At a Glance

Federal investments can provide long-term benefits and can spur economic growth. The federal budget records expenses for investment projects up front, not over the project’s lifetime of use. Because of that mismatch between when costs are recorded and when benefits occur, investment projects may seem expensive relative to other government expenditures, and the large amounts of up-front funding required for some types of investments can make it difficult to fund them within the constraints of the budget process.

The economic benefits of increasing capital spending would depend on how well the additional funds were targeted to high-value projects and on the extent to which they displaced spending that would otherwise be undertaken by the private sector or by state and local governments. However, among competing uses of federal resources, more federal investment might not be the most warranted or desirable option.

This report examines budgetary options that would distinguish expenditures for investment in physical capital, education, and research and development from other expenditures.

- Adopting an accrual approach with a separate capital budget would spread the cost of investments over the period when potential benefits accrued rather than appearing in full when the spending occurred (the current cash-based approach). For physical capital, the budget would record costs as the assets lost value over time.

Such an approach would eliminate some of the spikes in programs’ budgets from up-front funding of new capital investments. In addition, accrual accounting would facilitate comparisons of competing programs’ costs and benefits. However, an accrual approach with a separate capital budget could lessen lawmakers’ control over budgetary resources, increase complexity, and diminish transparency. It would also make the federal budget process more prone to manipulation by federal agencies and policymakers that might adopt a broad definition of capital investment or understate depreciation costs.

- An alternative (more incremental) approach would provide both cash and accrual measures of capital spending in separate budgetary accounts within the unified budget, which shows the sum of all government activity. The accounts would be structured so that depreciation was reported in an agency’s budget (and netted out elsewhere), but the cash flows associated with an investment would affect the overall budget deficit, as they do now.

- Other options would retain cash-based accounting. To focus on investment spending, lawmakers could adopt a separate cash-based capital budget (an approach used by many states). A more limited change can be found in the Trump Administration’s 2021 budget, which proposed establishing a revolving fund to serve as a cash-based capital budget for federally owned buildings. Alternatively, lawmakers could establish a separate cap on investment funding within the unified budget.

Notes

Notes

Unless this report indicates otherwise, all years referred to are federal fiscal years, which run from October 1 to September 30 and are designated by the calendar year in which they end.

Numbers in the text and tables may not add up to totals because of rounding.

The Congressional Budget Office has corrected this report since its original publication. Corrections are listed at the end of the report.

Summary

In general, federal investment comprises spending on goods and services that provide benefits for a long time after their acquisition. The federal budget records the full cost of commitments for federal investments when they are incurred, and it records the associated cash expenditures as outlays when they are disbursed. That budgetary practice is consistent with the principle that the budget acknowledges commitments when they are made, which is when they are easiest to control and verify.

Some observers question whether that system provides lawmakers with the information they need to allocate the government’s resources most efficiently among competing priorities. Different approaches to capital budgeting might provide lawmakers with more information about federal investments, but they would complicate the budget process and, in some cases, lessen control over spending.1

The alternative approach to budgeting for federal investment most frequently considered by policymakers is an accrual-based accounting system with a separate capital budget. Under that system, budgetary obligations and outlays for federal investments would be spread over many years to match annual budgetary resources with the assets’ pace of depreciation (wear and tear and technical obsolescence). That approach roughly corresponds to the system used by the private sector, by the federal government in its annual financial report, and by several other countries. It would better align the assets’ costs and benefits with their period of use.

What Constitutes Federal Investment?

In general, federal investments are assets that are expected to contribute to the economy for years to come. Many types of federal spending on goods and services meet that broad definition, though. As defined by the Congressional Budget Office, federal investment consists of three broad categories of spending, which are listed in order of their combined outlays for defense and nondefense investments in 2019.

- Physical capital, such as highways and buildings, which contributes to the functioning of the economy or national defense ($275 billion, or 6 percent of total federal outlays);

- Education and training, which helps produce a skilled and capable workforce ($126 billion, or 3 percent of total federal outlays); and

- Research and development (R&D), which encompasses a wide variety of work in government laboratories, universities, and the private sector ($124 billion, or 3 percent of total federal outlays).

What Is the Cash-Based Approach to Federal Budgeting?

The federal budget generally reports outlays for federal activities, including investments—no matter how long their expected useful life—on a cash basis when the funds are disbursed. The authority to incur financial obligations that will result in outlays of federal government funds (which is called budget authority) is provided up front by law before an asset can be acquired. (A notable exception is budget authority for major defense acquisitions, which can be provided over several years.) Appropriation acts provide that authority for most federal investments. Obligations of budget authority are recorded up front when the funds are legally committed, and estimates of how legislative proposals would affect the federal deficit reflect cash-based measures of costs over a 10-year period.

The main advantages of cash-based budgeting for federal investments are that it provides more complete information than accrual measures when funding decisions are being made, improves control over spending, and results in transparent and verifiable measures. The key disadvantage is that cash-based budgeting does not distinguish between investment spending and other types of spending that support current consumption; as a result, too few resources might be devoted to federal investment.

What Is the Accrual Approach to Federal Budgeting?

Accrual budgeting for federal investments differs from accrual budgeting for other federal activities and programs.2 For most programs, accrual budgeting consolidates a long-term stream of future cash flows, but capital budgeting on an accrual basis would do the opposite: It would spread out the costs of investments that have large up-front expenditures and long-term benefits or usefulness. One frequently proposed accrual approach would segregate cash spending on capital projects in a separate capital budget and report the cost in the regular (or “operating”) budget as the assets lost value. For physical capital, the operating budget would record costs as the assets depreciated. For education and training and R&D, which do not lose value at measurable rates, costs could be spread over the period when benefits were received.

According to proponents of an accrual approach with a separate capital budget, the large amount of up-front funding required for investments creates a bias against such spending and discourages additional spending that would benefit the economy by boosting productivity. Lawmakers might be reluctant to provide sharp increases in funding for new investments, especially if funding for other programs and activities declined as a result. (Some programs—like federal grants to state and local governments for transportation infrastructure—provide funding for many projects across the country, so large spikes in total federal spending for those programs would seldom occur.) Proponents assert that capital budgeting would eliminate some of the spikes in programs’ budgets from new investments and would better match budgetary costs with benefit flows. The extent of any bias against investments that result in large spikes in funding is unknown, however, and whether lawmakers would allocate funding differently with a capital budget is uncertain.

Previous groups charged with exploring budgetary concepts have rejected capital budgeting for the federal government.3 They contend that adopting capital budgeting on an accrual basis would increase complexity, diminish transparency, and make the federal budget process more sensitive to small changes in assumed parameters, such as depreciation rates. Furthermore, simply arriving at a uniform definition of investment for budgetary purposes would be a significant challenge (see Chapter 1). In addition, providing special treatment to certain areas of the budget, such as capital spending, could make the process more prone to manipulation. Lawmakers could make projects appear less expensive, for instance, by adopting a broad definition of capital investment or by understating depreciation costs. Other countries’ experience with capital budgeting suggests the need for additional controls on asset purchases, including annual limits on the acquisition of capital, to limit any increase in debt.

What Other Budgetary Approaches Could Lawmakers Pursue?

Switching from a cash-based system to a fully accrual- based system for federal investments would be a large undertaking. Lawmakers could pursue other approaches that were more incremental or that focused on a particular aspect of the budget. Those approaches might focus on changing budget enforcement rules or implementing procedures that improved the incentives for policymakers and agencies to focus on the long-term benefits and costs of capital investments.

For example, lawmakers could provide cash and accrual measures of capital spending in different budgetary accounts within the current overall federal budget. The accounts would be structured so that depreciation was reported in an agency’s budget (and netted out elsewhere), and only the cash flows associated with an investment would affect the overall budget deficit, as they do now. That approach might avoid the spikes in agencies’ budgets caused by spending on major investment projects.

If lawmakers wanted to retain a cash-based approach to budgeting, the federal government could prepare a capital budget on a cash basis that was separate from its operating budget. Many states already use that approach for their own investment spending. Alternatively, the Congress could establish a separate cap on funding for federal investments. (Currently, total defense and nondefense appropriations are capped.) Or lawmakers could establish a revolving fund to serve as a capital budget, in this case for federally owned buildings—a proposal featured in the Trump Administration’s 2021 budget. That fund would use rent collections (as well as mandatory funding) to help finance its spending. That approach also might avoid the spikes in agencies’ budgets from spending on major investment projects.

