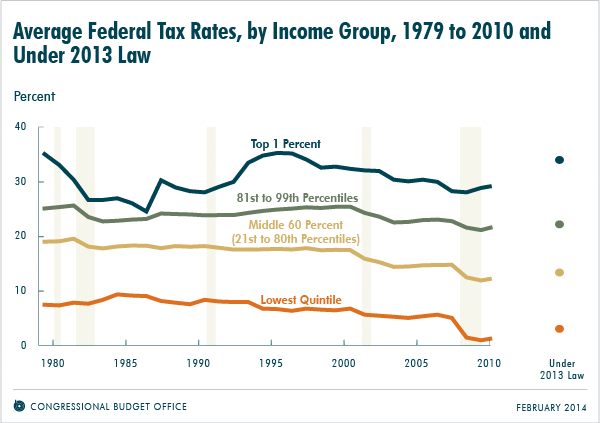

Different types of tax increases and spending cuts would affect various groups of people to different extents. CBO recently analyzed how tax burdens and government benefits and services were distributed among the population in 2006. The combined effect of federal transfers and taxes is to shift resources from people living in nonelderly households to people living in elderly households and to shift resources from higher-income nonelderly households to lower-income nonelderly households. CBO recently estimated that total federal taxes relative to household income in 2013 were near the low end of the range seen during the past 30 years for households up to the 99th percentile of the income distribution—but at the high end of the range for households with income in the top 1 percent of the distribution (see the figure below).