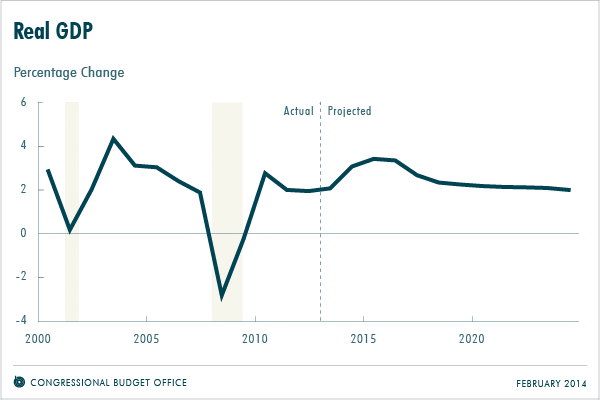

After a frustratingly slow recovery from the severe recession of 2007 to 2009, the economy will grow at a solid pace in 2014 and the next few years, averaging about 3 percent per year, according to CBO’s most recent economic projections, which were published earlier this month in The Budget and Economic Outlook: 2014 to 2024. From 2018 to 2024, CBO projects the growth of real (inflation-adjusted) gross domestic product (GDP) will average 2.2 percent per year.

What Is the Outlook for the Economy Through 2017?

Over the next few years, CBO anticipates that increases in housing construction and investment by businesses will boost overall output, employment, and incomes, and, therefore, consumer spending. In addition, under current law, federal fiscal policy will restrain the growth of the economy by much less than it has recently. As measured by the change from the fourth quarter of the previous year, real GDP is projected to increase by 3.1 percent this year, by 3.4 percent per year in 2015 and 2016, and by 2.7 percent in 2017; by comparison, real GDP increased by 2.7 percent in 2013 (see the figure below). By the second half of 2017, CBO projects, real GDP will return to its average historical relationship with potential (or maximum sustainable) GDP—that is, slightly below its potential level.

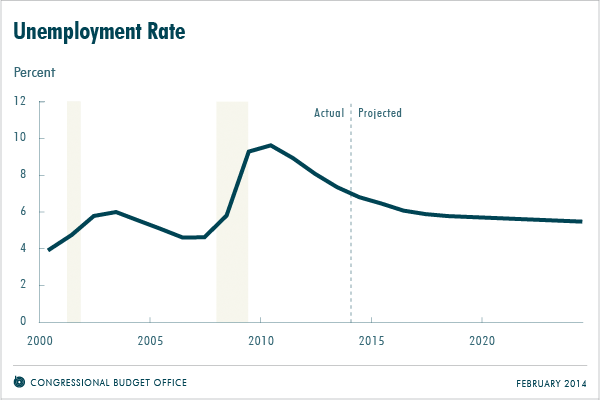

Nevertheless, CBO estimates that the economy will continue to have considerable unused labor and capital resources—or “slack”—for the next few years. According to the agency’s projections, the unemployment rate will decline gradually but remain above 6.0 percent until late 2016 (see the figure below). A post tomorrow will discuss, in greater detail, the slow recovery of the labor market.

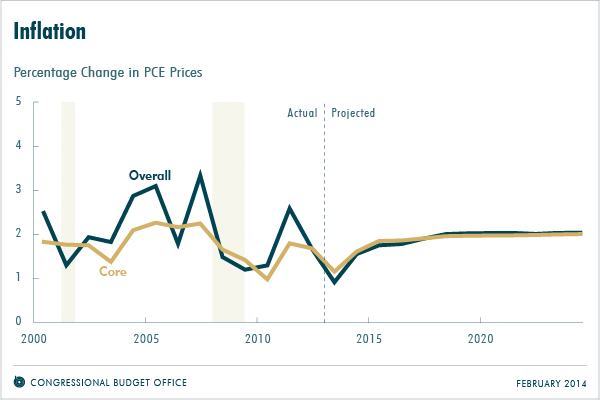

CBO anticipates that prices will rise at a modest pace over the next several years, consistent with the slack in the economy and expectations for stable inflation (see the figure below). In CBO’s projections, the price index for personal consumption expenditures excluding food and energy—the core PCE price index—increases by 1.6 percent in 2014, up from the unusually low reading of 1.1 percent in 2013. (Those increases represent the change from the fourth quarter of the previous year.) After 2014, according to CBO’s projections, the rate of inflation in the PCE price index will rise slowly toward 2.0 percent, which is the Federal Reserve’s goal.

