Last Monday, the Congressional Budget Office released The Budget and Economic Outlook: 2018 to 2028, the latest installment of an annual report explaining the agency’s budget and economic projections. This week, CBO is publishing daily blog posts to share key excerpts from the report, and today’s post is about the projections of federal revenues.

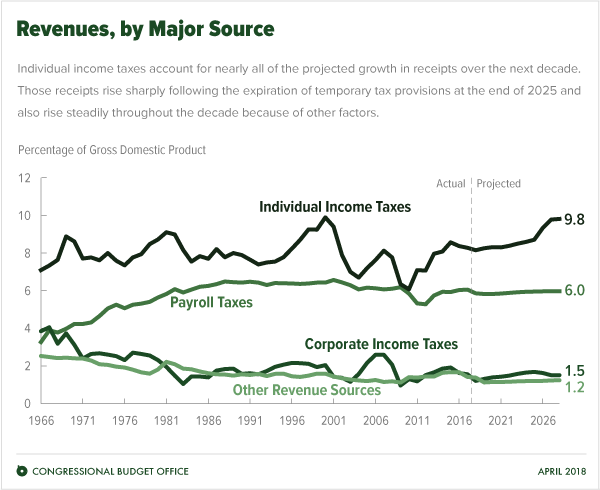

CBO projects that, if current laws generally remain unchanged, total revenues will rise by less than 1 percent in 2018, to just over $3.3 trillion. Revenues are expected to decline as a percentage of gross domestic product (GDP)—from 17.3 percent in 2017 to 16.6 percent in 2018—below the average of 17.4 percent of GDP recorded over the past 50 years. In CBO’s baseline projections, after a further slight decline in 2019, revenues rise markedly as a share of the economy, growing to 18.5 percent of GDP by 2028. Revenues over the past 50 years have been as high as 20.0 percent of GDP (in 2000) and as low as 14.6 percent (in 2009 and 2010).

What Key Factors Explain Changes in Revenues Over Time?

The decline in revenues as a percentage of GDP in 2018, and to a lesser extent in 2019, results from the enactment in late December 2017 of Public Law 115-97, referred to here as the 2017 tax act. That law made many significant changes to the individual and corporate income tax systems. Those changes, on net, lowered taxes owed by most individuals and businesses beginning in calendar year 2018. Most of the provisions that directly affect the individual income tax are scheduled to expire at the end of 2025.

After 2019, revenues are projected to rise steadily through 2025, reaching 17.5 percent of GDP in 2025. In CBO’s baseline, receipts then rise sharply following the scheduled expiration of many temporary provisions of the 2017 tax act at the end of calendar year 2025. As a share of GDP, they are projected to reach 18.1 percent in 2026, and 18.5 percent in 2027 and 2028.

The growth in revenues over the next decade reflects the following movements among sources of revenues:

- Individual income tax receipts are projected to rise sharply between 2025 and 2027, following the expiration of temporary provisions enacted in the 2017 tax act. In addition to those expirations, other factors would cause receipts to grow throughout the next decade, primarily the following: Wages are projected to grow faster than GDP; real bracket creep (which occurs when incomes rise faster than inflation) is projected to cause income to be taxed at higher rates, boosting taxes relative to income; and distributions from tax-deferred retirement accounts are expected to rise.

- Corporate income tax receipts are projected to rise as a percentage of GDP after 2018 for two reasons. First, changes in tax rules that are scheduled to occur over the next decade would gradually boost receipts. Second, CBO expects that the factors responsible for recent unexplained weakness in corporate tax collections will gradually dissipate. An anticipated decline in domestic economic profits relative to the size of the economy would partially offset those factors.

- Receipts from all other sources are projected to remain relatively stable over the next decade. Revenues from payroll taxes are projected to edge up slightly as a share of the economy and receipts from excise taxes to decline slightly.

How Have CBO’s Projections Changed Since June 2017?

CBO’s revenue projections for the 2019–2028 period are lower than those the agency released in June 2017. At that time, CBO published revenue projections for the 2017–2027 period; the projections in CBO’s current report cover the 2018–2028 period. For the overlapping years—2018 through 2027—the current projections are below the previous ones by $1.0 trillion (or about 2 percent). That reduction stems from legislative changes, including those from the enactment of the 2017 tax act, as well as from technical revisions. Those downward revisions are partly offset by changes to the agency’s economic forecast, primarily to projections of GDP and the types of income that comprise GDP, such as wages and salaries, corporate profits, and proprietors’ income.

How Much Revenue Is Forgone Because of Tax Expenditures?

The tax rules that form the basis of CBO’s projections include an array of exclusions, deductions, preferential rates, and credits that reduce revenues for any given level of tax rates, in both the individual and corporate income tax systems. Some of those provisions are called tax expenditures because, like government spending programs, they provide financial assistance for particular activities as well as to certain entities or groups of people.

Tax expenditures have a major impact on the federal budget. CBO estimates that in fiscal year 2017, the more than 200 tax expenditures in the income tax system totaled almost $1.7 trillion in forgone individual income tax, payroll tax, and corporate income tax revenues. That amount equaled 8.9 percent of GDP—more than half of all federal revenues received in that year. CBO estimates the magnitude of tax expenditures on the basis of the estimates prepared by the staff of the Joint Committee on Taxation, which has not yet released estimates incorporating the effects of the 2017 tax act and subsequent legislation. Those changes in law will generally reduce the magnitude of tax expenditures beginning in 2018.

How Uncertain Are CBO’s Revenue Projections?

CBO’s revenue projections since 1982 have, on average, been too high—more so for projections spanning six years than for those spanning two—owing mostly to the difficulty of predicting when economic downturns will occur. However, their overall accuracy has been similar to the accuracy of projections by other agencies.

Joshua Shakin is the chief of the Revenue Estimating Unit in CBO’s Tax Analysis Division. Nathaniel Frentz, Cecilia Pastrone, Kurt Seibert, Joshua Shakin, and Jennifer Shand performed this analysis, with guidance from John McClelland.