Under any of those approaches, budget authority and outlays for federal investments would continue to be reported up front in the budget on a cash basis, so lawmakers would still control the amount of federal investment spending through the provision of budget authority.

The budget process is already complicated, and it would become even more so if any of the approaches examined in this report were implemented. Another consideration is that two of the approaches, the accrual-based approach with a separate capital budget and the states’ approach of having a separate cash-based capital budget, would undermine the concept of a unified federal budget, which shows the sum of all government activity and has been the basis for federal budgeting since the late 1960s. An alternative to capital budgeting would be having the Congress request supplemental information about federal investments before committing any funds.

1. This report updates and expands on Congressional Budget Office, Capital Budgeting (May 2008), www.cbo.gov/publication/41689.

2. See Congressional Budget Office, Cash and Accrual Measures in Federal Budgeting (January 2018), www.cbo.gov/publication/53461.

3. See President’s Commission to Study Capital Budgeting, Report of the President’s Commission to Study Capital Budgeting (February 1999), https://clintonwhitehouse3.archives.gov/pcscb/; and President’s Commission on Budget Concepts, Report of the President’s Commission on Budget Concepts (October 1967), pp. 9 and 33–35, http://tinyurl.com/y7lxv3gp (PDF, 7.8 MB).

Chapter 1Defining Federal Investment

The federal budget mostly uses a cash-based approach to record expenses for investment projects—accounting for them in full when the spending occurs—even though the benefits of those projects can extend for years. An accrual approach with a separate capital budget would spread the cost of those investments over the useful life of the asset. Switching to an accrual or other accounting system for capital budgeting would be a major challenge, though, in part because there is no single accepted definition of federal investment.

In general, investment refers to assets—goods and services—that provide benefits over a long period after their acquisition. However, some government activities that are not typically categorized as investment also fit that broad definition. For example, some analysts classify government spending on programs to reduce child poverty as an investment.1

Specific definitions of investment can vary depending on who owns an asset or who pays for it. Although the government’s investments are public goods and services, they often provide a mix of public and private benefits and may be publicly or privately owned and operated. The federal government pays for more physical capital than it owns: Roads, airports, and mass transit systems, for instance, are paid for at least in part with federal revenues but are under the control of state and local governments or independent authorities. For analysts who are primarily interested in how investment affects productivity, it matters less whether the federal government owns an investment because the benefits are shared.2 For analysts who are more interested in the federal balance sheet, which reports federal assets and liabilities, the question of ownership is more critical. One reason is that the federal government has little control over the maintenance and other upkeep of the infrastructure assets that it helps fund but does not own.

Some definitions of investment focus narrowly on physical infrastructure, such as highways and water treatment facilities; others have a broader focus and include intangible assets, such as investment in education and social services. Recipients are the primary beneficiaries of those services, but the government also shares in the benefits through a stronger economy or the improved health and welfare of the population.

Deciding what types of goods and services meet the definition of investment—and therefore what spending to include in a capital budget—could significantly affect the allocation of resources as well as the amount of spending recorded in the federal budget in a given year. A wide-ranging definition might encompass so many activities as to make the categorization unhelpful, and it could invite criticism that a capital budget would simply be a device for understating federal spending; a limited definition could lead to forgone spending in other areas—education and training or research and development, for instance—that might be as productive as investments in physical capital. This analysis examines three definitions of federal investment.

The Congressional Budget Office’s Definition

In CBO’s view, federal investment consists of spending in three broad areas.3

- Physical capital includes structures, such as government buildings, transportation infrastructure, and water and power projects; major equipment, such as computers, machinery, and vehicles; and software, information systems, and technology. To qualify as investment, physical capital must have an estimated useful life of at least two years. Most federal investment spending for defense programs and activities is for purchases of major equipment, such as ships and aircraft. Investment spending on physical capital for nondefense programs and activities, by contrast, is dominated by transportation spending, which provides infrastructure that contributes to the functioning of the economy.

- Research and development has three components: basic research, which seeks to discover scientific principles; applied research, which attempts to translate those discoveries into practical applications; and the development of new products and technologies. Federal R&D spending supports work in government laboratories, universities, and the private sector. That investment builds the stock of knowledge that helps expand the economy over time or strengthen national defense.

- Education and training includes early childhood, elementary, secondary, and postsecondary education, as well as job training and vocational training (but not military training) for veterans and other people. Federal spending on those activities helps produce a skilled, capable workforce that contributes to the country’s productivity and thus enhances the body of skills, knowledge, and experience that the population possesses (its human capital).

In some cases, it is difficult to determine what qualifies as federal investment and what does not. CBO does not regard spending on health care and school lunch programs for children as investment spending, for example, because the goods and services are promptly consumed. Yet keeping children healthy and nourished improves their ability to learn and produces a healthier and more capable future workforce. A second reason the agency does not classify health care spending as investment spending is because the empirical link between increases in federal spending on health care and greater private-sector productivity is not well established.4 For similar reasons, spending on most social services does not qualify as investment spending, in CBO’s estimation.

CBO’s definition of federal investment is consistent with the categories used by the Office of Management and Budget (OMB).5 OMB defines federal capital assets more narrowly than federal investment, though, and it excludes grants to state and local governments, spending on R&D, and education and training.

The National Income and Product Accounts’ Definition

The national income and product accounts (NIPAs) provide a general economic framework that describes the entire U.S. economy, and they show how the federal government fits into that framework. Compiled by the Bureau of Economic Analysis (BEA) in the Department of Commerce, the NIPAs are used to determine gross domestic product (GDP) and other measures. Specifically, the accounts detail current production and the resulting income over specific periods, the major sources of that production, and the recipients of that income.6 In the context of the NIPAs, the federal government is both a producer and a consumer.

BEA’s definition of investment includes most of what CBO identifies as investment but omits spending on education. Spending on R&D was first included as investment in the NIPAs in July 2013. BEA measures R&D as the sum of its production or input costs and treats all R&D as contributing to the stock of knowledge and the provision of public services.7

As part of their GDP account, the NIPAs estimate government investment. Like private investment, public investment yields a capital stock that is used to provide a stream of government consumption expenditures (defense and nondefense) that is also part of GDP. In the NIPA income account (gross domestic income), the income attributable to government capital exactly equals capital consumption (economic depreciation).

The NIPA government accounts include multiple measures of government spending. Current government expenditures, which include government consumption and therefore capital consumption, are subtracted from current revenues to yield net saving, which is an accrual version of the current deficit. (For details, see Box 1-1.) Total government expenditures, which also include government gross investment and other capital-type expenditures but exclude capital consumption, are subtracted from total receipts to yield net lending, which is more like a cash measure of the current deficit.

Box 1-1.

Depreciation as Measured in the National Income and Product Accounts

The measure of depreciation used in the Bureau of Economic Analysis’s (BEA’s) national income and product accounts (NIPAs) is economic depreciation, which is the gradual decrease in the market value of an asset over time. That measure of depreciation differs from the depreciation that a corporation can take for tax purposes, in which the cost of acquiring an asset is expensed over a certain period of time according to a set schedule. Economic depreciation is not accelerated (unlike most depreciation for tax purposes), and it is based on an asset’s replacement cost, not its historic cost. (Accelerated depreciation allows greater expensing in the early years of the life of an asset.)

BEA’s measure of depreciation includes accidental damage, but it excludes losses from natural disasters and losses of military equipment during wartime, because the loss of structures and equipment produced in previous periods does not directly affect current production or income (except to the extent that it affects production capacity), which is what the NIPAs measure. Instead, losses of assets from natural disasters and wars are reported as changes in the net stock of produced assets, and the amount of the loss is deducted before depreciation is calculated.1

For investments in research and development (R&D), BEA bases its estimate of depreciation on the useful life of their contribution to output. Because that future contribution is not observable, BEA uses its judgment—in addition to annual surveys by the National Science Foundation on the rates at which new technology is introduced—to determine those estimates. Private-sector accounting, by contrast, expenses R&D up front rather than treat it as an investment.

Specifically, BEA uses different estimates of the annual depreciation rate for different types of federal R&D: 7 percent for space science, 9 percent for health, 16 percent for transportation, and 16 percent or 20 percent for defense, depending on the project. Some of BEA’s estimates for federal R&D are the same ones it uses for private R&D, but others take into account the highly specialized nature of some types of federal technology. For example, BEA’s estimates for investment in R&D for stealth technology are based on how long that technology would remain valuable for a particular military aircraft.2

1. See Eugene P. Seskin and Shelly Smith, “Preview of the 2009 Comprehensive Revisions to the NIPAs,” Survey of Current Business, vol. 89, no. 3 (March 2009), pp. 11–15, https://apps.bea.gov/scb/toc/0309cont.htm; and Bureau of Economic Analysis, “Frequently Asked Questions: How Are the Measures of Production and Income in the National Accounts Affected by a Natural or Man-Made Disaster?” (November 28, 2012), www.bea.gov/help/faq/1013.

