I was very pleased to speak yesterday at Williams College about federal health care spending. After explaining CBO’s approach to policy analysis, I addressed two main questions (view my slides).

Why Is Federal Health Care Spending Growing?

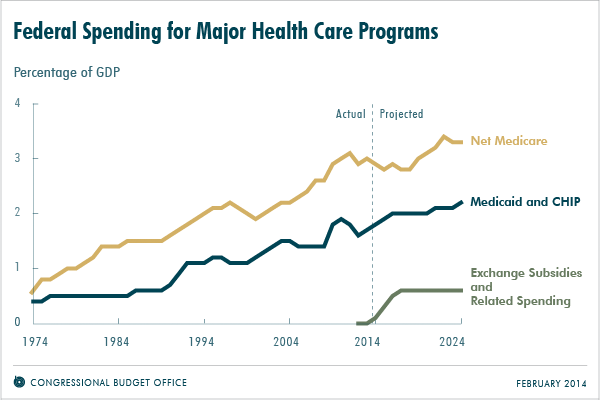

I described our projection that, under current law, net federal spending for major health care programs will grow from 4.6 percent of gross domestic product (GDP) in 2013 to 6.1 percent of GDP in 2024.

I then discussed the main factors that are causing federal health care spending to grow much faster than the economy:

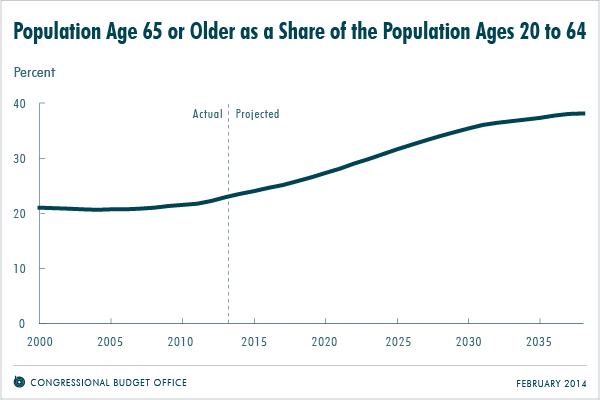

- The U.S. population is aging

- Health care costs per person have risen substantially over time, and that trend is likely to continue

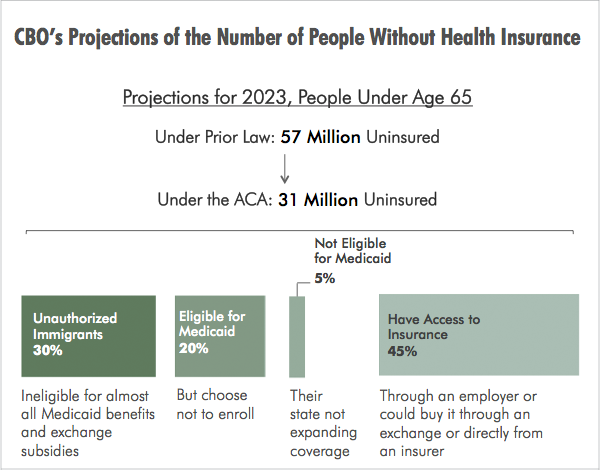

- The federal government is expanding its subsidies for health insurance through the Affordable Care Act (ACA); that expansion will significantly reduce the number of people without health insurance

What Could Be Done About the Growth of Federal Health Care Spending?

I summarized CBO’s analysis of a wide range of possible approaches in Health-Related Options for Reducing the Deficit: 2014 to 2023. In that report, we analyzed the consequences for the federal budget, beneficiaries, and health care providers of illustrative ways that have been proposed to:

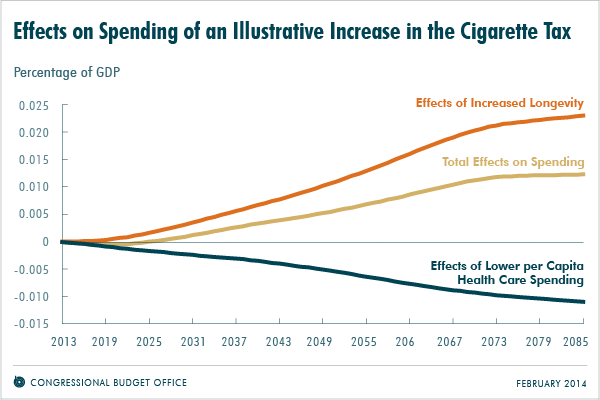

- Improve the health of the population (for example, by taking steps to reduce smoking or obesity, increase screening for diseases, or improve people’s compliance with treatment regimens for chronic diseases)—but I noted that policies that make people healthier do not necessarily reduce federal spending

- Reduce federal subsidies for health insurance (for example, by repealing or narrowing the expanded eligibility for subsidies under the ACA, reducing the size of exchange subsidies under the ACA, raising the eligibility age for Medicare, increasing premiums in Medicare, increasing cost sharing in Medicare, or reducing the tax subsidy for employment-based health insurance)

- Pay Medicare providers in different ways (for example, by shifting physicians’ payments away from the fee-for-service model or bundling payments for related services)

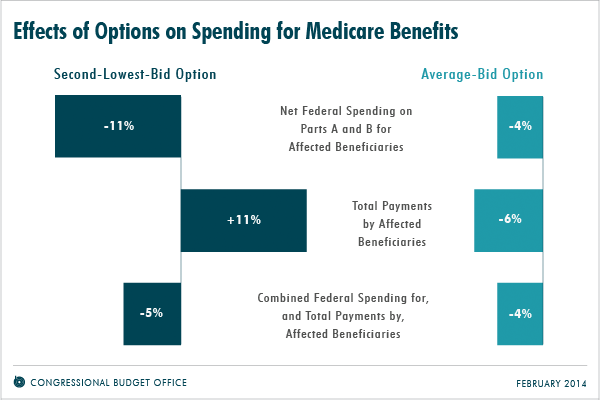

- Make larger structural changes to federal health care programs (for example, by adopting a premium support system for Medicare or capping payments to states for Medicaid)

In conclusion, I noted that federal lawmakers often strive for policies that both reduce the growth of federal health care spending and improve the effectiveness of the national health care system—but that designing federal policies to achieve both of those goals is challenging: Most policies have significant disadvantages as well as advantages, and how health insurers, health care providers, and individuals would respond to most policies is uncertain.