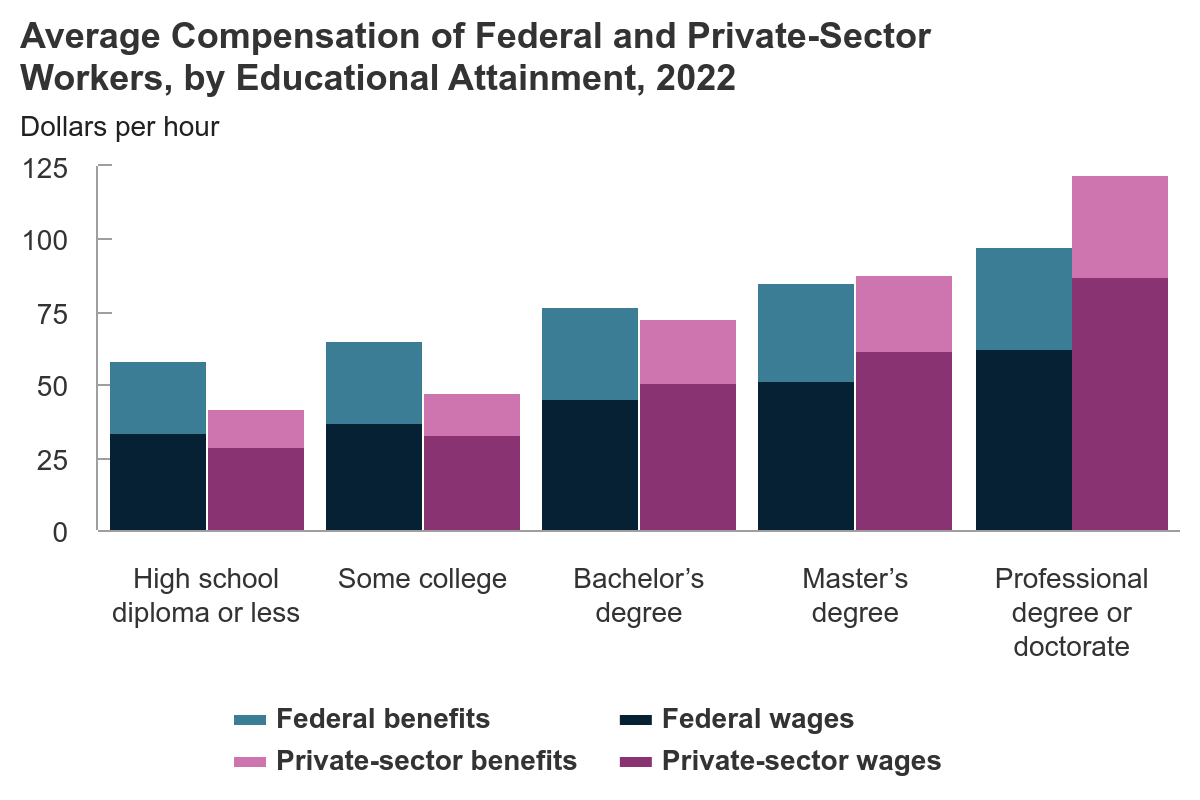

Compared with private-sector employees, the average compensation costs for federal employees in 2022 were greater among workers whose education culminated in a bachelor’s degree or less, but lower among workers with more education.

Retirement

- Report

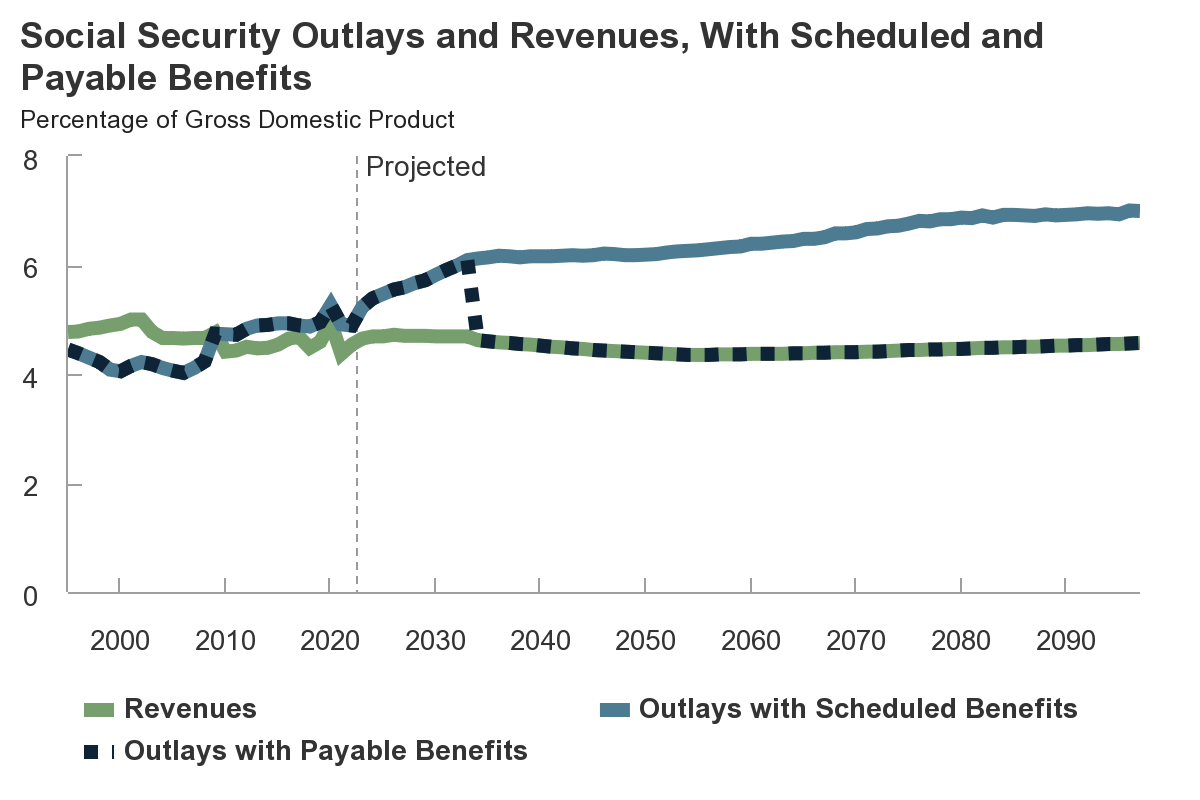

In CBO’s projections, spending for Social Security increases relative to GDP over the next 75 years, and the gap between outlays and revenues widens. If combined, the program’s trust funds would be exhausted in fiscal year 2033.

- Report

CBO issues a volume describing 17 policy options that would each reduce the federal budget deficit by more than $300 billion over the next 10 years or, in the case of Social Security options, have a comparably large effect in later decades.

- Report

CBO issues a volume that contains short descriptions of 59 policy options that would each reduce the federal budget deficit by less than $300 billion over the next 10 years.

- Report

CBO examines the differences between cash and accrual accounting for federal retirement and veterans’ benefits, the information that the two types of estimates provide, and ways to expand the use of accrual measures for such benefits.

- Report

This report explains the various measures and approaches for quantifying the adequacy of retirement income, providing a framework for further analysis.

- Report

CBO analyzes the impact of retirement benefits on the federal budget and on the compensation, recruitment, and retention of its employees. It assesses the short-term and long-term effects of potential changes to those benefits.