2. See Bureau of Economic Analysis, BEA Depreciation Estimates (2013), pp. 7 and 13, https://go.usa.gov/x7zEY (PDF, 83 KB).

A significant amount of what is often thought of as federal spending on physical capital shows up elsewhere in the NIPAs. Federal spending for infrastructure that is generally provided through grants to state and local governments—for air transportation, highways, transit, and water treatment plants—is excluded from the NIPAs’ estimates of federal investment and from federal expenditures. Instead, such spending is recorded as state investment, and depreciation of those assets is part of the expenditure measure for states, which own the assets and pay most of the costs to maintain them.

The Federal Financial Report’s Definition

The federal budget tracks the government’s cash flows, spending and receipts, and deficits and debt so that policymakers can see how fiscal policy changes over time and understand the nature and scope of government activities. To supplement that information, the federal government supplies financial details in a separate annual report, the Financial Report of the United States Government. That report’s balance sheet and statement of net cost provide information on holdings of capital assets and depreciation of that capital.8 It helps show how the federal government’s net financial position (the difference between its assets and liabilities) changed during the year.

The Financial Report adopts a narrower definition of investment than CBO, limiting it to physical capital and excluding intangible assets, such as R&D and education and training. It provides an estimated value (original cost minus accumulated depreciation) of federal property, plant, and equipment (defined as tangible assets that have a useful life of at least two years and are not intended for resale). That category includes capital leases but excludes most federal lands—including military bases, national parks, and forests—as well as roads, airports, and other facilities that are owned or controlled by other entities.

Using those accounting guidelines, federal agencies report the value of their investments as an asset and report depreciation as an expense.9 At the end of fiscal year 2019, the federal government reported $1.1 trillion of property, plant, and equipment on its balance sheet. The original cost of those assets was $2.4 trillion, and the difference of $1.3 trillion is accounted for by depreciation (see Table 1-1). Assets for national defense—mostly military equipment, such as ships, aircraft, combat vehicles, and weapons—account for about 70 percent of that value.

Table 1-1.

Value of Federal Property, Plant, and Equipment as of September 30, 2019

Billions of Dollars

Data source: Department of the Treasury, Financial Report of the United States Government, Fiscal Year 2019 (February 2020), p. 86. See www.cbo.gov/publication/56900#data.

Numbers may not add up to totals because of rounding.

n.a. = not applicable.

a. For financial reporting purposes, property, plant, and equipment excludes heritage assets and stewardship land. Heritage assets include national treasures like the Washington Monument. Stewardship land (such as national parks and forests) is held for the general welfare of the nation and is intended to be preserved and protected.

1. See Hilary W. Hoynes, and Diane Whitmore Schanzenbach, Safety Net Investments in Children, Brookings Papers on Economic Activity (Spring 2018), pp. 89–138, https://tinyurl.com/sdw4c74a.

2. Some analysts favor limiting investment spending to activities that raise long-term private-sector productivity; see the testimony of Paul L. Posner, Director, Budget Issues, Accounting and Information Management Division, General Accounting Office (now the Government Accountability Office), before the Subcommittee on Government Management, Information, and Technology of the House Committee on Government Reform and Oversight, Budget Structure: Providing an Investment Focus in the Federal Budget, GAO/T-AIMD-95-178 (June 29, 1995), www.gao.gov/products/T-AIMD-95-178. Some analysts would include tax expenditures that support investments in that category of spending; see Steve Redburn, Budgeting for Investment, Discussion Papers on Re-Imagining the Federal Budget Process (Brookings Institution, March 2017), p. 5, www.brookings.edu/research/budgeting-for-investment/.

3. See Congressional Budget Office, Federal Investment, 1962 to 2018 (June 2019), www.cbo.gov/publication/55375.

4. See Congressional Budget Office, The Macroeconomic and Budgetary Effects of Federal Investment (June 2016), www.cbo.gov/publication/51628.

5. For OMB’s discussion of federal investment, see Office of Management and Budget, Budget of the U.S. Government, Fiscal Year 2020: Analytical Perspectives (March 2019), Chapter 16, https://govinfo.gov/app/collection/budget. For details on OMB’s annual instructions to agencies’ budget officers, see Office of Management and Budget, Circular A-11, Appendix J and Supplement to Part 7: Capital Programming Guide (2019), p. 54, https://tinyurl.com/xtzpj9z3 (PDF, 1.7 MB).

6. See Congressional Budget Office, CBO’s Projections of Federal Receipts and Expenditures in the National Income and Product Accounts: 2019 to 2029 (July 2019), www.cbo.gov/publication/55466.

7. See Carol E. Moylan and Sumiye Okubo, The Evolving Treatment of R&D in the U.S. National Economic Accounts (Bureau of Economic Analysis, 2020), https://go.usa.gov/x7yBT (PDF, 494 KB); Dylan G. Rassier, “BEA Briefing: Treatment of Research and Development in Economic Accounts and in Business Accounts,” Survey of Current Business, vol. 94, no. 3 (March 2014), https://apps.bea.gov/scb/toc/0314cont.htm; and Bureau of Economic Analysis, “Preview of the 2013 Comprehensive Revision of the National Income and Product Accounts: Changes in Definitions and Presentations,” Survey of Current Business, vol. 93, no. 3 (March 2013), pp. 13–39, https://apps.bea.gov/scb/toc/0313cont.htm.

8. See Department of the Treasury, Financial Report of the United States Government, FY 2019 (February 2020), https://go.usa.gov/xshpc.

9. Ibid., pp. 59 and 86.

Chapter 2Federal Support for Investment

The federal government supports nondefense and defense investment in several ways. The main way is through spending: In 2019, federal outlays for investment totaled $525 billion, the Congressional Budget Office estimates. About 60 percent of that total was for nondefense investment, and 40 percent was for defense investment. An additional means of support is through tax expenditures—credits, exclusions, deductions, or preferential rates that reduce the federal income tax liabilities of firms and individuals that make or finance certain types of investments.1 For example, the federal government excludes the interest on state and local bonds from federal taxable income, which reduces the cost of investment projects for state and local governments. Tax expenditures that support investment had an estimated value of $190 billion in 2019.2 (Other alternative financing mechanisms exist for infrastructure, including options for an infrastructure bank or public-private partnerships, but those are beyond the scope of this report.)3

