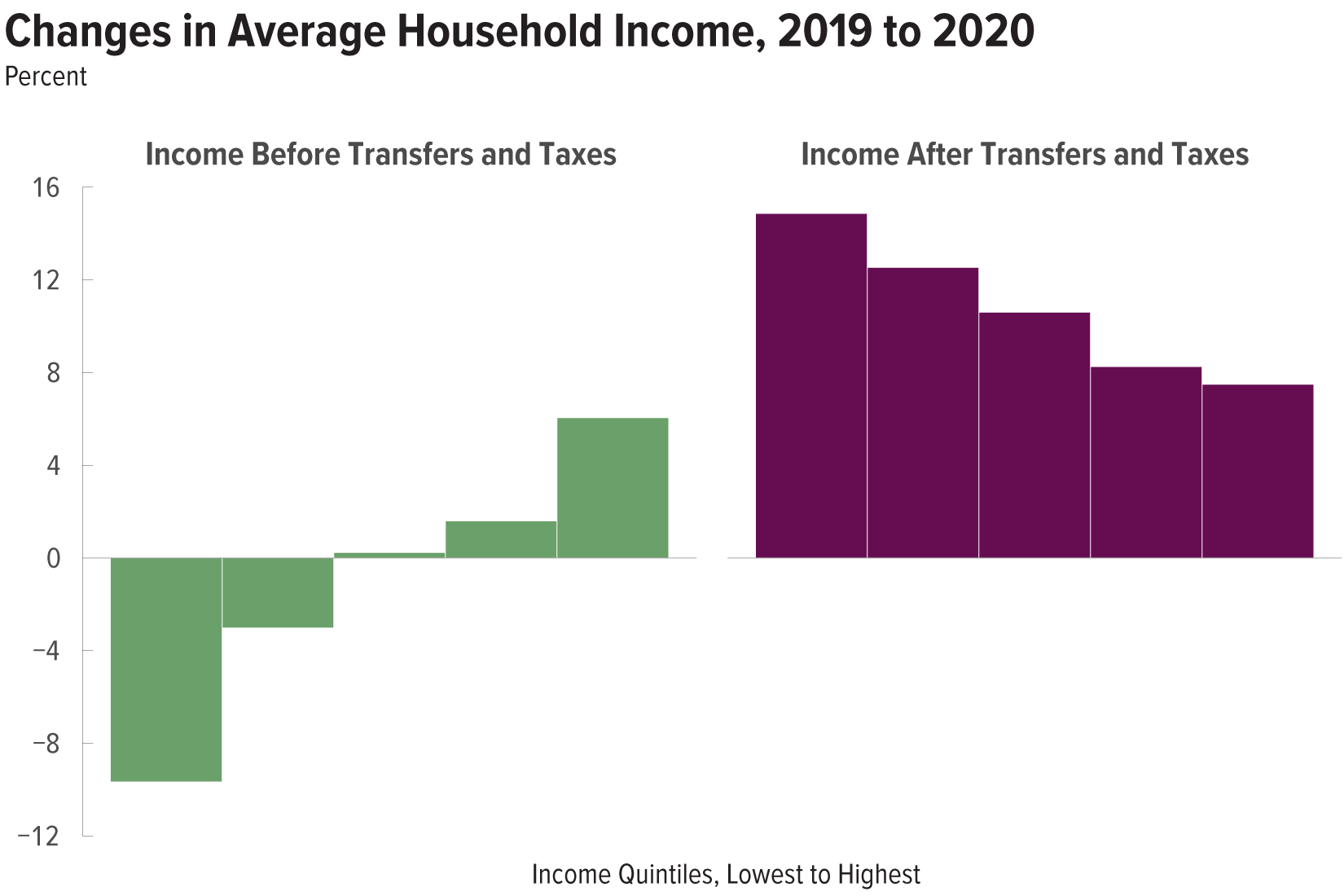

In 2020, the coronavirus pandemic and the ensuing federal response had significant effects on the distribution of household income. Income inequality before transfers and taxes increased, but inequality after transfers and taxes decreased.

