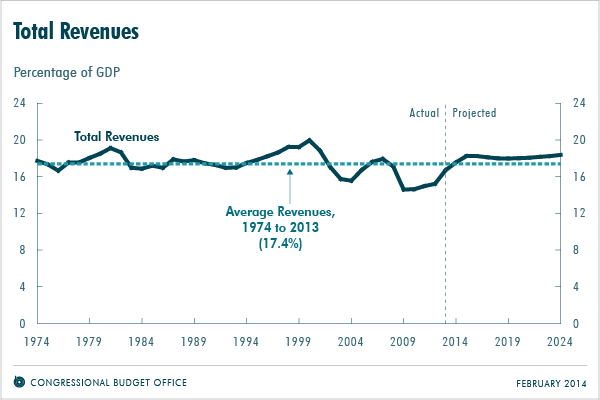

The federal government’s revenues will increase by 9 percent in 2014 and by another 9 percent in 2015, CBO projects in The Budget and Economic Outlook: 2014 to 2024, reaching $3.3 trillion in 2015—about $530 billion more than receipts in 2013. As a share of gross domestic product (GDP), revenues are projected to rise from 16.7 percent in 2013 to 17.5 percent (about the average for the past 40 years) in 2014 and to 18.2 percent in 2015. They are projected to remain between 18.0 percent and 18.4 percent of GDP from 2016 through 2024. Because of the recent recession, revenues had fallen to 14.6 percent of GDP in both 2009 and 2010 (see the figure below).

CBO’s current revenue projections are lower than the comparable projections published last May—by a total of $1.6 trillion (or 4 percent) over the ten-year period in which the forecasts overlap. That reduction largely reflects slower GDP growth in CBO’s updated economic forecast.

Revenues Are Projected to Rise as a Share of GDP Between 2013 and 2015

More than half of the projected growth in revenues relative to GDP between 2013 and 2015 comes from changes in provisions of law that have already occurred or are scheduled to occur. The largest contributors are the following:

- The expiration, at the end of calendar year 2013, of a number of tax provisions that reduced corporate and individual income taxes, especially one that allowed businesses to immediately deduct a significant portion of their investment in equipment.

- A number of changes that, because they took effect in January 2013, will increase revenues more in fiscal year 2014, the first full fiscal year they are in effect, than they did in fiscal year 2013. Those changes include the expiration of a two-year reduction in Social Security payroll tax rates, as well as increases in income tax rates and a new surtax on investment income that apply to certain high-income individuals.

- New taxes, fees, and fines related to health insurance coverage under the Affordable Care Act, although those additional revenues will be partially offset by new tax credits to subsidize the purchase of health insurance.

Revenues are also projected to rise relative to GDP this year and next year for a number of other reasons. The factors that significantly reduced corporate income tax revenues during the recession have since diminished, and CBO expects them to wane further as the economy continues to recover. In addition, CBO projects that growth in people’s real (inflation-adjusted) income will push more of their income into higher tax brackets, a phenomenon called real bracket creep. Moreover, CBO expects that taxable distributions from tax-deferred retirement accounts will increase faster than GDP, in part because the balances in those accounts have been boosted in the past two years by a rapid increase in equity prices, which will allow people to make larger withdrawals.

Revenues Are Projected to Vary Slightly as a Share of GDP From 2016 Through 2024

After this year and next, revenues in CBO’s baseline projections remain between 18.0 percent and 18.4 percent of GDP from 2016 through 2024, largely because of offsetting movements in three sources of revenue:

- Individual income tax receipts are projected to increase as a share of GDP, mostly as a result of real bracket creep and increases in withdrawals from tax-deferred retirement accounts as baby boomers retire.

- Corporate income tax receipts are projected to decline relative to the size of the economy because of an expected drop in domestic economic profits relative to GDP, a result of rising interest payments on businesses’ debt, growing labor costs, and increasing depreciation deductions on the larger stock of business capital.

- Remittances to the Treasury from the Federal Reserve—which have been very large in the past four years because of changes in the size and composition of the central bank’s portfolio—are projected to decline to more normal levels.

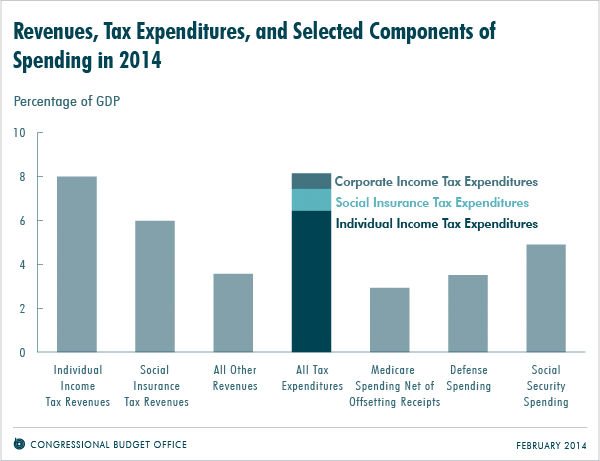

Tax Expenditures Have a Significant Effect on Total Revenues

The tax rules on which CBO’s projections are based include the tax rates that apply to different types of income; they also include an array of exclusions, deductions, preferential rates, and credits, which reduce revenues, for any given level of tax rates, in both the individual and corporate income tax systems. Some of those provisions are called tax expenditures because, like government spending programs, they provide financial assistance to particular activities, entities, or groups of people. The tax expenditures that have the largest effect on revenues are the following:

- The exclusion from workers’ taxable income of employers’ contributions for health care, health insurance premiums, and long-term-care insurance premiums;

- The exclusion of contributions to and earnings of pension funds (minus pension benefits that are included in taxable income);

- Preferential tax rates on dividends and long-term capital gains; and

- The deduction of interest that homeowners pay on mortgages for their residences.

Those and other tax expenditures have a major effect on the federal budget. On the basis of estimates prepared by the staff of the Joint Committee on Taxation, CBO expects that under current law, tax expenditures will total $1.4 trillion in 2014—or 8.2 percent of GDP—if their effects on social insurance taxes as well as on income taxes are included. That amount equals nearly half of all federal revenues projected for the year and exceeds projected spending on Social Security, defense, or Medicare (see the figure below). Most of that amount arises from the 12 largest tax expenditures, which CBO estimates will total about 6.0 percent of GDP in 2014 and 6.5 percent of GDP from 2015 to 2024.

The total amount of tax expenditures, however, does not represent the increase in revenues that would occur if all tax expenditures were eliminated, because repealing a tax expenditure would change incentives and lead taxpayers to modify their behavior in ways that would mute the revenue impact of the repeal. For example, if preferential tax rates on capital gains realizations were eliminated, taxpayers would reduce the amount of capital gains they realized; as a result, the amount of additional revenues that would be produced by eliminating the preferential rates would be smaller than the estimated size of the tax expenditure. Furthermore, a simple total of the estimated revenue effects of repealing various tax expenditures would not account for the interactions that would arise if multiple expenditures were repealed at the same time. As it turns out, however, the effect in fiscal year 2014 of eliminating all tax expenditures would be roughly equal to the sum of the effects of eliminating each of those tax expenditures.

Mark Booth is Unit Chief for revenue estimating in CBO’s Tax Analysis Division. Joshua Shakin is an analyst in CBO’s Tax Analysis Division.