Trends in Investment Spending

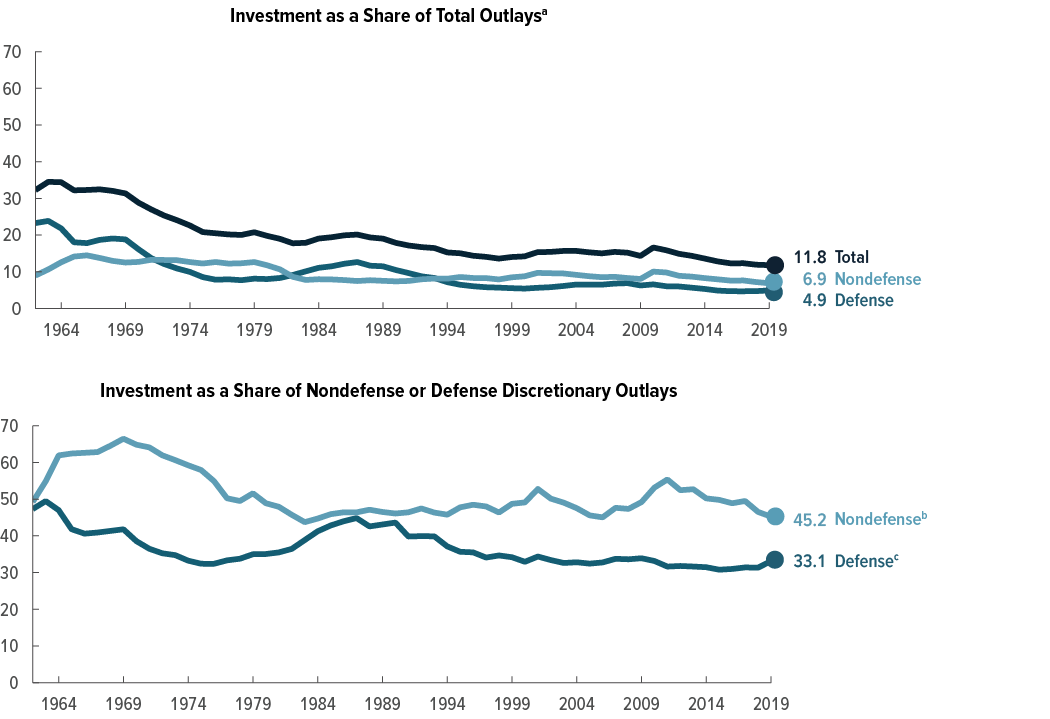

Federal spending for investment represented 12 percent of total federal outlays and 2.5 percent of the nation’s gross domestic product in 2019 (see Figure 2-1).4 Those shares have trended downward slightly over the past 25 years, though they reached higher levels (more than 15 percent of federal spending and nearly 4 percent of GDP) in the early 2010s, when the American Recovery and Reinvestment Act of 2009 (ARRA, Public Law 111-5) temporarily expanded funding for many investment programs. Federal investment spending as a share of the budget and the economy is lower now than it was in the 1960s, when it represented more than 30 percent of federal outlays and averaged nearly 6 percent of GDP.

Figure 2-1.

Federal Nondefense and Defense Investment Outlays, 1962 to 2019

Data sources: Office of Management and Budget; American Public Transportation Association; Bureau of Economic Analysis. See www.cbo.gov/publication/56900#data.

The figure reports budget outlays as the measure of investment spending.

Almost all federal investment spending is discretionary, meaning that it is controlled by lawmakers through annual appropriations. Since the 1960s, discretionary spending as a whole has fallen as a share of total federal spending, primarily because mandatory spending—particularly for Social Security, Medicare, and Medicaid—has increased. Nondefense investment peaked at more than 65 percent of all discretionary nondefense spending in the late 1960s and declined to about 50 percent during the 1970s. Since then, that share has mostly ranged between 45 percent and 55 percent; in 2019, it was about 45 percent, near the low end of that range (see Figure 2-2).

Figure 2-2.

Federal Nondefense and Defense Investment Outlays Relative to Federal Outlays, 1962 to 2019

Percent

Data sources: Office of Management and Budget; American Public Transportation Association. See www.cbo.gov/publication/56900#data.

Only a very small portion of federal investment is funded through mandatory spending.

The figure reports budget outlays as the measure of investment spending.

a. Includes discretionary spending, mandatory spending, and net interest.

b. Indicates nondefense investment as a share of total discretionary outlays for nondefense purposes.

c. Indicates defense investment as a share of total discretionary outlays for defense purposes.

Periodically, federal spending for nondefense investment has increased rapidly, typically to support certain programs:

- In the late 1960s, that spending supported expansion of the space program and development of the interstate highway system;

- In the late 1970s, it paid for improvements to water systems mandated by the Clean Water Act;

- In the late 1990s and early 2000s, it funded research and development for health-related programs; and

- In the late 2000s and early 2010s, ARRA-related outlays fostered the development of infrastructure for transportation and boosted spending for education at all levels.5

For defense investment, the federal government’s spending (both in inflation-adjusted dollars and as a share of the economy) has risen and fallen in tandem with the country’s international conflicts. Defense investment as a share of all discretionary defense outlays rose to about 50 percent—its peak—during the Vietnam War in the early 1960s. The other period of increased spending was during the intensifying Cold War arms race of the 1980s, when the share reached 45 percent (see Figure 2-2). Since then, that share has declined to a low of under 31 percent in 2015. In 2019, investment’s share of discretionary defense outlays increased to about 33 percent, primarily because of a jump in weapons procurement.

In recent years, decisions about investment spending have been made in the context of annual caps on discretionary appropriations, which were initially set in 2012 by the Budget Control Act of 2011 (P.L. 112-25) and later extended through 2021. Those caps have limited most nonemergency discretionary funding to amounts that are smaller than what would have been provided if annual appropriations had grown at the rate of inflation. Under current law, the caps are set to expire after 2021.6

Tax Expenditures

Measured on a cash basis, most of the tax expenditures that supported investment in 2019 (roughly 70 percent) were for investments in physical capital. The largest source of such support stems from provisions that allow businesses to accelerate tax deductions for the depreciation of equipment, allowing for larger tax deductions earlier in the assets’ expected lifetime. Legislation enacted in December 2017 temporarily expanded that tax expenditure by allowing for 100 percent bonus depreciation (or immediate expensing) of equipment purchases through 2022.

A cash measure may not be the most informative gauge of support, though, because it indicates the net amount of accelerated deductions claimed in a particular year independent of when the investment occurred. Because that tax expenditure provides a benefit by accelerating a tax deduction (decreasing revenues now while increasing revenues in the future, when the deduction would have otherwise been taken), the net present value of that timing benefit may more accurately reflect the economic effects. The net present value of the tax expenditure for investments in physical capital made in 2019, in CBO’s estimation, was smaller than the cash measure of deductions claimed in 2019.

A smaller source of support arises from the exclusion from taxable income of the interest on bonds issued by state and local governments.

Beyond investments in physical capital, about 20 percent of the tax expenditures in 2019 supported investments in education and training, mainly through deductions for charitable giving to educational institutions, credits for tuition for postsecondary education, exclusions of earnings on qualified tuition plans, and deductions for interest on student loans. The remaining 9 percent of the 2019 tax expenditures supported research and development, mostly through credits for research activities.

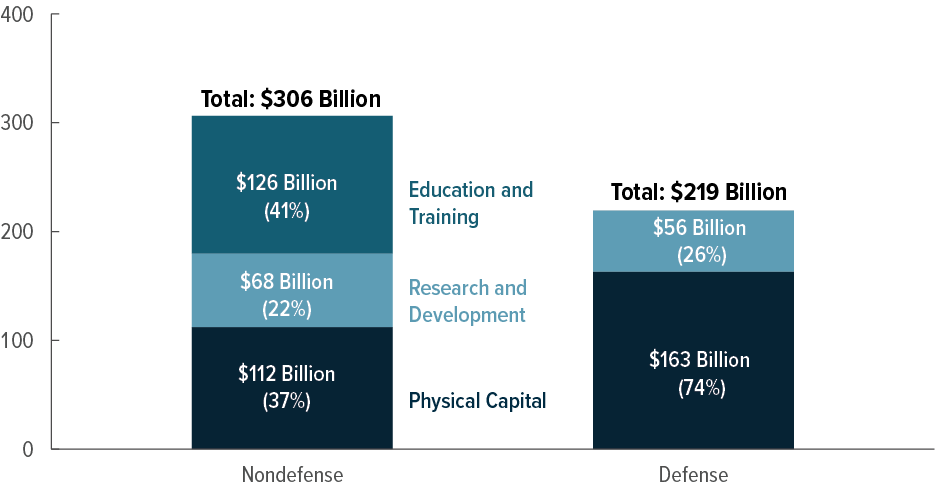

Nondefense Investment

More than half of all federal investment is for nondefense purposes. In 2019, outlays for nondefense investment totaled $306 billion, accounting for 58 percent of total federal investment outlays. Of that total, the largest shares were for education and training (41 percent) and physical capital (37 percent). The rest (22 percent) was for research and development (see Figure 2-3).

Figure 2-3.

Federal Nondefense and Defense Investment Outlays, 2019

Billions of Dollars

Data sources: Office of Management and Budget; American Public Transportation Association. See www.cbo.gov/publication/56900#data.

The nondefense outlays for education and training exclude a $26.5 billion investment in higher education through student loan programs in 2019, as estimated under the rules established by the Federal Credit Reform Act of 1990.

The Department of Defense (DoD) also spends money on education and training, but it is not reflected in the data on federal investment spending because much of it goes to train service members and employees to do their jobs. However, in 2019, nearly $13 billion went to the military academies, the education of service members’ children, and certain specialized training—all of which aligns with CBO’s definition of investment. That spending is not included in this report because DoD reports it only as obligational authority; therefore, it is not consistent with the spending described throughout this report, which is reported as outlays.

The figure reports budget outlays as the measure of investment spending.

Education and Training

The majority of federal nondefense investment in education and training in 2019 went for two purposes: higher education (35 percent), and elementary, secondary, and vocational education (32 percent). Nearly all of the investment in higher education was made directly by the federal government, and most of it was provided through Pell grants.7 In contrast, federal investment in elementary, secondary, and vocational education was almost entirely in the form of grants to state and local governments.