Explaining Analytical Methods

- Report

CBO examines how inflation has affected households at different income levels and compares inflation since 2019 with the growth in household income over the same period.

- Report

CBO examined how the benefits from major tax expenditures in the individual income tax and payroll tax systems were distributed among households in different income groups in 2019.

- Report

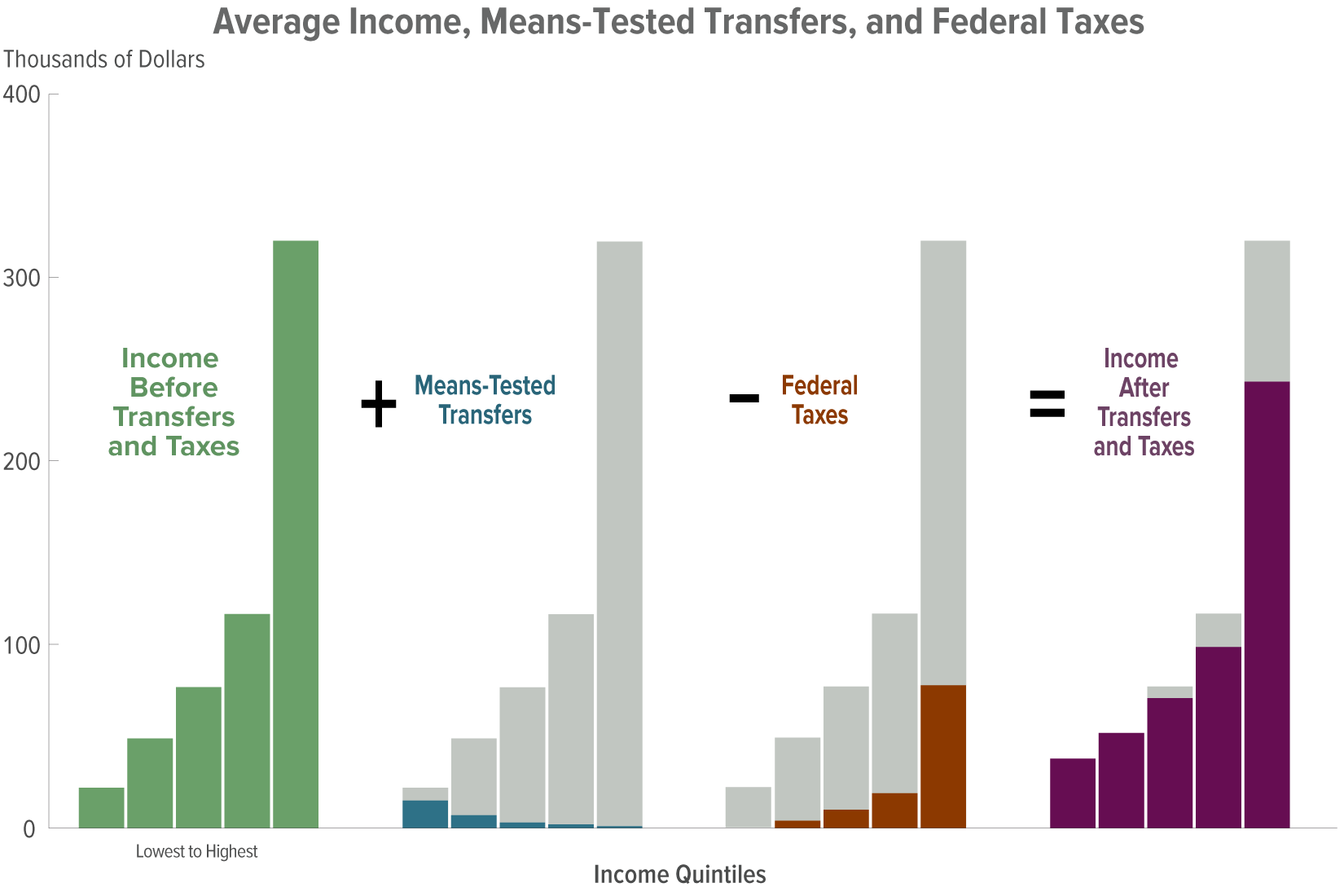

In 2018, average household income after accounting for means-tested transfers and federal taxes was $37,700 among households in the lowest quintile and $243,900 among households in the highest quintile.

