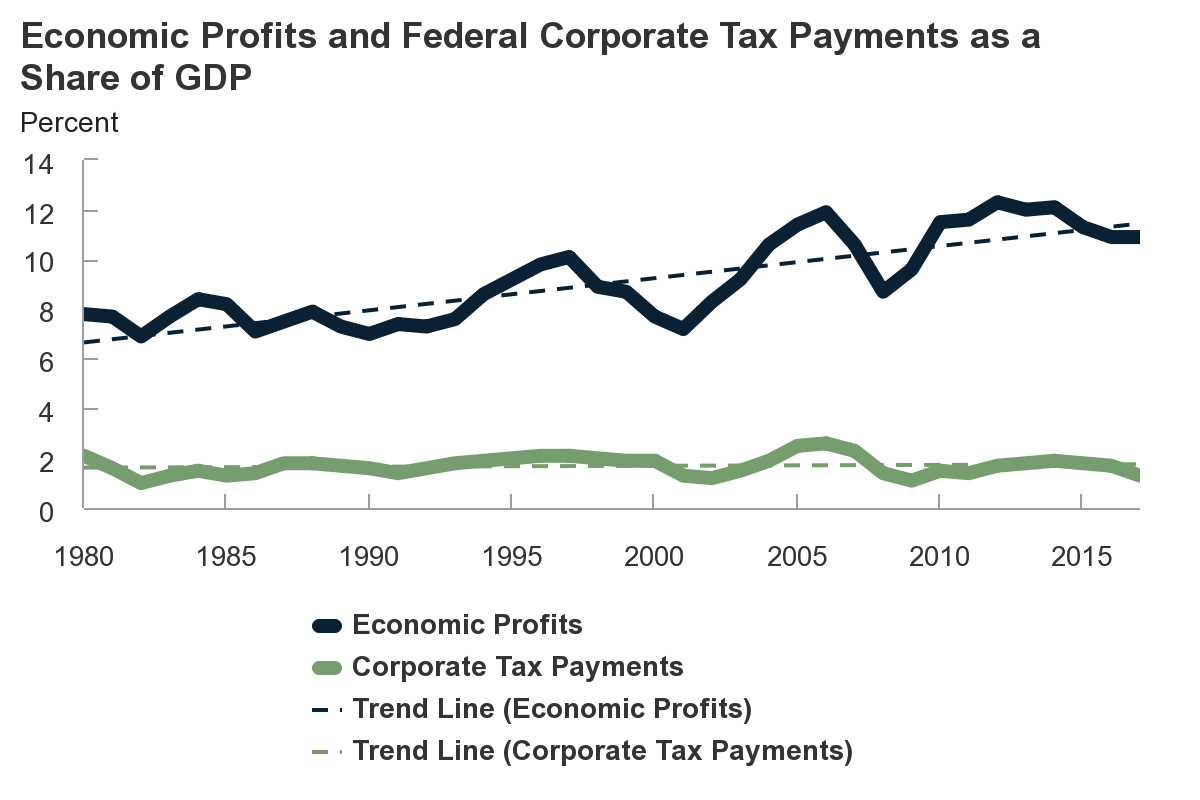

Over recent decades, corporate economic profits have grown faster than the amounts that corporations pay in federal taxes. CBO examined the factors that explain why corporate tax payments have not grown with corporate economic profits.

Tax Rates

- Report

CBO issues a volume that contains short descriptions of 59 policy options that would each reduce the federal budget deficit by less than $300 billion over the next 10 years.