Physical Capital

Since the early 1960s, the largest category of federal nondefense investment in physical capital has been grants to state and local governments. In 2019, such grants accounted for 68 percent of the $112 billion in federal nondefense investment in physical capital.8 The majority (54 percent) was for transportation, nearly all of which was distributed as grants to state and local governments from federal trust funds, such as the Highway Trust Fund.9 The federal grants also covered investments in pollution control and abatement, as well as community and regional development.

Most infrastructure spending is handled by state and local governments, which own most of the highways, mass transit systems, airports, and water utilities nationwide. State and local governments typically spend roughly three times as much money on highways each year as the federal government does, not only on capital projects but also to operate and maintain roads.

To finance that investment, state and local governments use various mechanisms. Over the 2007–2016 period, 60 percent of the infrastructure investment that state and local governments made from their own funds (excluding federal grants) was financed using mechanisms that impose costs on the federal government:

- Tax-exempt bonds,

- Tax credit bonds,

- Federal credit programs, which offer loans or loan guarantees for infrastructure projects,10 and

- State revolving funds and infrastructure banks (“state banks”).

All levels of government face calls to improve highways and other transportation systems, and federal lawmakers are considering proposals to significantly increase infrastructure spending. Lawmakers at all levels of government also face demands to make water and wastewater treatment systems safer and less expensive for users.11

Research and Development

Federal nondefense investment in R&D was $68 billion in 2019. Just over half of that amount went to health research, which is mostly directed by the National Institutes of Health, for investigating cancer, infectious diseases, and other conditions. An additional one-third or so of funding went to general science, space, and technology. The two largest recipients of those funds were the National Aeronautics and Space Administration, for research in planetary and earth sciences and space operations, and the National Science Foundation, for research in the physical sciences and engineering.

In response to the 2020–2021 coronavirus pandemic, the Congress appropriated about $48 billion in calendar year 2020 to assist in developing, manufacturing, and procuring vaccines, therapeutic aids, and diagnostic tools. (A precise breakout of the spending between R&D and procurement is not yet available.) Also in 2020, the federal government entered into contracts with manufacturers of vaccines that totaled $15 billion and with manufacturers of therapeutic aids or diagnostic tools that totaled approximately $3 billion. Outlays stemming from those contracts totaled about $8 billion in 2020.

Defense Investment

Outlays for defense-related investment in 2019 totaled $219 billion. Three-quarters of that amount was spent on physical capital, such as weapons, equipment, and facilities. The remainder was spent on R&D, mostly on the development of weapon systems (see Figure 2-3). The Department of Defense (DoD) spent money on education and training as well, but that spending is not reflected in the data on federal investment spending because much of it goes to train service members and employees to do their jobs. However, in 2019, nearly $13 billion went to the military academies, the education of service members’ children, and certain specialized training—all of which aligns with CBO’s definition of investment. (That spending is not included in this report because DoD reports it only as obligational authority; therefore, it is not consistent with the spending described throughout this report, which is reported as outlays. The difference between the two measures in this case is likely to be very small.)

1. CBO relies on estimates of tax expenditures from the staff of the Joint Committee on Taxation. For information on the identification of tax expenditures and methods of estimating them, see Joint Committee on Taxation, Estimates of Federal Tax Expenditures for Fiscal Years 2019–2023, JCX-55-19 (December 2019), www.jct.gov/publications/2019/jcx-55-19. For JCT’s most recent version of that report, see Estimates of Federal Tax Expenditures for Fiscal Years 2020–2024, JCX-23-20 (November 2020), www.jct.gov/publications/2020/jcx-23-20.

2. Reflecting CBO’s definition of investment, that $190 billion excludes several housing-related tax expenditures, such as the mortgage-interest deduction for owner-occupied residences and the exclusion of capital gains on the sale of principal residences; those tax expenditures were valued at $62 billion in 2019. The total also excludes $215 billion in tax expenditures for reduced tax rates on dividends and long-term capital gains and for the exclusion of capital gains at death. See Joint Committee on Taxation, Estimates of Federal Tax Expenditures for Fiscal Years 2019–2023, JCX-55-19 (December 2019), www.jct.gov/publications/2019/jcx-55-19.

3. See F. Stevens Redburn, Kenneth J. Buck, and G. Edward DeSeve, Mobilizing Capital Investment to Modernize Government (IBM Center for the Business of Government, 2020), https://tinyurl.com/y6bahsmq; and Barry Bosworth and Sveta Milusheva, Innovations in U.S. Infrastructure Financing: An Evaluation (Brookings Institution, October 2011), https://tinyurl.com/y66s7ysc.

4. See Congressional Budget Office, Federal Investment, 1962 to 2018 (June 2019), www.cbo.gov/publication/55375.

5. Ibid., p. 18.

6. For more details on the caps on appropriations, see Congressional Budget Office, The Budget and Economic Outlook: 2020 to 2030 (January 2020), pp. 1–23, www.cbo.gov/publication/56020.

7. The $126 billion spent on education and training in 2019 excludes a $26 billion investment in higher education provided through student loan programs (including discretionary administrative costs), as estimated under the rules established by the Federal Credit Reform Act of 1990. The loan programs can reduce the deficit or increase the deficit, depending in part on the size and direction of credit reestimates (changes to the estimated costs of the outstanding loan portfolio). In 2018, the budget reported a large negative reestimate ($9 billion), compared with a large positive reestimate in 2019 ($28 billion). Because of the negative reestimate, which generates budgetary savings, the programs yielded net savings of $11 billion for the federal government in 2018. (Whether the programs generate costs or savings under budget accounting rules also depends on other factors, such as the difference between the interest rate paid by borrowers and the average rate at which the Treasury borrows money, as well as the number of borrowers who default and the amounts recovered.)

8. Based on data from the American Public Transportation Association, CBO decreased the Office of Management and Budget’s estimates of grants by $4.5 billion to account for grants that went to support state and local governments’ operations, including infrastructure maintenance. See American Public Transportation Association, 2020 Public Transportation Fact Book, Appendix A: Historical Tables (March 2020), Tables 80 and 87, https://tinyurl.com/y4n5wy4j.

9. In its February 2021 baseline, CBO projects that under current law, the Highway Trust Fund would be exhausted in 2022. Sustaining it will require some or all of these approaches: continued transfers from the federal government’s general fund, reduced spending on highways and transit programs, increases in existing taxes on highway users, and new taxes credited to the Highway Trust Fund. For more details, see Congressional Budget Office, Reauthorizing Federal Highway Programs: Issues and Options (May 2020), www.cbo.gov/publication/56346; and Issues and Options for a Tax on Vehicle Miles Traveled by Commercial Trucks (October 2019), www.cbo.gov/publication/55688.

10. See Congressional Budget Office, Federal Support for Financing State and Local Transportation and Water Infrastructure (October 2018), www.cbo.gov/publication/54549.

11. See Congressional Budget Office, Public-Private Partnerships for Transportation and Water Infrastructure (January 2020), www.cbo.gov/publication/56003; The Penn Wharton Budget Model, “The $2 Trillion Congressional Democrat and White House Infrastructure Proposal” (brief, University of Pennsylvania, May 21, 2019), https://tinyurl.com/y4llwzbd; and Diane Whitmore Schanzenbach, Ryan Nunn, and Greg Nantz, If You Build It: A Guide to the Economics of Infrastructure Investment (The Hamilton Project, Brookings Institution, February 2017), https://tinyurl.com/y4gt72ge.