- Report

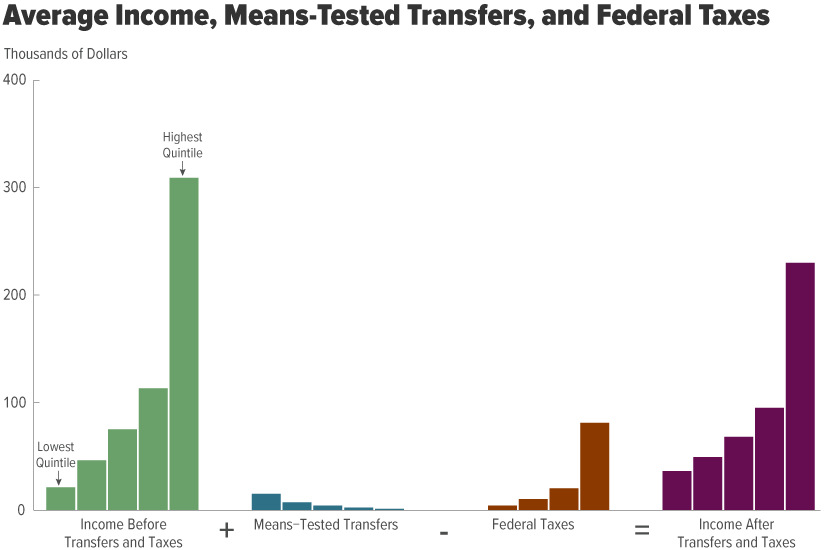

In 2017, average household income before accounting for means-tested transfers and federal taxes was $21,300 for the lowest quintile and $309,400 for the highest quintile. After transfers and taxes, those averages were $35,900 and $229,700.

- Report

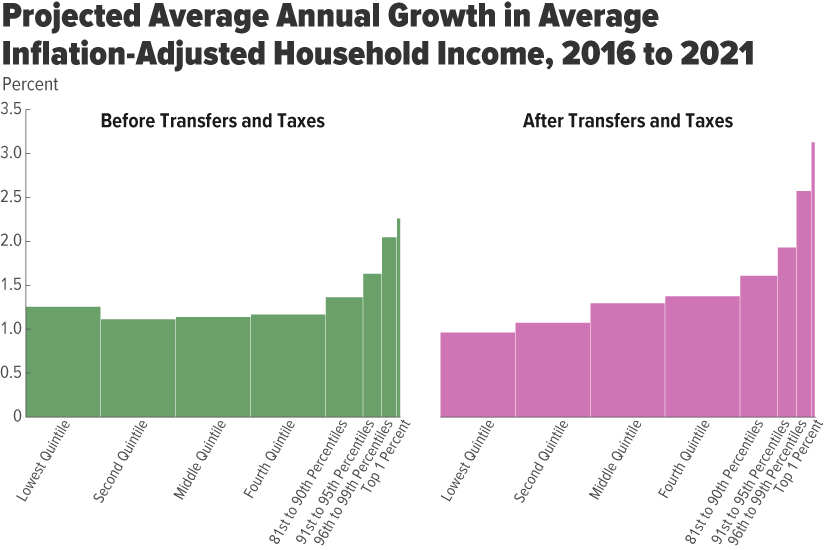

This report projects the distributions of household income, means-tested transfers, and federal taxes under current law in 2021 and compares them with the actual distributions in 2016.