Mandatory spending—which totaled about $2.0 trillion in 2013, or about 60 percent of federal outlays, CBO estimates—consists of all spending (other than interest on federal debt) that is not subject to annual appropriations. Lawmakers generally determine spending for mandatory programs by setting the programs’ parameters, such as eligibility rules and benefit formulas, rather than by appropriating specific amounts each year. Mandatory spending is net of offsetting receipts—certain fees and other charges that are recorded as negative budget authority and outlays.

Nearly all mandatory outlays are for social insurance programs (in which most people who are eligible to participate do so and to which those participants have contributed at least part of the funding) or means-tested programs (which link eligibility to income). The largest mandatory programs are Social Security and Medicare. Together, CBO estimates, those programs accounted for about 65 percent of mandatory outlays in 2013—or roughly 40 percent of all federal spending. Medicaid and other health care programs accounted for about 15 percent of mandatory spending last year.

The rest of mandatory spending is for income security programs (such as unemployment compensation, the nutrition assistance programs, and Supplemental Security Income), certain refundable tax credits, retirement benefits for civilian and military employees of the federal government, veterans’ benefits, student loans, and agriculture programs.

Trends in Mandatory Spending

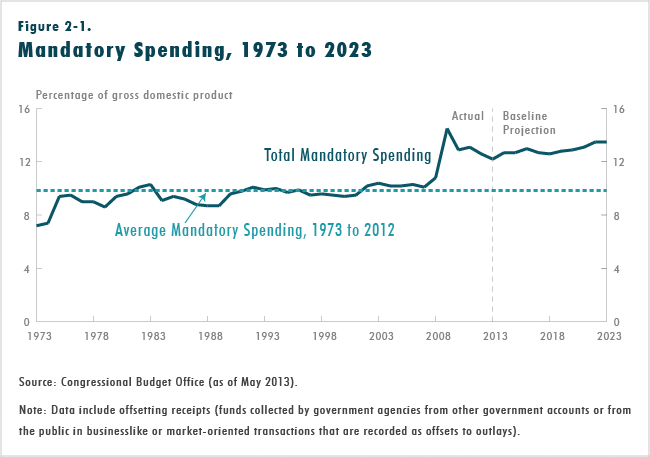

Relative to the size of the economy, mandatory spending varied between roughly 9 percent and 10 percent of gross domestic product (GDP) from 1975 through 2007. Such spending peaked in 2009 at 14.5 percent of GDP, before dropping to 12.6 percent of GDP in 2012. That decline reflects the economy’s gradual recovery from the 2007–2009 recession and the waning budgetary effects of policies enacted in response to the recession. CBO estimates that mandatory outlays fell to about 12 percent of GDP in 2013; much of that decline was attributable to payments from Fannie Mae and Freddie Mac (see Figure 2-1).

If no new laws were enacted that affected mandatory programs, CBO estimates, mandatory outlays would remain fairly stable as a share of the economy, between 12.6 percent and 13.1 percent, from 2014 through 2021. Mandatory spending would accelerate in the final two years of the projection period, however, reaching 13.5 percent of GDP in 2022 and 2023, by CBO’s estimate. By comparison, such spending averaged 11.5 percent of GDP over the past 10 years and 9.9 percent over the past four decades.

CBO’s projections for total mandatory spending mask diverging trends for different components of such spending. CBO projects that, under current law, spending for Social Security and the major health care programs, notably Medicare and Medicaid, would grow from 9.8 percent of GDP in 2014 to 11.2 percent by 2023, driven largely by the aging of the population, rising health care costs per person, and an expansion of federal subsidies for health insurance. At the same time, outlays for all other mandatory programs would decline relative to GDP, from 3.0 percent in 2014 to 2.3 percent by 2023. That projected decline reflects an anticipated economic expansion, which would reduce the number of people who are eligible for many income security programs, and scheduled changes to tax provisions, which would reduce outlays arising from some tax credits.

Methodology Underlying Mandatory Spending Estimates

The budgetary effects of the various options are measured relative to the spending that CBO projected in its May 2013 baseline. In creating its baseline budget projections, CBO generally assumes that existing laws will remain unchanged. That assumption applies to most, but not all, mandatory programs. Following long-standing Congressional procedures, CBO assumes that most mandatory programs that are scheduled to expire in the coming decade under current law will instead be extended. In particular, under CBO’s baseline, all such programs that predate the Balanced Budget Act of 1997 and that have outlays in the current year above $50 million are presumed to continue; for programs established after 1997, continuation is assessed on a program-by-program basis in consultation with the House and Senate Committees on the Budget. CBO’s projection of mandatory outlays is $135 billion (or 4 percent) higher in 2023 as a result of the assumption that expiring programs continue. (The Supplemental Nutrition Assistance Program accounts for more than half of that increment.)

Another of CBO’s assumptions involves the federal government’s dedicated trust funds for Social Security and Medicare. If a trust fund is exhausted and the receipts coming into it during a given year are insufficient to pay full benefits as scheduled under law for that year, the program has no legal authority to pay full benefits. In that case, benefits must be reduced to bring outlays in line with receipts. Nonetheless, in keeping with longstanding Congressional procedures, CBO’s baseline incorporates the assumption that, in coming years, beneficiaries will receive full payments and all services to which they are entitled under Social Security or Medicare.

Options in This Chapter

The 23 options in this chapter encompass a broad range of mandatory spending programs, excluding those involving health care. (Options that would affect spending for health care programs are presented in the chapter on health-related options, as are options affecting taxes related to health.)

The options are grouped by program, but some are conceptually similar even though they concern different programs. For instance, several would shift spending from the government to a program’s participants or from the federal government to the states. Others would redefine the population that is entitled to benefits or would reduce the amount of payments that beneficiaries receive.

Seven options in this chapter concern Social Security. Another four involve means-tested benefit programs (including nutrition programs and the Supplemental Security Income program). The remaining options focus on Fannie Mae and Freddie Mac; the Pension Benefit Guaranty Corporation; and programs that deal with education, the environment, veterans’ benefits, federal pensions, and agriculture. Each option’s budgetary impact is estimated independently, without consideration for potential interactions with other options.