Chapter 3The Current Budgetary Treatment of Investment and an Overview of Options to Change It

To see how investment fits in to the budgetary framework of the federal government, it is helpful to first have an overview of the federal budget and federal financial reports—the government’s main tools for providing information and tracking financial resources. Neither document provides an all-purpose picture of the government’s fiscal position, but taken together they offer a way to gauge the current and future implications of present policies.1

The Federal Budget and Federal Financial Reports

The federal budget measures the overall size and scope of federal activities. It is a key instrument in national policymaking, displaying the effects of the government on the economy and communicating the nature and breadth of government to the public. It is also the primary tool that policymakers use to decide how to allocate resources to meet national priorities, control spending, and promote economic stability and growth. The federal budget is “unified,” meaning it comprises all revenues and spending of the federal government, including those of the Social Security trust funds and the net cash flow of the Postal Service, which are considered off-budget for certain purposes.2

The federal budget process is a set of procedures that lawmakers use to plan, establish, control, and account for spending and revenue policies. That process is governed by various rules and procedures for meeting budgetary goals, including the use of enforcement mechanisms that are applied largely on the basis of estimates of how new legislation would affect federal deficits over a 10-year period. As a result, the basis for how the net costs of federal activities are measured and reported has significant implications for how federal resources are allocated among competing priorities and for the overall outcome of that process.3

Currently, the budget records spending for most federal activities on a cash basis; the major exceptions are federal credit programs (including student loans) and interest on the public debt, which are recorded on an accrual basis. The principal difference between cash and accrual accounting lies in the timing of when the spending (or collection) of budgetary resources is recognized.4 In cash-based accounting, outlays and receipts are recorded when payments are made or receipts are collected. By contrast, accrual measures summarize in a single estimate the anticipated net financial effects when the government makes a commitment. Thus, for federal credit programs, the budget records the entire amount of expected budget authority—the positive or negative subsidy cost—when the government enters into a loan obligation or guarantee commitment, even though the cash flows to and from the Treasury arising from the obligation or commitment may continue for many years into the future. In other words, accrual methods for federal credit programs record the cost of commitments—the estimated net present value of the government’s projected cash outlays and related receipts—when they are incurred, and the budget shows the associated outlays from those commitments when the loans are disbursed (rather than recording the various cash transactions as they occur).5 The Federal Credit Reform Act of 1990 switched the government from cash to accrual accounting for credit programs to more accurately measure the full net cost of credit programs over the long term and to facilitate comparisons of the net cost of direct loans, loan guarantees, and grants.

In addition to the budget, the federal government issues an annual report on its fiscal performance—the Financial Report of the United States Government. The budget and the financial reports serve different and complementary purposes.6 Unlike budget figures, which can encompass both past and future periods, financial reporting largely describes what has already happened and explains changes in the government’s financial position based on an accrual-based balance sheet and operating statement. That reporting requires agencies to prepare financial reports that are then audited. Together with internal accounting and administrative controls, those audited reports demonstrate accountability to taxpayers for money raised and expenses incurred.

The Federal Budget’s Cash Treatment of Investment

When the federal government buys an asset (such as a building or a piece of equipment) or provides a grant to state and local governments for infrastructure investment, the federal budget treats that investment spending the same way it treats most other spending: on a cash basis.7 Budget authority is generally required and reported up front for the capital asset or investment when the resources are committed, and outlays are reported for the associated cash expenditures in the years they are disbursed.8 (For many capital investments, the outlays occur over a number of years.) No depreciation is reported, and spending on maintenance is recorded as it occurs. Likewise, to the extent that federal investments affect cash flows in future years—for example, by generating income or by affecting an agency’s operating costs—those effects are reported in the years when they occur.

Cash measures convey more complete information about the budgetary effects of spending on investments when those decisions are made than accrual measures would. Cash budgeting reports the budget authority provided for an investment when the decision to approve that funding is made, which is usually the only point at which all or most of the costs are controllable.9 (To the extent that the government purchases marketable assets, like office buildings, some or all of the cost could be offset if the government ultimately sold the asset.) Up-front recognition of costs has several advantages: It measures the value of the economic resources that the government will use, shows the trade-offs among spending choices, and helps keep lawmakers accountable for the budgetary effects of their decisions in the year they are made.

The current cash-based accounting system also has some disadvantages. The budget process does not focus on investment spending apart from other types of spending that support current consumption. As a result, investment spending is less visible and explicit than it could be, and investment projects, which often have a mismatch between when costs are recorded and when benefits occur, may seem expensive relative to other government expenditures. In addition, the large amount of up-front funding required for some investment projects can make it difficult to fund them.

The Federal Financial Report’s Accrual Treatment of Investment

Like the financial statements of private companies, the federal government’s financial report consists of a balance sheet, an income statement, a cash flow statement, and notes to those financial statements.10 The financial statements describe what has already happened and provide more comprehensive information than the budget about the government’s financial operations and condition. As of September 30, 2019, the federal balance sheet reported more than $1 trillion of property, plant, and equipment (after subtracting depreciation).11 Other categories of investment—education and training or research and development—are not reported as assets on the federal balance sheet; nor are most roads and transit systems that receive federal funding, because they are not owned by the federal government.

As in private-sector financial reporting, purchases of capital assets (those owned by the federal government) are recorded on the federal government’s balance sheet as an exchange of assets. Those purchases therefore do not directly change the federal government’s reported net financial position. In contrast, the financial report recognizes up front the full costs of federal grants to state and local governments for infrastructure investments that are not reported on the federal balance sheet.

The federal government’s income statement recognizes the cost of federally owned property, plant, and equipment (fixed assets) as those items are consumed rather than when they are purchased. Depreciation is measured using a systematic method for assigning the cost of an asset to each period during its estimated useful life. Costs for education and training or R&D are recognized up front and are not depreciated because the financial report does not classify those categories as assets.

