As a companion to CBO’s The Budget and Economic Outlook: 2014 to 2024 released earlier this month, CBO released The Slow Recovery of the Labor Market—a report that takes a closer look at developments in the labor market since the recent recession and CBO’s projections for the labor market for the next decade.

The Slow Recovery of the Labor Market Largely Reflects Slow Growth in Demand for Goods and Services

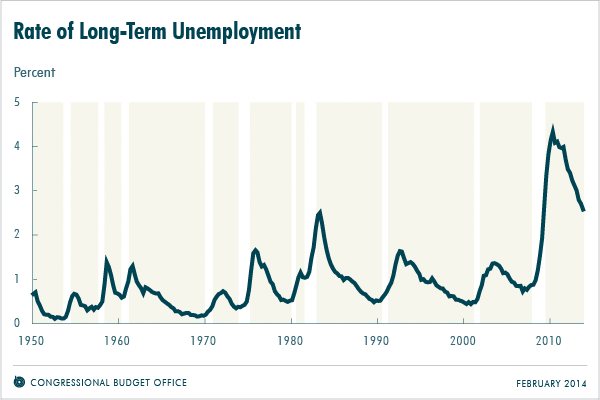

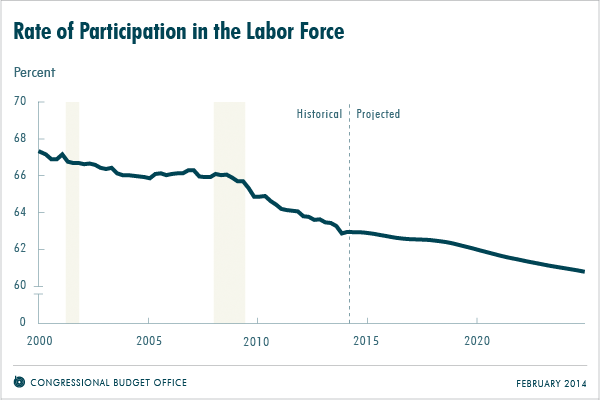

The deep recession that began in December 2007, when the economy began to contract, and ended in June 2009, when the economy began to expand again, has had a lasting effect on the labor market. More than four and a half years after the end of the recession, employment has risen sluggishly—much more slowly than it grew, on average, during the four previous recoveries that lasted more than one year. At the same time, the unemployment rate has fallen only partway back to its prerecession level (as shown in yesterday’s blog post), and a significant part of that improvement is attributable to a decline in labor force participation that has occurred as an unusually large number of people have stopped looking for work (see the figure below). Moreover, the rate of long-term unemployment—the percentage of the labor force that has been out of work for more than 26 consecutive weeks—remains extraordinarily high.

To a large degree, the slow recovery of the labor market reflects the slow growth in the demand for goods and services, and hence gross domestic product (GDP). CBO estimates that GDP was 7½ percent smaller than potential (maximum sustainable) GDP at the end of the recession; by the end of 2013, less than one-half of that gap had been closed. With output growing so slowly, payrolls have increased slowly as well—and the slack in the labor market that can be seen in the elevated unemployment rate and in part of the reduction in the rate of labor force participation mirrors the gap between actual and potential GDP.

To a smaller degree, the slow recovery of the labor market is the result of structural factors that stem from the recession and the slow recovery of output but that are not directly related to the economy’s current cyclical weakness. For example, an exceptionally large number of people have been unemployed for long periods, and the stigma attached to their long-term unemployment, along with a possible erosion of their job skills, has made it difficult for them to find new work.

In assessing the slow recovery of the labor market, CBO reached the following conclusions:

- Of the roughly 2 percentage-point net increase in the unemployment rate between the end of 2007 and the end of 2013, the portions that can be attributed to different factors are shown in the table below.

Percentage Points About 1 Cyclical weakness in demand for goods and services About 1 Structural factors—specifically: About ½ Stigma and erosion of skills from long-term unemployment About ½ Decrease in efficiency of matching workers and jobs, at least partly from mismatches in skills and locations - Of the roughly 3 percentage-point net decline in the labor force participation rate between the end of 2007 and the end of 2013, the portions that can be attributed to different factors are shown in the table below.

Percentage Points About 1 ½ Long-term trends (primarily aging of the population) About 1 Cyclical weakness in job prospects and wages About ½ Discouraged workers who have dropped out of the labor force permanently - Employment at the end of 2013 was about 6 million jobs short of where it would be if the unemployment rate had returned to its prerecession level and if the participation rate had risen to the level it would have attained without the current cyclical weakness. Those factors account roughly equally for the shortfall.

Over the Next Decade: A Strengthening Economy but Slow Growth in the Labor Force

CBO expects that, under current laws governing federal taxes and spending, output will grow more rapidly in the next few years than it has in the recent past but recovery in the labor market will continue for some time. The agency projects that by the second half of 2017, the gap between actual and potential GDP will return to its average historical relationship—bringing the effects of cyclical conditions on unemployment and labor force participation back to their average values in 2018.

However, CBO projects, the aging of the population will further reduce labor force participation during the coming decade, and the longer-lasting effects of the recession and slow recovery on unemployment and the size of the labor force will continue, albeit with diminishing magnitude, throughout the decade. All told, CBO projects that the unemployment rate will fall to 5.8 percent by the end of 2017 and to 5.5 percent by 2024 (compared with 4.8 percent at the end of 2007) and that the labor force participation rate will decline to 60.8 percent by 2024 (compared with 66.0 percent at the end of 2007; see figure below).

The pace and nature of the economic recovery have been difficult to predict, and the path of the economy and the labor market will no doubt hold surprises as well. CBO’s projections of the labor market are subject to several sources of uncertainty, and many developments could cause outcomes substantially different from those CBO has projected.

David Brauer and Charles Whalen are analysts in CBO’s Macroeconomic Analysis Division.