- Report

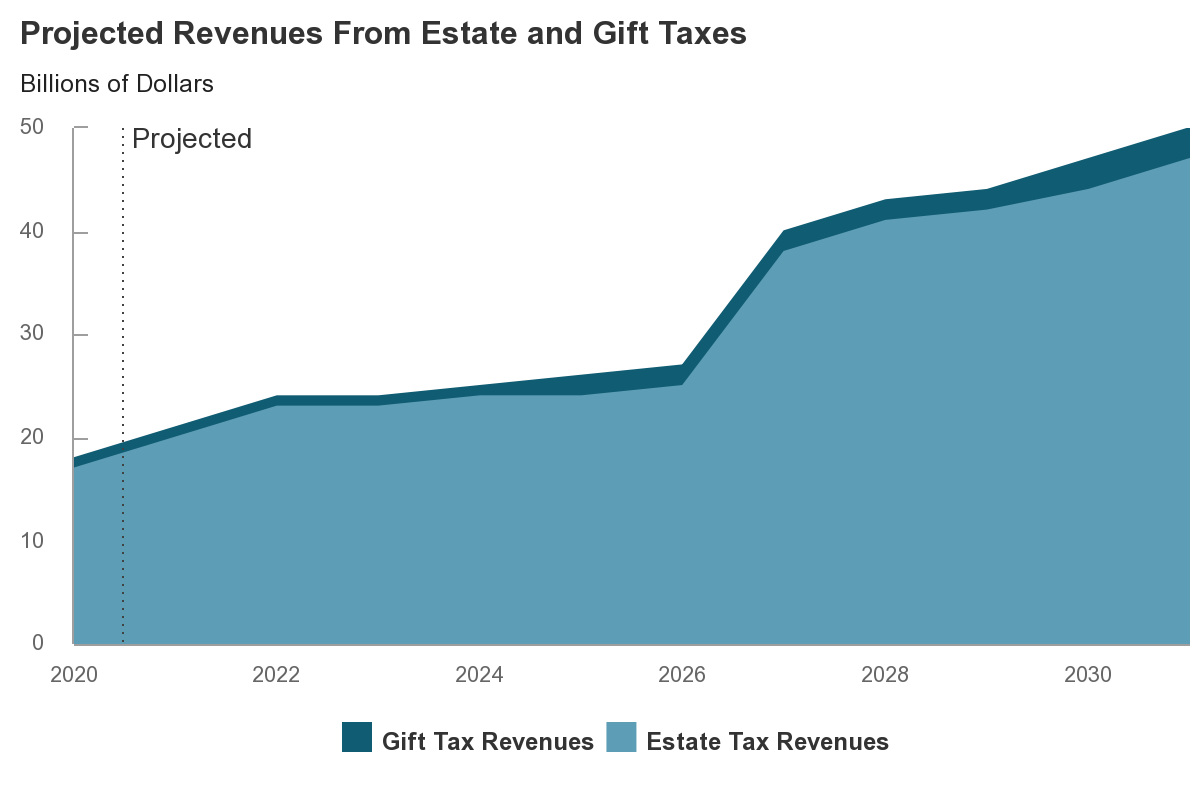

CBO describes estate and gift taxes, the people who pay them, the types of assets that make up taxable estates, and the model the agency uses to project estate and gift tax revenues in its baseline.

- Report

In this report, CBO projects, on the basis of current law, marginal federal tax rates on labor income from 2018 through 2028. So that current trends can be understood in a historical context, the projections are accompanied by rates from 1962.

- Report

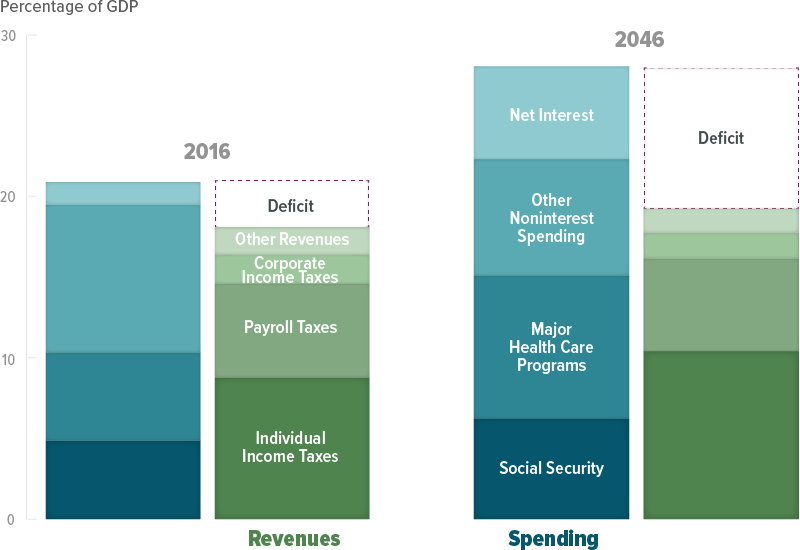

If current laws remained generally unchanged, the United States would face steadily increasing federal budget deficits and debt over the next 30 years—reaching the highest level of debt relative to GDP ever experienced in this country.

- Report

On average, the effective marginal tax rate on capital income is 18 percent, but that rate varies significantly by sector. In this report, CBO estimates effective rates under current law and eight policy options.