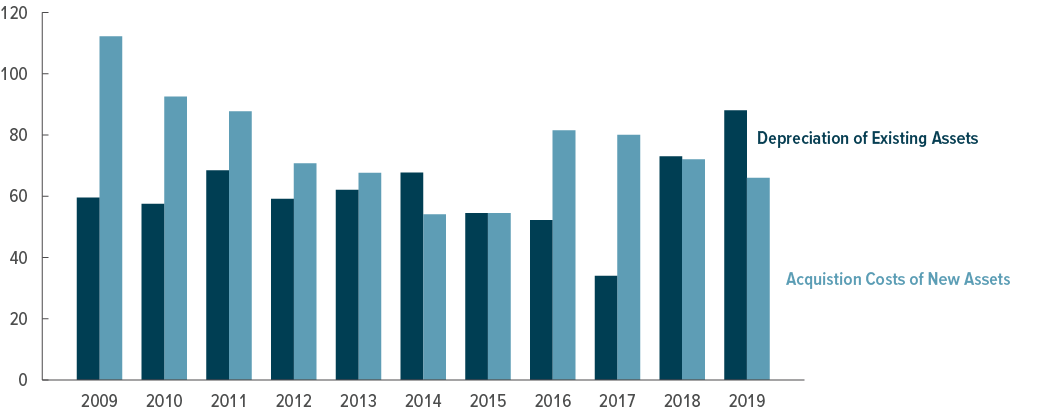

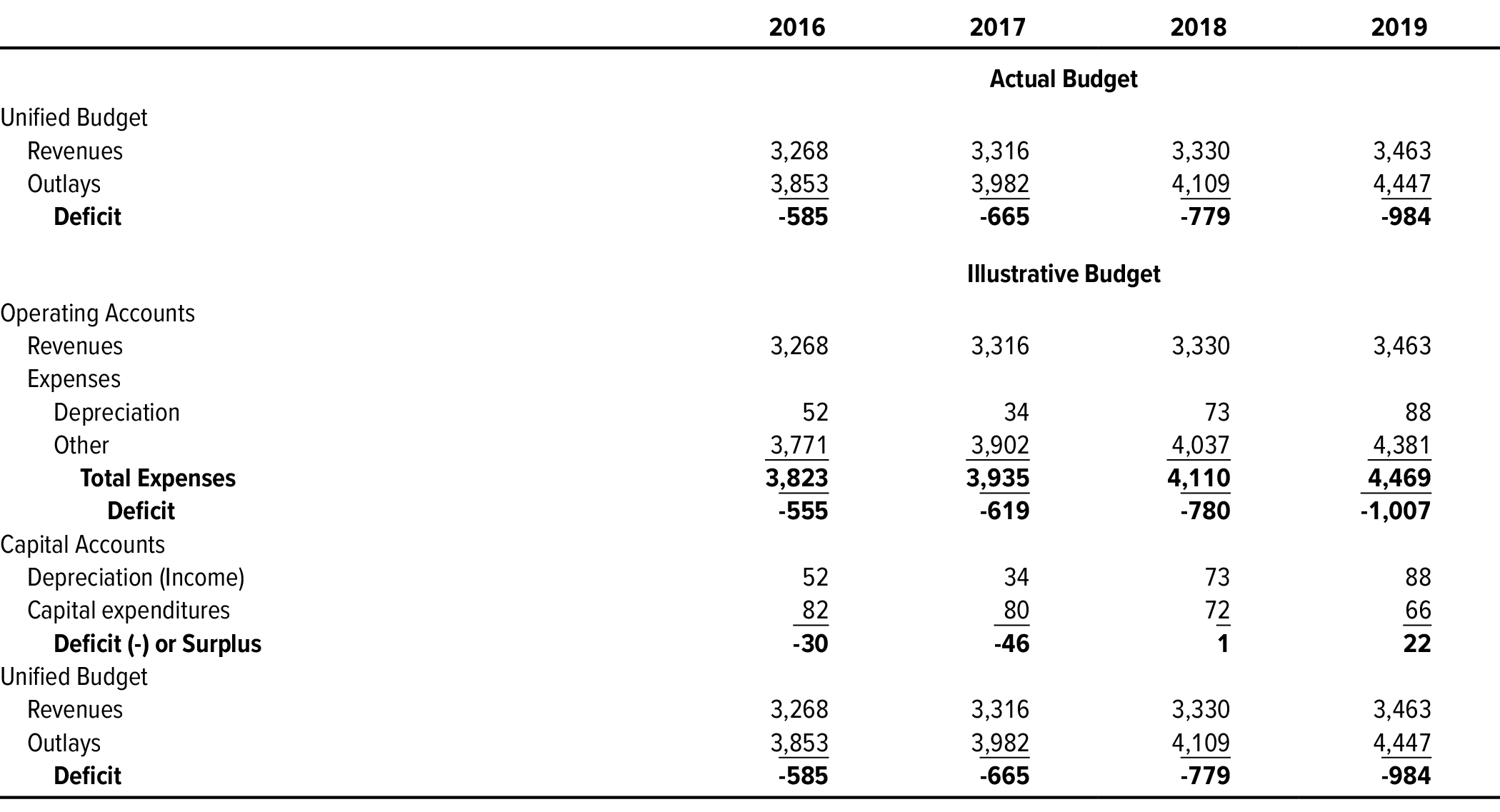

Because costs in the federal budget and financial statements are recognized at different times, summary measures for those reports differ. In 2019, the budget recorded a deficit of $984 billion, whereas the equivalent measure in the financial report—net operating cost, or the cost of operations minus revenues—was $461 billion larger, at $1,445 billion. Most of the difference stemmed from the reporting of retirement costs for federal civilian and military personnel; the treatment of fixed assets accounted for only $22 billion of the difference. Depreciation expenses—which are not counted in the federal budget—added $88 billion to the net operating cost, while the purchase of fixed assets added $66 billion to the budget deficit.12 Over the 2009–2019 period, the cost of acquiring property, plant, and equipment has generally exceeded the cost of depreciation, though not in 2018 and 2019 (see Figure 3-1). As a result, net investment has generally been positive, as would be expected with a growing economy.

Figure 3-1.

The Federal Government’s Depreciation of Existing Assets Versus Acquisition Costs of New Assets, 2009 to 2019

Billions of 2019 Dollars

Data source: The 2009 through 2019 editions of Department of the Treasury, Financial Report of the United States Government. See www.cbo.gov/publication/56900#data.

In this context, assets are property, plant, and equipment. Not shown is the expense (or gain) from disposals and revaluations of that property, plant, and equipment.

Acquisition costs are reported in the budget, whereas depreciation costs are reported in the federal financial statements. The differences between those two costs contribute to differences between summary measures in the budget and the financial statements.

An Example of the Different Treatments as Applied to an Infrastructure Investment

The differences between cash measures and accrual measures hinge on timing. The following example uses a hypothetical infrastructure investment to highlight those differences.

Suppose that lawmakers approved a $3 billion infrastructure investment and that cash disbursements for construction costs were spread evenly over three years. For accounting purposes, assume that the useful life of that investment was 30 years. Under the current cash-based approach for investments, the budget would record the full acquisition cost of $3 billion as budget authority in the first year and $1 billion of outlays in each of the first three years, when the construction costs were paid (see Table 3-1).

Table 3-1.

Examples of Cash- and Accrual-Based Accounting for a Hypothetical $3 Billion Infrastructure Investment Under Two Scenarios

Millions of Dollars

Data source: Congressional Budget Office. See www.cbo.gov/publication/56900#data.

The examples assume that the cash disbursements occur evenly over the first three years.

a. Calculated using straight-line depreciation over 30 years ($3 billion divided by 30).

b. Calculated using straight-line deprectiation over 10 years ($3 billion divided by 10).

Under an accrual approach to capital budgeting that reported the cost of depreciation on a straight-line basis (that is, evenly distributed the acquisition cost over the useful life of the investment), the budget would report $100 million ($3 billion divided by 30) of both budget authority and outlays each year for 30 years. That approach is similar to how acquisitions of property, plant, and equipment are reported in the federal government’s financial report.

Costs under the accrual approach would be significantly influenced by assumptions about the useful life of the investment. The projection period used for most budget enforcement purposes is 10 years. In this example, only $1 billion of budget authority and outlays would be reported over the 10-year period using the accrual approach, compared with $3 billion under cash-based budgeting. If, instead of 30 years, the useful life of the investment was 10 years, the accrual approach would report $300 million of budget authority each year for 10 years, and the 10-year total would be the same as under the cash treatment. Thus, the longer the useful life of an asset, the greater the degree to which the accrual budgeting approach would differ from the cash approach in the timing of budget authority and outlays as measured for accounting purposes.

Options for Changing the Budgetary Treatment of Investment

Various approaches to capital budgeting have been implemented by other levels of government, the private sector, and other countries. At the federal level, capital budgeting could be instituted using either cash or accrual measures, and policymakers could choose to have separate capital and operating budgets or to adhere to the unified budget framework (see Figure 3-2). Even though no consensus exists on what exactly is meant by capital budgeting, a capital budget treats investment spending differently from other types of spending because investment spending provides a stream of future benefits rather than benefits at just a point in time.13

Figure 3-2.

Comparing Options for Budgeting for Federal Investment

Data source: Congressional Budget Office.

a. Accrual measures reporting depreciation would be reported in federal agencies’ budgets. Depreciation would be reported on an intragovernmental basis (amounts paid by one part of the government to another) and would not affect the unified budget deficit. Only the cash payments for investments would affect the unified budget deficit.

Some countries that budget on an accrual basis also use the accrual approach to capital budgeting, but they typically limit capital budgeting to spending on physical capital (see Appendix A). Those countries generally use accrual measures of costs and revenues rather than cash in their budgets, and they report the estimated annual depreciation of the investment as a cost in the current year rather than the acquisition cost. (The national income and product accounts take a similar approach, reporting the depreciation of capital rather than outlays as a cost.) To control their debt, several countries have had to limit their asset purchases.

Capital budgeting could be implemented using cash measures only, which is the practice used by most states (see Appendix B). The capital budget records on a cash basis the up-front expenditures for certain types of investments, including physical infrastructure but generally excluding education and training. Under the capital budget, states can borrow to fund their investments, which is consistent with the logic that future taxpayers would share in the benefits of those investments and thus should help pay for them. In contrast, the operating budget, which is separate from the capital budget, is typically subject to a balanced budget requirement.

This report examines six options for changing the budgetary treatment of investment. Some of the options are more complicated and would significantly alter budgetary outcomes, so they are explained in greater detail. Other options would have fewer budgetary implications and thus are examined in less detail. The first two options would use an accrual-based approach (see Chapter 4).

- The federal government could adopt an accrual approach with a separate capital budget. That model, which is based on the financial accounting model of capital budgeting used by the United Kingdom and New Zealand, would report depreciation of physical capital as a cost in agencies’ budgets and in the government’s overall budget.14 If U.S. policymakers chose that approach, they would need to decide whether to extend the accrual treatment to spending on intangible assets (education and R&D).

- The federal government could use a mix of cash and accrual measures in a unified budget. Agencies would report budget authority and outlays for depreciation (or amortization) of their investments for each program on an accrual basis.15 The depreciation would flow to on-budget capital accounts and thus be netted out as an intragovernmental transaction. The capital accounts would report the budget authority and outlays associated with the acquisition on a cash basis, so total outlays and the unified budget deficit would not change.

The other four options would use a cash-based approach (see Chapter 5).

- The federal government could implement separate operating and capital budgets (the model used by the states).

- The federal government could create a separate cap on investment funding for budget enforcement purposes while retaining cash-based budgeting for investment spending within the unified budget.

- The federal government could create a mandatory capital revolving fund in the unified budget. (A revolving fund charges for the sale of products or services and uses the proceeds to finance its spending, in a continuous cycle of activity.) At least initially, the fund would be limited to purchases and long-term capital leases of federal buildings. This option would apply only to assets that the federal government owned.