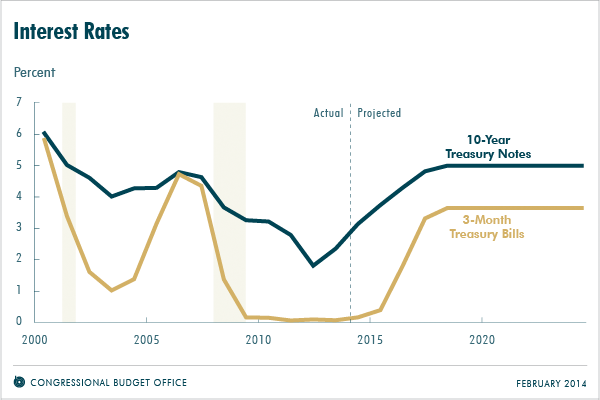

CBO also projects that the Federal Reserve will keep short-term interest rates at their current low levels until mid-2015 and that long-term interest rates will rise gradually as the economy strengthens (see the figure below).

What Is the Outlook for the Economy From 2018 Through 2024?

From 2018 through 2024, CBO projects real GDP to grow at the same rate as potential output—2.2 percent, on average—because the agency does not attempt to predict the timing or magnitude of fluctuations in the economy so far into the future. In CBO’s projections, the unemployment rate falls to 5.5 percent by 2024, and inflation stays at 2.0 percent between 2018 and 2024. The interest rate on 10-year Treasury securities, which will gradually increase during the next few years as the economy strengthens, is projected to be 5.0 percent during the 2018–2024 period.

During that period (and over the next few years as well), potential output is projected to grow much more slowly than it has, on average, since 1950. That difference primarily reflects long-term trends, particularly slower growth of the labor force caused by the aging of the baby boom generation. In addition, by CBO’s estimates, potential output in 2024 will be constrained by the lingering effects of the recent recession and slow recovery and by federal tax and spending policies in current law.

How Do CBO’s Current Projections Differ From its Previous Forecast?

CBO’s current economic projections differ in a number of ways from its previous projections, which were issued in February 2013. In particular, CBO now projects real GDP growth averaging 2.6 percent annually during the 2014–2023 period, which is roughly 0.3 percentage points below the projection a year ago. That difference derives principally from three factors:

- CBO has revised downward its estimate of the growth of potential output, in part because its growth during the past five years now appears to have been lower than previously estimated; in CBO’s projections, potential output in 2023 is about 1.5 percent lower than the amount estimated a year ago.

- Actual GDP currently appears to be closer to potential GDP than was previously estimated, in part because revisions to historical data raised estimated real GDP growth since 2009, leaving less room for GDP to grow before it nears its potential.

- CBO now expects that output will fall slightly short of its potential, on average, even after the economy has largely recovered from the recent economic downturn in the later years of the projection period. In the same vein, CBO has revised its projection for the unemployment rate in the second half of the coming decade so that it remains above the natural rate (the rate arising from all sources except fluctuations in overall demand for goods and services). Also, the agency has lowered its estimates of interest rates in the latter part of the coming decade, primarily because of the slight projected shortfall of output relative to its potential.

How Do CBO’s Current Projections Differ From Those of Other Forecasters?

CBO’s current economic projections differ only modestly from the January 2014 Blue Chip consensus forecast (which is based on the forecasts of about 50 private-sector economists) and the December 2013 forecasts by members of the Federal Reserve Board and presidents of the Federal Reserve Banks. CBO’s projection for the growth of real GDP is slightly higher than that of the Blue Chip consensus for 2014 but is within the central tendency of the range of Federal Reserve forecasts for both 2014 and 2015. CBO’s projection for the unemployment rate is essentially the same as that of the Blue Chip consensus for 2014 but is slightly above the central tendency of the range of Federal Reserve forecasts for 2014 and 2015. CBO’s projections for inflation are very similar to those of the outside forecasters.

The economic recovery has had unusual features that have been hard to predict, and the path of the economy in coming years is also likely to be surprising in various ways. Many developments, such as changes in laws governing federal fiscal policy and unforeseen changes in businesses’ confidence, the economies of other countries, interest rates, stock prices, and the availability of mortgage credit, could cause economic outcomes to differ substantially, in one direction or the other, from those that CBO and other forecasters have projected.

Mark Lasky and Charles Whalen are analysts in the Macroeconomic Analysis Division.