- Agencies could provide supplemental information on investments to allow policymakers to judge their value without changing the budget numbers or budget enforcement procedures.

1. For more information about financial reporting, see Congressional Budget Office, Comparing Budget and Accounting Measures of the Federal Government’s Fiscal Condition (December 2006), www.cbo.gov/publication/18262; and Measures of the U.S. Government’s Fiscal Position Under Current Law (August 2004), www.cbo.gov/publication/15943.

2. See President’s Commission on Budget Concepts, Report of the President’s Commission on Budget Concepts (October 1967), http://tinyurl.com/y7lxv3gp (PDF, 7.8 MB).

3. For a discussion of the budget’s other purposes, see General Accounting Office (now the Government Accountability Office), Accrual Budgeting: Experience of Other Nations and Implications for the United States, GAO-AIMD-00-57 (February 2000), www.gao.gov/products/AIMD-00-57.

4. See Congressional Budget Office, Cash and Accrual Measures in Federal Budgeting (January 2018), www.cbo.gov/publication/53461.

5. A present value is a single number that expresses a flow of future income or payments in terms of an equivalent lump sum received or paid at a specific time.

6. See Congressional Budget Office, Comparing Budget and Accounting Measures of the Federal Government’s Fiscal Condition (December 2006), www.cbo.gov/publication/18262.

7. For an alternative approach to valuing certain types of investments using market prices, see Deborah J. Lucas and Jorge Jimenez Montesinos, “A Fair Value Approach to Valuing Public Infrastructure Projects and the Risk Transfer in Public Private Partnerships,” in Edward L. Glaeser and James M. Poterba, eds., Economic Analysis and Infrastructure Investment (University of Chicago Press, forthcoming, October 2021).

8. Budget authority is provided by federal law to incur financial obligations that will result in immediate or future outlays of federal government funds. In the case of federal investments, appropriation acts generally provide that authority. Funding for some high-cost defense items is provided over a period of several years but still a much shorter span of time than the useful life of the asset. Moreover, not all the life-cycle costs for those items are reported together up front in the budget request. For example, funds for operation and support and disposal costs are appropriated on an annual basis when needed. In addition, the federal government reimburses states for a share of their expenses for most of the major highway and transit infrastructure projects over the lifetime of the project as the states submit receipts.

9. Some expected costs associated with asset purchases, such as maintenance and repairs, do not require budget authority up front but rather are funded (and reported as outlays) when the work is done. Similarly, any remediation costs for environmental cleanup after an asset is retired are also funded when the work is done.

10. See Department of the Treasury, Financial Report of the United States Government, Fiscal Year 2019 (February 2020), p. 59, https://go.usa.gov/xshpc. The report’s version of an income statement is called the “statement of net cost” and “statement of operations and changes in net position.”

11. Ibid., p. 207. That estimate excludes stewardship land and heritage assets whose values may be indeterminable or are omitted for other reasons. Examples include museum collections, national forests, parks, and historic sites. The financial report also provides unaudited, supplemental information on deferred maintenance and repairs—valued at $183 billion as of September 30, 2019, compared with $167 billion in fiscal year 2018.

12. Ibid., p. 57.

13. See the following articles, all from Public Budgeting & Finance, vol. 18, no. 3 (Fall 1998): Marvin Phaup, “The President’s Commission to Study Capital Budgeting: An Interim Review,” pp. 1–10, https://doi.org/10.1046/j.0275-1100.1998.01138.x; Paul Posner, Trina V. Lewis, and Hannah Laufe, “Budgeting for Federal Capital,” pp. 11–23, https://doi.org/10.1046/j.0275-1100.1998.01139.x; and Cameron Gordon, “The Fables and Foibles of Federal Capital Budgeting,” pp. 54 –71, https://doi.org/10.1046/j.0275-1100.1998.01142.x.

14. New Zealand has had greater success with accrual budgeting for investment than have other countries, in part because program managers there have discretion in how they achieve their results. In addition, agencies can keep most of the savings from asset sales. Showing the depreciation of assets allows officials and the public to more easily monitor the government’s wealth (the difference between its assets and liabilities). That information allows New Zealand to spread the cost of long-lived assets across the generations that benefit from the investments. See New Zealand Treasury, 2018 Investment Statement (March 2018), https://tinyurl.com/j4js983y.

15. Amortization is an accounting method that allows the cost of an intangible asset to be reported over a set period of time as it loses value. Thus, amortization is similar to depreciation.

Chapter 4Options That Would Use an Accrual Approach to Capital Budgeting

The primary goal of an accrual approach to capital budgeting is to more closely align the costs of investments with their long-term usefulness. Doing so would provide agencies with a more comprehensive understanding of how the costs of delivering their services relate to the benefits provided. This paper examines two options that would incorporate accrual measures. The first option is covered extensively because it represents the biggest departure from current practice and has been the main focus of policy debates and past Presidential budget commissions.1

Adopt an Accrual Approach With a Separate Capital Budget

This approach would treat the purchases or commitments of capital resources as an exchange of assets in which the funding and outlays required to pay for the asset would be allocated to the future—in other words, spread over the period when that asset’s benefits were realized. Accrual budgeting for investment differs conceptually from accrual accounting for other activities and programs.2 For most programs, accrual accounting consolidates a long-term stream of future cash flows, but an accrual approach to capital budgeting would do the opposite: It would spread up-front costs over time and thus reduce the recognition of the commitment when it was made.

The budget would report the depreciation (or amortization) of the asset as both the annual budget authority and outlays.3 In technical terms, the operating budget would report the depreciation, and the capital budget would report the cash transactions for the investment. For investments in physical capital and possibly research and development, estimated depreciation from physical wear and tear or technological obsolescence would be reported as budget authority and outlays. For investments in education and training programs, funding could be spread out over the period when benefits were expected to be received.

Benefits and Drawbacks of an Accrual Approach

Some benefits and drawbacks are common to any accrual approach to accounting for investments, and others are specific to this option.

A particular benefit of adopting an accrual approach with a separate capital budget, according to proponents, is that it would eliminate the bias against investment spending imposed by cash-based budgeting.4 Proponents claim that the bias arises in part because some investment projects require up-front budget authority for the full cost of acquisition, which can make them seem expensive relative to other government purchases.5 As a result, proponents argue, the federal government underspends on federal investment, thereby forgoing the long-run benefits—including higher productivity—of that investment relative to spending on other programs and activities whose benefits are largely realized sooner.

The accrual approach to capital budgeting would better align the appropriations provided to acquire the assets with the time period over which the benefits to society are accruing, according to proponents. (Benefits from investments can be greater or lesser than costs, and those benefits may vary greatly over the useful life of an investment.) That alignment would level the comparison of investment spending with other spending, and it would eliminate some of the spikes in certain programs’ budgets from new investments. (Investments in physical assets, which often involve large single projects that will be completed in the future, are most prone to spikes. Investments in R&D and education are less prone to spikes because that spending generally recurs each year. Budgetary spikes also are less of a problem for federal investments in infrastructure, most of which are in the form of grants to states.)

An advantage that is common to all accrual approaches is that they align the costs of the investment with its use. By recognizing depreciation (or amortization) as a cost, an accrual approach might give policymakers and program managers more accurate and timely information about the cost to operate physical assets, like buildings, that the government owns. Such information might encourage them to sell underused assets, allowing agencies to reduce their depreciation expense. Recognition might also highlight the need for routine maintenance, which would be reported on a cash basis, or for major repairs or refurbishments, which could be treated as new investments and depreciated because they extend the asset’s useful life.

The existence and extent of any current budgetary bias against investment depend on how differently policymakers would behave with a capital budget instead. If there was an across-the-board bias against investment spending, one would expect to see widespread underinvestment and high rates of return on new federal projects. In CBO’s assessment, based on its analyses and a review of relevant research, the average rate of return from federal investment spending on physical capital, education and training, and R&D is lower than that from private investment.6 That is because public investment is not driven by market forces; its goals include not only achieving positive economic returns but also improving quality of life, reducing inequities, and addressing other objectives. In addition, an increase in federal investment spending is often partially offset by a decrease in investment spending by states and localities.

Evidence suggests that additional spending on investment could have larger economic benefits than costs, on average. Nevertheless, the economic benefits of increasing capital spending would partly depend on how well the additional funds were targeted to high-value projects and on the extent to which they displaced spending that would otherwise be undertaken by the private sector or by state and local governments.